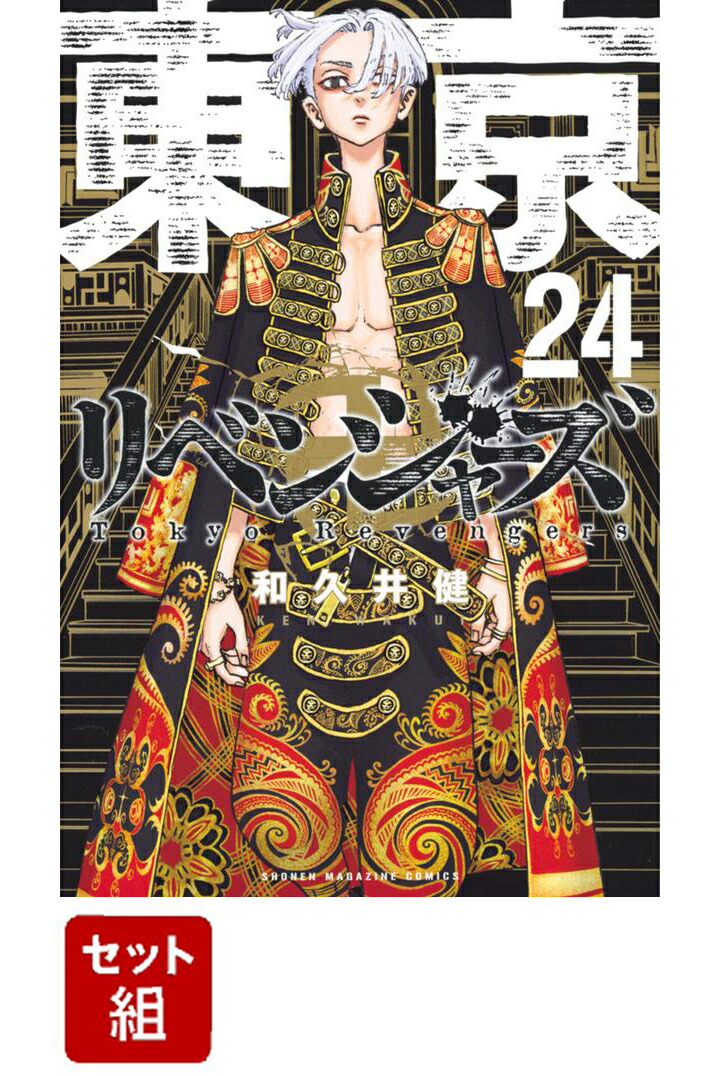

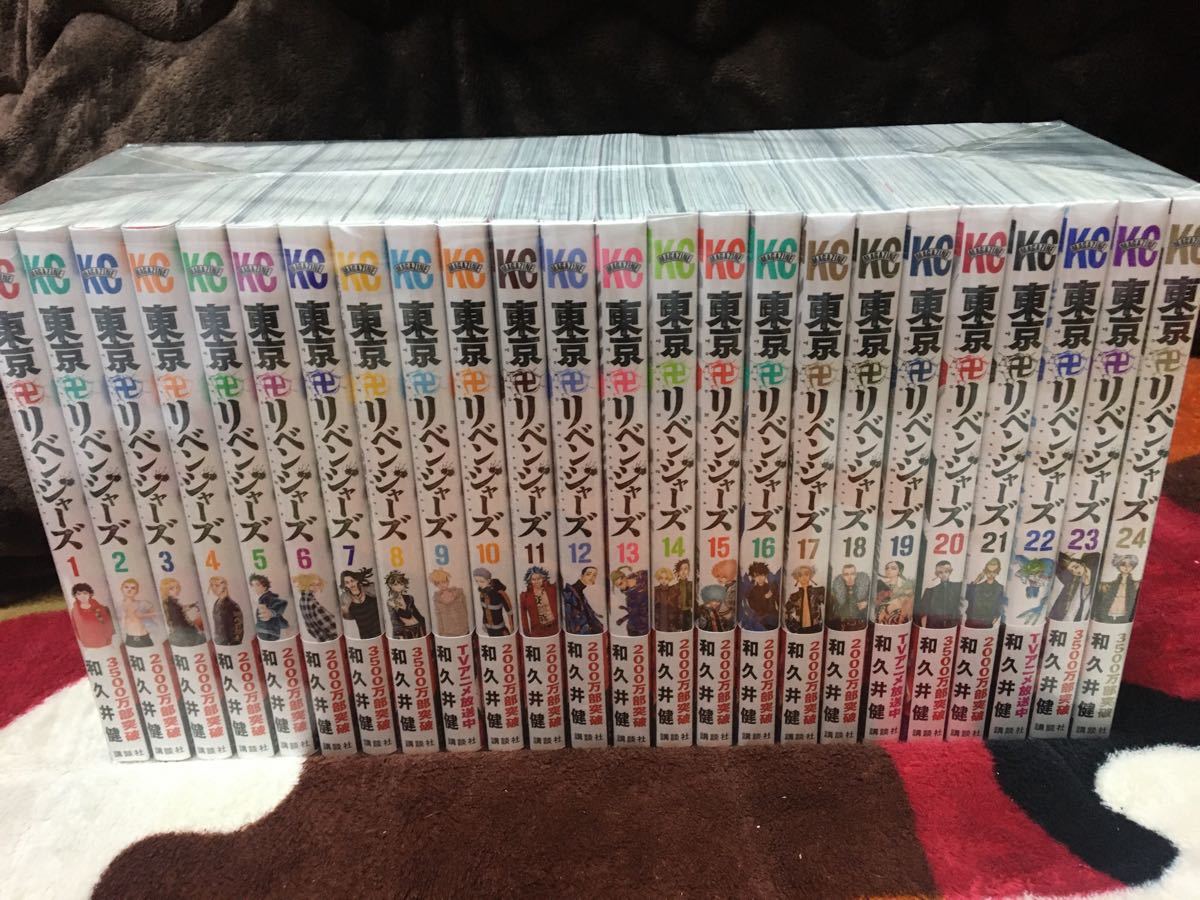

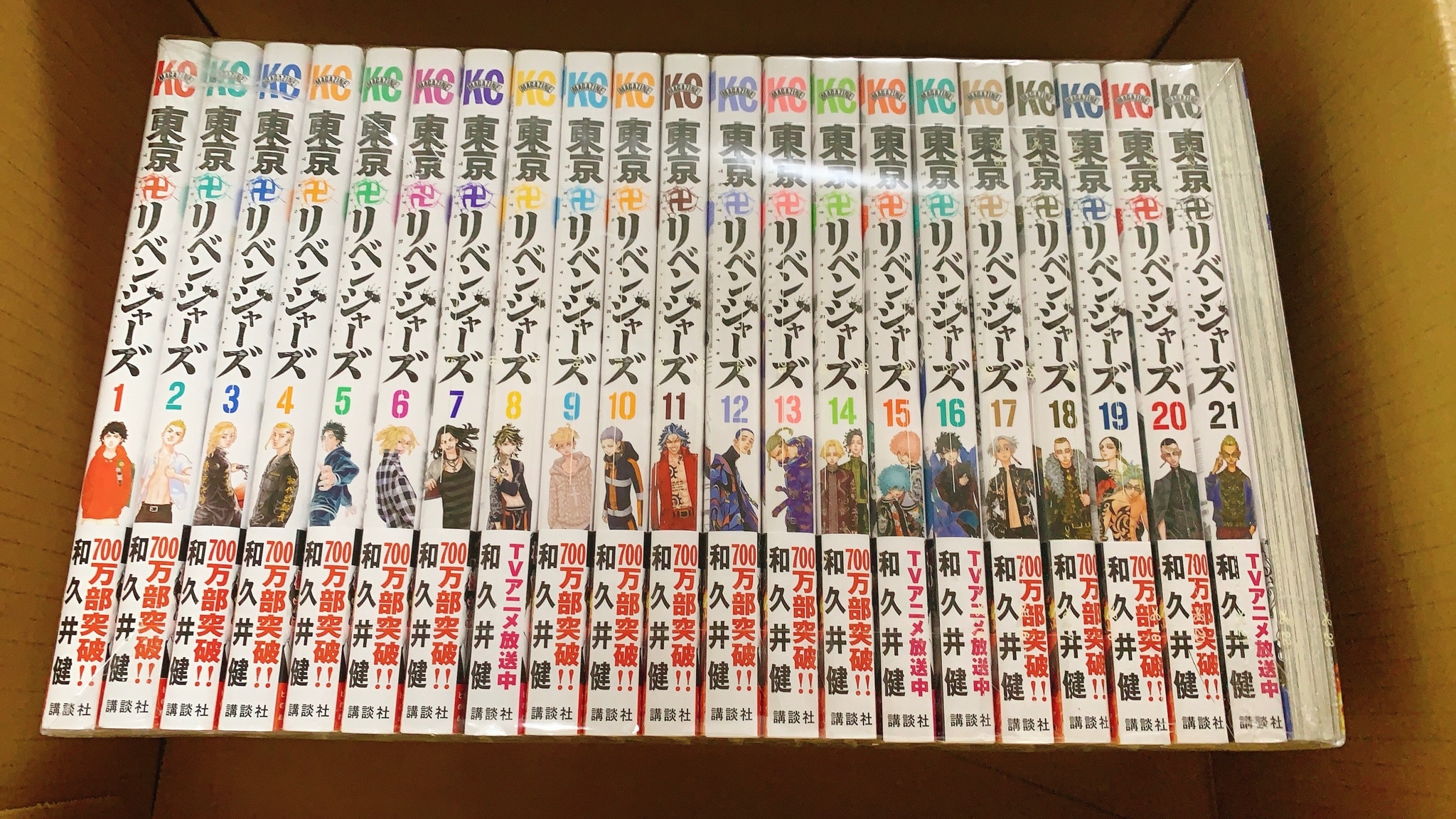

