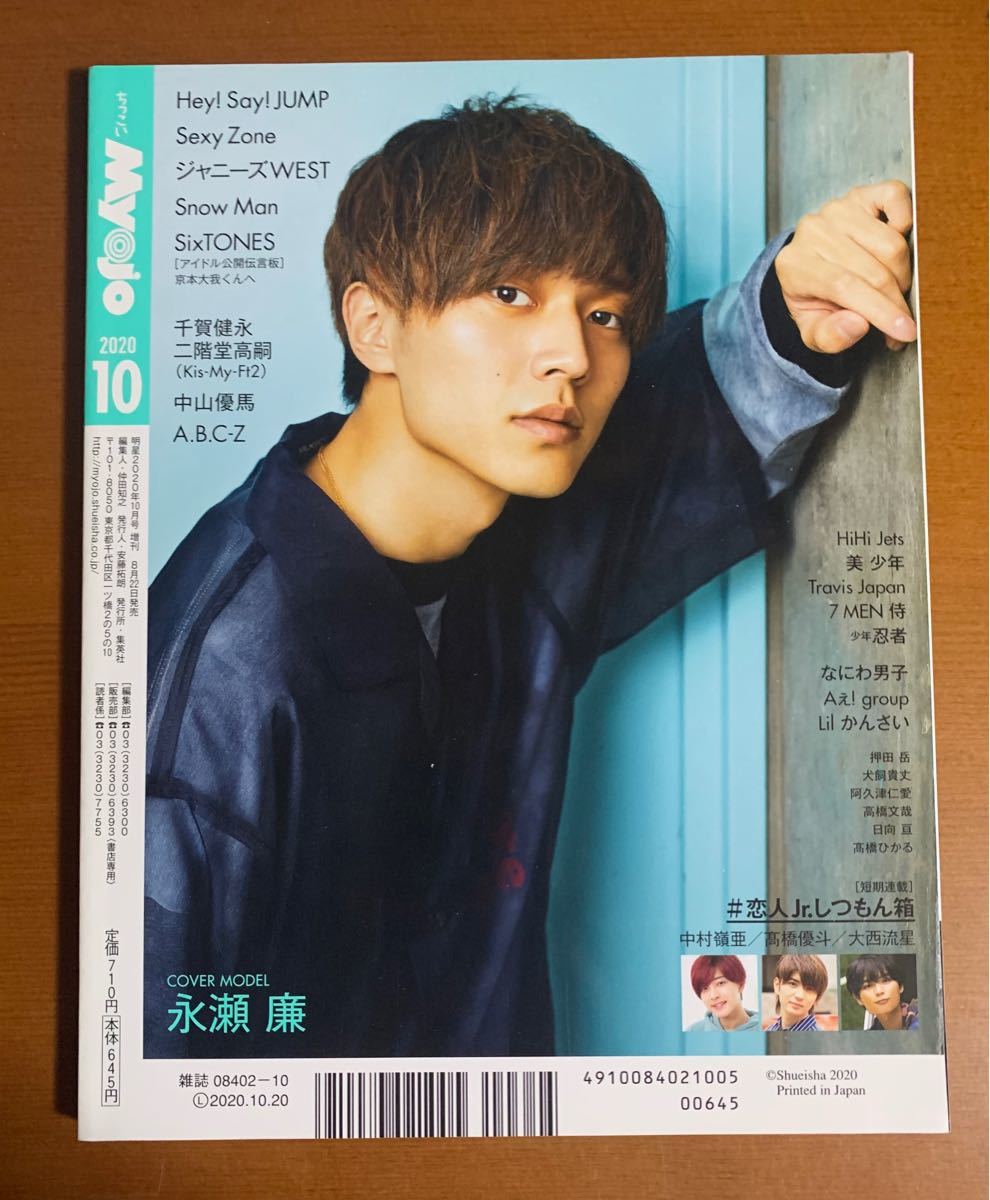

Myojo 2020年 10月号

(税込) 送料込み

商品の説明

商品説明

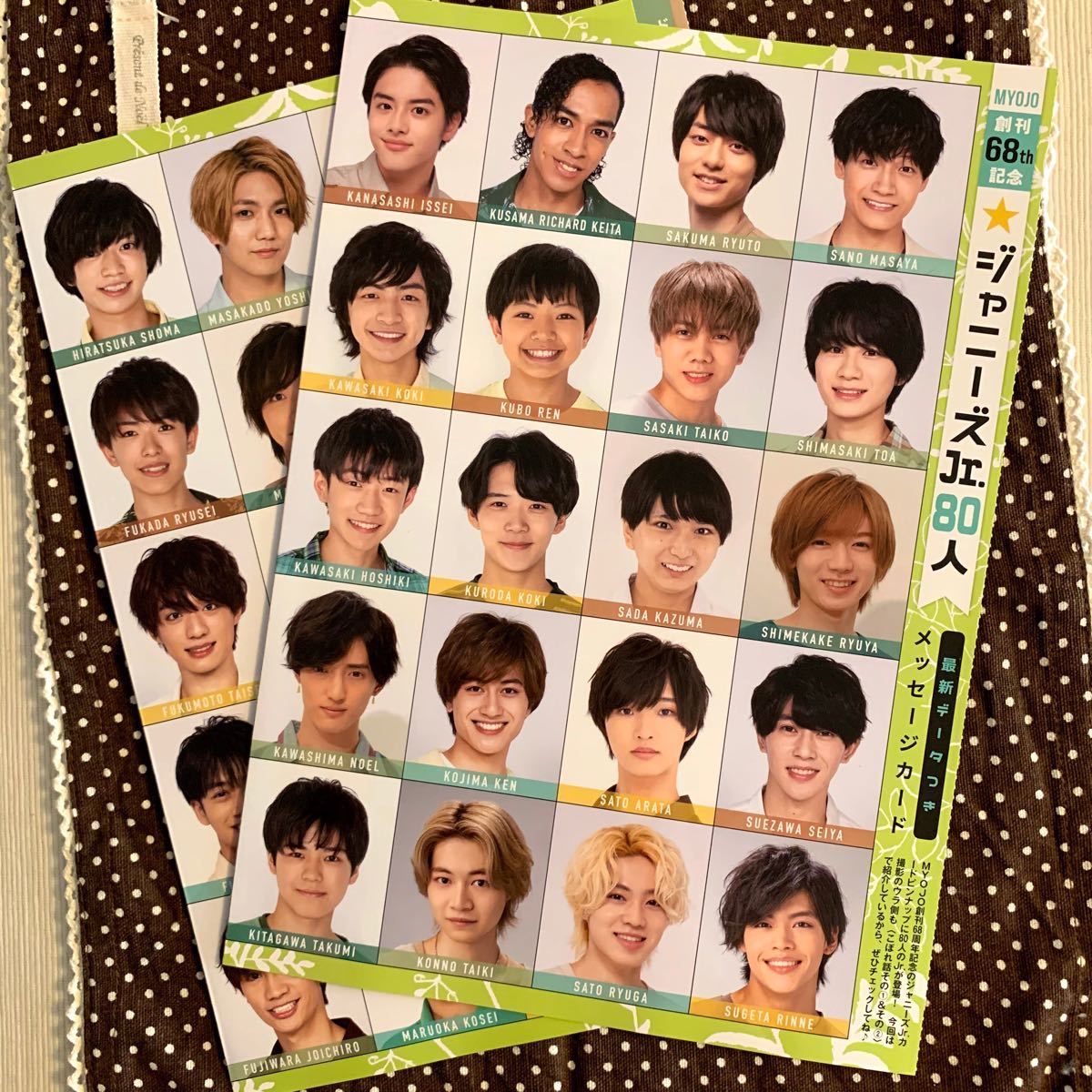

myojoちっこい版2020年10月号の出品です。データカードのページは切り抜いてありますので、完全品お求めの方はご購入をお控えください。

ページ抜けがあるため、傷ありでの出品をしております。

複数冊ご希望の方居ましたらコメント欄よりご連絡ください。

宜しくお願い致します。

18000円Myojo 2020年 10月号エンタメ/ホビー雑誌Myojo 2020年10月号 - アートAmazon.com: Myojo (ミョージョー) 2020年10月号[雑誌] (Myojo

