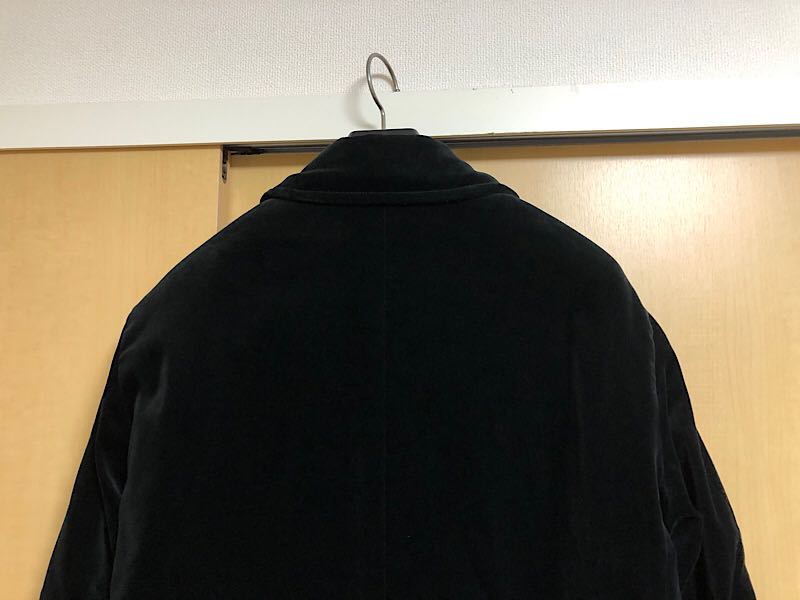

【美品】 GRAND GEORGE カシミヤ100% ステンカラーコート L 黒

(税込) 送料込み

商品の説明

商品説明

10月まで圧縮袋に入れて保管しております。状態も再確認したいのでご購入希望の方はお手数ですがご購入前にコメントよりお知らせください。

カシミヤ100%なので手触りがよく、シンプルでスッキリしたデザインです。

【ブランド】

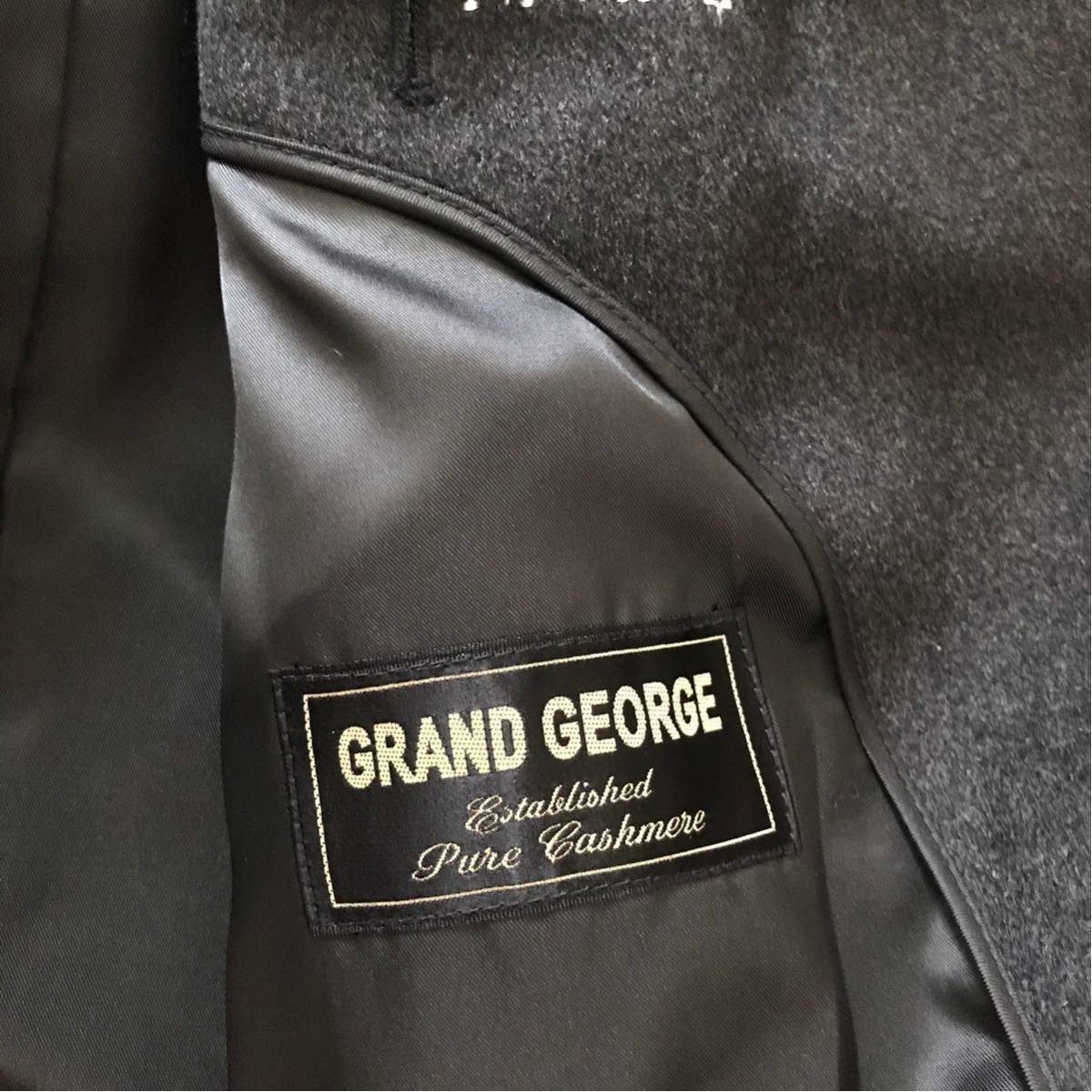

GRANDGEORGE/グランドジョージ

【アイテム】

ステンカラーコート

【カラー】黒/ブラック

【サイズ】

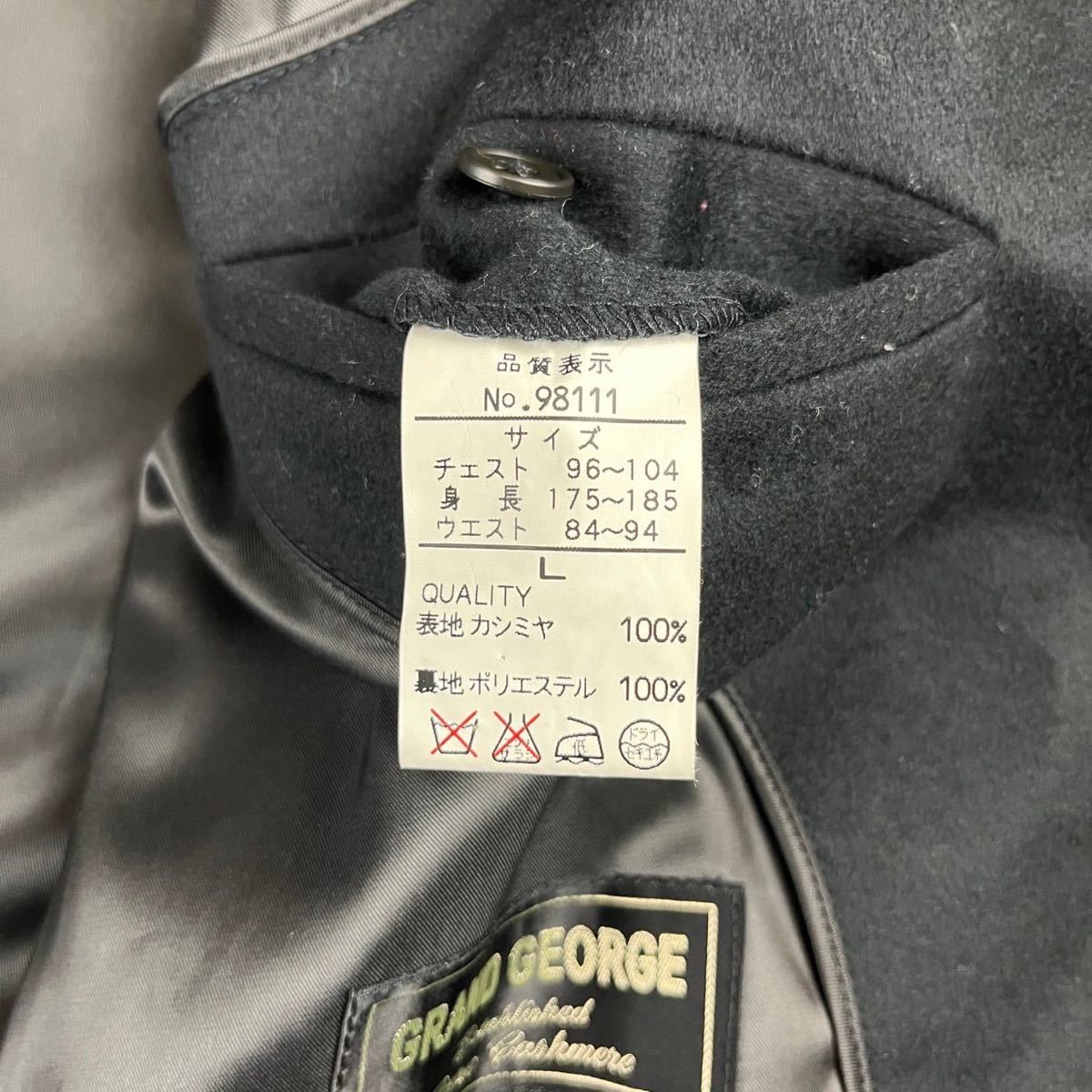

サイズ:Lサイズ

チェスト:95~104

身長:175~185

ウエスト:84~94

【素材】

表地:カシミヤ100%

裏地:ポリエステル100%

【状態】

◾︎目立った傷や汚れは見当たりません

◾︎品質表示のタグにクリーニングのホチキスの穴が開いています。

※素人検品の古着ですのでほつれや汚れの見逃しがあるかもしれません。

#sakiのメンズアパレル

↑他にも出品していますのでご覧下さい✩.*˚

梱包は簡易的で、コンパクトにたたんで圧縮しての発送となります。

都合により発送方法を変更する場合がございます。

ご理解いただける方お願いいたします。

比翼仕立て/カシミア

6566円【美品】 GRAND GEORGE カシミヤ100% ステンカラーコート L 黒メンズジャケット/アウター【美品】 GRAND GEORGE カシミヤ100% ステンカラーコート L 黒【美品】 GRAND GEORGE カシミヤ100% ステンカラーコート L 黒 | フリマアプリ ラクマ

【美品】 GRAND GEORGE カシミヤ100% ステンカラーコート L 黒

