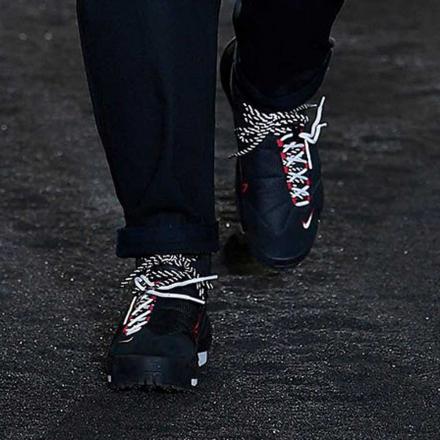

29cm sacai Nike Magmascape Black マグマスケープ

(税込) 送料込み

商品の説明

商品説明

sacaixNikeMagmascape

カラー:Black

サイズ:29.0cm

sacai公式オンラインにて購入した商品となります。

sacai限定「GOFINDOUT」のステッカーと、sacaiの商品タグが付属します。

状態のみ確認の新品未使用。

ご購入いただいた翌日に発送を予定しています。

すぐにお支払いいただける方のみ、ご購入ください。

他でも出品しているため、売れ違いとなる場合があります。

サカイナイキマグマスケープブラック黒

20400円29cm sacai Nike Magmascape Black マグマスケープメンズ靴/シューズ大量購入用 29cm sacai Nike Magmascape Black マグマスケープ | wwwNIKE公式】マグマスケープ x sacai 'Black' (FN0563-001 / MAGMASCAPE

NIKE公式】マグマスケープ x sacai 'Black' (FN0563-001 / MAGMASCAPE

NIKE公式】マグマスケープ x sacai 'Black' (FN0563-001 / MAGMASCAPE

大量購入用 29cm sacai Nike Magmascape Black マグマスケープ | www

正式的 sacai × Nike Magmascape Pecanl”29cm | emplumado.mx

sacai × Nike Magmascape Black サカイ×ナイキ マグマスケープ (Nike

29cm FN0563-001 NIKE sacai MAGMASCAPE Black ナイキ サカイ

NIKE公式】マグマスケープ x sacai 'Varsity Royal' (FN0563-400

29 sacai × Nike Magmascape

国内11月30日/12月6日/7日発売予定】 サカイ × ナイキ マグマスケープ

sacai - sacai × Nike Magmascape マグマスケープ 29cmの通販 by

NIKE公式】マグマスケープ x sacai 'Pecan' (FN0563-200 / MAGMASCAPE

NIKE公式】マグマスケープ x sacai 'Pecan' (FN0563-200 / MAGMASCAPE

NIKE マグマスケープ × sacai 29cm - 靴/シューズ

sacai×NIKE MAGMA SCAPE US11nike - スニーカー

29 sacai × Nike Magmascape

NIKE マグマスケープ × sacai 29cm - 靴/シューズ

楽天市場】ナイキ NIKE ×サカイ Sacai サイズ:29cm MAGMASCAPE SP

NIKE公式】マグマスケープ x sacai 'Black' (FN0563-001 / MAGMASCAPE

SACAI x NIKE MAGMASCAPE SP VARSITY ROYAL/BLACK ( サカイ x ナイキ

NIKE公式】マグマスケープ x sacai 'Black' (FN0563-001 / MAGMASCAPE

NIKE公式】マグマスケープ x sacai 'Black' (FN0563-001 / MAGMASCAPE

NIKE ナイキ FN0563-001 × sacai Magmascape Black サカイ マグマ

国内11月30日/12月6日/7日発売予定】 サカイ × ナイキ マグマスケープ

NIKE公式】マグマスケープ x sacai 'Black' (FN0563-001 / MAGMASCAPE

楽天市場】ナイキ NIKE ×サカイ Sacai サイズ:29cm MAGMASCAPE SP

29cm sacai Nike Magmascape Royal マグマスケープ - 靴/シューズ

NIKE公式】マグマスケープ x sacai 'Black' (FN0563-001 / MAGMASCAPE

オンラインストア直販 Sacai Nike magmascape 29.5 マグマスケープ - 靴

オンラインストア限定 X SACAI NIKE MAGMASCAPE 27cm マグマスケープ

NIKE公式】ナイキ マグマスケープ x sacai メンズシューズ.オンライン

直販値下 NIKE×sacai magmascape マグマスケープ 26.5cm | artfive.co.jp

楽天市場】NIKE × sacai / ナイキ サカイMagmascape

長期納期 NIKE ×sacai Magmascape/×サカイ マグマスケープ | artfive.co.jp

NIKE ナイキ FN0563-001 × sacai Magmascape Black サカイ マグマ

sacai - 29cm sacai Nike Magmascape Black マグマスケープの通販 by

NIKE公式】マグマスケープ x sacai 'Varsity Royal' (FN0563-400

sacai Nike Magmascape Varsity Royal サカイ ナイキ マグマスケープ

sacai × Nike Magmascape Black 28 マグマスケープ

楽天市場】NIKE × sacai / ナイキ サカイMagmascape

商品の情報

メルカリ安心への取り組み

お金は事務局に支払われ、評価後に振り込まれます

出品者

スピード発送

この出品者は平均24時間以内に発送しています