Amazon.com: ちっこいMyojo 2020年10 月号[雑誌] (Myojo(ミョージョー

Myojo 2020年10月号 - アート

Myojo 2020年10月号 - アート

Myojo (ミョウジョウ)2020年 10月号 【表紙:King & Prince】 : Myojo

Myojo 2020年9月号

Myojo 2020年10月号 King&Prince - アート

公式サイト MYOJO 2020年 10月号 - 雑誌

Johnny's - Myojo 2020年10月号の通販 by sss_e67 shop|ジャニーズ

代引き人気 MYOJO 2020年 10月号 | thetaiwantimes.com

魅了 MYOJO 2020年 10月号 | www.pro13.pnp.gov.ph

Myojo 2020年10月号 デタカ付き - アート

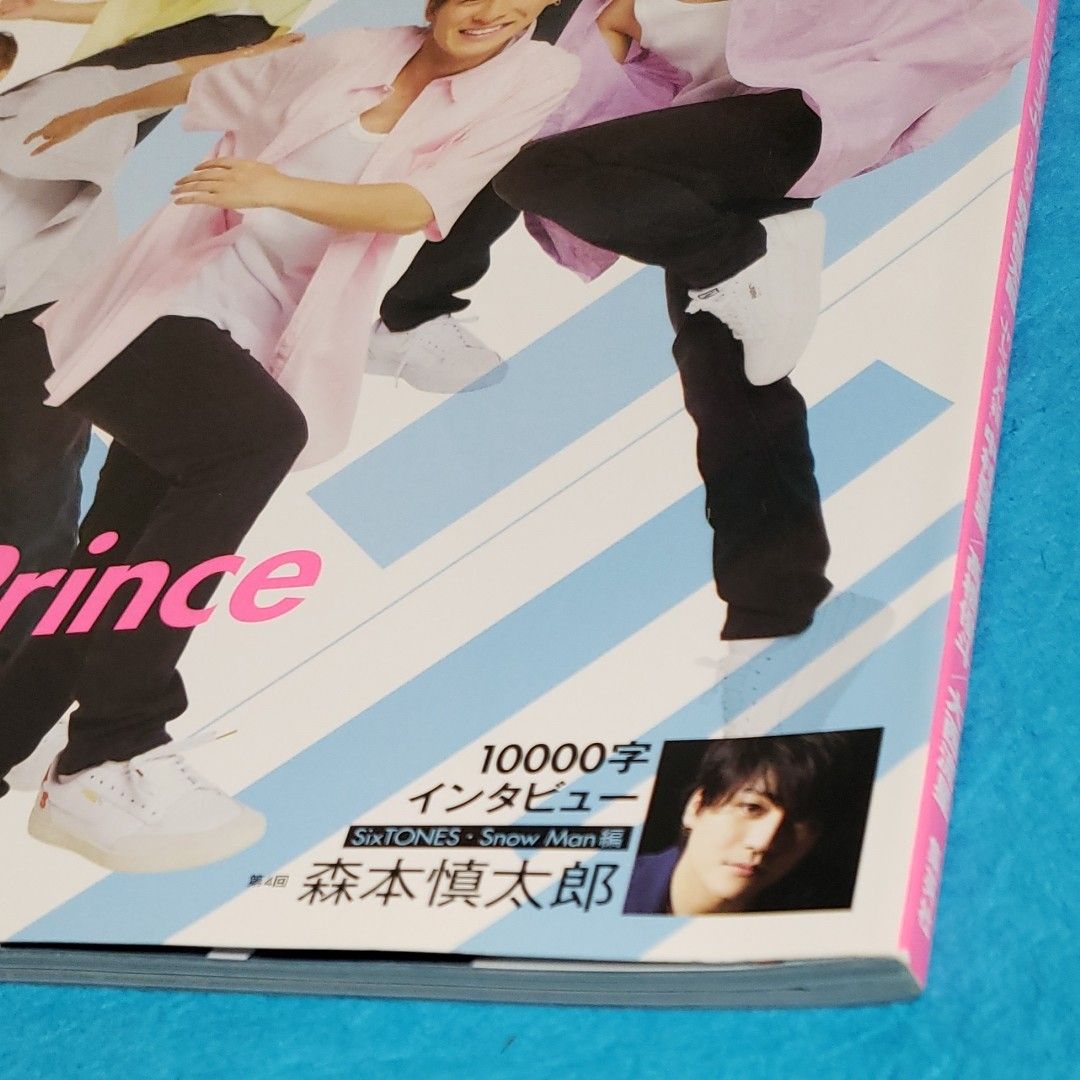

Myojo 2020年10月号森本慎太郎10000字インタビュー|mercariメルカリ

Myojo 2020年10月号 - アート

Myojo 2020年9月号

日曜日楽園: Myojo 2020年10月号

公式サイト MYOJO 2020年 10月号 - 雑誌

Myojo 2020年10月号 ジャニーズJr.メッセージカード付 - アート

Myojo(ミョージョー)2019年10月号 |本 | 通販 | Amazon

SnowMan 切り抜き MYOJO ポポロ

Myojo 2020年10月号 キンプリ表紙 - アート

MyoJo(ミョージョー)2020年10月号

Myojo 2020年10月号 - その他

Myojo 2020年10月号 キンプリ表紙 - アート

Myojo 2020年11月号 - アート

Myojo 2020年10月号 デタカ付き - アート

博客來-Myojo 10月號/2023

Myojo 2020年10月号 - アート

公式サイト MYOJO 2020年 10月号 - 雑誌

限定価格中 Myojo 2020年10月号 | lasgranadasoaxaca.com

Myojo (ミョージョー) 2020年7月号 [雑誌] (Myojo(ミョージョー))

