美品 DELL P2421DC 23.8インチワイド USB-C 4Kモニタ-

(税込) 送料込み

商品の説明

商品説明

商品名:DELLP2421DC23.8インチワイドUSB-C4Kモニタ-付属品:電源ケーブル、USB-Cケーブル、HDMIケーブル、DPケーブル

こちらの商品は目立つ傷汚れ等はなくきれいな商品です。

動作も良好です。

きれいに清掃をし厳重に梱包後、発送させていただきます。

以下商品詳細

画面サイズ:23.8"

特徴:USB3.0ハブ

パネルタイプ:IPS

アスペクト比:16:9

実効解像度:QHD2560x1440@60Hz

画素ピッチ:0.2058mm

輝度:300cd/m²

コントラスト比:1000:1

応答時間:8ms(GtoG典型);5ms(GtoG高速)

最大表示色:1670万色

寸法(幅x奥行きx高さ)-スタンド含む53.78cm35.61cm

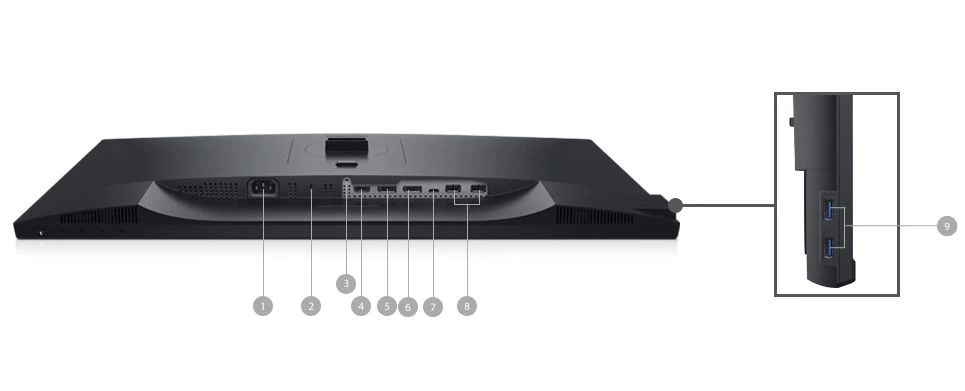

ポートとスロット:

1.電源コネクター

2.セキュリティロックスロット

3.スタンドロック機能

4.HDMI1.4ポート

5.DisplayPort1.2(入力)

6.DisplayPort1.2(出力)

7.USB-Cポート

8.USB2.0ダウンストリームポート(x2–背面)

9.USB3.0ダウンストリームポート(x2–側面)

USB-Cの絶大なパワー

USB-C接続で時間の節約:たった1本のケーブル接続で、作業スペースのセットアップにかかる時間を最大72%も節約できます。これにより、ケーブルの整理も不要になり、あらゆる電源、データ、オーディオを同時につなぐことができます。

生産性を高める作業スペースを拡大:解像度QHD2,560x1,440を備えたこの大型23.8インチ対角スクリーンにより、フルHDより広い画面上の表示域が提供されます。

DellDisplayManagerによる最適化と管理

あらゆるレベルで生産性を向上:EasyArrangeでは、38の事前設定されたウィンドウパーティションと、最大5つのウィンドウをカスタマイズする機能を使用して1つまたは複数の画面に複数のアプリケーションを簡単に並べてタイル表示することができ、これによってマルチタスク処理能力が向上します。

18540円美品 DELL P2421DC 23.8インチワイド USB-C 4Kモニタ-スマホ/家電/カメラPC/タブレットDell P2421DC 23.8インチワイド USB-C モニタ- - タブレットクラシック 美品 DELL 4Kモニタ- USB-C 23.8インチワイド P2421DC 24