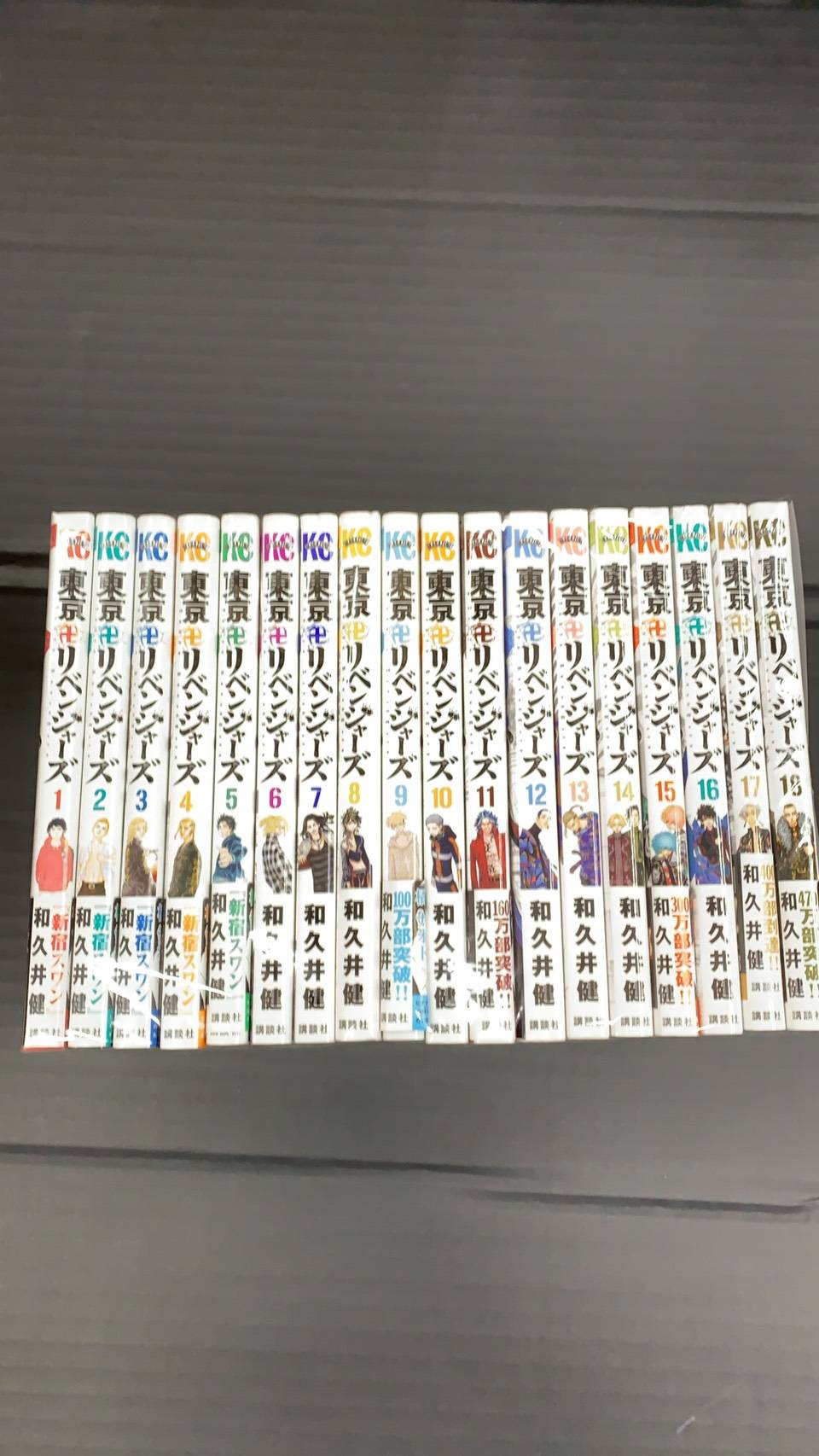

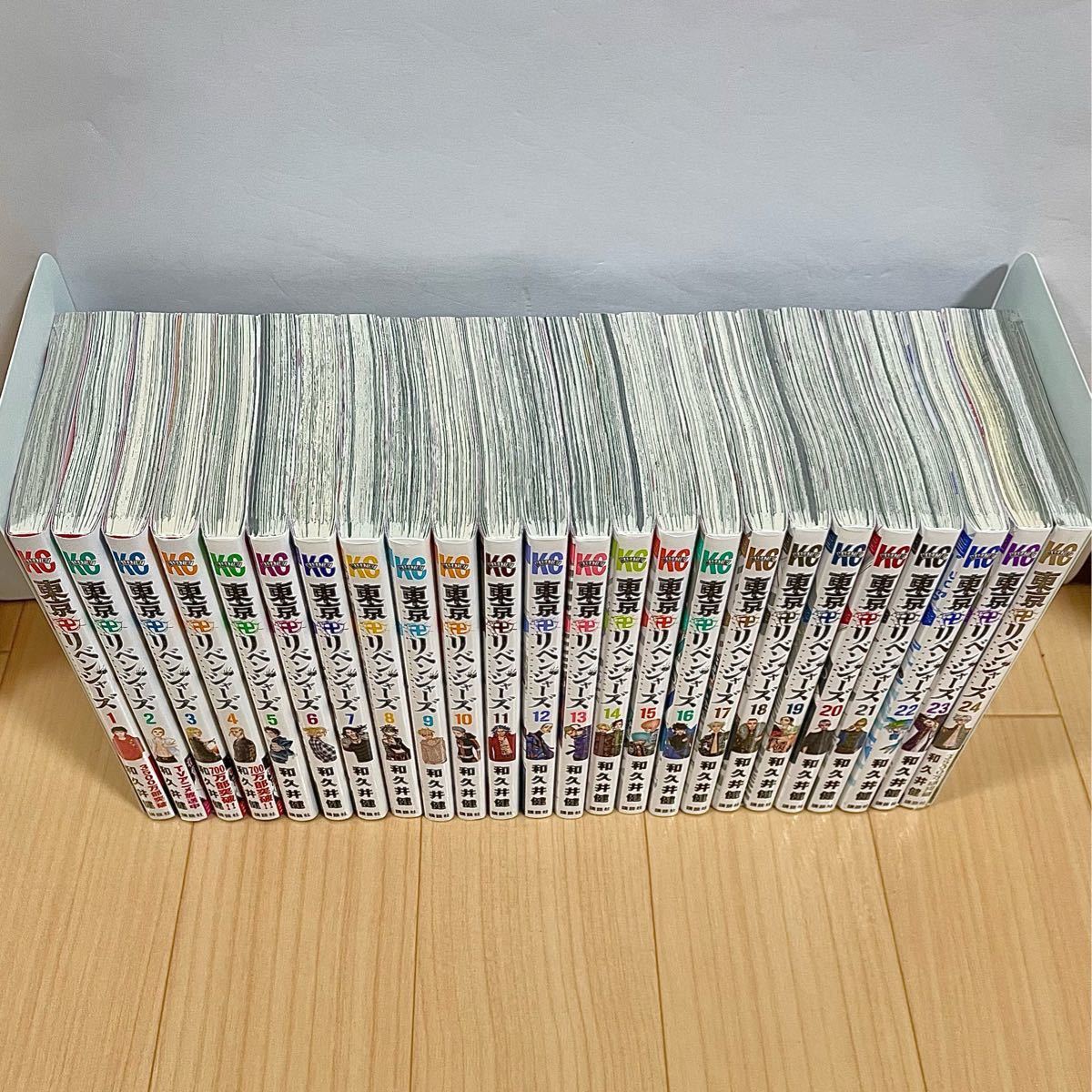

東京リベンジャーズ 1巻〜全24巻セット

(税込) 送料込み

商品の説明

商品説明

東京卍リベンジャーズ全巻セット

和久井健

シュリンク未開封帯付

ゆうパックまたはラクマパックにて発送致します。

花垣武道

佐野万次郎マイキー

龍宮寺堅ドラケン

三ツ谷隆

場地圭介

松野千冬他

6958円東京リベンジャーズ 1巻〜全24巻セットエンタメ/ホビー漫画Amazon | 東京卍リベンジャーズ コミック 1-24巻セット 全巻シュリンク【全巻新品シュリンク】東京卍 リベンジャーズ コミック 1-24全巻セット 全巻 セット 東京 リベンジャーズ 全巻 東京リベンジャーズ全巻 東京リベンジャーズ 全巻セット コミック 漫画 和久井健 東リベ 新装版 1〜24 ぴったりダンボール箱出荷 9/17発売 24巻含む | サンキューブ

