ナトゥーラ ゴールゼロ ミニマライト 3種類 LEDランタン 4本セット

(税込) 送料込み

商品の説明

商品説明

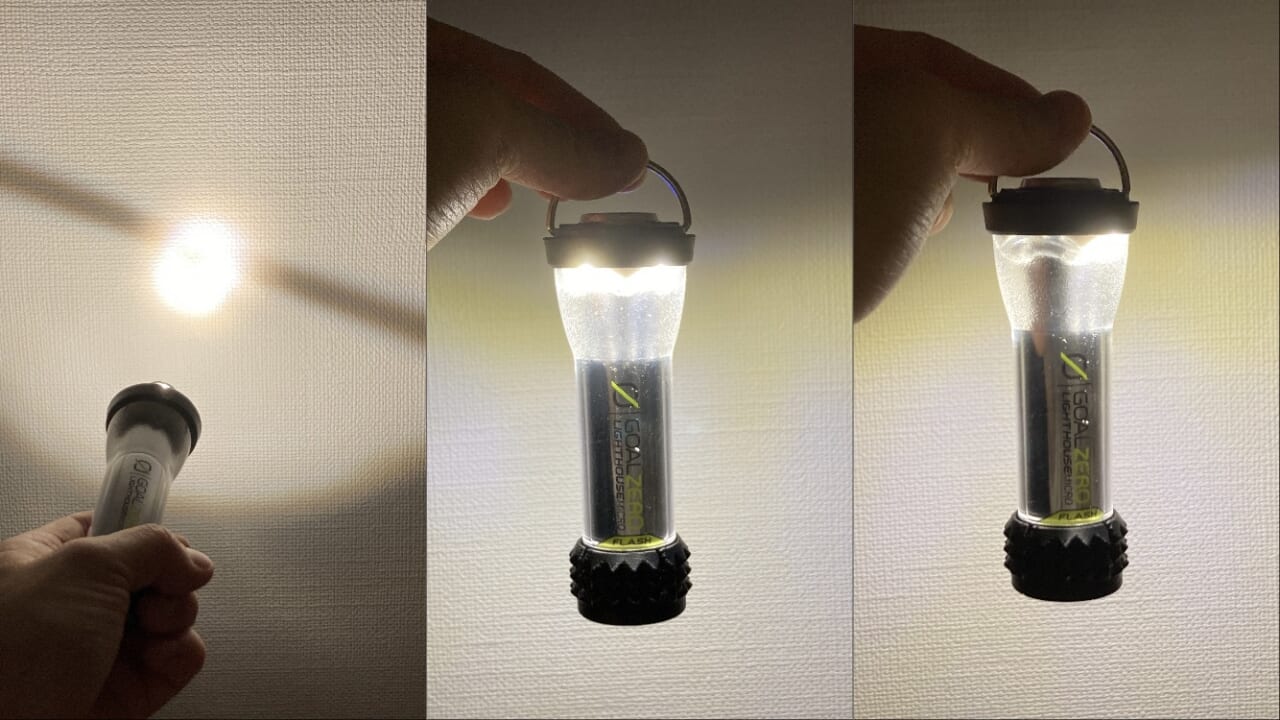

NATURA『LEDSUPERFLASHLIGHT』×1(新品未使用)GoalZeroLIGHTHOUSEmicro×1(新品未使用)

50/50WorkShopMINIMALightミニマライトブラック×2(開封済未使用)

の4本セットです。

ミニマライトは一度開封し、充電しましたが、使用はしておりません。

当面、バラ売りはしません。ご了承ください。

10920円ナトゥーラ ゴールゼロ ミニマライト 3種類 LEDランタン 4本セットスポーツ/アウトドアアウトドア楽天市場】KALUGII カルギイ 変幻4在 ヘンゲンジザイ【真鍮製】 4way喜ばれる誕生日プレゼント ナトゥーラ ゴールゼロ ミニマライト 3種類

