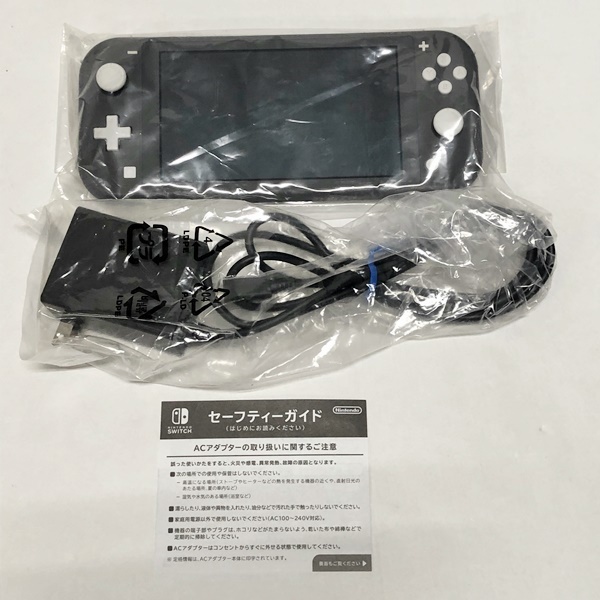

Nintendo Switch light グレー

(税込) 送料込み

商品の説明

商品説明

コロナ禍で購入し緊急事態宣言中によく使っていましたがここ1年ほど仕事が忙しかったりで使わなくなってしまい、ずっと引き出しの中に入れっぱなしだったため売ることにしました。動作の問題はなく、自宅でしか使っていなかったので傷や汚れもなく良品です。初期化済みです。

購入当初の箱に本体、充電器を入れて包んで発送させていただきます。

アルコール消毒済みですが、素人保管のため気になる方はお控えくださいませ。

また、クレームは一切受け付けませんのでご了承くださいませ。

※ご購入意思のないいいねはお控えいただくようお願いいたします。

#Nintendo#NintendoSwitchlight#Switchlight

8970円Nintendo Switch light グレーエンタメ/ホビーゲームソフト/ゲーム機本体Nintendo Switch Lite グレー ニンテンドー スイッチ ライト - wwwNintendo Switch™ Lite - Gray

任天堂Switch light グレー ニンテンドー スイッチ ライト ケース付

Nintendo Switch Lite | 任天堂

Nintendo Switch Lite グレー ニンテンドー スイッチ ライト - www

新品】Nintendo Switch Lite グレー スイッチライト本体

即日出荷可 ニンテンドーSwitch ライト グレー | www.artfive.co.jp

Nintendo Switch Lite グレー [ゲーム機本体]

ニンテンドースイッチライト グレー - www.sorbillomenu.com

楽天市場】【あす楽、土日、祝日発送、店舗受取可】新品未使用品【S

Nintendo Switch Lite - Gray - Hardware - Nintendo - Nintendo

Hori Split Pad Compact for Nintendo Switch Light Gray & Yellow NSW

ニンテンドースイッチライト グレー Switch lite

Amazon.co.jp: 連射・連射ホールド機能搭載【任天堂ライセンス商品

Nintendo Switch Lite - Coral - Hardware - Nintendo - Nintendo

Nintendo Switch Lite グレー HDH-S-GAZAA | ヤマダウェブコム

公式売上 任天堂 Switchライト グレー | mcdc.padesce.cm

値下げ】Nintendo Switch light グレー - www.sorbillomenu.com

最安挑戦! 美品 Nintendo - 任天堂 Switch スイッチ ライト グレー

任天堂 Nintendo Switch Lite ニンテンドースイッチ ライト ターコイズ グレー コーラル ブルー イエロー 本体のみ 中古 : switchlite2 : SHOP M&M - 通販 - Yahoo!ショッピング

Nintendo Switch Light グレー - 家庭用ゲーム機本体

ニンテンドースイッチライト グレー 箱・充電器付-

ゲオ公式通販サイト/ゲオオンラインストア【新品】Nintendo

Nintendo HDH-S-GAZAA 【インディゲームセール】【Switch

時間指定不可 Nintendo Switch Switch Switch グレー Lite LITE

ニンテンドースイッチライト グレー Switch lite

任天堂 - 任天堂Switch ライトグレー色【美品・フィルム付・ケース付

プレゼント対象商品 買取 Nintendo スイッチライト Switchライト グレー

Nintendo Switch Lite グレー | Joshin webショップ 通販 | 任天堂

ゲオ公式通販サイト/ゲオオンラインストア【新品】Nintendo

任天堂 Nintendo Switch Lite 本体 ☆ 新品 未使用 ☆ ニンテンドー

Nintendo Switch Lite グレー [ゲーム機本体] 任天堂|Nintendo 通販

SwitchLight グレー あつ森カセット付き-

素敵でユニークな Nintendo 値下げ!ニンテンドースイッチライト

いいスタイル ニンテンドースイッチライト グレー Switch 楽天市場

ニンテンドースイッチライト グレー - www.sorbillomenu.com

2024年最新】ニンテンドースイッチライト グレーの人気アイテム - メルカリ

NINTENDO SWITCH LITE ニンテンドースイッチライト グレー-

公式専門店 ニンテンドースイッチライト グレー | www.sonextiles.com

オリジナル 任天堂 スイッチライト グレー グレーの人気アイテム

売れ筋 switch 任天堂Switch スイッチ Light スイッチライト light

商品の情報

メルカリ安心への取り組み

お金は事務局に支払われ、評価後に振り込まれます

出品者

スピード発送

この出品者は平均24時間以内に発送しています

![Nintendo Switch Lite グレー [ゲーム機本体]](https://image.biccamera.com/img/00000007135445_A04.jpg)

![Nintendo Switch Lite グレー [ゲーム機本体] 任天堂|Nintendo 通販](https://image.biccamera.com/img/00000007863225_A01.jpg)