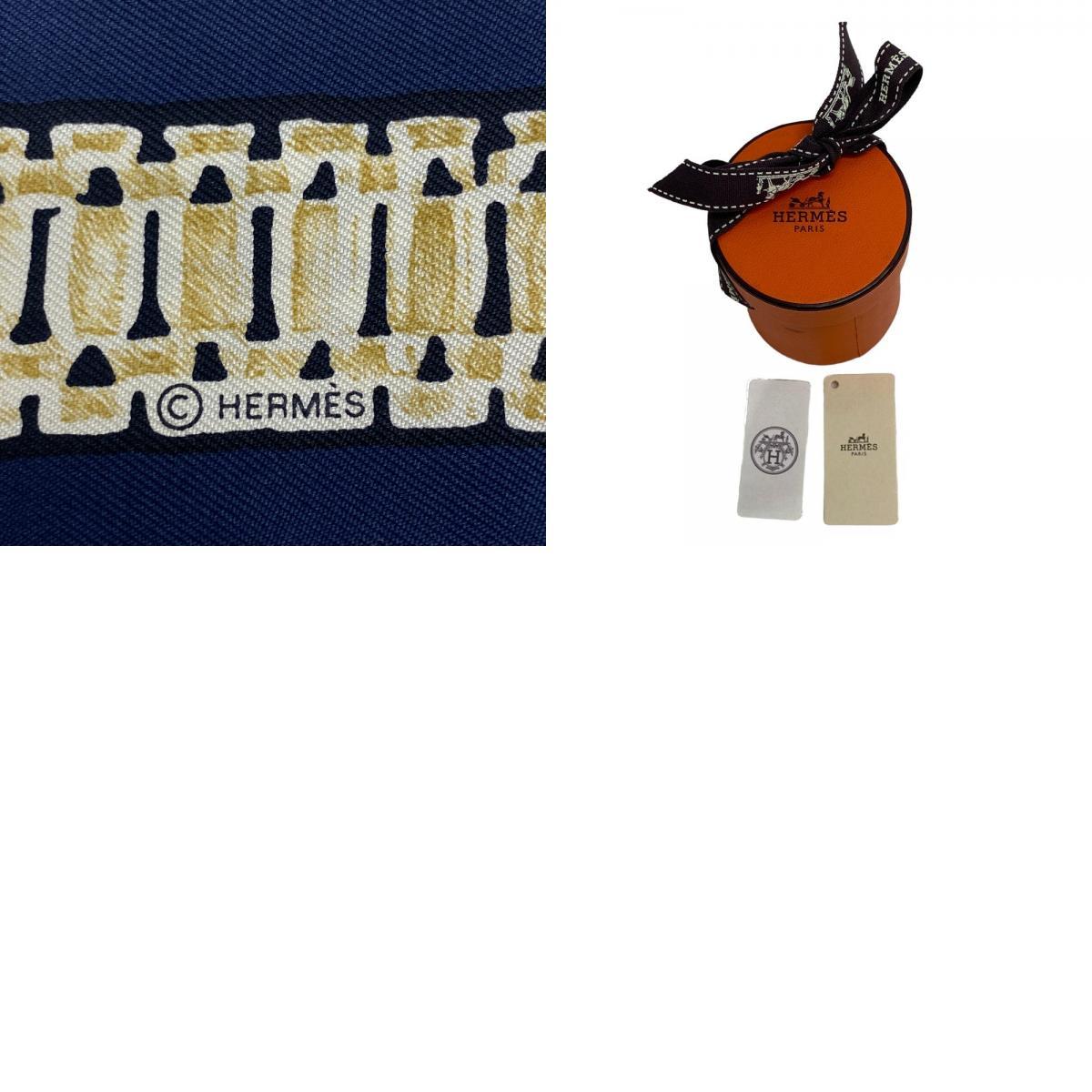

HERMES エルメス ツイリー メドール ネイビー

(税込) 送料込み

商品の説明

商品説明

HERMESエルメス

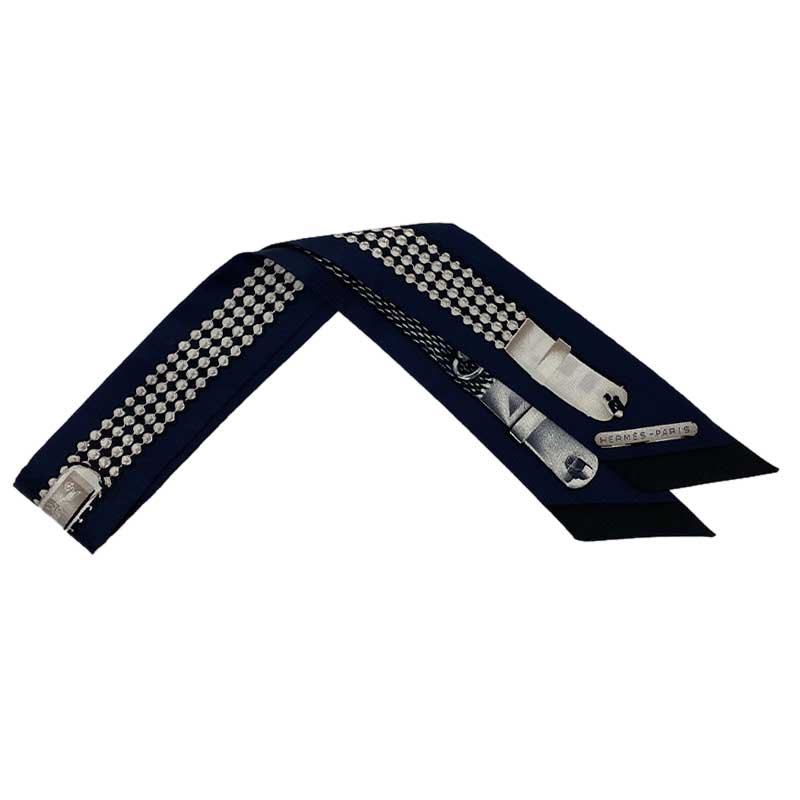

ツイリー

●トレゾールドゥメドール

TRESORDEMEDOR

●色ネイビー

Marine/Gris/Noir濃紺/グレー/黒

●購入経路...国内HERMES店舗購入品

●付属品ショップカード、バーコードタグ、お取扱上のご注意の紙

大変人気のお品で、完売したツイリーです!

汚れ、ツレはありませんが

中古品のお品物であること、ご了承下さいます方のみ

よろしくお願いいたします。

若干の巻きじわと、若干の白っぽいところがあります。

個人的見解ですが、極若干で決して目立つ物ではありません。

シルクの張りもしっかりあり、

あまり使用感はないお品物です。

14700円HERMES エルメス ツイリー メドール ネイビーレディースファッション小物業界大好評 HERMES エルメス ツイリー スカーフ トレゾール ドゥHERMES/エルメス ツイリー ツイリー LE TRESOR DE MEDOR トレゾール ドゥ メドール シルク スカーフ ネイビー ユニセックス ブランド

HERMES エルメス ツイリー トレゾール ドゥ メドール ネイビー 紺-

業界大好評 HERMES エルメス ツイリー スカーフ トレゾール ドゥ

業界大好評 HERMES エルメス ツイリー スカーフ トレゾール ドゥ

クーポン対象外】 【 濃紺☆スカーフ メドール】エルメス ドゥ

楽天市場】HERMES/エルメス ツイリー LE TRESOR DE MEDOR トレゾール

HERMES エルメス ツイリー メドール ネイビーバンダナ/スカーフ

楽天市場】HERMES/エルメス ツイリー LE TRESOR DE MEDOR トレゾール

HERMES エルメス ツイリー スカーフ トレゾール ドゥ メドール

HERMES エルメス ツイリー シルク トレゾール ドゥ メドール TRESOR DE

エルメス 未使用品 ツイリー LE TRESOR DE MEDOR 063457S 02 メドール

楽天市場】HERMES/エルメス ツイリー LE TRESOR DE MEDOR トレゾール

レディースHERMES エルメス ツイリー メドール ネイビー - バンダナ

えぬわた砲」 HERMES エルメス ツイリー トレゾール ドゥ メドール

豪華ラッピング無料 MEDOR エルメス ネイビー ツイリー LE TRESOR