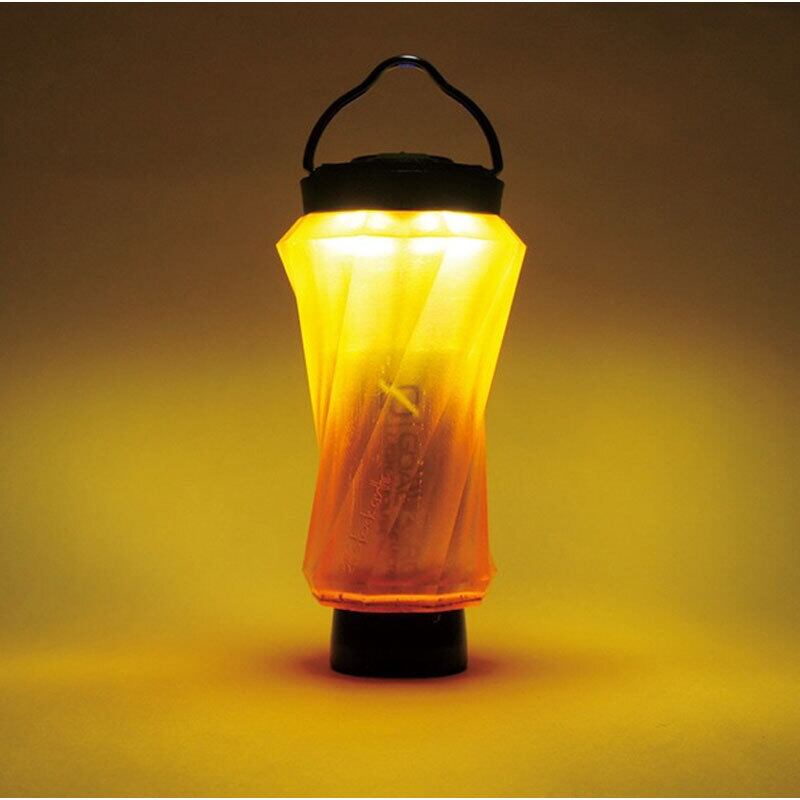

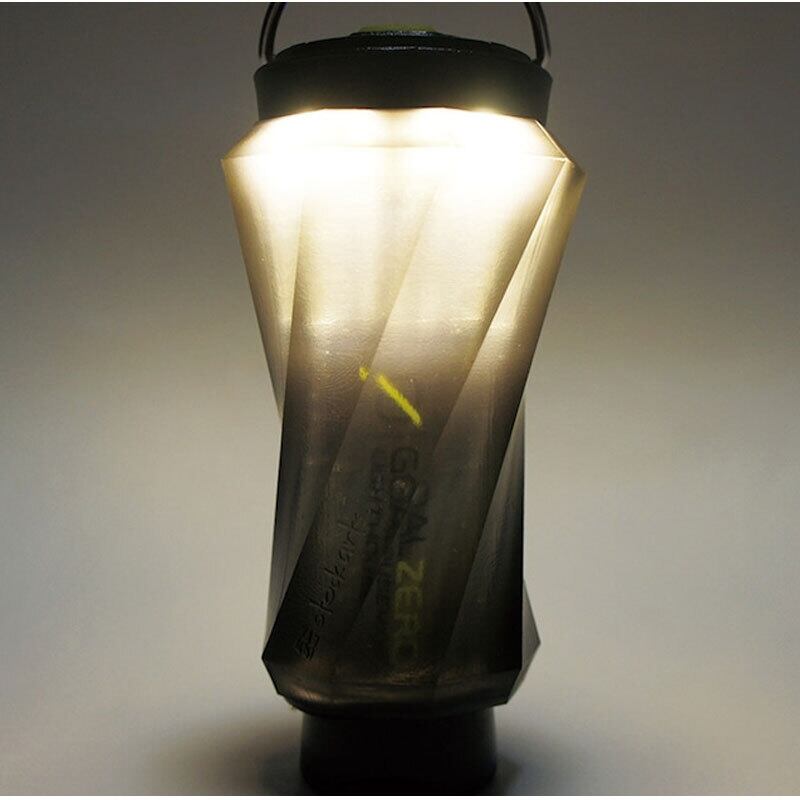

HIROMARE ランタンシェード ゴールゼロ ランタン シェード ミニランタン ランプシェード かさのみ (ブラック)

