新品 保証付き純正富士フイルムVG-XT4 縦位置バッテリーグリップ

(税込) 送料込み

商品の説明

商品説明

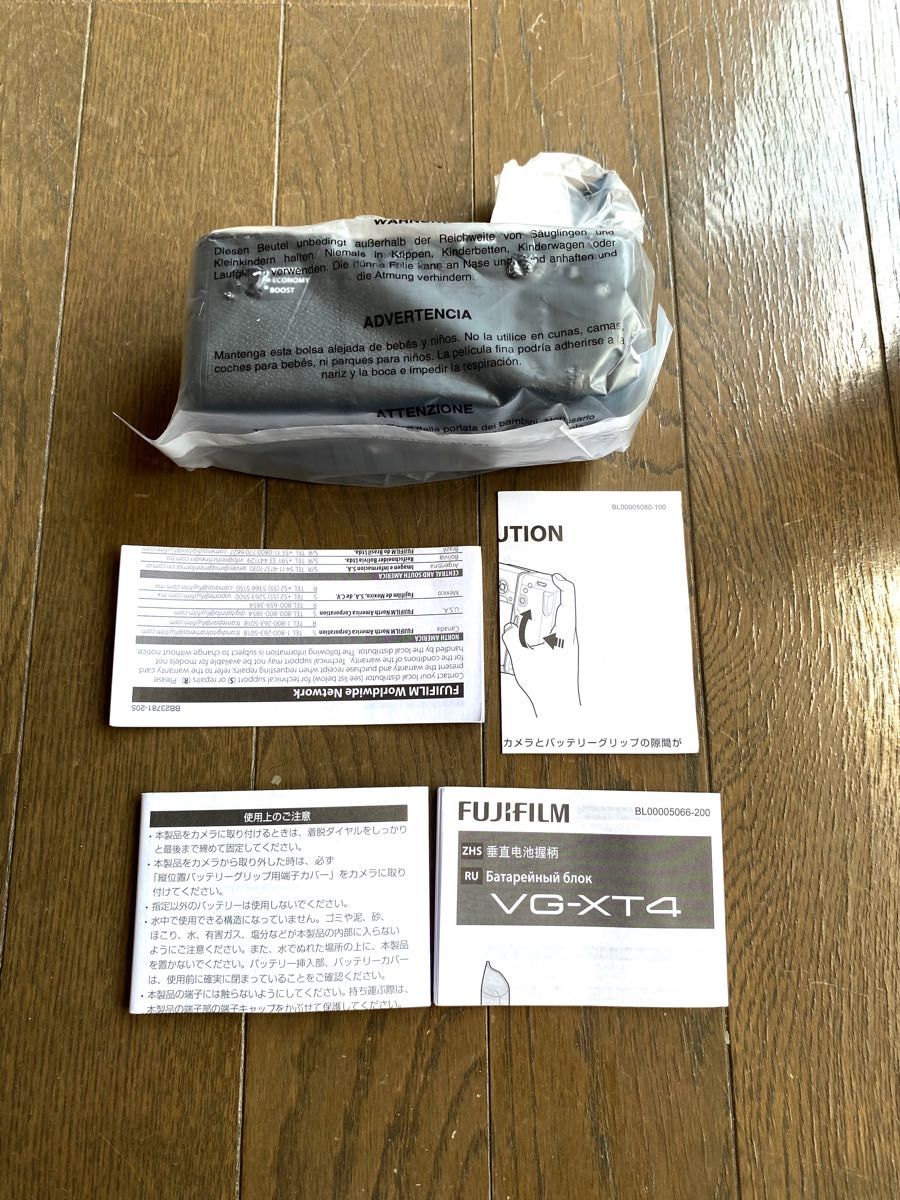

新品未使用純正富士フイルムX-T4バッテリーグリップVG-XT4となります。・説明書などの印刷品が揃ってます。写真でご確認の程何卒よろしくお願い申し上げます。

・動作は保証いたします。到着後、1週間以内うまく動作しない場合、交換で対応いたしますので、安心してご購入いただけます。

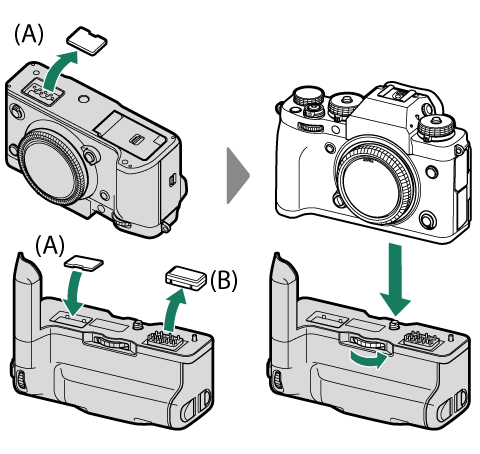

●防塵・防滴・耐低温-10℃に対応。バッテリーグリップに大容量バッテリー「NP-W235」を2つ装填することで、最大約1,700枚(エコノミーモード)の静止画撮影が可能です。

