メンズ 美品 ビンテージ USA 古着 90s Tシャツ プリント アニマル 黒

(税込) 送料込み

商品の説明

商品説明

◆送料無料・匿名配送で安心◆◆コメント無し即購入OK◆

◆『値引き交渉』も受け付けております!◆

大幅なお値引きはできませんが、”〇〇円で購入したいです”とお気軽にお声掛けください!

○アイテム

メンズ

Tシャツ

プリントTシャツ

ライオン

○サイズ

M

素人採寸ですが、ご参考にしてください??????

肩幅46cm

袖丈22cm

身幅48cm

着丈75.5cm

○状態・特徴

前面にライオンがどかーんとプリントされている

インパクトある90年代頃のアメリカ製古着です。

このTシャツにルーズフィットの明るめのブルーデニムを合わせたらかっこいい古着コーデになります。

他にもいろいろ試してみてぴったりのコーデを

探してみてください???????

※写真のカラーは撮影環境やお使いの端末によって、現物と色味が異なる場合があります。

ご了承の上お買い求め下さい。

8580円メンズ 美品 ビンテージ USA 古着 90s Tシャツ プリント アニマル 黒メンズトップスビッグサイズ 90年代 USA製 GET INVOLVED INC. 海洋生物 アニマル受注発注 メンズ 美品 ビンテージ USA 古着 90s Tシャツ プリント

90年代 猫 ねこ アニマル プリント Tシャツ メンズXL 古着

☑USA古着 the mountain アニマルTシャツ ロンT ワシ タイダイ

ビッグサイズ 90年代 USA製 GET INVOLVED INC. 海洋生物 アニマル

古着 90s USA製 袖裏 牛柄 ウシ 両面 リアル アニマル グラフィック T

vintage 90s EXPRESS プリントTシャツ アニマル ネコ 猫

ビッグサイズ 90年代 USA製 ホワイトタイガー アニマルプリント T

90s USA製 ☆ ウシ アニマル プリント 半袖 Tシャツ ( メンズ L ) 古着

90s アニマルプリント 総柄 vintage Tシャツ リキッドブルー-

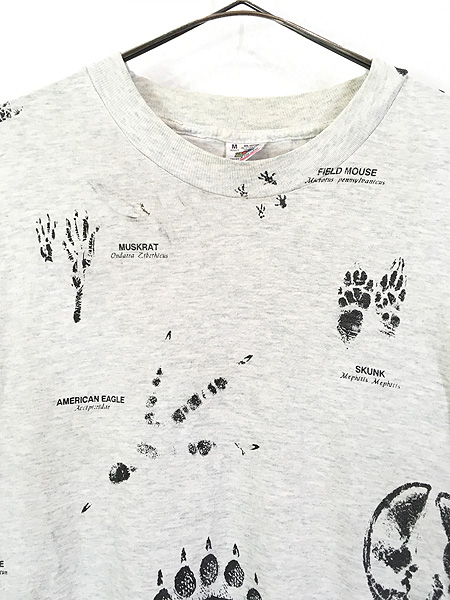

古着 90s USA製 動物 アニマル ネーム入り 足跡 総柄 プリント Tシャツ

90年代 90s アメリカ製 半袖 アニマル | ビンテージ古着屋Feeet 通販

vintage 90s EXPRESS プリントTシャツ アニマル ネコ 猫

24時間以内に発送‼️古着 犬Tシャツ アニマルT カナダ製-

古着 90年代 USA THUNDER クロヒョウ柄 サンダー柄 アニマルプリントT

90年代 猫 ねこ アニマル プリント Tシャツ メンズXL 古着

90s USA製 □ アニマル キャラクター 袖 プリント モックネック 長袖 T

ROCK CHANG ロックチャン tシャツ 猫 キャット 両面プリント | LUCKY

アラスカ アメリカ アニマル ベアー 熊 鳥 Tシャツ 黒 USA古着 半袖

古着 90s USA製 犬 わんちゃん 両面 アニマル プリント Tシャツ L 古着

詳細不明 ビッグプリント Tシャツ 古着 アニメTシャツ? ゲームTシャツ?-

90sヴィンテージUSA製古着NBAデトロイトピストンズチャンピオン

Slipknot 両面 プリント バンドTシャツ バンT ロックT 音楽 ダメージ

アラスカ アメリカ アニマル ベアー 熊 鳥 Tシャツ 黒 USA古着 半袖

53cm肩幅90年代 TSC 犬柄 アニマルプリントTシャツ USA製 メンズL

USA製 90s くまのプーさん Tシャツ ビンテージ ディズニー ミッキー-

90s アニマルプリント 総柄 vintage Tシャツ リキッドブルー-

90S USA製 古着 半袖 Tシャツ シェルティ アニマルプリント 犬 ヴィンテージ メンズXL BA2413

anvil】90s ウルフ オオカミ アニマルプリント USA製 アメリカ古着 T

vintage 90s EXPRESS プリントTシャツ アニマル ネコ 猫

adidas ブラック tシャツ 3本ライン 刺繍タグ ヴィンテージ 90s

90s~Bootleg OLD STUSSY/RANK FILM Tee/Korea製/赤青タグ/L

53cm肩幅90年代 TSC 犬柄 アニマルプリントTシャツ USA製 メンズL

古着 90s USA製 「Pug」 パグ 犬 ワンちゃん アニマル Tシャツ L 古着

レギュラー古着! SUPERMARKET お肉 プリント Tシャツ ブラック-

90年代 USA製 イヌ アニマルプリントTシャツ メンズL 古着 90s

アラスカ アメリカ アニマル ベアー 熊 鳥 Tシャツ 黒 USA古着 半袖

90s Lee スウェット プリント イーグル 鷲 ヘビーウェイト

90年代 90s アメリカ製 半袖 アニマル | ビンテージ古着屋Feeet 通販

正規店仕入れの USA製 アニマルプリント hanes ドッグ 楽天市場】90s

USA古着 スウェット トレーナー プリント クルーネック メンズL ネイビー

商品の情報

メルカリ安心への取り組み

お金は事務局に支払われ、評価後に振り込まれます

出品者

スピード発送

この出品者は平均24時間以内に発送しています