【美品】 GRAND GEORGE カシミヤ100% ステンカラーコート L 黒

【美品】 GRAND GEORGE カシミヤ100% ステンカラーコート L 黒

最高級ピュアカシミヤ100%!!極美品!! グランドジョージ『紳士の振舞

最高級ピュアカシミヤ100%!!極美品!! グランドジョージ『紳士の振舞

【美品】 GRAND GEORGE カシミヤ100% ステンカラーコート L 黒

最高級ピュアカシミヤ100%!!極美品!! グランドジョージ『紳士の振舞

ステンカラーコート【美品】カシミヤ100% ステンカラーコート ロング

フジコウ】カシミヤ100% ダブル プレスト ロング丈 コート ウール

即決 markaマーカ17AW中綿入りベロアバルカラーコート黒2|Yahoo

GRAND GEORGEグランドジョージ カシミアコート ロングコート

L&B HOMME エルアンドビーオム ステンカラー ロングコート カシミヤ100

最高級ピュアカシミヤ100%!!極美品!! グランドジョージ『紳士の振舞

GRAND GEORGEグランドジョージ☆カシミアコート☆ロングコート☆グレー☆ | Aspiration01 powered by BASE

【美品】 GRAND GEORGE カシミヤ100% ステンカラーコート L 黒

美品 ダンテフィレンツェ ステンカラーコート カシミヤ100% Lサイズ 黒

GRAND GEORGEグランドジョージ☆カシミアコート☆ロングコート☆グレー☆ | Aspiration01 powered by BASE

美品 ダンテフィレンツェ ステンカラーコート カシミヤ100% Lサイズ 黒

最高級ピュアカシミヤ100%!!極美品!! グランドジョージ『紳士の振舞

美品】 GRAND GEORGE カシミヤ100% ステンカラーコート L 黒の通販 by

