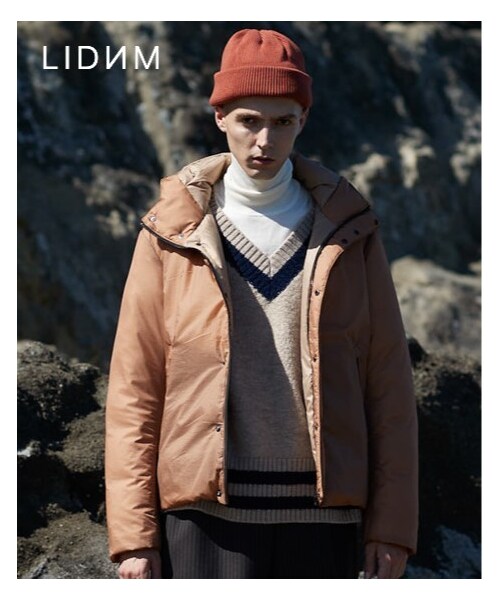

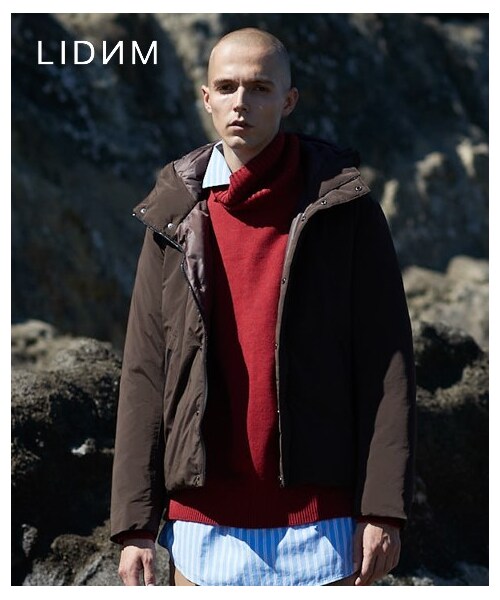

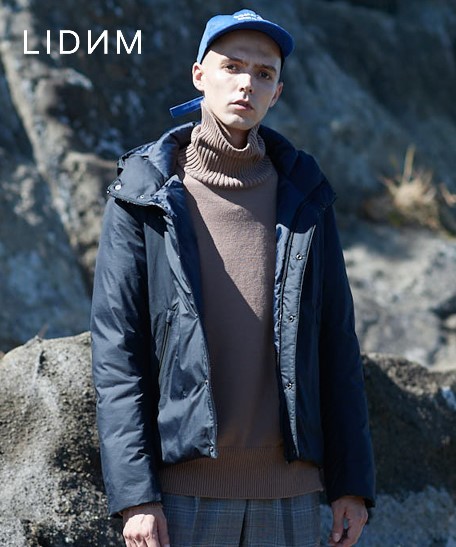

LIDNM CORDURA ナイロンフーデッドダウン

(税込) 送料込み

商品の説明

商品説明

リドムの大人気商品のダウンです。もお完売している商品です。新品未使用未開封です

カラーはブラックです

定価24840円

リドム

げんじ

6440円LIDNM CORDURA ナイロンフーデッドダウンメンズジャケット/アウターLIDNM(リドム)の「LIDNM/リドム/CORDURAナイロンフーデッドダウンLIDNM(リドム)の「LIDNM/リドム/CORDURAナイロンフーデッドダウン

LIDNM(リドム)の「LIDNM/リドム/CORDURAナイロンフーデッドダウン

LIDNM(リドム)の「CORDURAナイロンフーデッドダウン【ネイビー

LIDNM(リドム)の「LIDNM/リドム/CORDURAナイロンフーデッドダウン

LIDNM(リドム)の「LIDNM/リドム/CORDURAナイロンフーデッドダウン

LIDNM(リドム)の「LIDNM/リドム/CORDURAナイロンフーデッドダウン

LIDNM(リドム)の「LIDNM/リドム/CORDURAナイロンフーデッドダウン

LIDNM CORDURA ナイロンフーデッドダウン | hartwellspremium.com

LIDNM(リドム)の「CORDURAナイロンフーデッドダウン

LIDNM(リドム)の「LIDNM/リドム/CORDURAナイロンフーデッドダウン

LIDNM(リドム)の「LIDNM/リドム/CORDURAナイロンフーデッドダウン

LIDNM CORDURA ナイロンフーデッドダウン | hartwellspremium.com

LIDNM CORDURA ナイロンフーデッドダウン | hartwellspremium.com

LIDNM(リドム)の「LIDNM/リドム/CORDURAナイロンフーデッドダウン

LIDNM CORDURA ナイロンフーデッドダウン | hartwellspremium.com

アウトレット価格比較 リドム LIDnM CORDURAナイロンフーデッドダウン

LIDNM CORDURA ナイロンフーデッドダウン | hartwellspremium.com

リドム CORDURA ナイロンフーデッドダウン Lサイズ ブラック - アウター

LIDNM(リドム)の「CORDURAナイロンフーデッドダウン【キャメル

LIDNM CORDURA ナイロンフーデッドダウン リドム 商品の状態

LIDNM CORDURA ナイロンフーデッドダウン リドム 商品の状態

LIDNM CORDURAナイロンフーデッドダウン - ダウンジャケット

LIDNM リドム CORDURA ナイロンフーデットダウン 新品未使用の通販 by

LIDNM CORDURA ナイロンフーデッドダウン - ダウンジャケット

LIDNM CORDURA ナイロンフーデッドダウン リドム 商品の状態

リドム CORDURA ナイロンフーデッドダウン Lサイズ ブラック - アウター

ゆうき|LIDNMのダウンジャケット/コートを使ったコーディネート - WEAR

LIDNM CORDURA ナイロンフーデッドダウン | hartwellspremium.com

LIDNM CORDURA ナイロンフーデッドダウン リドム 商品の状態

楽天市場】日本製 CORDURAナイロン フーデッド リアルダウンジャケット

LIDNM(リドム)の「LIDNM/リドム/CORDURAナイロンフーデッドダウン

リドム CORDURA ナイロンフーデッドダウン Lサイズ ブラック - アウター

ダウンジャケット/L/ナイロン/BRW/ダウン90%/CORDURAナイロンフーデッドダウン

LIDNM CORDURA ナイロンフーデッドダウン リドム 商品の状態

LIDNM(リドム)の「CORDURAナイロンフーデッドダウン【ネイビー

LIDNM(リドム)の「LIDNM/リドム/CORDURAナイロンフーデッドダウン

LIDNM CORDURA ナイロンフーデッドダウン リドム 商品の状態

LIDNM CORDURA ナイロンフーデッドダウン | hartwellspremium.com

楽天市場】日本製 CORDURAナイロン フーデッド リアルダウンジャケット

LIDNM CORDURA ナイロンフーデッドダウン リドム 商品の状態

商品の情報

メルカリ安心への取り組み

お金は事務局に支払われ、評価後に振り込まれます

出品者

スピード発送

この出品者は平均24時間以内に発送しています