東京リベンジャーズ 漫画1巻~24巻 全巻 東リべ 和久井健 - 全巻セット

東京リベンジャーズ 1~24巻 全巻 セット 日本特典付き漫画 - 全巻セット

Amazon | 東京卍リベンジャーズ コミック 1-24巻セット 全巻シュリンク

東京卍リベンジャーズ 1〜24巻

半額セールサイト 東京リベンジャーズ 1巻〜全24巻セット | skien

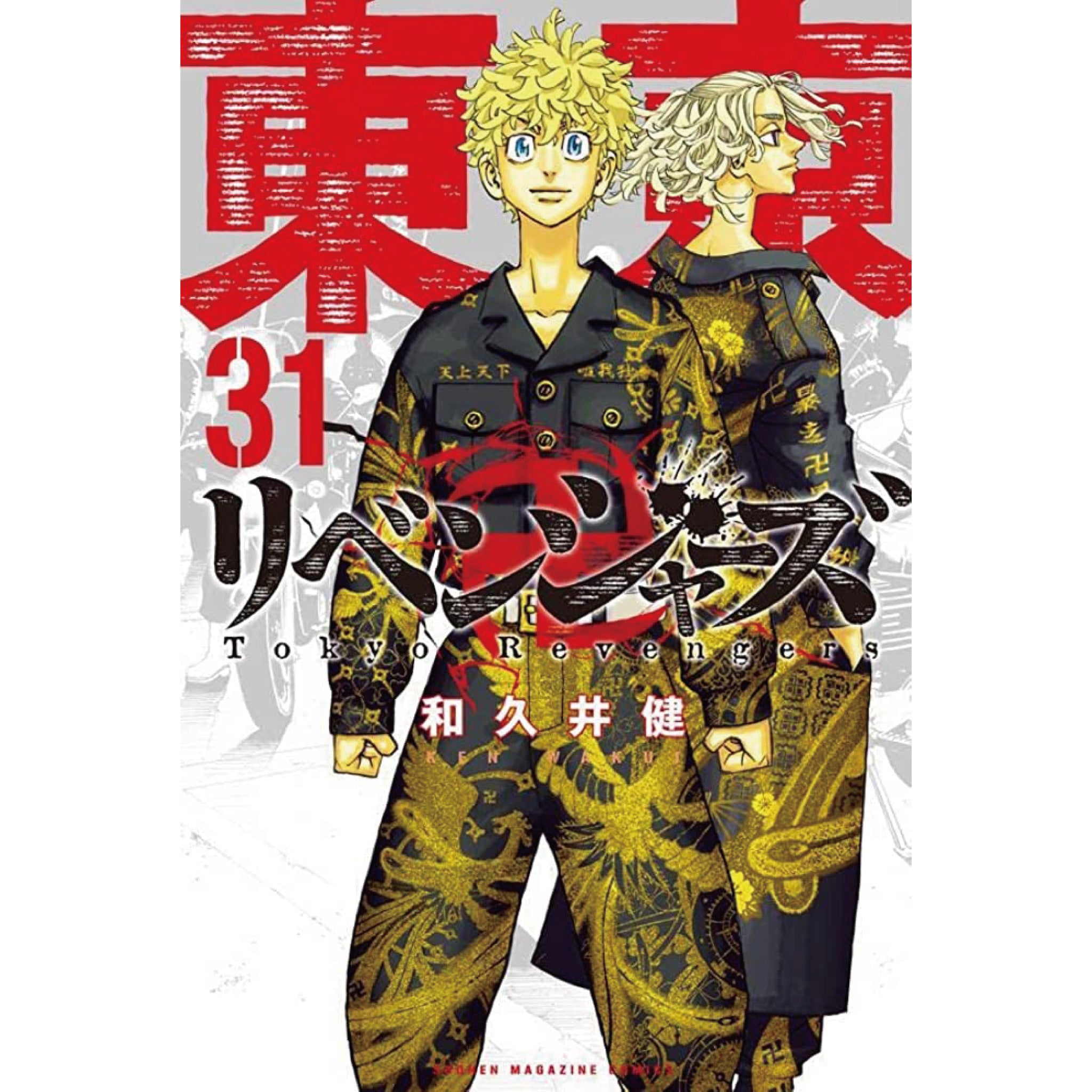

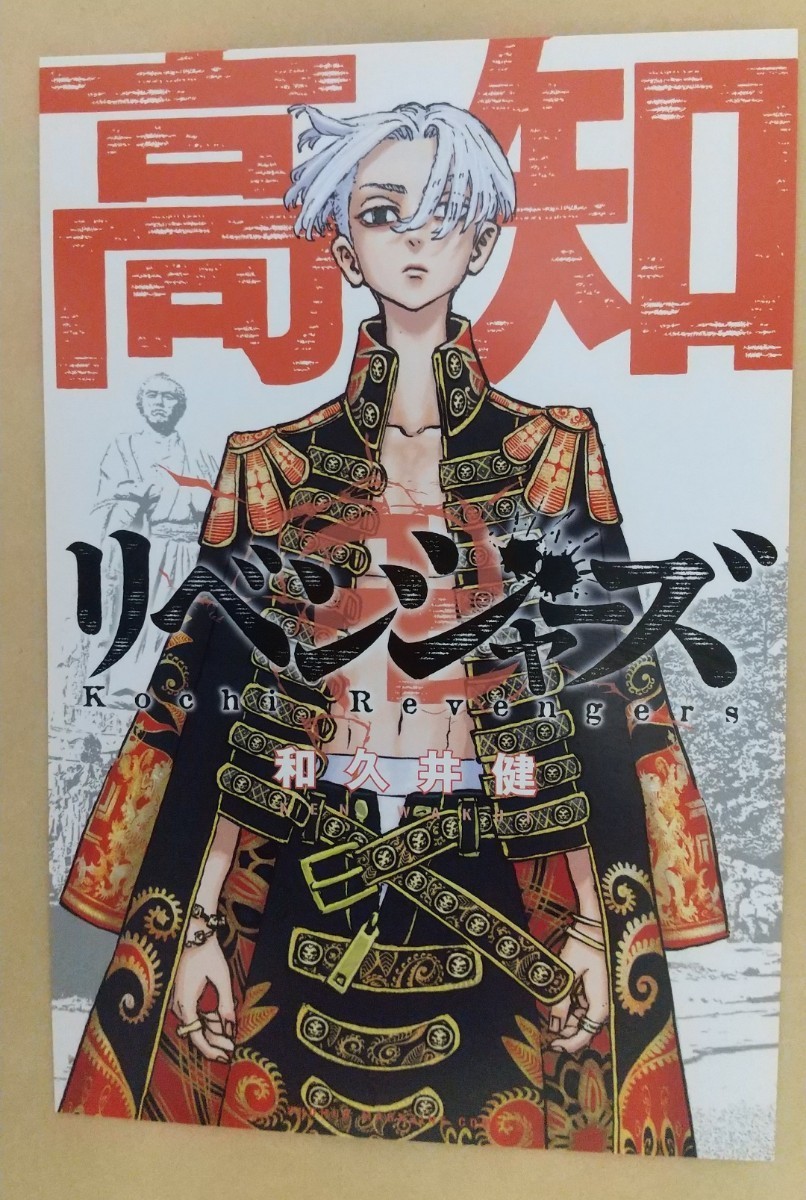

数量限定 特典複製色紙付属】東京卍リベンジャーズ 全31巻 全巻セット

東京リベンジャーズ 漫画1巻~24巻 全巻 東リべ 和久井健 - 全巻セット

東京リベンジャーズ 漫画 全巻セット 1巻〜24巻 新品未読品全巻セット

東京卍リベンジャーズ 漫画 東リべ 1巻〜24巻

