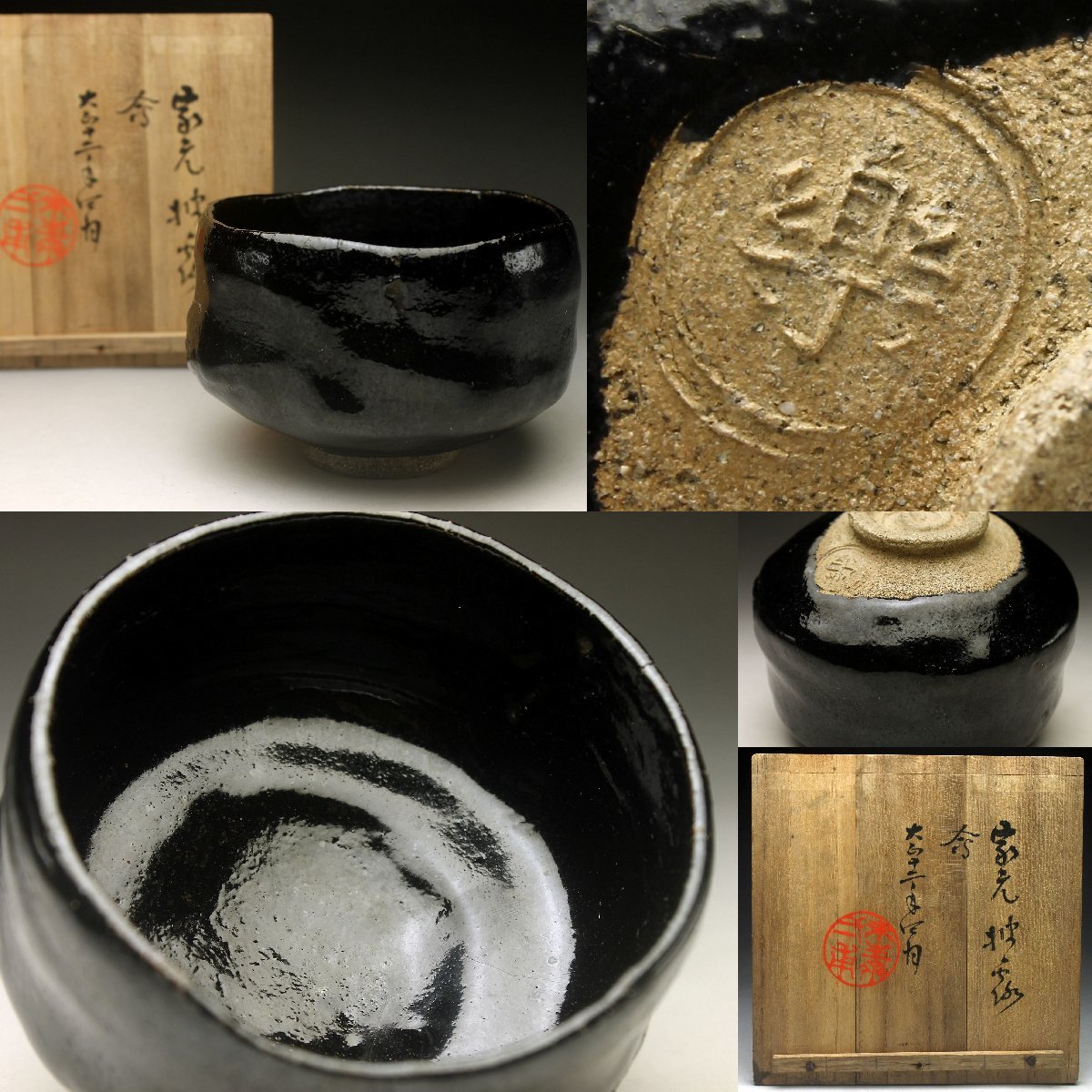

茶道具 楽吉左衛門 黒楽茶碗 共箱 M R4326

(税込) 送料込み

商品の説明

商品説明

大きさ高さ約7.5cm幅約12cm土日祝日は、発送、返信等が出来ません。

また、夏季、年末年始など長期休暇を頂く場合がございますので、

プロフィールにて、その都度ご案内しております。

トラブル防止のため、必ずご確認下さい。

送料込みの商品は、こちらで配送方法を変更する場合があります。

ご了承ください。

22200円茶道具 楽吉左衛門 黒楽茶碗 共箱 M R4326エンタメ/ホビー美術品/アンティーク茶道具 楽吉左衛門 黒楽茶碗 共箱 M R4326茶道具 楽吉左衛門 黒楽茶碗 共箱 M R4326-