GRAND GEORGEグランドジョージ カシミアコート ロングコート

美品 ダンテフィレンツェ ステンカラーコート カシミヤ100% Lサイズ 黒

美品】 GRAND GEORGE カシミヤ100% ステンカラーコート L 黒の通販 by

美品 ダンテフィレンツェ ステンカラーコート カシミヤ100% Lサイズ 黒

GRAND GEORGEグランドジョージ☆カシミアコート☆ロングコート☆グレー☆ | Aspiration01 powered by BASE

美品】 GRAND GEORGE カシミヤ100% ステンカラーコート L 黒の通販 by

最高級ピュアカシミヤ100%!!極美品!! グランドジョージ『紳士の振舞

美品 ダンテフィレンツェ ステンカラーコート カシミヤ100% Lサイズ 黒

ステンカラーコート ロング カシミヤ100% ブラック M

ステンカラーコート ロング カシミヤ100% ブラック M

GRAND GEORGEグランドジョージ☆カシミアコート☆ロングコート☆グレー

ステンカラーコート ロング カシミヤ100% ブラック M

最高級ピュアカシミヤ100%!!極美品!! グランドジョージ『紳士の振舞

ステンカラーコート ロング カシミヤ100% ブラック M

RIGELリーガルカシミヤ100%ステンカラーロングコート正装通勤ビジネス黒

2024年最新】Yahoo!オークション -#フジコウ(ファッション)の中古品

美品 ダンテフィレンツェ ステンカラーコート カシミヤ100% Lサイズ 黒

GRAND GEORGEグランドジョージ カシミアコート ロングコート

【美品!】最高の手触りelevatoカシミヤ100% 黒 L ステンカラーコート

商品の情報

メルカリ安心への取り組み

お金は事務局に支払われ、評価後に振り込まれます

出品者

スピード発送

この出品者は平均24時間以内に発送しています