特別SALE HERMES エルメス ツイリー メドール ブラック | kotekservice.com

HERMES エルメス ツイリー トレゾール ドゥ メドール ネイビー-

売れてます ツイリー トレゾール ネイビー♡ | kotekservice.com

エルメス 未使用品 ツイリー LE TRESOR DE MEDOR 063457S 02 メドールの宝物 スカーフ シルク100% ネイビー系 HERMES リボンスカーフ バッグスカーフ【中古】

新品同様 エルメス バッグチャーム メドール コリエドシアン ネイビー 青

広尾店】エルメス ツイリー【トレゾールドゥメドール】ネイビー10314-

えぬわた砲」 HERMES エルメス ツイリー トレゾール ドゥ メドール

Hermes - エルメス ツイリー トレゾール ドゥ メドールの通販 by momo

新品同様 エルメス バッグチャーム メドール コリエドシアン ネイビー 青

新品未使用タグ付き HERMES エルメス ツイリー トレゾール ドゥ メドール-

HERMES エルメス ツイリー スカーフ トレゾール ドゥ メドール

HERMES/エルメス ツイリー ツイリー LE TRESOR DE MEDOR トレゾール ドゥ メドール シルク スカーフ ネイビー ユニセックス ブランド

HERMES/エルメス ツイリー ツイリー LE TRESOR DE MEDOR トレゾール ドゥ メドール シルク スカーフ ネイビー ユニセックス ブランド

エルメス ツイリー トレゾール ドゥ メドール マリン/グリス/ブラック

レディースエルメス ツイリー/ビーズ メドール - dso-ilb.si

極美品 希少】HERMES エルメス トレゾール ドゥ メドール ツイリー-

えぬわた砲」 HERMES エルメス ツイリー トレゾール ドゥ メドール

HERMES/エルメス ツイリー ツイリー LE TRESOR DE MEDOR トレゾール

楽天市場】HERMES エルメス ツイリー “トレゾール ドゥ メドール

広尾店】エルメス ツイリー【トレゾールドゥメドール】ネイビー10314-

えぬわた砲」 HERMES エルメス ツイリー トレゾール ドゥ メドール

新品同様 エルメス バッグチャーム メドール コリエドシアン ネイビー 青

HERMES エルメス ツイリー トレゾール・ドゥ・メドール 黒

HERMES エルメス ツイリー トレゾール ドゥ メドール ネイビー 紺-

新品同様 エルメス バッグチャーム メドール コリエドシアン ネイビー 青

商品の情報

メルカリ安心への取り組み

お金は事務局に支払われ、評価後に振り込まれます

出品者

スピード発送

この出品者は平均24時間以内に発送しています