茶道具 楽吉左衛門 黒楽茶碗 共箱 M R4326

茶道具 楽吉左衛門 黒楽茶碗 共箱 M R4326-

茶道具 楽吉左衛門 黒楽茶碗 共箱 M R4326

茶道具 楽吉左衛門 黒楽茶碗 共箱 M R4326

茶道具 楽吉左衛門 黒楽茶碗 共箱 M R4326

茶道具 楽吉左衛門 黒楽茶碗 共箱 M R4326

茶道具 楽吉左衛門 黒楽茶碗 共箱 M R4326の通販 by takaryo123's shop

茶道具 楽吉左衛門 黒楽 筒茶碗 共箱 F R4960-

茶道具 楽吉左衛門 黒楽茶碗 共箱 M R4326の通販 by takaryo123's shop

茶道具 楽吉左衛門 黒楽茶碗 共箱 M R4385 - 陶芸

茶道具 楽吉左衛門 黒楽茶碗 共箱 M R4385 - 陶芸

茶道具 楽吉左衛門 黒楽茶碗 共箱 AEPK-

茶道具 楽吉左衛門 黒楽茶碗 共箱 M R4326 - 陶芸

茶道具 楽吉左衛門 黒楽 筒茶碗 共箱 F R4960-

茶道具 楽吉左衛門 了入造 黒楽茶碗 時代箱付 M R3242 - 陶芸

ご了承ください茶道具 楽吉左衛門 黒楽茶碗 小服茶碗 V R6202 - 陶芸

茶道具 楽吉左衛門 黒楽 筒茶碗 共箱 F R4960-

2024年最新】楽吉左衛門の人気アイテム - メルカリ

茶道具 楽吉左衛門 黒楽筒茶碗 V 5533共箱はありますか - 陶芸

茶道具 楽吉左衛門 黒楽茶碗 共箱 M R4013 - 陶芸

茶道具 楽吉左衛門 黒楽筒茶碗 V 5533共箱はありますか - 陶芸

茶道具 楽吉左衛門 了入造 赤茶碗 共箱 M R5029-

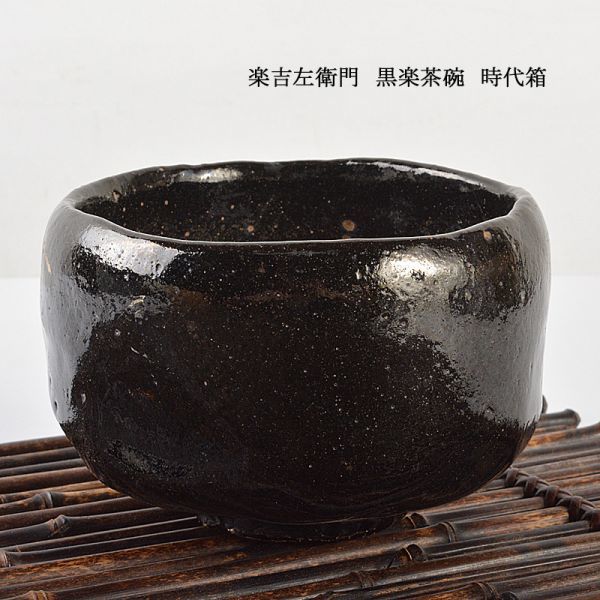

茶道具 十一代楽吉左衛門 慶入造 富士ノ絵 黒楽茶碗 共箱 D R6036

茶道具 楽吉左衛門 赤楽茶碗 共箱 M R4314 - 陶芸

茶道具 楽吉左衛門 黒楽茶碗 共箱 AEPK-

茶道具 楽吉左衛門 黒楽 筒茶碗 共箱 F R4960-

2024年最新】楽吉左衛門の人気アイテム - メルカリ

十二代 楽 吉左衛門 弘入作 黒楽茶碗 茶道具

茶道具 楽吉左衛門 黒楽茶碗 共箱 M R4013 - 陶芸

茶道具 楽吉左衛門 赤楽茶碗 共箱 M R4314 - 陶芸

茶道具 楽吉左衛門 黒楽茶碗 共箱 M R4385 陶芸 大特価キャンペーン

茶道具 楽吉左衛門 黒楽 筒茶碗 共箱 F R4960-

Amazon.co.jp: 楽吉左衛門 九代了入 黒筒茶碗「仙厳」共箱玄々斎花押

2023年新作入荷 楽吉左衛門十一代 慶入 黒茶碗/共箱/楽吉左衛門十二

茶道具 楽吉左衛門 黒楽 筒茶碗 共箱 F R4960-

2024年最新】楽吉左衛門の人気アイテム - メルカリ

茶道具 十二代楽吉左衛門 弘入作 黒楽茶碗 銘逢莱 即中斎極箱 M R6779

Yahoo!オークション -「楽吉左衛門茶碗」の落札相場・落札価格

茶道具 楽吉左衛門 赤楽茶碗 共箱 M R4314 - 陶芸

商品の情報

メルカリ安心への取り組み

お金は事務局に支払われ、評価後に振り込まれます

出品者

スピード発送

この出品者は平均24時間以内に発送しています