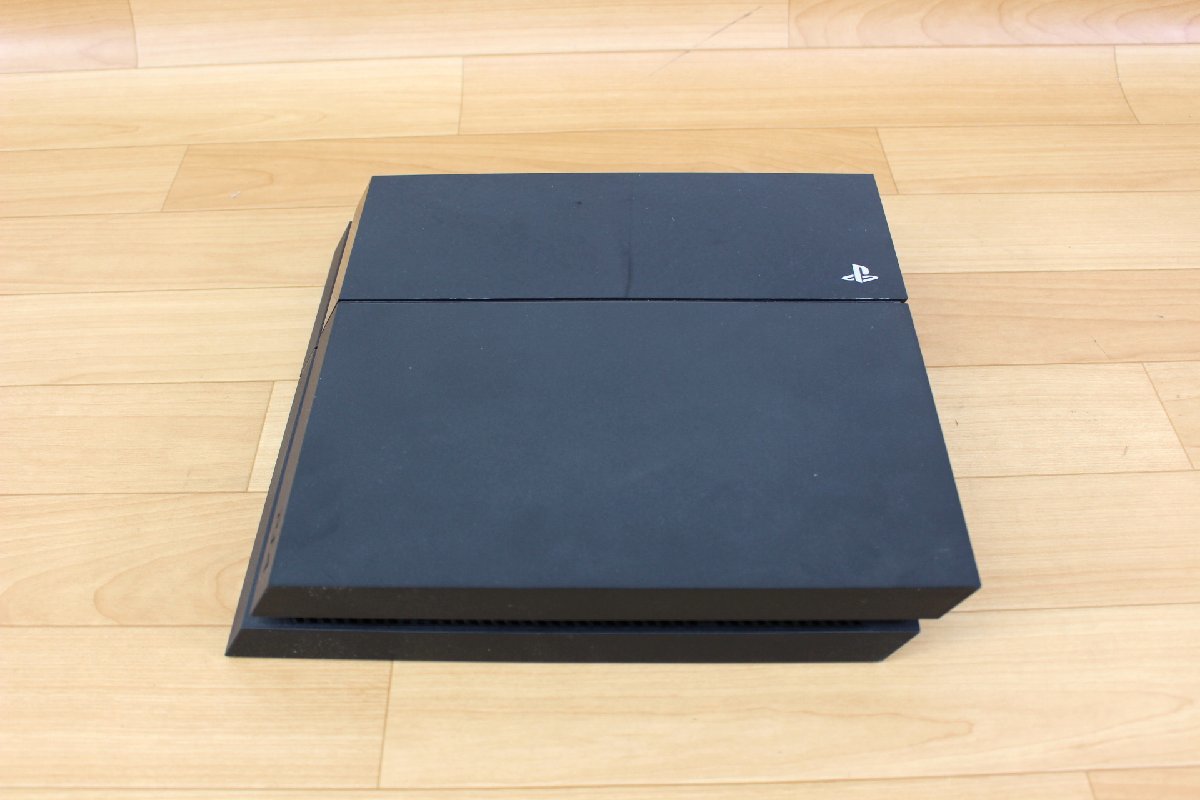

SONY PS4 500GB CUH-1100A ブラック プレステ4 本体

(税込) 送料込み

商品の説明

商品説明

◎中古品◎・PlayStation4CUH-1100本体

⇒目立った傷なし

・純正コントローラーブラック

⇒裏面シールの剥げあり

・ACアダプター

・HDMIケーブル

商品をご覧いただきありがとうございます。

動作確認済み+初期化済み

箱なしのため発送の際は緩衝材等でしっかりと梱包させていただきます。

中古品ですのでご理解の程、よろしくお願いいたします。

#プレーステーション4

#PlayStation4

#PS4

#CUH-1100

#ゲーム

#テレビゲーム

8970円SONY PS4 500GB CUH-1100A ブラック プレステ4 本体エンタメ/ホビーゲームソフト/ゲーム機本体PS4 プレステ4 プレイステーション4 ジェット・ブラック 500GB (CUHPlayStation®4 ジェット・ブラック 500GB CUH-1100A… 世界有名な 本

