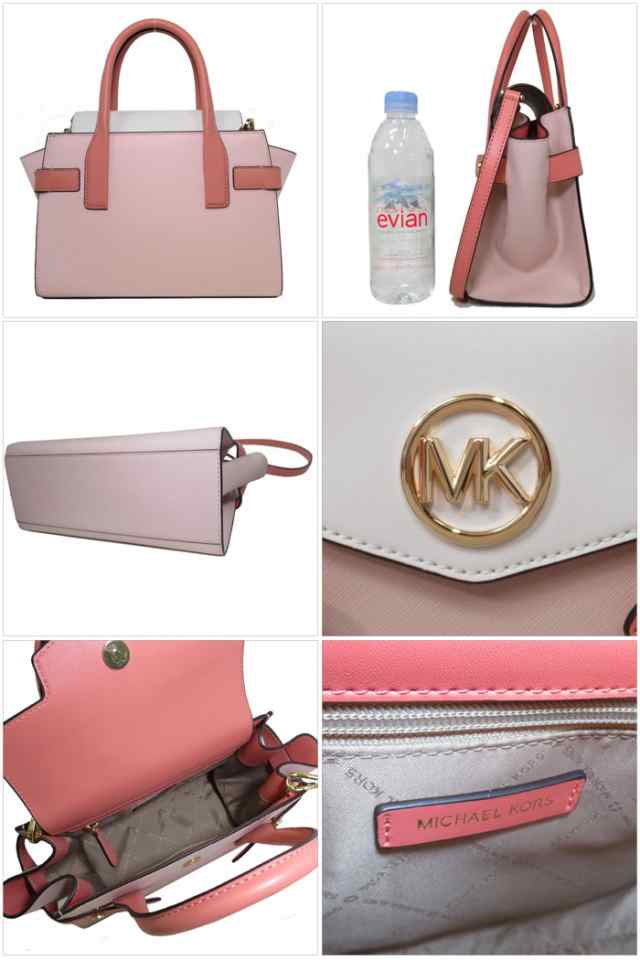

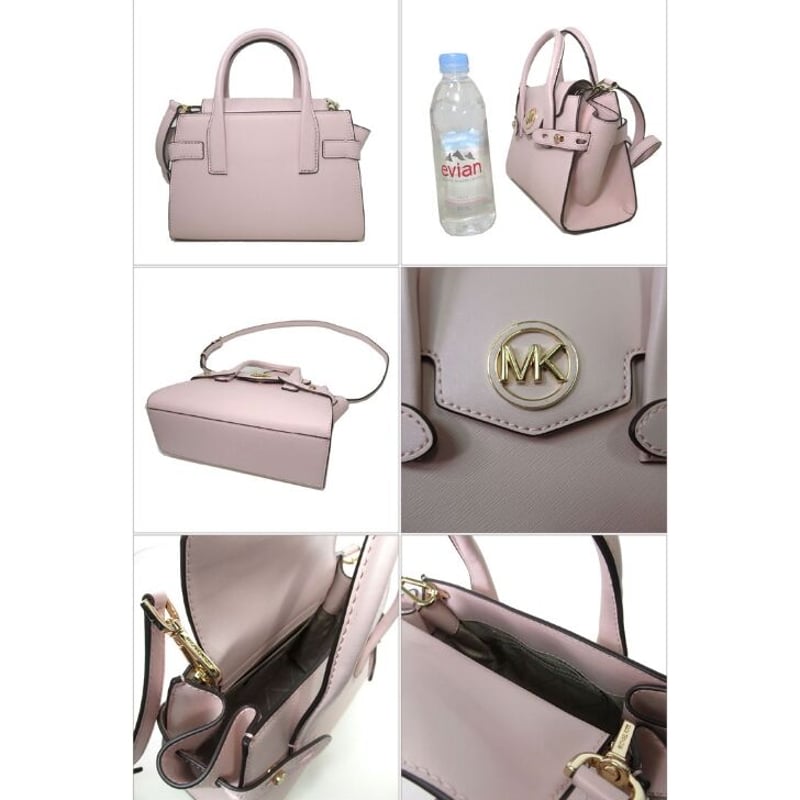

マイケルコース ハンドバッグ カルメン ピンク

(税込) 送料込み

商品の説明

商品説明

⋆┈┈┈┈┈┈┈┈┈┈┈┈┈┈┈⋆ご覧頂き誠にありがとうございます。

マイケルコースハンドバッグ

カルメンカラーがピンクになります。

公式アウトレットサイトで一目惚れし

購入しました。

何度か使いましたが、使う頻度がすくなくなり

眠ってたので出品致しました。

サイズ

約w28.H21.D12です

画像にも載せましたが、バック裏面の手持ち部分ひ

おそらくデニムのスレで青くなってる部分があります。ご確認お願い致します。

プロフィール必ずご覧下さい。

お読み頂いてない方のコメントの返事は致しません。

ご購入を御遠慮下さい。

質問等ございましたらお気軽にコメントお願い致します。

11375円マイケルコース ハンドバッグ カルメン ピンクレディースバッグ楽天市場】【P10倍 12/19 20時〜12/26 2時】マイケルコース MICHAELAmazon | [マイケルコース] アウトレット ハンドバッグ ショルダー