東京リベンジャーズ 漫画1巻~24巻 全巻 東リべ 和久井健 - 全巻セット

最安値に挑戦! 東京卍リベンジャーズ リベンジャーズ 1 24巻 コミック

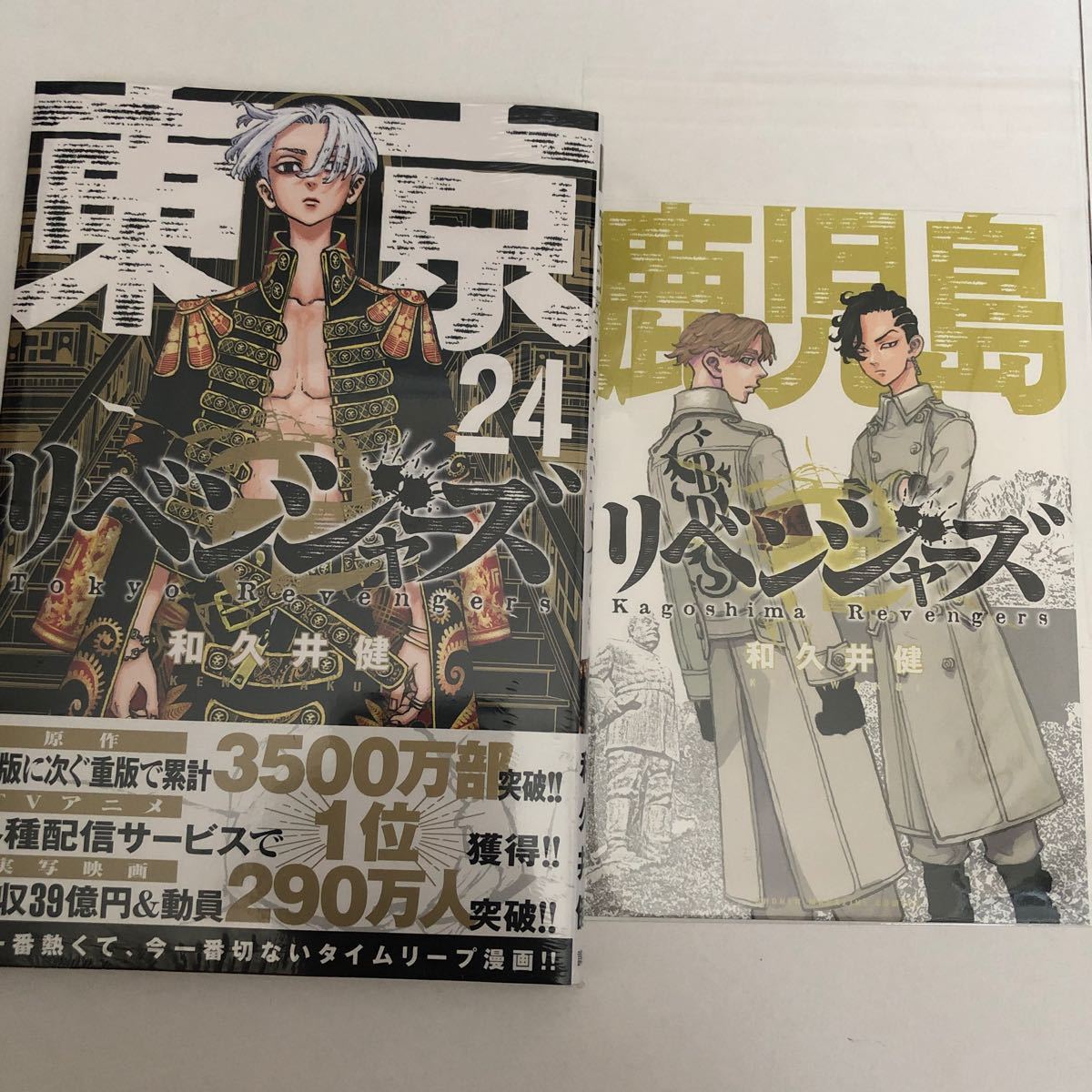

東京卍リベンジャーズ コミック 1-24巻セット 全巻シュリンク付き 日本リベンジャーズ ポストカード(ランダム1枚封入)

