オーダー様専用¥9871

(税込) 送料込み

商品の説明

商品説明

ネイルチップ×26909円オーダー様専用¥9871コスメ/美容ネイルREDWING - ☆廃盤☆復刻刺繍犬タグ☆15年☆9871☆8.5D☆レッドウィングレッドウイング9871 アイリッシュセッター 販売場所 - www

レッドウィング アイリッシュセッター 9871 26センチ | ktscr.com

⭐︎たかひろ様専用⭐︎-

REDWING - ☆廃盤☆復刻刺繍犬タグ☆15年☆9871☆8.5D☆レッドウィング

⭐︎たかひろ様専用⭐︎-

オンラインストア入荷 レッドウィング 9871 ゴールドラセットセコイア

最安値挑戦!】 カッパ様専用 レッドウィング ブーツ ブーツ

最も激安 レッドウィング RED WING 9871 | mersolsureste.com.mx

直売オーダー 【デカデカリビングちゃん様専用】RED WING ベックマン - 靴

M.様 オーダーウィッグ 《白膠木簓》 レディース コスプレ おすすめ

⭐︎たかひろ様専用⭐︎-

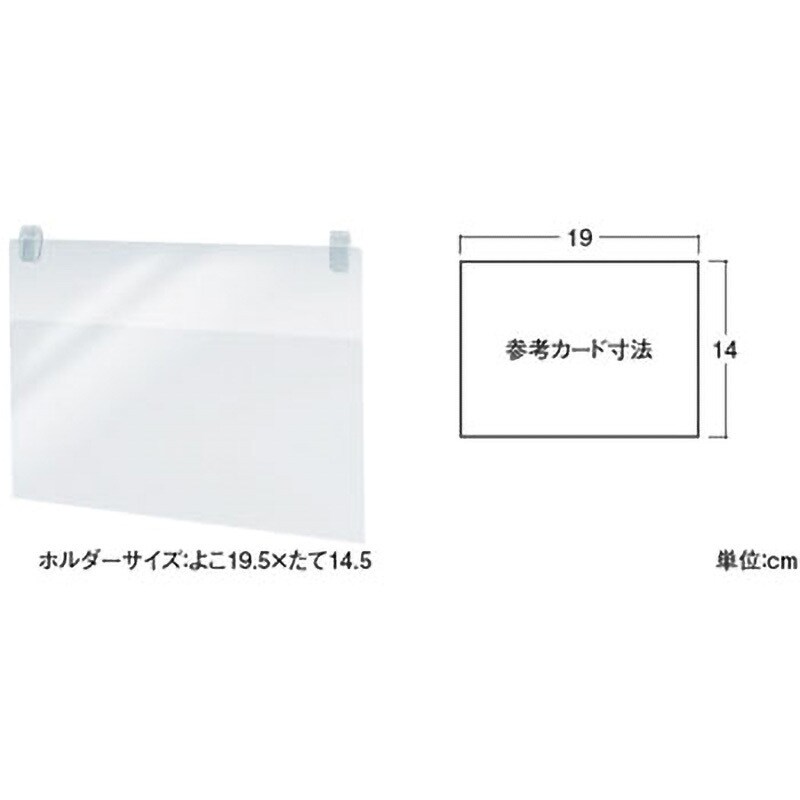

PBプライスカードホルダー

9871 Pentax 6×7 Takumar 105mm 2.4 グリップ付き - フィルムカメラ

オーダー様専用

Supreme - supreme sticky note molded lamp 葵産業の+solo-truck.eu

⭐︎たかひろ様専用⭐︎-

REDWING - ☆廃盤☆復刻刺繍犬タグ☆15年☆9871☆8.5D☆レッドウィング

お得セール MODE S カーテングレードアップ(約2倍ヒダカーテン) 縫製

mila schon オーダーカーテン D-4161 防炎 2倍ヒダ|スミノエ公式通販

REDWING レッドウィング 8169 ペコスブーツ 6.5E レッドウィング

退職祝い 送別 記念品 定年 名前詩LS サイズ 1人〜2人用 還暦祝い 古希

mila schon オーダーカーテン D-4160 防炎 フラット|スミノエ公式通販

ダイハツ レッドウイング 27.5cm プレーントゥ | rpagrimensura.com.ar

2007年製 USA製 レッドウィングREDWING8166 サイズ71/2D レッド

楽天市場】網戸 オーダーサイズ 上部調整桟付TS網戸 テラスサイズ 1枚

レッドウイング9871 アイリッシュセッター Yahoo!フリマ(旧)+olivera

Levi´s - LEVIS リーバイス 501 の+samostalnisindikatbvk.rs

sacai サカイ sacai nylon twill blouson MA-1-

オーダー製作 ワイドタイプの脚付きテレビボード チェッカーガラス仕様

mila schon オーダーカーテン D-4134・4135 防炎 2倍ヒダ|スミノエ

Hunterdouglas -ハンターダグラス-アーカイブ|施工ブログ|新築

華奢カーテンレール 専用カーテンフック(10個1セット) | DW-CB011-09

希少 RED WING × BEAMS Engineer No.8274 9.5-

sacai サカイ sacai nylon twill blouson MA-1-

D-4166~D-4169 モードエス スミノエ|カーテン・オーダーカーテン取扱

オーダー主様専用 - GRASSK'S GALLERY | minne 国内最大級の

超安い】 RIMOWA キャリーケース トパーズ 64㍑ 旅行用バッグ/キャリー

楽天市場】網戸 オーダーサイズ 上部調整桟付TS網戸 テラスサイズ 1枚

レッドウイング9871 アイリッシュセッター Yahoo!フリマ(旧)+olivera

高品質 実物撮影 ONE PIECE ワンピース コスチューム コスプレ衣装

商品の情報

メルカリ安心への取り組み

お金は事務局に支払われ、評価後に振り込まれます

出品者

スピード発送

この出品者は平均24時間以内に発送しています