el conductorH 23ss SPANGLE EMBROIDERED

(税込) 送料込み

商品の説明

商品説明

新入荷情報は当店のInstagramアカウント(@union3daimyo)にて掲載しております。是非フォロー宜しくお願い致します。

【商品説明】

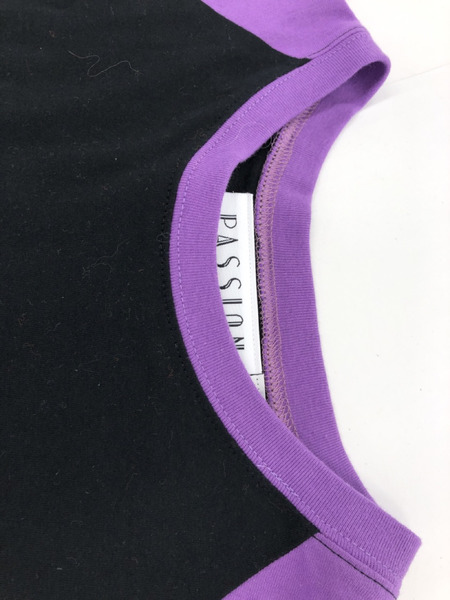

elconductorH23ssSPANGLEEMBROIDEREDRAGRANTEE

コンダクタースパンコールラグランTシャツ

■管理番号:da230522-12

■ブランド:

■サイズ:4

■採寸:裄丈73身幅65着丈72.5

■品番:PD23SC01

■カラー:BLACK/NATURAL

■状態:未使用品。

■付属品:無

【お問い合わせについて】

公式アカウントにつきコメントにはお答えできかねます。

取引メッセージ上でのご対応のみとなりますので予めご了承ください。

お問い合わせの際は、マイページ>ヘルプ・その他>お問い合わせからお願いします。

【受取連絡について】

受取連絡は商品到着後商品の状態を確認いただいた後に実施してください。

受取連絡後の返品およびキャンセルは対応できませんのでご了承ください。

受取連絡は商品到着後、1週間以内に対応をお願い申し上げます。

【注意事項】

・お色味について、極力実物に近くなるよう撮影を心掛けておりますが、ご使用のモニター環境等により、実際のお色味と多少異なる場合がございます。

・商品チェックについて、確認には、細心の注意を払っておりますが、初期傷や劣化、保管時の小傷等がある場合がございます。あくまでもUSED品となっておりますので神経質な方のご購入はお控え下さい。

・当店の商品は実店舗でも販売しております。お買い上げ頂いた商品が品切れになってしまう場合がございます。ご迷惑をおかけ致しますが、予めご了承くださいませ。

・返品と交換について、不良品以外の返品と交換はお受け致しかねますのでサイズ、状態などよくお確かめの上でご購入下さい。

・ラクマ公式店舗となりますので、取扱商品は全て正規品です。

【お問い合わせ先】

UNION3大名店

福岡県福岡市中央区大名1丁目10番20号ベイシック大名1F

092-737-8997

8580円el conductorH 23ss SPANGLE EMBROIDEREDメンズトップスel conductorH 23ss SPANGLE EMBROIDEREDの通販 by UNION3 ラクマ店メーカー包装済】 el conductorH 23ss SPANGLE EMBROIDERED | skien

el conductorH 23ss SPANGLE EMBROIDEREDの通販 by UNION3 ラクマ店

el conductorH 23ss SPANGLE EMBROIDEREDの+triclubdoha.com

el conductorH 23ss SPANGLE EMBROIDEREDの通販 by UNION3 ラクマ店

el conductorH 23ss SPANGLE EMBROIDEREDの+triclubdoha.com

el conductorH 23ss SPANGLE EMBROIDEREDの+triclubdoha.com

メーカー包装済】 el conductorH 23ss SPANGLE EMBROIDERED | skien

el conductorH 23ss SPANGLE EMBROIDEREDの通販 by UNION3 ラクマ店

el conductorH 23ss SPANGLE EMBROIDEREDの+triclubdoha.com

el conductorH - コンダクター | STORY 公式通販 - オンラインストア

厳選された商品】 el conductorH 23ss SPANGLE EMBROIDERED Tシャツ

メーカー包装済】 el conductorH 23ss SPANGLE EMBROIDERED | skien

23SS el conductorHコンダクターSPANGLE EMBROIDERED RAGRAN SLEEVE 4

el conductorH - コンダクター | STORY 公式通販 - オンラインストア

el conductorH 23ss SPANGLE EMBROIDEREDの+triclubdoha.com

el conductorH SPANGLE EMBROIDERED RAGRAN SLEEVE T-SHIRT (WHT

23SS el conductorHコンダクターSPANGLE EMBROIDERED RAGRAN SLEEVE 4

el conductorH - コンダクター | 公式通販サイト | ACRMTSM

エル コンダクター el conductorH 23SS ハット ブラック サイズ:0

el conductorH 23ss SPANGLE EMBROIDEREDの+inforsante.fr

el conductorH SPANGLE EMBROIDERED RAGRAN SLEEVE T-SHIRT (WHT

60%OFF】el conductorH コンダクター DOUBLE BUCKLE BELT PD23SAC02

23SS el conductorHコンダクターSPANGLE EMBROIDERED RAGRAN SLEEVE 4

el conductorH 23ss SPANGLE EMBROIDEREDの+inforsante.fr

el conductorH ONLINE STORE

el conductorH - コンダクター | STORY 公式通販 - オンラインストア

楽天市場】60%OFF【公式・正規取扱】コンダクター el conductorH x

エル コンダクター el conductorH 23SS ハット ブラック サイズ:0

ヘンリーネック袖丈el conductorH Tシャツ・カットソー -(XXL位) 赤

ヘンリーネック袖丈el conductorH Tシャツ・カットソー -(XXL位) 赤

23SS el conductorHコンダクターSPANGLE EMBROIDERED RAGRAN SLEEVE 4

残り1点] el conductorH DEMON EMBROIDERED SOURVENIR JKT

el conductorh Demon Embroidered Sourvenir JKT(OLIVE) PD23SJ08

el conductorH SPANGLE EMBROIDERED RAGRAN SLEEVE T-SHIRT (WHT

el conductorH ONLINE STORE

セール 美品 カットソー お得】 【美品】HERMES Tシャツ エルメス

el conductorH DEMON EMBROIDERED SOURVENIR JKT OLIVE - boys in the band

Gold Work Embroidery Spanish Bullion Applique Baroque Panel - Etsy

el conductorH Tシャツ・カットソー -(XXL位) 赤 【古着】-

ヘッドプレステージS HEAD Yahoo!フリマ(旧)+urbandrive.co.ke

商品の情報

メルカリ安心への取り組み

お金は事務局に支払われ、評価後に振り込まれます

出品者

スピード発送

この出品者は平均24時間以内に発送しています

![残り1点] el conductorH DEMON EMBROIDERED SOURVENIR JKT](https://noranekostore.com/cdn/shop/products/DSC03012.jpg)