ブラック小型オイルランタン&マットブラックシェード【色付き

楽天市場】KALUGII カルギイ 変幻4在 ヘンゲンジザイ【真鍮製】 4way

We compared five different types of small LED lanterns.Recommended LED lanterns are also introduced.

【楽天市場】5050WORKSHOP(5050ワークショップ) efim ランタン

次世代型 LEDライト『B.F.F』

楽天市場】KALUGII カルギイ 変幻4在プラス ヘンゲンジザイ【真鍮製

NATURA B.F.F | CAMPLABO

stockarts. ストックアーツ kumibako GOALZERO クミバコ ゴールゼロ

YAMAKATA SHADE (ミニマライトサイズ)和三 | ヤマカタストア

楽天市場】YAMAKATA SHADE(GOAL ZERO専用) ヤマカタシェード

LEDランタン ルーメナー LUMENA マルチプル LEDライト エムスリー

ゴールゼロやミニマライトにも対応】 キャンプサイコーライトシェード

HIROMARE ランタンシェード ミニマライト ゴールゼロ ランタン

stockarts. ストックアーツ go-st distortion for GOALZERO ゴールゼロ

ゴールゼロ マイクロフラッシュ マイクロ - ライト/ランタン

KALUGII カルギイ 変幻4在 ヘンゲンジザイ【真鍮製】 4wayランタン

YAMAKATA SHADE (ナトゥーラサイズ) | ヤマカタストア

ゴールゼロ LEDランタン かわいいランタンシェード アダプタ2種類付属

楽天市場】YAMAKATA SHADE(GOAL ZERO専用) ヤマカタシェード

ゴールゼロ マイクロフラッシュ マイクロ - ライト/ランタン

ナトゥーラ ゴールゼロ ミニマライト 3種類 LEDランタン 4本セット

ゴールゼロ LEDランタン用 ミニ三脚|Yahoo!フリマ(旧PayPayフリマ)

3個】 ポータブル スティックバーナー ターボⅡ ゴールゼロ ミニマ

LEDランタン ルーメナー LUMENA マルチプル LEDライト エムスリー

ランタンシェード goal zero ゴールゼロ ml4 ランプシェード 深茶 - ライト

KALUGII カルギイ 変幻4在プラス ヘンゲンジザイ【真鍮製】 4way

楽天市場】YAMAKATA SHADE(GOAL ZERO専用) ヤマカタシェード

Goal Zeroだけじゃない!おススメミニLEDランタンをご紹介♪ | CAMPLOG

Goal Zero ゴールゼロ ライトハウス マイクロ フラッシュ LEDランタン

ゴールゼロ マイクロフラッシュ マイクロ - ライト/ランタン

Lighthouse Micro Flash

何個あってもいい!コンパクトLEDライトおすすめ4選 | CAMPLOG GEAR

stockarts. ストックアーツ go-st distortion for GOALZERO ゴールゼロ

楽天市場】ADDSPICEFACTORY アドスパイスファクトリー ランタン

ミニマライト専用 ニ点セット ゴールゼロ

逸品 コンパクト&マルチタイプLEDランタン LUMENA 「M3」 | skien

stockarts. ストックアーツ go-st distortion for GOALZERO ゴールゼロ

MIKAN(ミカン)3WAY LEDランタン | RIVER MOUNTAIN (リバーマウン...

商品の情報

メルカリ安心への取り組み

お金は事務局に支払われ、評価後に振り込まれます

出品者

スピード発送

この出品者は平均24時間以内に発送しています