リチャードジノリ メトロクアドロ スイカ ジュース

(税込) 送料込み

商品の説明

商品説明

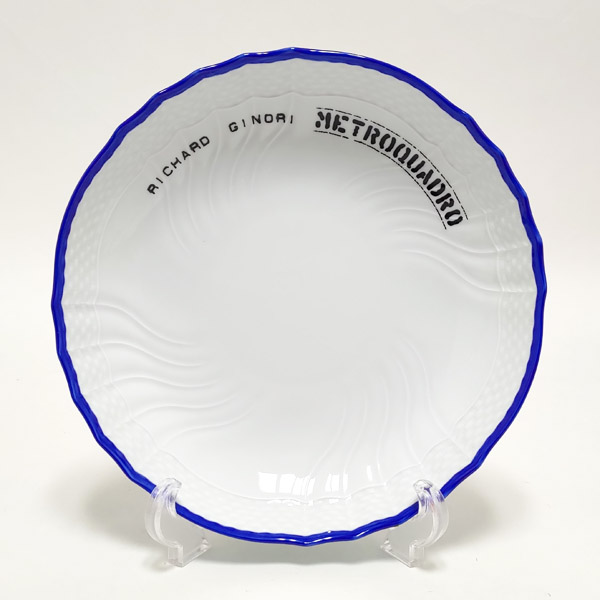

リチャードジノリメトロクアドロ

すいか

ジュース

とてもレアなお品です

メトロクアドロは色々な柄がありますが、こちらのプレートの絵柄がとても可愛いです

同じ絵柄はなく、唯一のお品と聞いています

イタリアのアートディレクター、PaolaNavoneパオラ・ナヴォーネとのコラボレーション作品になります

2009年ミラノサローネで発表されたウォールプレートインスタレーションは、壁一面にカラフルな素敵なプレートを飾られた創造を超える"アート"として世界的に注目されました。

その中の一部である"Metroquadro"(メトロクアドロ)シリーズのプレートになります

メトロクアドロとは1平方メートルという意味で、その限られた空間の中に色とりどりのプレートの裏面をランダムに並べられました。

色鮮やかで一枚一枚どれをとってもアートを感じられる、そしてなかなか手に入ることのない超レアなプレートです。

インテリアとして壁に飾ったり、コレクションの一部として絵になる御品です

最終画像2枚に参考画像あります

色々な絵柄がありそれぞれ唯一のお品です

楽天市場などでも3-4万ほどで出ていますが絵柄はそれぞれ違います

未使用美品、綺麗な御品です

白く光っていましたら光の反射です

お手入れによる微細な物はご容赦ください

直径27cm

#アザラシリチャードジノリ

ジノ多数出しています

他のフリマサイトにも出していますので突然の削除にもご理解ください

お品は信用おけるサイトにしか出していません

よく解らないネットショッピングに同じお品が出ていますが、詐欺のサイトです

こちらは唯一のお品で、同じお品はなく画像説明転用されていますのでお気をつけ下さい

ー・ー

お手数ですが、必ずプロフィールを読んで頂きますようお願い致します

製造過程で出来る凹凸や、色飛びはよくあり、また未使用美品でも保管期間がありますので、微細な擦り傷や高台の汚れなどはご容赦お願い致します。

アンティークのお品に関しては、アンティークにご理解のある方でお願いいたします

神経質な方、大きさの誤差を気にされる方はお店でのご購入をお勧めします。丁寧に確はしていますが素人の点検である事、自宅保管品である事をご理解の上でお願い致します

21780円リチャードジノリ メトロクアドロ スイカ ジュースインテリア/住まい/日用品キッチン/食器Richard Ginori - リチャードジノリ メトロクアドロ スイカ ジュースのRichard Ginori - リチャードジノリ メトロクアドロ スイカ ジュースの

リチャードジノリ メトロクアドロ スイカ ジュース-

Richard Ginori - リチャードジノリ メトロクアドロ スイカ ジュース

Richard Ginori - リチャードジノリ メトロクアドロ スイカ ジュースの

Richard Ginori - リチャードジノリ メトロクアドロ スイカ ジュースの

Richard Ginori - リチャードジノリ メトロクアドロ スイカ ジュースの

リチャードジノリ メトロクアドロ - 食器

Richard Ginori - リチャードジノリ メトロクアドロ スイカ ジュースの

リチャードジノリ メトロクアドロ スイカ ジュース-

Richard Ginori - リチャードジノリ メトロクアドロ スイカ ジュースの

Richard Ginori - リチャードジノリ メトロクアドロ スイカ ジュースの

最終値下げ リチャードジノリ メトロクアドロ RICHARD GINORI

安い販売店 ☆箱付きレア リチャードジノリ x パオラ・ナヴォーネ

最終値下げ リチャードジノリ メトロクアドロ RICHARD GINORI

Richard Ginori - リチャードジノリ メトロクアドロ スイカ ジュースの

Richard Ginori - リチャードジノリ メトロクアドロ スイカ ジュースの

4年保証』 リチャードジノリ - パオラ ナヴォーネ パオラ・ナヴォーネ

Richard Ginori - リチャードジノリ メトロクアドロ 古典模様 パープル

最終値下げ リチャードジノリ メトロクアドロ RICHARD GINORI

お値下げ】リチャード ジノリ メトロクワドロ 絵柄プレート お皿 レア

リチャードジノリ メトロクアドロ - 食器

リチャードジノリ メトロクアドロ スイカ ジュース | www.triak.pl

スモーキーベア インテリア | www.causus.be

リチャードジノリ メトロクアドロ スイカ ジュース-

リチャードジノリ メトロクアドロ スイカ ジュース-

Richard Ginori - リチャードジノリ メトロクアドロ スイカ ジュースの

リチャードジノリ メトロクアドロ スイカ ジュース | www.triak.pl

人気を誇る 廃盤貴重☆ローゼンタール アンディ・ウォーホル 食器

安い販売店 ☆箱付きレア リチャードジノリ x パオラ・ナヴォーネ

リチャードジノリ メトロクアドロ スイカ ジュース-

お値下げ】リチャード ジノリ メトロクワドロ 絵柄プレート お皿 レア

Richard Ginori - リチャードジノリ メトロクアドロ 古典模様 パープル

2024年最新】ジノリ paola navoneの人気アイテム - メルカリ

リチャードジノリ メトロクアドロ スイカ ジュース-

Richard Ginori - リチャードジノリ メトロクアドロ スイカ ジュースの

リチャードジノリ メトロクアドロ スクエア 古典模様 グリーン

4年保証』 リチャードジノリ - パオラ ナヴォーネ パオラ・ナヴォーネ

ガラスプレート スイカ柄 新品未使用 - 食器

リチャードジノリ メトロクアドロ スイカ ジュース-

2024年最新】paola navoneの人気アイテム - メルカリ

商品の情報

メルカリ安心への取り組み

お金は事務局に支払われ、評価後に振り込まれます

出品者

スピード発送

この出品者は平均24時間以内に発送しています