ホットトイズ ACS006 アイアンマン ハルクバスター拡張1/6アクセサリー

(税込) 送料込み

商品の説明

商品説明

新品、未開封の状態です。新品未開封で中身の確認もしていませんので、破損・劣化・不具合等の受付は出来ませんのでご了承ください。ご注文後のキャンセルは固くお断りしておりますので、十分にご検討の上ご購入下さい。神経質な方の購入は御遠慮いただき、ご了承いただける方のみ購入よろしくお願いします。#アベンジャーズ#アメコミ#ホットトイズ#damtoys#hottoys#threezero#スリーゼロ#i8toys#エンターベイ#enterbay#アントマン#ハルク#ソー#Ironman#アイアンマン#Thor#hulk#captainamerica#キャプテンアメリカ#Spiderman#スパイダーマン#venom#ヴェノム#ベノム17880円ホットトイズ ACS006 アイアンマン ハルクバスター拡張1/6アクセサリーエンタメ/ホビーフィギュアホットトイズ ACS006 アイアンマン ハルクバスター拡張1/6アクセサリーYahoo!オークション - 新品未開封 ホットトイズ ACS006 アイアンマン

ホットトイズ ACS006 アイアンマン ハルクバスター拡張1/6アクセサリー

ホットトイズ ACS006 アイアンマン ハルクバスター拡張1/6アクセサリー

ホットトイズ ACS006 アイアンマン ハルクバスター拡張1/6アクセサリー

ホットトイズ ACS006 アイアンマン ハルクバスター拡張1/6アクセサリー

ホットトイズ ACS006 アイアンマン ハルクバスター拡張1/6アクセサリー

ホットトイズ ACS006 アイアンマン ハルクバスター拡張1/6アクセサリー

新品未開封 ホットトイズ ACS006 アイアンマン ハルクバスター拡張

ホットトイズ ACS006 アイアンマン ハルクバスター拡張1/6アクセサリー

ホットトイズ ACS006 アイアンマン ハルクバスター拡張1/6アクセサリー

新品未開封 ホットトイズ ACS006 アイアンマン ハルクバスター拡張

新品未開封 ホットトイズ ACS006 アイアンマン ハルクバスター拡張

Amazon.co.jp: 【ホットトイズ・アクセサリー・コレクション

ホットトイズ・アクセサリー・コレクション ハルクバスター拡張

【ホットトイズ・アクセサリー・コレクション】『アベンジャーズ

ホットトイズ ACS006 アイアンマン ハルクバスター拡張1/6アクセサリー