SORAバッグ特集新品未使用 マイケルコース カルメン MK - 折り財布

セール】マイケルコース アウトレット ハンドバッグ ショルダーバッグ

楽天市場】【P10倍 12/19 20時〜12/26 2時】マイケルコース MICHAEL

KEMPNER NS トート ラージ-

マイケルコース MICHAEL KORS ハンドバッグ レディース カルメン

Amazon | [マイケルコース] アウトレット ハンドバッグ ショルダー

マイケル マイケル コース MICHAEL MICHAEL KORS ショルダーバッグ

セール】マイケルコース アウトレット ハンドバッグ ショルダーバッグ

マイケル マイケル コース MICHAEL MICHAEL KORS アウトレット

マイケルコース ショルダーバッグ クロスボディ ピンク 斜めがけのり

マイケル マイケル コース MICHAEL MICHAEL KORS アウトレット

マイケルコース ハンドバッグ 35T2GNMS5L POWDER BLUSH (ピンク系) レ...

楽天市場】マイケルコース バッグ ハンドバッグ MICHAEL KORS カルメン

マイケル マイケル コース MICHAEL MICHAEL KORS アウトレット 二

マイケルコース ハンドバッグ 35T2GNMS5L POWDER BLUSH (ピンク系) レ...

マイケルコース バッグ カルメン テラコッタ色-

Amazon | [マイケルコース] アウトレット ハンドバッグ ショルダー

マイケルコース日本限定桜デザインカルメンフラップサッチェルスモール

マイケルコース チャーム

マイケル マイケル・コースの新作バッグ、“MK サークルロゴ”を配した

マイケルコース MICHAEL KORS ハンドバッグ レディース カルメン

マイケル マイケル コース MICHAEL MICHAEL KORS アウトレット

レア色】マイケルコース ショルダーバッグ 2way ハンドバッグ-

マイケル マイケル コース MICHAEL MICHAEL KORS アウトレット 二

マイケルコース バッグ ハンドバッグ MICHAEL KORS カルメン 2WAY

楽天市場】マイケルコース バッグ ハンドバッグ MICHAEL KORS カルメン

セール】マイケルコース アウトレット ハンドバッグ ショルダーバッグ

新品】マイケルコース ハンドバッグ 35S2GNMS8L 2WAY 斜め掛け

マイケルコース MICHAEL KORS ショルダー ハンド バッグ

Michael Kors - マイケルコース カルメン の通販 by りーちゃん's shop

MICHAEL KORS(マイケルコース)の「CARMEN(カルメン) フラップ

セール】マイケルコース アウトレット ハンドバッグ ショルダーバッグ

Michael Kors - マイケルコース ハンドバッグ カルメン ピンクの通販

マイケルコース スマホショルダー MICHAEL KORS カルメン MK

マイケル マイケル コース MICHAEL MICHAEL KORS アウトレット

レアカラー、美品】マイケルコース カルメン ハンドバッグ サッチェル

マイケルコース MICHAEL KORS ショルダー ハンド バッグ

Michael Kors - ☆新品未使用☆マイケルコースフラップサッチェル

MICHAEL KORS(マイケルコース)の「CARMEN(カルメン) フラップ

商品の情報

メルカリ安心への取り組み

お金は事務局に支払われ、評価後に振り込まれます

出品者

スピード発送

この出品者は平均24時間以内に発送しています

![Amazon | [マイケルコース] アウトレット ハンドバッグ ショルダー](https://m.media-amazon.com/images/I/61HQ sUdRWL._AC_SL1100_.jpg)

![Amazon | [マイケルコース] アウトレット ハンドバッグ ショルダー](https://m.media-amazon.com/images/I/41jpl-q8nYL._AC_UY350_.jpg)

![Amazon | [マイケルコース] アウトレット ハンドバッグ ショルダー](https://m.media-amazon.com/images/I/61Dz4G8fN0L._AC_UY580_.jpg)