ジャニーズJr. - Myojo 2020年 10月号の通販 by m's |ジャニーズ

ちっこいMyojo Myojo (ミョウジョウ)2020年 10月号増刊 【表紙:King

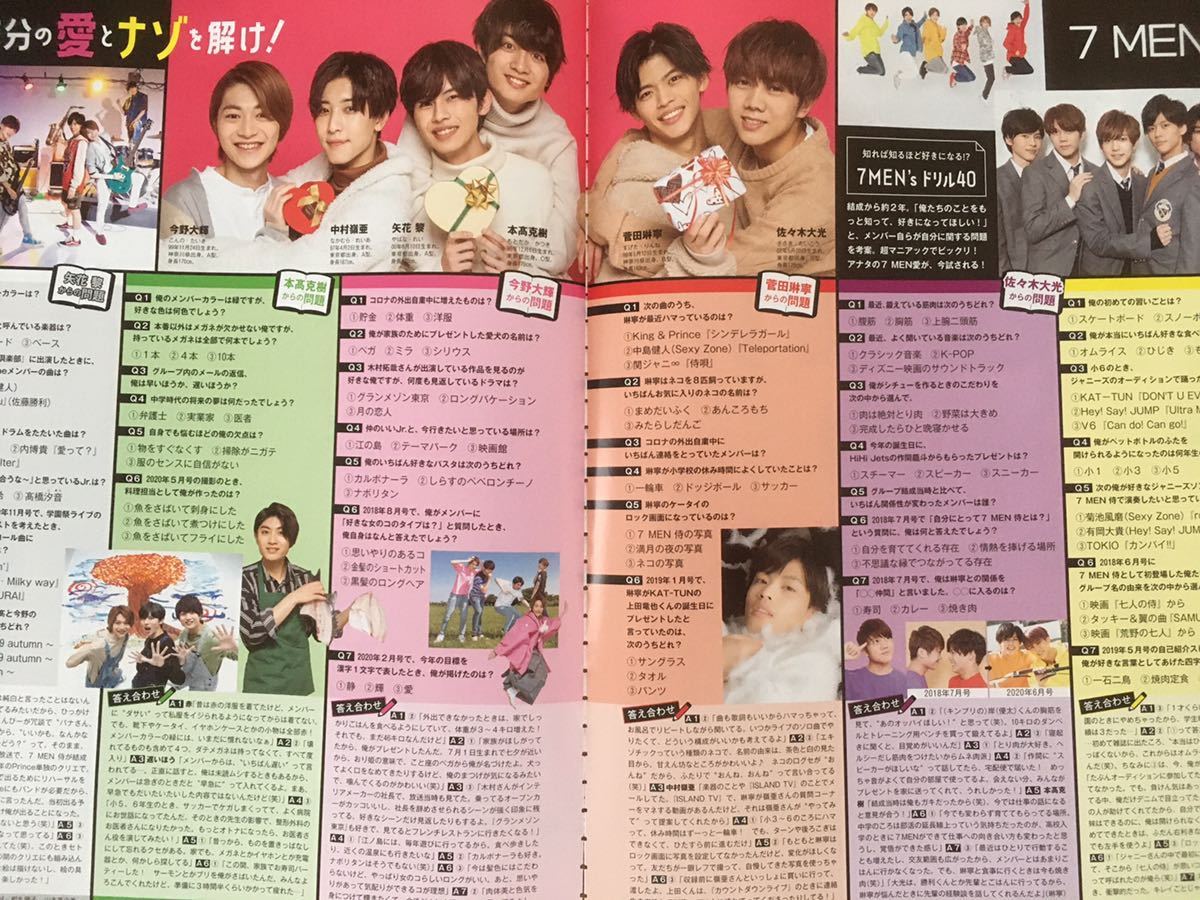

7MEN侍/Travis Japan☆切り抜きMyojo 2020/8月号6P-日本代購代Bid第一

MyoJo(ミョージョー)2020年10月号

MyoJo(ミョージョー) 2020年 03 月号 [雑誌] |本 | 通販 | Amazon

Myojo増刊 ちっこいMyojo 2020年10月号 King & Prince

Myojo 2020年10月号 ジャニーズWEST - アート

明星(Myojo) 2020年5月号 (発売日2020年03月21日) | 雑誌/定期購読の

Myojo 2020年10月号 - メルカリ

商品の情報

メルカリ安心への取り組み

お金は事務局に支払われ、評価後に振り込まれます

出品者

スピード発送

この出品者は平均24時間以内に発送しています

![Amazon.com: Myojo (ミョージョー) 2020年10月号[雑誌] (Myojo](https://m.media-amazon.com/images/I/61x 6dIG0L._AC_UF1000,1000_QL80_.jpg)

![Amazon.com: ちっこいMyojo 2020年10 月号[雑誌] (Myojo(ミョージョー](https://m.media-amazon.com/images/I/51XIg6mRLhL._AC_UF1000,1000_QL80_.jpg)

![Myojo (ミョージョー) 2020年7月号 [雑誌] (Myojo(ミョージョー))](https://m.media-amazon.com/images/I/71LlcCnckzL._AC_UF1000,1000_QL80_.jpg)

![MyoJo(ミョージョー) 2020年 03 月号 [雑誌] |本 | 通販 | Amazon](https://m.media-amazon.com/images/I/71bm NPOt8L._AC_UF1000,1000_QL80_.jpg)