【新品保証有】ワイヤレステレビドアホン アイホン WL-11(配線工事不要)

(税込) 送料込み

商品の説明

商品説明

ワイヤレステレビドアホンアイホンWL-112021年3月購入。新品未開封品です。

使用予定がなくなったため出品します。

購入時の納品書のコピーをお付けいたしますので

メーカー保証も受けられます。

<セット内容>

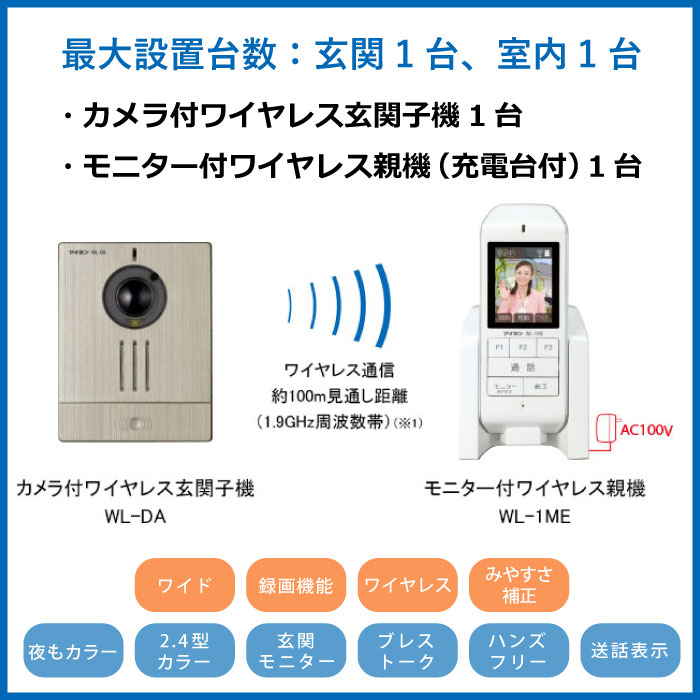

・モニター付ワイヤレス親機(WL-1ME)

・充電台(WLW-C)

・カメラ付ワイヤレス玄関子機(WL-DA)

