ラルフローレン ジャケット コート コットン ナイロン フーディー ジップアップ

(税込) 送料込み

商品の説明

商品説明

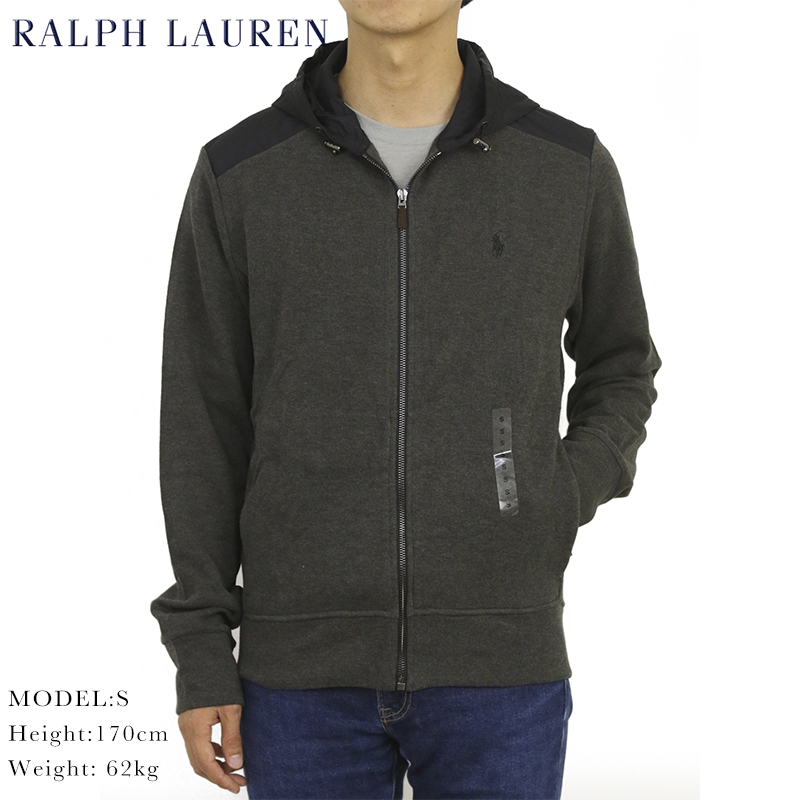

■商品名ラルフローレンRALPHLAURENジャケットコートコットンナイロンフーディージップアップメンズアウターネイビーサイズM

■状態説明

・程よくハリ感のあるコットン×ナイロンのブレンド素材を使用した、RALPHLAURENのジップアップジャケットです♪

・コーティング加工された生地を使用しており、防水性にも優れた一着です◎

・国内正規店取り扱いの製品です。

・袖先に多少アタリがございますが、気になるキズや汚れもなくキレイな状態です!

【付属品:なし】

■素材

コットン80%ナイロン20%(ポリウレタンコーティング)

■カラー

ネイビー

■表記サイズ

M

■実寸サイズ

着丈:約80cm

身幅:約65cm

肩幅:約55cm

袖丈:約60cm

■状態ランク

A使用感の少ないキレイな状態

■店舗管理番号

ch04mm-rm10c09935

6548円ラルフローレン ジャケット コート コットン ナイロン フーディー ジップアップメンズジャケット/アウターラルフローレン ジャケット コート コットン ナイロン フーディー ジップアップラルフローレン ジャケット コート コットン ナイロン フーディー ジップアップ