美品 DELL P2421DC 23.8インチワイド USB-C 4Kモニタ- 液晶ディスプレイ ノングレア

DELL - 美品 DELL P2421DC 23.8インチワイド USB-C 4Kモニタ-の通販

Dell P2421DC 23.8インチワイド USB-C モニタ- - タブレット

美品 DELL P2421DC 23.8インチワイド USB-C 4Kモニタ- 液晶ディスプレイ ノングレア

Dell P2421DC [23.8インチ] オークション比較 - 価格.com

Dell P2421DC 23.8インチワイド USB-C モニタ- - タブレット

DELL P2421DC WQHD USB-C

DELL P2421DC WQHD USB-C

ASCII.jp:デル、USB-Type C接続の23.8型QHDディスプレー

DELL P2421DC WQHD USB-C

2024年最新】p2421dcの人気アイテム - メルカリ

DELL - 美品 DELL P2421DC 23.8インチワイド USB-C 4Kモニタ-の通販

Dell プロフェッショナルシリーズ P2421DC 23.8インチワイド USB-C

DELL P2421DC WQHD USB-C

美品 DELL P2421DC 23.8インチワイド USB-C 4Kモニタ- 液晶ディスプレイ ノングレア

Dell P2421DC 23.8インチワイド USB-C モニタ- - タブレット

付属品完備】Dell P2421DC 23.8インチワイド モニタ--

Dell P2421DC 23.8インチワイド USB-C モニタ- 日本に www.geyrerhof.com

Dell プロフェッショナルシリーズ P2421DC 23.8インチワイド USB-C

2024年最新】p2421dcの人気アイテム - メルカリ

Dell プロフェッショナルシリーズ P2421DC 23.8インチワイド USB-C

Dell P2421DC 23.8インチワイド USB-C モニタ- - タブレット

付属品完備】Dell P2421DC 23.8インチワイド モニタ--

Dell P2421DC 23.8インチワイド USB-C モニタ- 日本に www.geyrerhof.com

Dell P2421DC [23.8インチ] オークション比較 - 価格.com

美品 DELL P2421DC 23.8インチワイド USB-C 4Kモニタ- 液晶ディスプレイ ノングレア

Dell プロフェッショナルシリーズ P2421DC 23.8インチワイド USB-C

2ページ目 - デル ディスプレイの通販 1,000点以上 | DELLのスマホ

2024年最新】p2421dcの人気アイテム - メルカリ

Dell S2421HSX 23.8インチワイドモニター-

Dell P2421DC 23.8インチワイド USB-C モニタ-+crysperfumaria.com.br

付属品完備】Dell P2421DC 23.8インチワイド モニタ--

Amazon.co.jp: P P2421D [プロフェッショナルシリーズ 23.8インチ

DELL P2421DC 23.8型 WQHD USB-C 付属品完備 - タブレット

2024年最新】p2421dcの人気アイテム - メルカリ

Dell P2421DC 23.8インチQHD, USB-C給電可能ディスプレイ - ディスプレイ

Dell P2421DC [23.8インチ] オークション比較 - 価格.com

付属品完備】Dell P2421DC 23.8インチワイド モニタ--

DELL - Dell P2421DC 23.8インチQHD, USB-C給電可能の通販 by

商品の情報

メルカリ安心への取り組み

お金は事務局に支払われ、評価後に振り込まれます

出品者

スピード発送

この出品者は平均24時間以内に発送しています

![Dell P2421DC [23.8インチ] オークション比較 - 価格.com](https://auc-pctr.c.yimg.jp/i/auctions.c.yimg.jp/images.auctions.yahoo.co.jp/image/dr000/auc0312/users/11e3900bbb8e1da659fcd5e7a5fa8bb134c96994/i-img1200x1200-1672051198hpimzq228124.jpg)

![Dell P2421DC [23.8インチ] オークション比較 - 価格.com](https://img1.kakaku.k-img.com/images/smartphone/icv/l_K0001251202.jpg)

![Dell P2421DC [23.8インチ] オークション比較 - 価格.com](https://auc-pctr.c.yimg.jp/i/auctions.c.yimg.jp/images.auctions.yahoo.co.jp/image/dr000/auc0312/users/1eedc3a312f9f4eae14805832ebb3261abca41f2/i-img640x480-1671116611pkpgg3668913.jpg)