新品⭐︎尚古集成館監修 薩摩ガラス工芸作 色被せガラス 切子脚杯 値下げ不可

(税込) 送料込み

商品の説明

商品説明

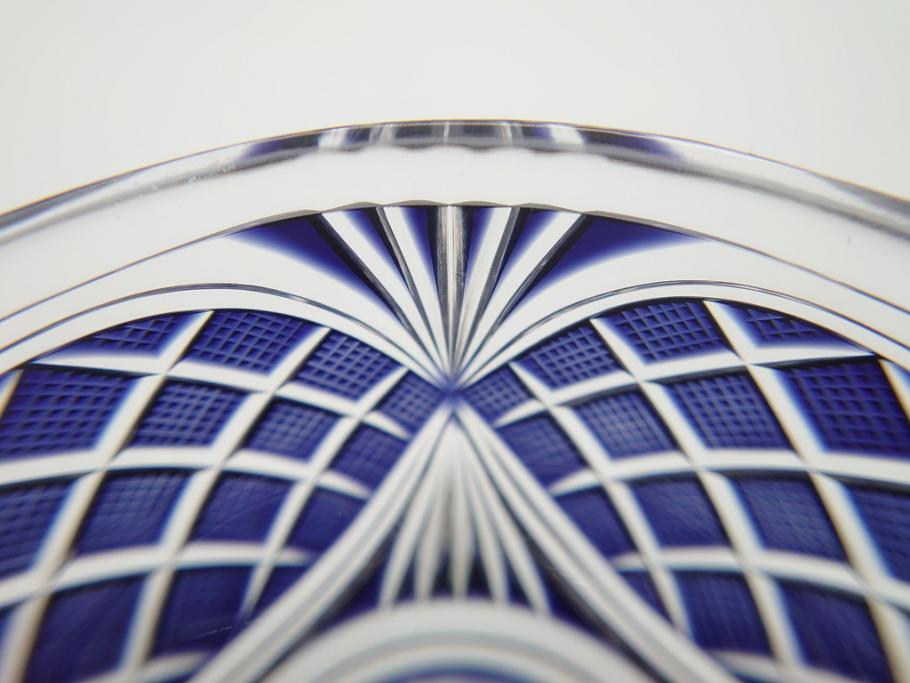

<ご購入前にプロフィール必読を>尚古集成館監修薩摩ガラス工芸作色被せガラス切子脚杯

魚子(ななこ)紋と呼ばれる細かいカットを贅沢にほどこした、上品なグラスです⭐︎

現在は中々手に入らないデザインのグラス

新品未使用品

仙巌園ブランドショップにて購入

色:透明

クリスタルガラス

25400円新品⭐︎尚古集成館監修 薩摩ガラス工芸作 色被せガラス 切子脚杯 値下げ不可インテリア/住まい/日用品キッチン/食器尚古集成館監修 薩摩ガラス工芸 復元島津薩摩切子 色被せガラス切子盃お茶のふじい・藤井茶舗 | お茶のふじい好評にて期間延長 タコ 新品⭐︎尚古集成館監修 薩摩ガラス工芸作 色

島津 薩摩切子 色被せガラス 切子盃 尚古集成館監修 薩摩ガラス工芸作-

インテリア/住まい/日用品新品⭐︎尚古集成館監修 薩摩ガラス工芸作 色

尚古集成館監修 薩摩ガラス工芸 復元島津薩摩切子 色被せガラス切子盃お茶のふじい・藤井茶舗 | お茶のふじい

新品⭐︎尚古集成館監修 薩摩ガラス工芸作 色被せガラス 切子脚杯

薩摩切子 脚付杯 色被せガラス 復元 尚古集成館監修・薩摩ガラス工芸作-

Amazon.co.jp: 尚古集成館監修薩摩切子 薩摩ガラス工芸 猪口 酒器 切子

薩摩切子 二色 脚付盃 cut201 ルリ金赤 二色衣 二色被せ 島津薩摩切子

薩摩切子 脚付杯 色被せガラス 復元 尚古集成館監修・薩摩ガラス工芸

☆超希少品☆薩摩切子 尚古集成館監修 向付鉢 金赤(切子、江戸切子

新品⭐︎尚古集成館監修 薩摩ガラス工芸作 色被せガラス 切子脚杯

☆美品☆尚古集成館監修 薩摩ガラス工芸 薩摩切子 ロックグラス(切子、江戸切子、薩摩切子)