ラルフローレン ジャケット コート コットン ナイロン フーディー ジップアップ

ラルフローレン ジャケット コート コットン ナイロン フーディー ジップアップ

ラルフローレン ジャケット コート コットン ナイロン フーディー ジップアップ

90s- ポロラルフローレン ナイロンジャケット スイングトップ

Ralph Lauren - ラルフローレン ジャケット コート コットン ナイロン

ポロラルフローレン ナイロンジャケット ジップアップ ワンポイント

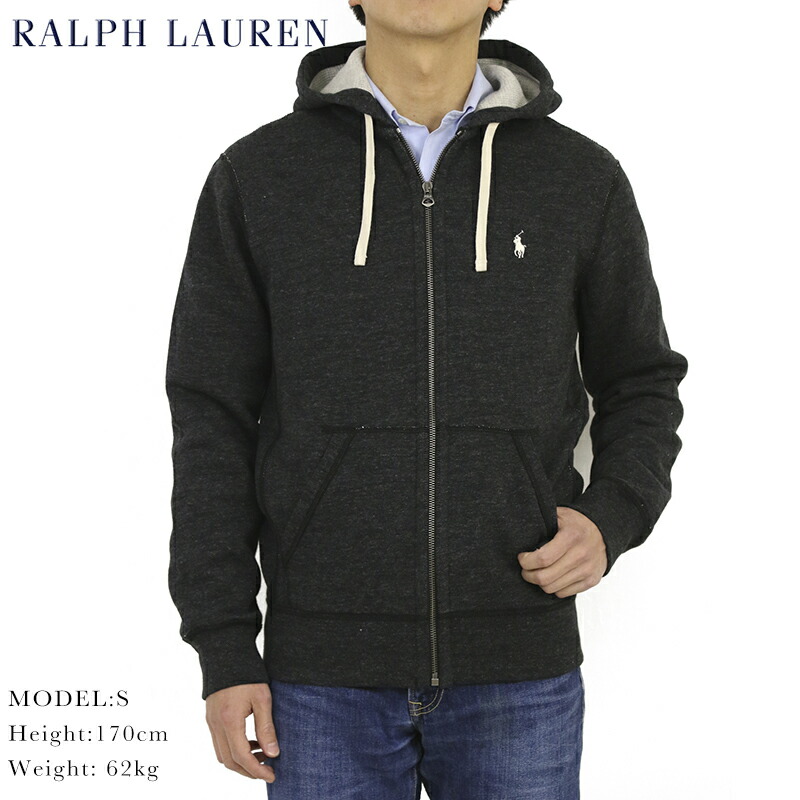

楽天市場】ポロ ラルフローレン メンズ ジップアップスウェット

90s- ポロラルフローレン ナイロンジャケット スイングトップ

Ralph Lauren - 美品 ラルフローレン ブラックレーベル RALPH LAUREN

楽天市場】ポロ ラルフローレン エステートリブ コットン ジップアップ

90s ポロラルフローレン ポロスポーツ ナイロンジャケット ワン

POLO RALPH LAUREN ポロラルフローレン ブルゾン 紺 XL

Amazon | (ポロ ラルフローレン) POLO Ralph Lauren メンズ フリース

[POLO RALPH LAUREN]

楽天市場】ポロ ラルフローレン フリース ジップアップパーカー

90年代 Polo by Ralph Lauren ポロバイラルフローレン ハーフコート

店舗ランキング商品 ポロラルフローレン ジップパーカー ナイロン

ラルフローレン

ポロ ラルフローレン パーカー ジップアップ フーディー スウェット

☆正規品 ラルフローレン ブルゾン ジャケット 赤 ポニー刺繍 内側

90s ポロラルフローレン 中綿ナイロンジャケット ジップアップ

POLO RALPH LAUREN 【美品】ボアフリースパーカー アウター-

楽天市場】ポロ ラルフローレン エステートリブ コットン ジップアップ

お洒落【Polo Ralph Lauren】BIGサイズ ジップ デニムジャケット (POLO

Ralph Lauren sport ジップアップ コットン ニット パーカー ウィメンズ M ホワイト ケーブル ラルフローレン 古着卸 アメリカ仕入れ a412-5206

ポロ ラルフローレン パーカー ジップアップ フーディー スウェット

Amazon | (ポロ ラルフローレン) POLO Ralph Lauren メンズ フード付き

☆SWC☆ナイロンジップアップジャンパー M グレー M

90s ポロラルフローレン ナイロンジャケット ハーフジップ | Vintage.City

楽天市場】ポロ ラルフローレン メンズ フード付き レトロパイル

POLO RALPH LAUREN ZIP UP HOODIE S Red Cotton Talon Zip BRUSHED

00s ポロ ラルフローレン ワンポイント ヘンリーネック コットン

90s- ポロラルフローレン スウェードジャケット ジップアップ ヘビー

POLO RALPH LAUREN(ポロ ラルフ ローレン)の「Polo Ralph Lauren

M】POLO By Ralph Lauren ポロ ラルフローレン 肉厚生地 刺繍ロゴ

ラルフローレン

ベイポート コットン ジャケット

Ralph Lauren - ラルフローレン ジャケット コート コットン ナイロン

ポロ ラルフローレン Polo by Ralph Lauren ジップアップ コットン

商品の情報

メルカリ安心への取り組み

お金は事務局に支払われ、評価後に振り込まれます

出品者

スピード発送

この出品者は平均24時間以内に発送しています

![[POLO RALPH LAUREN]](https://baseec-img-mng.akamaized.net/images/item/origin/3012d32eb2836da842b359b7d414216b.jpg)