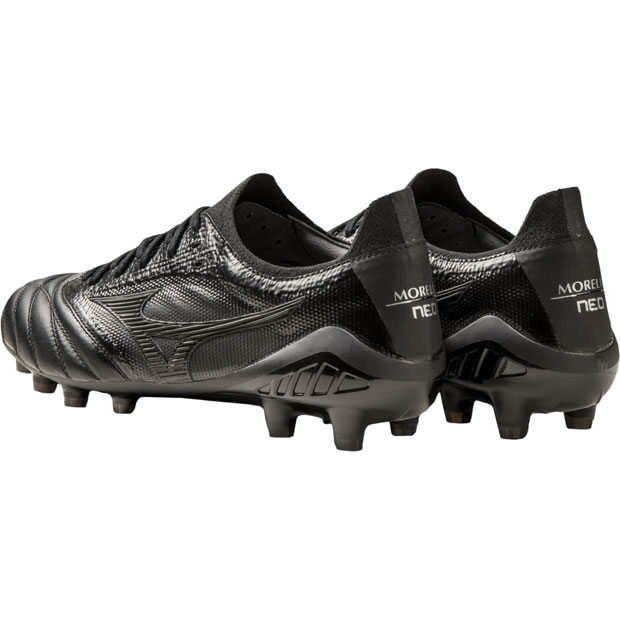

モレリア NEO 3 JAPAN β 26.5cm ブラック×ブラック

(税込) 送料込み

商品の説明

商品説明

天然芝のみで数回使用しました。対応グラウンド:天然芝グラウンド、土グラウンド、人工芝グラウンド

質量:約201g(27.0cm片足)

カラー:ブラック×ブラック

9750円モレリア NEO 3 JAPAN β 26.5cm ブラック×ブラックスポーツ/アウトドアサッカー/フットサル約201gカラーモレリア NEO 3 JAPAN β 26.5cm ブラック×ブラック - www約201gカラーモレリア NEO 3 JAPAN β 26.5cm ブラック×ブラック - www

紐は無いですミズノ モレリアネオ3 ブラック 26.5cm - シューズ

モレリア NEO 3 JAPAN β 26.5cm ブラック×ブラック - www.hug.business

約201gカラーモレリア NEO 3 JAPAN β 26.5cm ブラック×ブラック - www

注目の モレリア NEO 3 JAPAN β 26.5cm ブラック×ブラック -シューズ

約201gカラーモレリア NEO 3 JAPAN β 26.5cm ブラック×ブラック

注目の モレリア NEO 3 JAPAN β 26.5cm ブラック×ブラック -シューズ

MIZUNO - MORELIA NEO(モレリア ネオ) Ⅲ β 26.5cmの+solo-truck.eu

注目の モレリア NEO 3 JAPAN β 26.5cm ブラック×ブラック -シューズ

モレリア NEO 3 JAPAN ブルー×ホワイト-

ミズノ モレリアネオ3β ブラックアウト 25.0㎝-

スポーツ/アウトドアMORELIA NEO(モレリア ネオ) Ⅲ β 26.5cm - シューズ

morelianeo3[ 26.0cm ] ミズノ モレリアNEO3 JAPAN - シューズ

スポーツ・レジャー モレリア NEO 3 JAPAN β 26.5cm ブラック×ブラック

ミズノ モレリア ネオ 3 β エリート 26.5cmスポーツ/アウトドア - シューズ

MIZUNO - モレリア NEO 3 JAPAN β 26.5cm ブラック×ブラックの+

モレリア NEO 3 β JAPAN ブラック×サックス - フットサル

MIZUNO ミズノ モレリアネオ3βJAPAN ジャパン SR4 26.5cm-

モレリア ネオ3 SR4 JAPAN 26.5 セルヒオラモス-

スポーツ/アウトドアMORELIA NEO(モレリア ネオ) Ⅲ β 26.5cm - シューズ

MORELIA NEO III β SR4 26.5cm-

日本未発売!ミズノ モレリアネオ3 βジャパン26.5cm-

ミズノ モレリア ネオ 3 β エリート 26.5cmスポーツ/アウトドア - シューズ

ミズノ モレリア NEO 3 β JAPAN(ブラック×サックス)

ミズノ モレリア ネオ3 β JAPAN-

26.5cm】Mizuno Morelia NEO III β SR4 ベータ-

ミズノ モレリア ネオ 3 β エリート 26.5cm-

約201gカラーモレリア NEO 3 JAPAN β 26.5cm ブラック×ブラック

MIZUNO MORELIA NEO 3 β JAPAN モレリアネオ 26.5 | nate-hospital.com

ミズノ モレリア NEO 3 JAPAN(ブラック) 26.0cm - フットサル

ミズノ モレリア ネオ 3 β エリート 26.5cmスポーツ/アウトドア - シューズ

ミズノ モレリア NEO 3 β JAPAN(レッド×ブラック)

注目の モレリア NEO 3 JAPAN β 26.5cm ブラック×ブラック -シューズ

モレリアネオ3ベータ 26.5cm Ⅲ β SR4 JAPAN-

限定カラー)モレリア NEO 3 β JAPAN ブラック×サックス27.5cm-

シューズ希少 mizuno MORELIA NEO Ⅲ SR4 JAPAN 26.0cm - シューズ

MIZUNO モレリア ネオ4 JAPAN-

MIZUNO モレリア ネオ3 限定カラー 26.5cm - フットサル

モレリア NEO 3 β JAPAN ブラック×サックス - フットサル

モレリア NEO 3 セルヒオ・ラモス 26.5 - フットサル

商品の情報

メルカリ安心への取り組み

お金は事務局に支払われ、評価後に振り込まれます

出品者

スピード発送

この出品者は平均24時間以内に発送しています

![morelianeo3[ 26.0cm ] ミズノ モレリアNEO3 JAPAN - シューズ](https://jpn.mizuno.com/static/mallDefault/images/goods/zoom1000/SH_P1GA208009_XL.jpg)