<商品説明>

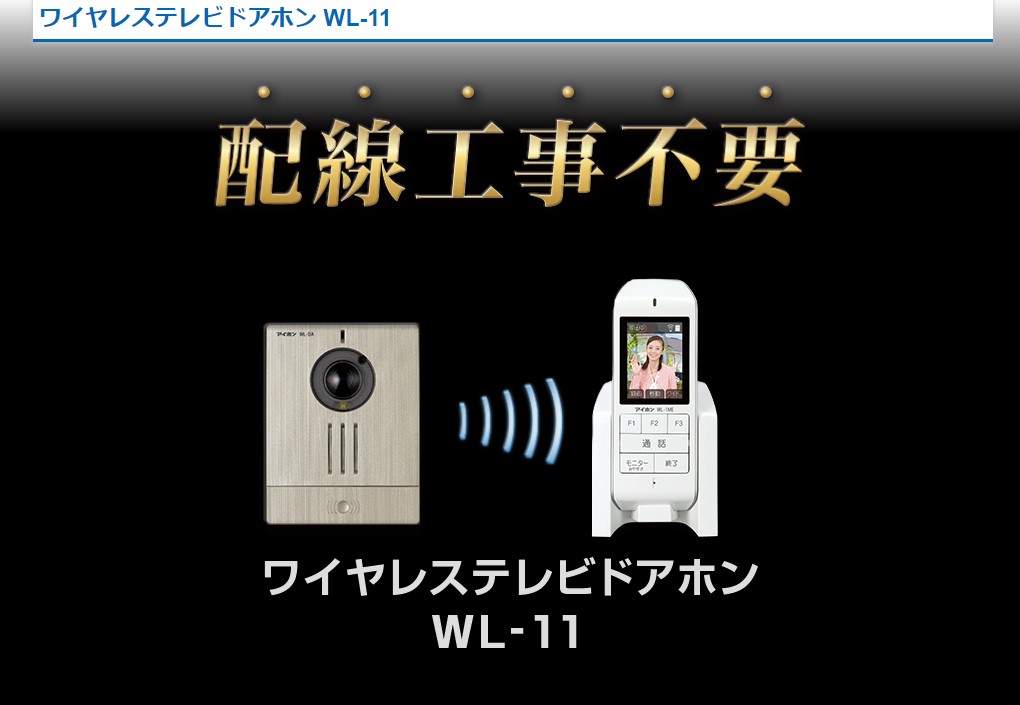

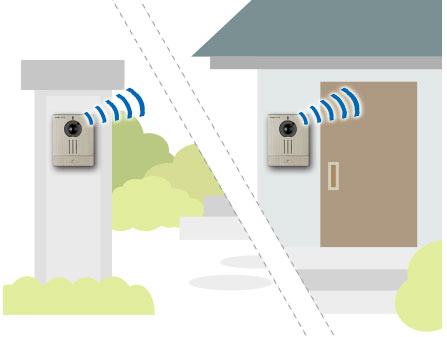

●電源アダプターをコンセントに挿すだけ。配線工事不要で既存のインターホンから簡単に取替え可能。

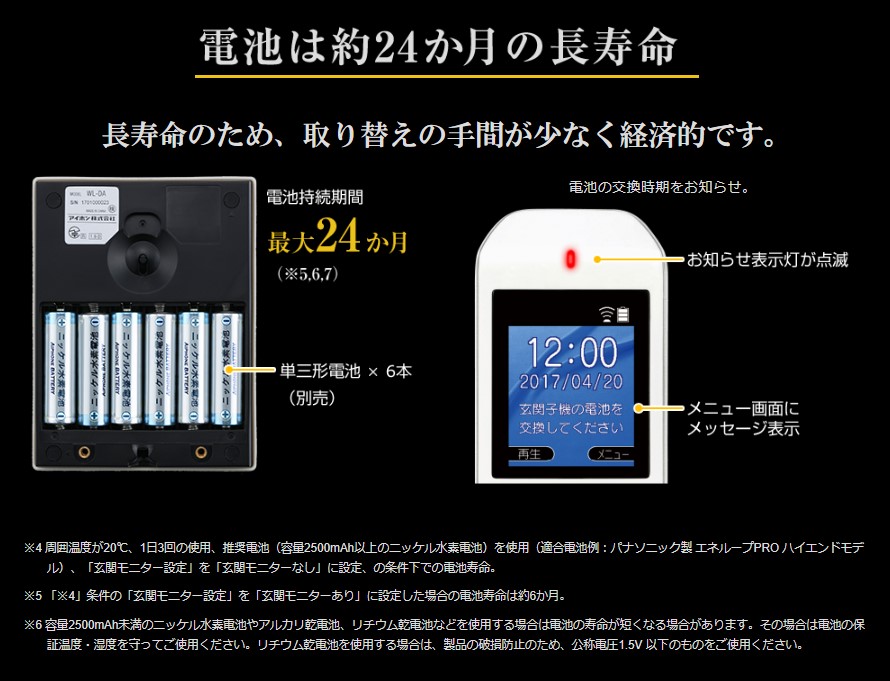

●カメラ付ワイヤレス玄関子機の電池寿命は約2年間。頻繁な交換は不要です。

●高級感を追求したヘアライン仕上げ。どんな外構にもマッチします。

●左右画角約110°の広角ワイド画面で玄関周りの様子をしっかり確認。

●留守中の来訪者を最大100件録画できます。

6825円【新品保証有】ワイヤレステレビドアホン アイホン WL-11(配線工事不要)スマホ/家電/カメラカメラ楽天市場】インターホン ワイヤレス アイホン ワイヤレステレビ楽天市場】インターホン ワイヤレス アイホン ワイヤレステレビ