PlayStation®4 ジェット・ブラック 500GB CUH-1100A… 世界有名な 本

PS4 プレイステーション4 本体 CUH-1100A 500G-

PS4 プレステ4 プレイステーション4 ジェット・ブラック 500GB (CUH

新素材新作 CUH-1100A PS4 プレステ4 本体 ホワイト Amazon.co.jp

PS4本体 SONY PlayStation4 CUH-1100A-

PS4 プレイステーション4 本体 CUH-1100A 500G-

2022高い素材 ・65070 【動作確認済】 SONY PlayStation4 PS4 プレステ

PS4 本体 プレイステーション4 CUH-1100A ジェットブラック-

PlayStation®4 ジェット・ブラック 500GB CUH-1100A…

PlayStation4 本体 ブラック 500GB CUH-1100A… ぷ-

PlayStation®4 ジェットブラック 500GB CUH-1100A-

PlayStation®4 ジェット・ブラック 500GB CUH-1100A

PS4 プレステ4 PlayStation 4 ジェット・ブラック 500GB PlayStation

楽天市場】PS4 本体 付属品完備 完品 プレステ4 CUH-2100AB01 500GB

PlayStation®4 ジェット・ブラック 500GB CUH-1100A… 家庭用ゲーム本体

Amazon.co.jp: PlayStation 4 ジェット・ブラック 500GB (CUH-1100AB01

PS4 本体のみ ブラック 500GB CUH-1100 プレイステーション4 はぴ価格

24時間以内配送】ps4 本体 1100 PlayStation®4 - www.sorbillomenu.com

PlayStation®4 ジェット・ブラック 500GB CUH-1100A…-

人気特価 プレイステーション4 PlayStation®4 ジェットブラック 500GB

ファッション PlayStation®4 ジェット・ブラック 500GB CUH-1100A

話題の行列 ver.10.50 500GB CUH-1100A △現状品△ PS4 (2712055

PS4 本体 500GB CUH-1100A 動作確認済み プレステ4 ブラック 直営

PS4 PlayStation4 本体CUH-1100A 500G グレイシ - www.sorbillomenu.com

新作がお得買い SONY PS4 500GB CUH-1100A ブラック プレステ4 本体

楽天市場】SONY ソニー PlayStation 4 ゲーム機本体 ジャンク品 CUH

PlayStation®4 ジェット・ブラック 500GB CUH-1100A…-

PlayStation4 - 美品 PS 4本体 CUH-1100A B01 500GB ジェットブラック

2年保証』 ジェットブラック 500GB CUH-1100A PS4 SONY 動作品 Sony

PS4 本体 CUH-1100 500GB ソフト付エンタメ/ホビー - 家庭用ゲーム機本体

Amazon.co.jp: PlayStation 4 ジェット・ブラック 500GB (CUH-1100AB01

PlayStation®4 ジェット・ブラック 500GB CUH-1100A… - ゲームソフト

PS4 プレステ4 プレイステーション4 ジェット・ブラック 500GB (CUH

半額品 PlayStation 4 本体 PS4 500GB CUH-1100 - テレビゲーム

PlayStation4 - 美品 PS 4本体 CUH-1100A B01 500GB ジェットブラック

選ぶなら S5308 中古 PS4 CUH-1100A 500GB ブラック コントローラー×1

PlayStation 4 (プレイステーション4) ジェット・ブラック 500GB

新型コロナウイルス PS4 本体 500GB CUH-1100A ブラック

SONY PS4 本体 ジェットブラック CUH-1100A SSHD2TB換装-

商品の情報

メルカリ安心への取り組み

お金は事務局に支払われ、評価後に振り込まれます

出品者

スピード発送

この出品者は平均24時間以内に発送しています