●操作しやすい位置に各種ボタンを配置しており、横位置撮影時と変わらず快適に撮影できます。

メーカー希望小売価格:49,000円(税別)

発送方法:

匿名配送

発送時間:

24時間内に発送いたします。

6825円新品 保証付き純正富士フイルムVG-XT4 縦位置バッテリーグリップスマホ/家電/カメラカメラFUJIFILM (フジフイルム) 縦位置バッテリーグリップ VG-XT4富士フイルム - 新品 保証付き純正富士フイルムVG-XT4 縦位置

Amazon.co.jp: 富士フイルム(FUJIFILM) 縦位置バッテリーグリップ VG

富士フイルム - 新品 保証付き純正富士フイルムVG-XT4 縦位置

FUJIFILM (フジフイルム) 縦位置バッテリーグリップ VG-XT4

新品 保証付き純正富士フイルムVG-XT4 縦位置バッテリーグリップ

Amazon | 富士フイルム(FUJIFILM) 縦位置バッテリーグリップ

VG-XT4 X-T4用 縦位置バッテリーグリップ γS2752-2D4 | 富士フイルム

新品 保証付き純正富士フイルムVG-XT4 縦位置バッテリーグリップ

縦位置バッテリーグリップ VG-XT4 | Accessories | 富士フイルム X

VG-XT4 X-T4用 縦位置バッテリーグリップ γS2752-2D4 | 富士フイルム

縦位置バッテリーグリップ VG-XT4 富士フイルム|FUJIFILM 通販

Amazon.co.jp: 富士フイルム(FUJIFILM) 縦位置バッテリーグリップ VG

FUJIFILM X-T3 縦位置バッテリーグリップ

中古】(フジフイルム) FUJIFILM VG-XT4 バッテリーグリップ|ナニワ

azoさん/富士フイルム VG-XT4 縦位置バッテリーグリップ 富士フイルム

富士フイルム - 新品 保証付き純正富士フイルムVG-XT4 縦位置

楽天市場】【あす楽】 【中古】 《良品》 FUJIFILM 縦位置バッテリー

富士フイルム - 新品 保証付き純正富士フイルムVG-XT4 縦位置

VG-XT4 X-T4用 縦位置バッテリーグリップ γS2752-2D4 | 富士フイルム

FUJIFILM(フジフイルム) X-T4専用 縦位置バッテリーグリップ VG-XT4(縦

富士フイルム、X-T4縦位置グリップの修理受付について案内 - デジカメ

楽天市場】【あす楽】 【中古】 《良品》 FUJIFILM 縦位置バッテリー

富士フイルム - 新品 保証付き純正富士フイルムVG-XT4 縦位置

VG-XT4 X-T4用 縦位置バッテリーグリップ γS2752-2D4 | 富士フイルム

Amazon | 富士フイルム VG-XT4 垂直バッテリーグリップ | 富士フイルム

縦位置バッテリーグリップ VG-XH 富士フイルム|FUJIFILM 通販

新品 保証付き純正富士フイルムVG-XT4 縦位置バッテリーグリップ

Amazon.co.jp: 富士フイルム(FUJIFILM) 縦位置バッテリーグリップ VG

未使用品 送料込み 富士フイルム VG-XT4 X-T4 バッテリーグリップ 富士

中古】(フジフイルム) FUJIFILM VG-XT4 バッテリーグリップ|ナニワ

富士フイルム X-T4 バッテリーグリップ VG-XT4 FUJIFILM - www

中古】(フジフイルム) FUJIFILM VG-XT4 バッテリーグリップ|ナニワ

メーカー保証期間内 FUJIFILM フジフイルム 縦位置バッテリーグリップ VG-XT4 (X-T4用)

縦位置バッテリーグリップ

ヨドバシ.com - SmallRig スモールリグ SR2810 [縦位置バッテリー

メーカー保証期間内 FUJIFILM フジフイルム 縦位置バッテリーグリップ VG-XT4 (X-T4用)

富士フイルム - 新品 保証付き純正富士フイルムVG-XT4 縦位置

楽天市場】【あす楽】 【中古】 《美品》 FUJIFILM 縦位置バッテリー

メーカー保証期間内 FUJIFILM フジフイルム 縦位置バッテリーグリップ VG-XT4 (X-T4用)

中古】(フジフイルム) FUJIFILM VG-XT4 バッテリーグリップ|ナニワ

商品の情報

メルカリ安心への取り組み

お金は事務局に支払われ、評価後に振り込まれます

出品者

スピード発送

この出品者は平均24時間以内に発送しています