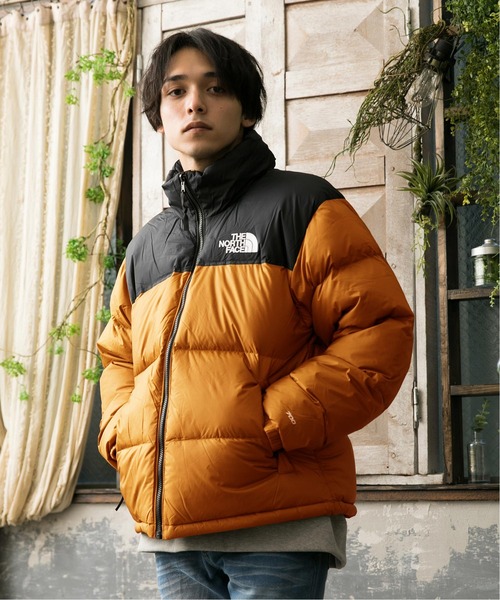

ノースフェイス ヌプシダウンジャケット

(税込) 送料込み

商品の説明

商品説明

700フィル古着屋での購入ですが

多少の汚れがあるためこの値段での出品になります。

サイズ表記はM

カラーは青/黒

コンディションは薄汚れ

多少のダウン抜け

全ジッパースムーズに可動致します。

古着に慣れている方でしたら問題なくお使い頂けると思います。

90年代ビンテージオールドVINTAGEブルーツートン2トン元ネタシュプリームsupremeNorthFace

6440円ノースフェイス ヌプシダウンジャケットメンズジャケット/アウター楽天市場】◇[NDW92232]THE NORTH FACE(ザ・ノースフェイス) Shortメンズノースフェイス ヌプシダウンジャケット - ダウンジャケット

ザ ノースフェイス ジャケット THE NORTH FACE メンズ ヌプシ フーディー ( Nuptse Hoodie JKT 2023秋冬 JACKET ダウンジャケット アウター ND92331 国内正規 ) : nor-nd92331 : ice field - 通販 -

新品国内正規⭐︎ノースフェイス ヌプシ ジャケット ブラック メンズ S

楽天市場】◇[NDW92232]THE NORTH FACE(ザ・ノースフェイス) Short

ダウン ダウンジャケット THE NORTH FACE/ザノースフェイス/ヌプシ

ノースフェイス ダウン ジャケット 衣類 メンズ ヌプシ ヌプシジャケット 2023 新作 S M L XL XXL ブラック M'S NUPTSE ON BALL JACKET NJ3NP55A THE NORTH FACE | リヴェラール楽天市場店

ヌプシ ダウン」に該当するTHE NORTH FACE(ザノースフェイス)の

ダウン ダウンジャケット THE NORTH FACE ザ・ノースフェイス ヌプシ

THE NORTH FACE(ザノースフェイス)の「THE NORTH FACE NUPTSE JACKET

限定展開 THE NORTH FACE/ザ・ノースフェイス Short Nuptse Jacket/ショートヌプシジャケット

THE NORTH FACE / ザ・ノース・フェイス 1996 RETRO NUPSTE JACKET

ダウン ダウンジャケット THE NORTH FACE/ザノースフェイス/ヌプシ

国内未発売 THE NORTH FACE(ザ・ノースフェイス)/軽量 保温 防風 撥水 フード収納可能 ヌプシ ダウンジャケット/M'S 1996 ECO NUPTSE JACKET

楽天市場】THE NORTH FACE ザ・ノースフェイス ダウンジャケット

ノースフェイス ヌプシ ダウンジャケット[品番:OE000007561]|Rocky Monroe(ロッキーモンロー)のメンズファッション通販|SHOPLIST(ショップリスト)

Amazon | [ノースフェイス] THE NORTH FACE 正規品 メンズ アウター

セール】THE NORTH FACE/ザノースフェイス/ヌプシダウン NUPTSE HYBRID

ノースを代表するダウン。ヌプシジャケットの特徴、サイズ感からUS

ノースフェイス ヌプシ ダウンジャケットの通販・価格比較 - 価格.com

楽天市場】【2023秋冬モデル】 NDW92335 ノースフェイス ショート

2022 新作☆【ザノースフェイス】1996 ECO NUPTSE ヌプシ ダウン (THE

ヌプシジャケット(メンズ)(ND92335)- THE NORTH FACE公式通販

THE NORTH FACE - ノースフェイス ヌプシダウンジャケット アンダイド

セール】【THE NORTH FACE】ノースフェイス ダウンジャケット NF0A3C8D

楽天市場】現品限り 送料無料 ノースフェイス 高品質 ダウン

THE NORTH FACE - 入手困難 激レア 90s ノースフェイス ヌプシ ダウン

ノースフェイス ヌプシ ダウンジャケット nd92234 s - www

ダウン ダウンジャケット 国内未発売 THE NORTH FACE(ザ・ノース

THE NORTH FACE / ザ・ノース・フェイス 1996 RETRO NUPSTE JACKET

名作ダウン「ザ・ノース・フェイス ヌプシ」の歴史と最新作の「正解

THE NORTH FACE(ザノースフェイス)の「【THE NORTH FACE/ザノース

安定感抜群のロングセラーダウンジャケット「ノースフェイス ヌプシ

ノースフェイス ダウン THE NORTH FACE 1996 エコ ヌプシ ジャケット ECO NUPTSE JACKET : nj1dl50 : MONA ROSETTA - 通販 - Yahoo!ショッピング

The North Face】2021年新作 1996 ヌプシ ダウンジャケット (THE NORTH

ノースフェイスを代表するダウン。ヌプシジャケット、ベストが今年も

ノースフェイス ヌプシ ダウンジャケット アウター ブラック 120-

THE NORTH FACE - 90s ノースフェイス ヌプシ ダウンジャケット メンズ

ヌプシジャケット(メンズ)(ND92335)- THE NORTH FACE公式通販

ノースフェイス ダウンジャケット メンズ 正規品 THE NORTH FACE

THE NORTH FACE(ザノースフェイス)の「【THE NORTH FACE/ザノース

商品の情報

メルカリ安心への取り組み

お金は事務局に支払われ、評価後に振り込まれます

出品者

スピード発送

この出品者は平均24時間以内に発送しています

![楽天市場】◇[NDW92232]THE NORTH FACE(ザ・ノースフェイス) Short](https://tshop.r10s.jp/woody-h/cabinet/02711814/thenorthface3/ndw92232-01.jpg)

![ノースフェイス ヌプシ ダウンジャケット[品番:OE000007561]|Rocky Monroe(ロッキーモンロー)のメンズファッション通販|SHOPLIST(ショップリスト)](https://cdn.shop-list.com/res/up/shoplist/shp/__thum370__/rockymonroe/abito2011/cabinet/10009426/13103-15.jpg)

![Amazon | [ノースフェイス] THE NORTH FACE 正規品 メンズ アウター](https://m.media-amazon.com/images/I/51YsBbZEHJL._AC_UY580_.jpg)