楽天市場】【全巻新品シュリンク】東京卍 リベンジャーズ コミック 1

東京卍リベンジャーズ 1〜24巻

東京卍リベンジャーズ 1から24巻セットセール中 - 全巻セット

東京リベンジャーズ 漫画1巻~24巻 全巻 東リべ 和久井健 - 全巻セット

東京卍リベンジャーズ 全巻セット 全24巻 1巻~24巻セット セット

東京リベンジャーズ全巻セット(1〜24巻まで) - マンガ、コミック、アニメ

東京卍リベンジャーズ 漫画 東リべ 1巻〜24巻

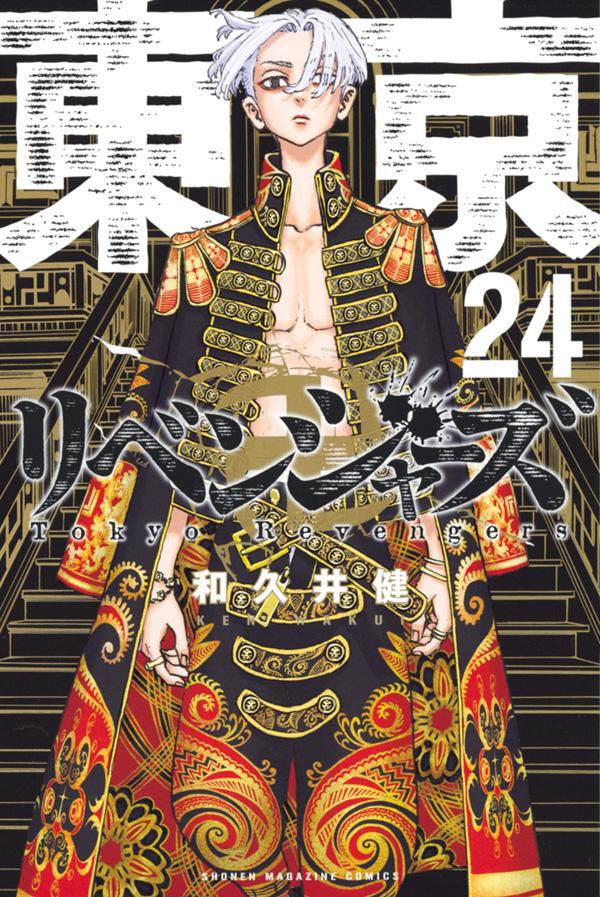

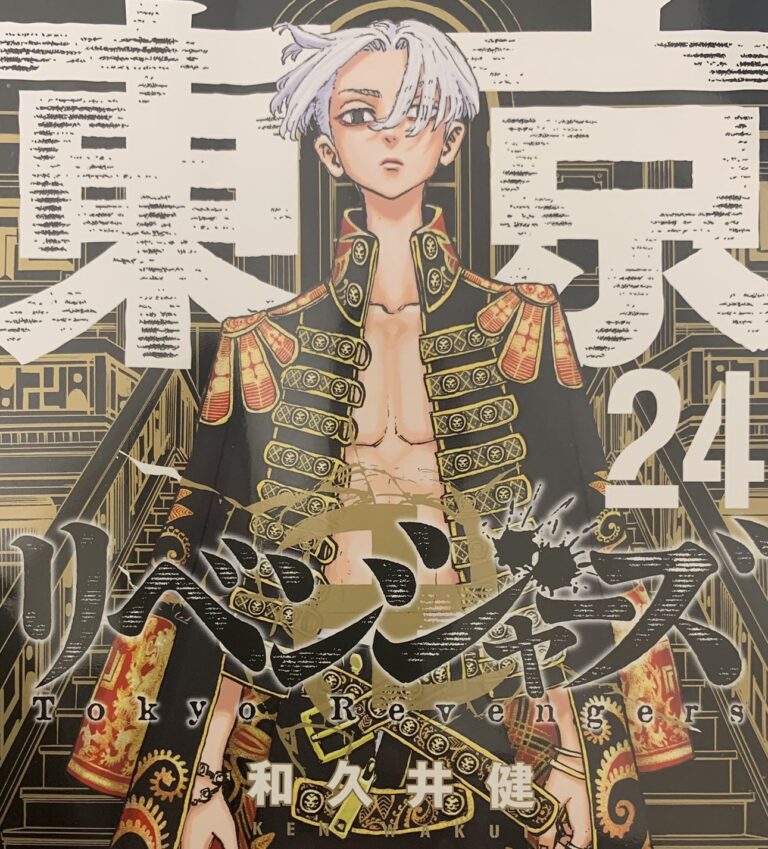

佐野万次郎 24巻表紙Ver.

東京リベンジャーズ 漫画1巻~24巻 全巻 東リべ 和久井健 - 全巻セット

東京卍リベンジャーズ(24) (講談社コミックス) | 和久井 健 |本 | 通販

東京卍リベンジャーズ 漫画 東リべ 1巻〜24巻

新品・当日発送・シュリンク付き】東京卍リベンジャーズ コミック 1-24

東京リベンジャーズ 1~24巻 全巻セット ポストカード付-

楽天市場】【全巻新品シュリンク】東京卍 リベンジャーズ コミック 1

特典付き】東京リベンジャーズ 1-24巻 全巻セット【和久井健】|Yahoo

東京卍リベンジャーズ 1〜24巻

東京リベンジャーズ 漫画 全巻セット 1巻〜24巻 新品未読品全巻セット

東京リベンジャーズ 漫画1巻~24巻 全巻 東リべ 和久井健 - 全巻セット

Amazon | 東京卍リベンジャーズ コミック 1-24巻セット 全巻シュリンク

東京卍リベンジャーズ 漫画 東リべ 1巻〜24巻

東京卍リベンジャーズ(24)』(和久井 健)|講談社コミックプラス

東京卍リベンジャーズ(24)』(和久井 健)|講談社コミックプラス

特典付き】東京リベンジャーズ 1-24巻 全巻セット【和久井健】|Yahoo

東京卍リベンジャーズ 東京リベンジャーズ 24巻

東京リベンジャーズ 漫画1巻~24巻 全巻 東リべ 和久井健 - 全巻セット

☆おまけ付き☆新品 未開封品 東京卍リベンジャーズ 全巻 セット 全24

東京卍リベンジャーズ(24) (講談社コミックス) | 和久井 健 |本 | 通販

商品の情報

メルカリ安心への取り組み

お金は事務局に支払われ、評価後に振り込まれます

出品者

スピード発送

この出品者は平均24時間以内に発送しています