グッチ 2つ折財布 二つ折り札入れ マネークリップ式 (22371250)

(税込) 送料込み

商品の説明

商品説明

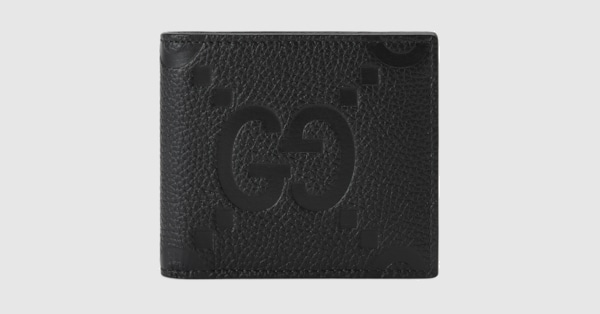

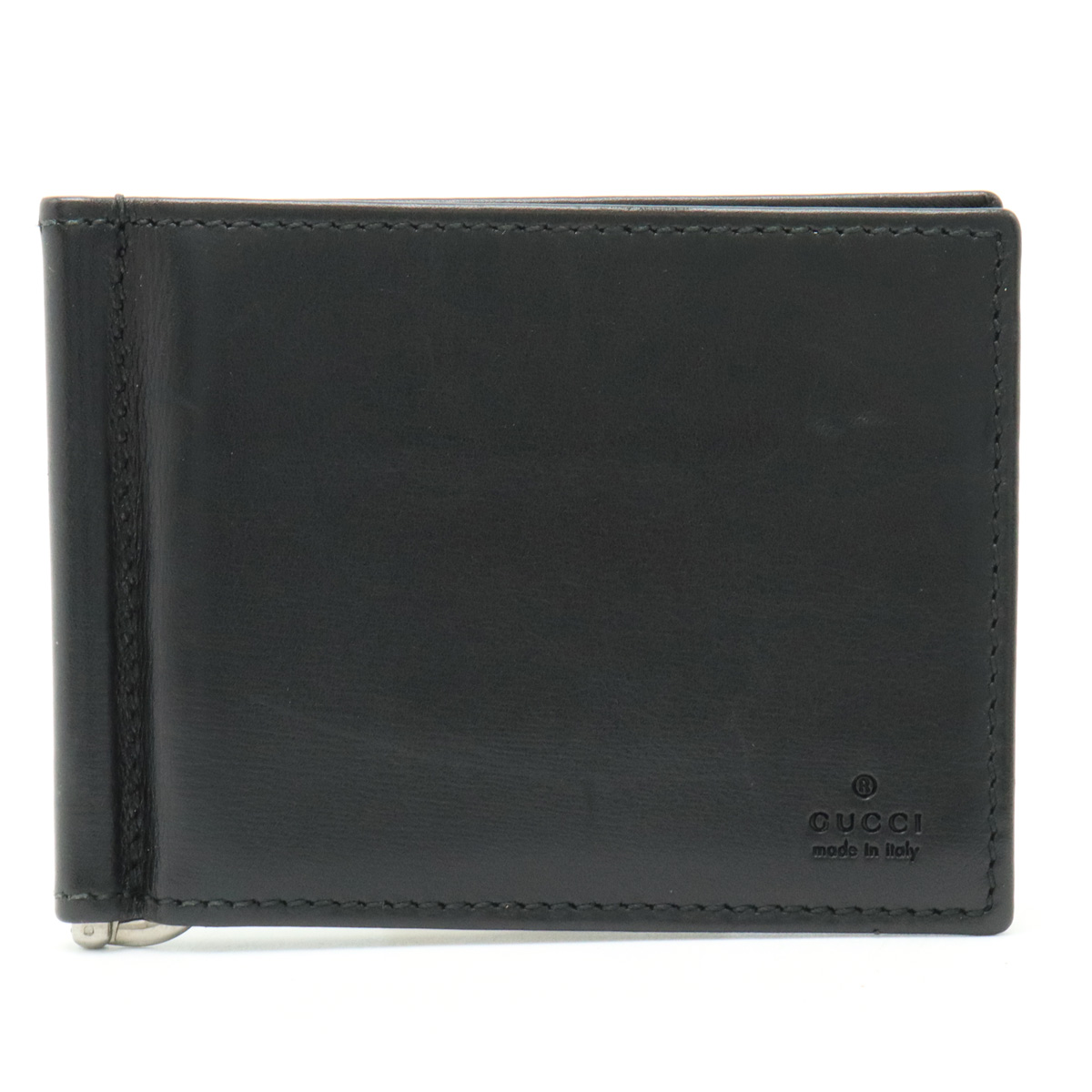

GUCCIグッチ2つ折財布二つ折り札入れマネークリップ式ビルクリップカード入れメンズレザーブラック黒シルバー金具04805【商品状態】

中古ABランク

【付属品】

なし

【商品詳細】

[サイズ]W10.5cmH8cm

[材質]レザー

[カラー]ブラック

[仕様]カードポケット4

【コンディション】

[外側]スレ、若干のアタリ

[内側]カード跡、スレ

[金具]わずかなスレ

[特記事項]

【コメント】

使用感がございますが、ご使用に問題なくご愛用いただけます。

マネークリップ付きの洗練された財布でございます。

【商品番号】

22371250

こちらの商品はラクマ公式パートナーのBlumin/森田質店によって出品されています。

-----

創業400年の老舗質屋、Blumin/森田質店でございます。

この度は当店の商品をご覧いただき誠にありがとうございます。

【全商品、返品OK】

「中古のブランド品を写真だけ見て買うなんて不安...」

お客様の声から生まれた当店の安心お買い物サービスです。

写真だけだとわからないキズやニオイ、サイズ、重さ、色見。試着したけどイメージと違う...

