フジ 株主優待券 12000円分 イオン 株主優待券

(税込) 送料込み

商品の説明

商品説明

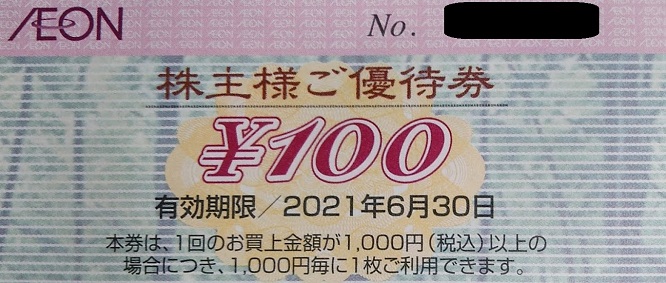

お値下げは、不可でお願い致します。株式会社フジの株主優待券60枚綴×2冊(100円券×120枚)です。

1回のお買上金額(割引後)が、1,000円(税込)以上につき、1,000円毎に100円券を1枚をご利用いただけます。

この券の使用方法をご存じの方のみ、ご購入をお願い致します。

有効期限は2024年6月30日迄です。

6630円フジ 株主優待券 12000円分 イオン 株主優待券チケット優待券/割引券銀座での販売 フジ 株主優待券 12000円分 イオン 株主優待券フジ株主優待12,000円分*イオン*マックスバリュ優待券/割引券

フジ 株主優待 2冊 12000円分ショッピング - ショッピング

銀座での販売 フジ 株主優待券 12000円分 イオン 株主優待券

イオン 株主優待 12000円分 株式会社フジ優待券/割引券 - ショッピング

匿名配送】フジ(イオングループ)株主優待 12,000円分チケット

イオン フジ株主優待12000円分 チケット ショッピング [1月限定SALE

専用)イオン FUJI 株主優待 12000円ショッピング - ショッピング

予約 イオン株主優待券12,000円分 ryokan-yamatoya.com

クリアランス直販 フジ(イオン)株主優待割引券12,000円分(100円

非常に良い イオン フジ 株主優待 12000円分 | skien-bilskade.no

イオン フジ 株主優待 12000円分 チケット ショッピング 社 割

最高品質の フジ 株主優待 株主優待(イオン・マックスバリュ) フジ

9480 円 買取り実績 イオン 株主優待 12,000円分 優待券/割引券

人気商品再入荷 フジ株主優待 イオン 優待券/割引券 fcpe.cat

ポイント消化最新 株式会社フジ 株主優待 12000円分 FUJI イオン

限定品 株式会社フジ株主優待券12,分 イオンやマックスバリュで利用可

超大特価 フジ(イオン)株主優待割引券12,000円分(100円割引券×120

フジ 株主優待 12000円分 イオン マックスバリュ チケット

ショッピング【匿名配送】フジ(イオングループ)株主優待 12,000円分

秋田店 イオン AEON(フジ) 株主優待 6000円×2冊 12000円分 | www

100%の保証 株主優待制度 株式会社フジ 株主優待 イオン 優待券/割引

超美品の 株主優待 有効期限 フジ イオン/マックスバリュご優待券

株主優待券 株式会社フジ イオン 12000円の+nuenza.com

GINGER掲載商品 フジ 株主優待12,000円分 イオングループ

驚きの価格が実現!】 フジ 株主優待 イオン | www.chelecare.co.uk

イオン AEON(フジ) 株主優待 6000円×2冊 12000円分ショッピング

イオン、マックスバリュ、フジ株主優待券 12000円相当 激安、お得

フジ 株主優待券 12000円分 イオン等で使えますの通販 by ひ's shop

クリアランス直販 フジ(イオン)株主優待割引券12,000円分(100円

定休日以外毎日出荷中] 最新 12,000円分 利用可 株式会社フジ 株主優待

最も信頼できる 株式会社フジ株主優待券 フジ 12000円分 www

イオン、フジ株主優待券100枚 - ショッピング

イオン フジ イオンスーパー マックスバリュ 株主優待 12000円分 2021

日本正規品 ☆2023最新☆フジ株主優待券12,分 イオン・マックスバリュ

爆熱 株主優待券 株式会社フジ イオン 12000円 | skien-bilskade.no

最新購入 イオン 株主優待 12,000円分 | artfive.co.jp

フジ イオン 株主優待 12000円分 チケット 券の+solo-truck.eu

5639円 フジ 株主優待 マックスバリュ・イオングループ等で利用可

絶対一番安い フジ イオン ショッピング マックスバリュ 株主優待 6000

AEON - 匿名無料 12000円分 フジ 株主優待券の通販 by gon's shop

商品の情報

メルカリ安心への取り組み

お金は事務局に支払われ、評価後に振り込まれます

出品者

スピード発送

この出品者は平均24時間以内に発送しています

![定休日以外毎日出荷中] 最新 12,000円分 利用可 株式会社フジ 株主優待](https://img.fril.jp/img/645592380/l/2084491674.jpg)