ハルクバスター ホットトイズの値段と価格推移は?|6件の売買データ

流行 ホットトイズ ACS006 アイアンマン ハルクバスター拡張

Hot toys (ホットトイズ) ハルクバスター 1/6スケール ※アイアンマン

ムービー・マスターピース】『アベンジャーズ/エイジ・オブ

1/6 ムービー・マスターピース アベンジャーズ/エイジ・オブ

Yahoo!オークション -「ホットトイズ ハルクバスター アベンジャーズ

Amazon.co.jp: 【ホットトイズ・アクセサリー・コレクション

ホットトイズ・アクセサリー・コレクション | 株式会社ホットトイズ

ホットトイズ ハルクの人気商品・通販・価格比較 - 価格.com

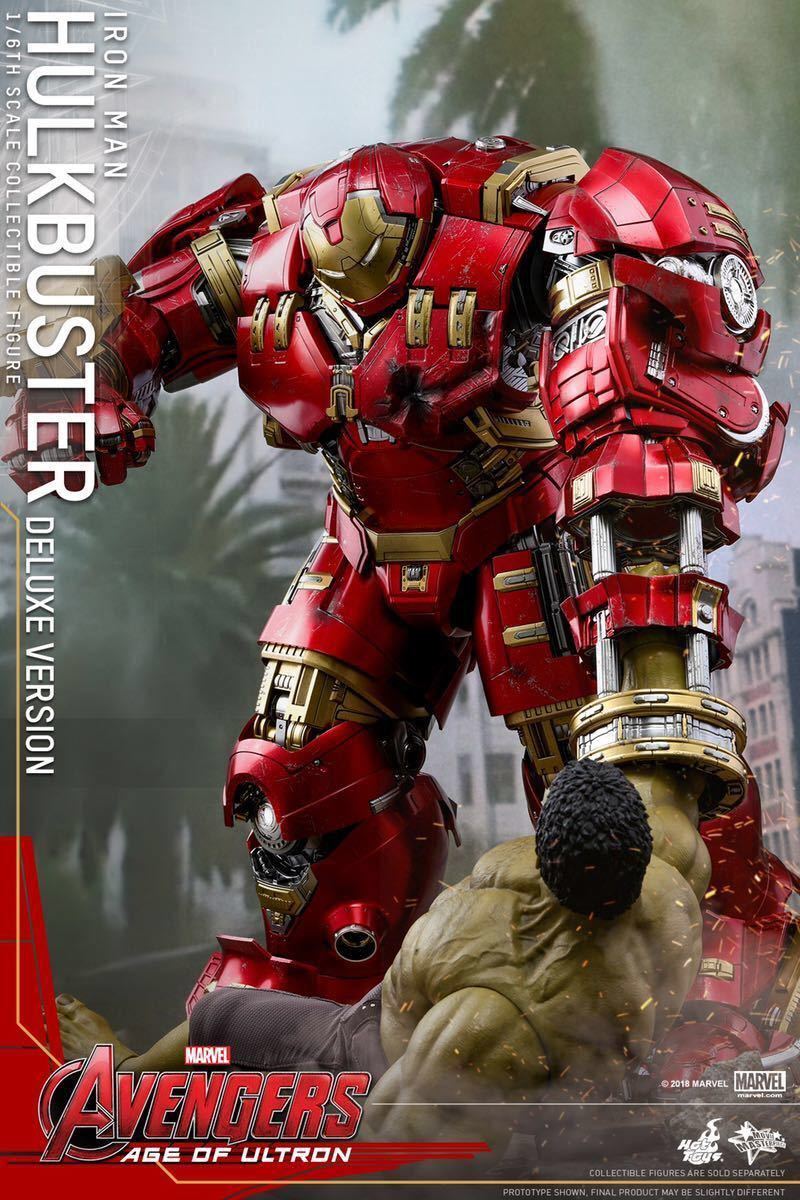

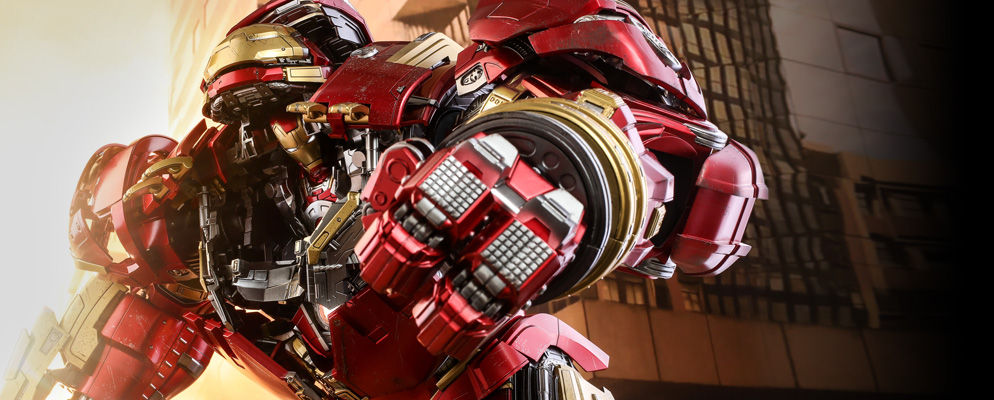

ムービー・マスターピース アベンジャーズ/エイジ・オブ・ウルトロン ハルクバスター 1/6スケール プラスチック製 塗装済み可動フィギュア

ムービー・マスターピース】『アベンジャーズ/エイジ・オブ

2024年最新】Yahoo!オークション -アイアンマン ハルクバスター

ホットトイズ・アクセサリー・コレクション ハルクバスター拡張

2024年最新】ハルクバスター ホットトイズの人気アイテム - メルカリ

ムービー・マスターピース】『アベンジャーズ/エイジ・オブ

Yahoo!オークション -「ハルクバスター ホットトイズ」(フィギュア) の

Hot toys (ホットトイズ) ハルクバスター 1/6スケール ※アイアンマン

中古通販のオフモール ☆新品未開封☆ HOTTOYSホットトイズ1/6 ACS006

楽天市場】アイアンマン フィギュア ハルクバスターの通販

Amazon.co.jp: 【ムービー・マスターピース】『アベンジャーズ/エイジ

2024年最新】ハルクバスター ホットトイズの人気アイテム - メルカリ

ムービー・マスターピース】『アベンジャーズ/エイジ・オブ

ホットトイズ・アクセサリー・コレクション | 株式会社ホットトイズ

Hot toys (ホットトイズ) ハルクバスター 1/6スケール ※アイアンマン

商品の情報

メルカリ安心への取り組み

お金は事務局に支払われ、評価後に振り込まれます

出品者

スピード発送

この出品者は平均24時間以内に発送しています