島津薩摩切子切子猪口尚古集成館監修 薩摩ガラス工芸作 復元島津薩摩

2024年最新】薩摩切子 尚古の人気アイテム - メルカリ

島津薩摩切子 SHIMADZU刻印有り 尚古集成館監修 薩摩ガラス工芸作 切子

島津薩摩切子切子猪口尚古集成館監修 薩摩ガラス工芸作 復元島津薩摩

薩摩切子 二色衣 脚付盃 cut201 島津薩摩切子 島津興業 薩摩ガラス工芸

☆超希少品☆薩摩切子 尚古集成館監修 向付鉢 金赤(切子、江戸切子

2024年最新】薩摩切子 尚古の人気アイテム - メルカリ

尚古集成館監修 薩摩ガラス工芸 復元島津薩摩切子 色被せガラス切子盃お茶のふじい・藤井茶舗 | お茶のふじい

2024年最新】Yahoo!オークション -☆薩摩切子☆(工芸ガラス)の中古品

薩摩切子 脚付杯 色被せガラス 復元 尚古集成館監修・薩摩ガラス工芸作-

薩摩切子 尚古集成館監修 薩摩ガラス工芸 猪口(切子、江戸切子、薩摩

2024年最新】薩摩切子 尚古の人気アイテム - メルカリ

ふるさと割 島津 薩摩切子 色被せガラス 切子盃 尚古集成館監修 薩摩

☆超希少品☆薩摩切子 尚古集成館監修 向付鉢 金赤(切子、江戸切子

Amazon.co.jp: 尚古集成館監修薩摩切子 薩摩ガラス工芸 猪口 酒器 切子

薩摩切子 脚付杯 色被せガラス 復元 尚古集成館監修・薩摩ガラス工芸作-

島津薩摩切子 SHIMADZU刻印有り 尚古集成館監修 薩摩ガラス工芸作 切子

薩摩切子 二色衣 脚付盃 cut201 島津薩摩切子 島津興業 薩摩ガラス工芸

2024年最新】Yahoo!オークション -☆薩摩切子☆(工芸ガラス)の中古品

薩摩切子 尚古集成館監修 薩摩ガラス工芸 猪口(切子、江戸切子、薩摩

島津 薩摩切子 色被せガラス 切子盃 尚古集成館監修 薩摩ガラス工芸作-

2024年最新】薩摩切子 尚古の人気アイテム - メルカリ

ふるさと割 島津 薩摩切子 色被せガラス 切子盃 尚古集成館監修 薩摩

尚古集成館監修 薩摩ガラス工芸 復元島津薩摩切子 色被せガラス切子盃お茶のふじい・藤井茶舗 | お茶のふじい

尚古集成館監修☆薩摩切子 薩摩ガラス工芸 猪口 酒器(切子、江戸切子

☆超希少品☆薩摩切子 尚古集成館監修 向付鉢 金赤(切子、江戸切子

島津薩摩切子 SHIMADZU刻印有り 尚古集成館監修 薩摩ガラス工芸作 切子

薩摩切子 二色衣 脚付盃 cut201 島津薩摩切子 島津興業 薩摩ガラス工芸

商品の情報

メルカリ安心への取り組み

お金は事務局に支払われ、評価後に振り込まれます

出品者

スピード発送

この出品者は平均24時間以内に発送しています