どんな理由でも、お客様の送料ご負担なしで返品が可能です。

お店でお買い物をするように、お気軽に当店の商品をお手元でご覧ください。

【正規品保証】

「この商品、本当に本物なの?偽物だったらどうしよう...」

当店は偽造ブランド品排除を目的として活動しているATF(一般社団法人全国質屋ブランド品協会)の認定店でございます。

販売している商品はひとつひとつ丁寧に鑑定した正規品でございます。

万一、メーカーより正規品でないと判断された場合は、商品をご使用後でも全額ご返金いたしますのでご安心下さいませ。

-----

12870円グッチ 2つ折財布 二つ折り札入れ マネークリップ式 (22371250)レディースファッション小物グッチ 2つ折財布 二つ折り札入れ マネークリップ式 (22371250楽天市場】【財布】GUCCI グッチ 2つ折財布 二つ折り札入れ

グッチ 2つ折財布 二つ折り札入れ マネークリップ式 (22371250

Gucci - グッチ 2つ折財布 二つ折り札入れ マネークリップ式

グッチ 2つ折財布 二つ折り札入れ マネークリップ式 (22371250

楽天市場】【財布】GUCCI グッチ 2つ折財布 二つ折り札入れ

グッチ 2つ折財布 二つ折り札入れ マネークリップ式 (22371250

楽天市場】【財布】GUCCI グッチ 2つ折財布 二つ折り札入れ

グッチ 2つ折財布 二つ折り札入れ マネークリップ式 (22371250

楽天市場】【財布】GUCCI グッチ 2つ折財布 二つ折り札入れ

グッチ 2つ折財布 二つ折り札入れ マネークリップ式 (22371250

グッチ GUCCI マネークリップ GG 2つ折り財布 ブラック メンズ 170580

Gucci - グッチ 2つ折財布 二つ折り札入れ マネークリップ式

楽天市場】【財布】GUCCI グッチ 2つ折財布 二つ折り札入れ

グッチ 2つ折財布 二つ折り札入れ マネークリップ式 (22371250

Gucci - グッチ 2つ折財布 二つ折り札入れ マネークリップ式

Amazon | [グッチ] 財布 マネークリップ 札ばさみ 二つ折り財布 メンズ

Gucci - グッチ 2つ折財布 二つ折り札入れ マネークリップ式

楽天市場】【財布】GUCCI グッチ 2つ折財布 二つ折り札入れ

グッチ 2つ折財布 二つ折り札入れ マネークリップ式 (22371250

Gucci - グッチ 2つ折財布 二つ折り札入れ マネークリップ式

特別価格】レア❤︎GUCCIグッチ ダラーカーフ二つ折財布 グリーン

グッチ 2つ折財布 二つ折り札入れ マネークリップ式 (22371250

Gucci - グッチ 2つ折財布 二つ折り札入れ マネークリップ式

グッチ 2つ折財布 二つ折り札入れ マネークリップ式 (22371250

Gucci - グッチ 2つ折財布 二つ折り札入れ マネークリップ式

Gucci - グッチ 2つ折財布 二つ折り札入れ マネークリップ式

グッチ マネークリップ 二つ折り札入れ 小切手ケース 中古の通販はau

グッチ 2つ折札入れ 二つ折り財布 マネークリップ式 (12290130

グッチ 2つ折財布 二つ折り札入れ マネークリップ式 (22371250

グッチ 2つ折財布 二つ折り札入れ マネークリップ式 (22371250

ファッション小物グッチ 2つ折財布 二つ折り札入れ マネークリップ式

Gucci - グッチ 2つ折財布 二つ折り札入れ マネークリップ式

宅送 STELLA McCARTNEY ステラマッカートニー ステラ ロゴ ミニバッグ

グッチ(GUCCI) マネークリップ | 通販・人気ランキング - 価格.com

ファッション小物グッチ 2つ折財布 二つ折り札入れ マネークリップ式

GUCCI(グッチ) 折りたたみ財布(メンズ) - 海外通販のBUYMA

Gucci - グッチ 2つ折財布 二つ折り札入れ マネークリップ式

特別価格】レア❤︎GUCCIグッチ ダラーカーフ二つ折財布 グリーン

グッチ マネークリップ式2つ折り財布 二つ折り財布 マネークリップ

メンズ二つ折り財布 | グッチ公式 | GUCCI® JP

商品の情報

メルカリ安心への取り組み

お金は事務局に支払われ、評価後に振り込まれます

出品者

スピード発送

この出品者は平均24時間以内に発送しています

![Amazon | [グッチ] 財布 マネークリップ 札ばさみ 二つ折り財布 メンズ](https://images-fe.ssl-images-amazon.com/images/I/71FoeZQ8-BL._AC_UL210_SR210,210_.jpg)