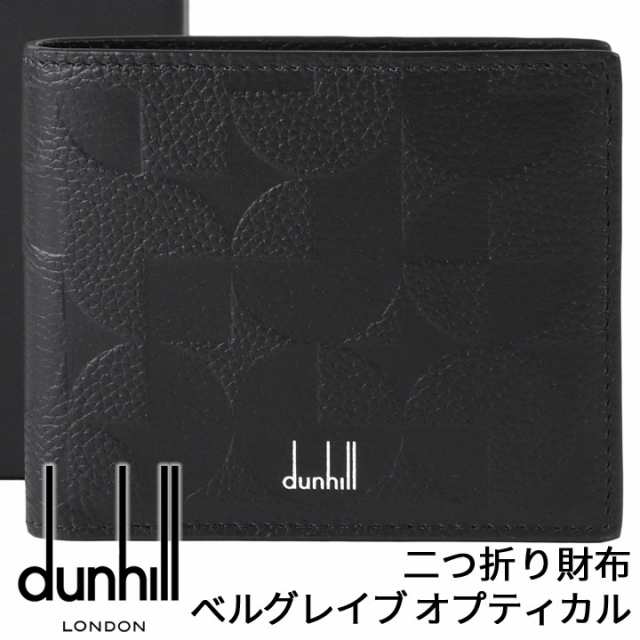

ダンヒル 二つ折り財布 オプティカル ベルグレイヴ カーフレザー ブラック メンズ 牛革 本革 新品 96202

(税込) 送料込み

商品の説明

商品説明

管理番号96202ブランドDUNHILLダンヒル

商品名ベルグレイヴオプティカル4CC&コインパースビルフォールド

ラインBELGRAVEOPTICAL

ベルグレイヴオプティカル

素材カーフレザー

型番DU22R2320ER001

カラー[全体]ブラック

[金具]シルバー

形状二つ折り財布(コインケース有)

性別メンズ

参考定価77,000円

サイズ約:横10.5cm×高さ9cm×マチ2.5cm

重量約80g

機能お札入れ×2

ホックコインケース×1

カードポケット×4

フリーポケット×2

付属品純正箱

写真・説明欄に表記されている付属品以外は付属しておりません。

商品ランクN(新品、未使用品製造から2年以内の商品)

スタッフコメント

上質なレザーに型押しされた、英国風の幾何学模様が印象的なダンヒルの【ベルグレイヴオプティカル】コレクションの二つ折り財布。シンプルにおしゃれなので大人の男性への贈り物やサプライズで彼氏や旦那様・敬老の日におじいちゃんへ日ごろの感謝を込めてのプレゼントにもおすすめなブランド財布です。

27390円ダンヒル 二つ折り財布 オプティカル ベルグレイヴ カーフレザー ブラック メンズ 牛革 本革 新品 96202メンズファッション小物ダンヒル DUNHILL 財布 二つ折り メンズ ベルグレイヴ オプティカル楽天市場】ダンヒル 二つ折り財布 小銭入れあり オプティカル ベル

楽天市場】ダンヒル 二つ折り財布 小銭入れあり オプティカル ベル

楽天市場】ダンヒル 二つ折り財布 小銭入れあり オプティカル ベル

ダンヒル DUNHILL 財布 二つ折り メンズ ベルグレイヴ オプティカル

Dunhill - ダンヒル 二つ折り財布 オプティカル ベルグレイヴ カーフ

楽天市場】ダンヒル 二つ折り財布 小銭入れあり オプティカル ベル

楽天市場】ダンヒル 二つ折り財布 小銭入れあり オプティカル ベル

Dunhill - ダンヒル 二つ折り財布 オプティカル ベルグレイヴ カーフ

Dunhill - ダンヒル 二つ折り財布 オプティカル ベルグレイヴ カーフ

未使用 dunhill レザー二つ折り財布 ベルグレイヴ オプティカル 箱付き

未使用 dunhill レザー二つ折り財布 ベルグレイヴ オプティカル 箱付き

旬新作続々入荷 ダンヒル 二つ折り財布 オプティカル ベルグレイヴ

旬新作続々入荷 ダンヒル 二つ折り財布 オプティカル ベルグレイヴ

ダンヒル 二つ折り財布

Dunhill - ダンヒル 二つ折り財布 オプティカル ベルグレイヴ カーフ

売れ筋】 レザー 三つ折り財布 ダンヒル ブラック 横浜BLANC dunhill

旬新作続々入荷 ダンヒル 二つ折り財布 オプティカル ベルグレイヴ

ダンヒル 二つ折り財布

未使用 dunhill レザー二つ折り財布 ベルグレイヴ オプティカル 箱付き

[ダンヒル] 二つ折り財布 メンズ ベルグレイヴ オプティカル 4CC&コインパース ビルフォールド ブラック 22R2320ER001 [並行輸入品]

Dunhill - 良品!【ダンヒル 二つ折り財布】の通販 by ハッピーライフs

売り尽くしセール開催中】ダンヒル 二つ折り財布 財布 メンズ ベル

未使用 dunhill レザー二つ折り財布 ベルグレイヴ オプティカル 箱付き

ダンヒル 財布 DUNHILL 二つ折り財布 小銭入れあり ベルグレイブ

売れ筋ショッピング リュックサックメンズ パソコンバッグ 盗難防止

メンズ ダンヒル ベルグレイヴ オプティカル コートウォレット

Dunhill - 良品!【ダンヒル 二つ折り財布】の通販 by ハッピーライフs

ダンヒル(dunhill) レザー メンズ二つ折り財布 | 通販・人気ランキング

ダンヒル 二つ折り財布

未使用 dunhill レザー二つ折り財布 ベルグレイヴ オプティカル 箱付き

売れ筋ショッピング リュックサックメンズ パソコンバッグ 盗難防止

ダンヒル 二つ折り財布 メンズ ベルグレイヴ ブラック 19F2300AR001

メンズ ダンヒル ベルグレイヴ オプティカル シティ メッセンジャー

ダンヒル 革 折り財布(メンズ)の通販 65点 | Dunhillのメンズを買う

使い勝手の良い 【ANGELS APPLEBUM】スウェット古着 大谷翔平

売れ筋】 レザー 三つ折り財布 ダンヒル ブラック 横浜BLANC dunhill

楽天市場】Dunhill ダンヒル 二つ折り財布 BELGRAVE OPTICAL ベル

ダンヒル 二つ折り財布

ダンヒル 二つ折り財布 財布 メンズ ベルグレイヴ ブラック

Amazon | [ダンヒル] 二つ折り財布 メンズ ベルグレイヴ オプティカル

商品の情報

メルカリ安心への取り組み

お金は事務局に支払われ、評価後に振り込まれます

出品者

スピード発送

この出品者は平均24時間以内に発送しています

![[ダンヒル] 二つ折り財布 メンズ ベルグレイヴ オプティカル 4CC&コインパース ビルフォールド ブラック 22R2320ER001 [並行輸入品]](https://m.media-amazon.com/images/I/41tSb-pJqKL._AC_UY580_.jpg)

![Amazon | [ダンヒル] 二つ折り財布 メンズ ベルグレイヴ オプティカル](https://m.media-amazon.com/images/I/41q6xsk3LBL._AC_UY580_.jpg)