アイホン ドアホン WL-11 ワイヤレス インターホン 配線工事不要 テレビモニター付き ハンズフリー

新品保証有】ワイヤレステレビドアホン アイホン WL-11(配線工事不要

楽天市場】インターホン ワイヤレス アイホン ワイヤレステレビ

緊急安全保障会議開催へ ワイヤレス テレビドアホン WL-11 アイホン

アイホン WL-11 ワイヤレステレビドアホンセット : 4968249282228

Amazon.co.jp: アイホン ドアホン インターホン ワイヤレス 子機電池

売れ筋がひ! ワイヤレステレビドアホンセット 【アイホン】WL-11 配線

【工事不要】アイホン ワイヤレステレビドアホン WL11[送料無料 インターホン ドアフォン インターフォン]WL11|||||| : wl100 : 便利雑貨のCOCONIAL(ココニアル) - 通販 - Yahoo!ショッピング

楽天市場】ワイヤレス テレビ ドアホン インターホン セット 配線工事

楽天市場】インターホン ワイヤレス アイホン ワイヤレステレビ

特長 | ワイヤレステレビドアホン WL-11 |インターホン・テレビ

WL-11 ワイヤレステレビドアホン WL-11 1セット アイホン 【通販

アイホン ドアホン WL-11 ワイヤレス インターホン 配線工事不要 テレビモニター付き ハンズフリー

ワイヤレステレビドアホン WL-11 |インターホン・テレビドアホン

特長 | ワイヤレステレビドアホン WL-11 |インターホン・テレビ

楽天市場】インターホン ワイヤレス アイホン ワイヤレステレビ

特長 | ワイヤレステレビドアホン WL-11 |インターホン・テレビ

Amazon.co.jp: パナソニック ワイヤレステレビドアホン VS-SGE20L 配線

柔らかな質感の アイホン ワイヤレスドアホン 動作確認済み 配線工事

static.mercdn.net/item/detail/orig/photos/m2173795...

WL-11 | インターホン | アイホン ワイヤレステレビドアホンセット

直売卸売り アイホン ワイヤレステレビドアホン 配線工事不要 | www

楽天市場】【LINE友だち追加で限定クーポンGET!】 アイホン ドアホン

新品 ほぼ新品 アイホン ドアホン インターホン ワイヤレス 配線工事

特長 | ワイヤレステレビドアホン WL-11 |インターホン・テレビ

ワイヤレステレビドアホン wl-11の通販・価格比較 - 価格.com

戸建住宅向けワイヤレステレビドアホン「WL-11」配線工事不要

在庫有り即納 アイホン ワイヤレステレビドアホン WL-11 | varquimica

楽天市場】インターホン ワイヤレス アイホン ワイヤレステレビ

新品保証有】ワイヤレステレビドアホン アイホン WL-11(配線工事不要

アイホン ワイヤレステレビドアホン WL-11 (WL-1ME,WL-DA) - 防犯カメラ

WL-11 アイホン ワイヤレステレビドアホン 約2.4インチ 録画機能付 配線工事不要 テレビインターホン

2023新発 アイホン ワイヤレスドアホンWL-11 専用電源 カメラ

楽天市場】インターホン ワイヤレス アイホン ワイヤレステレビ

特長 | ワイヤレステレビドアホン WL-11 |インターホン・テレビ

新品保証有】ワイヤレステレビドアホン アイホン WL-11(配線工事不要

特長 | ワイヤレステレビドアホン WL-11 |インターホン・テレビ

Amazon.co.jp: アイホン ドアホン インターホン ワイヤレス 子機電池式

特長 | ワイヤレステレビドアホン WL-11 |インターホン・テレビ

商品の情報

メルカリ安心への取り組み

お金は事務局に支払われ、評価後に振り込まれます

出品者

スピード発送

この出品者は平均24時間以内に発送しています