両世界評論 2006年6月号

(税込) 送料込み

商品の説明

商品説明

フランスの文芸誌です。LaRevuedesDeuxMondes

現地で買いましたが内容はよくわかりません。

18000円両世界評論 2006年6月号エンタメ/ホビー雑誌両世界評論 2006年6月号の通販 by うなぎ屋|ラクマ両世界評論 2006年6月号 割引 carltonarms.com-日本全国へ全品配達料金

両世界評論 2006年6月号の通販 by うなぎ屋|ラクマ

両世界評論 2006年6月号 ウクライナ緊迫で - www.woodpreneurlife.com

両世界評論 2006年6月号の通販 by うなぎ屋|ラクマ

両世界評論 2006年6月号の通販 by うなぎ屋|ラクマ

両世界評論 2006年6月号の通販 by うなぎ屋|ラクマ

両世界評論 2006年6月号の通販 by うなぎ屋|ラクマ

両世界評論 2006年6月号の通販 by うなぎ屋|ラクマ

両世界評論 2006年6月号エンタメ/ホビー - northwoodsbookkeeping.com

両世界評論 2006年6月号 ウクライナ緊迫で - www.woodpreneurlife.com

両世界評論 2006年6月号 ウクライナ緊迫で - www.woodpreneurlife.com

両世界評論 2006年6月号の+solo-truck.eu

両世界評論 2006年6月号の+solo-truck.eu

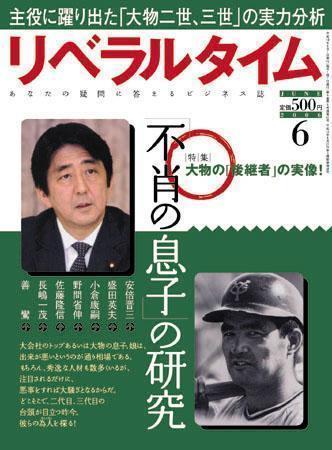

月刊リベラルタイム 6月号

両世界評論 2006年6月号の+solo-truck.eu

両世界評論 2006年6月号の+solo-truck.eu

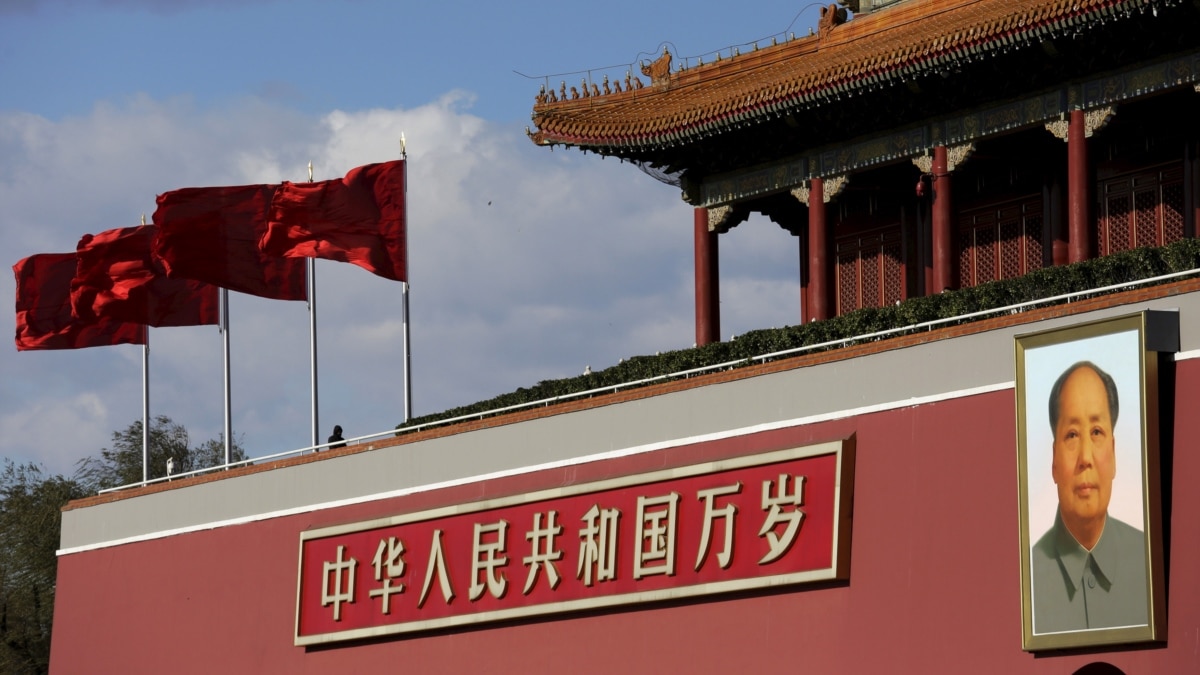

由“六四”造就的今日中国- 纽约时报中文网

台北等多地举行活动纪念“六四”死难者以及“曾经的香港” - 纽约时报中文网

胡锦涛- 维基百科,自由的百科全书

第一次世界大战- 维基百科,自由的百科全书

看中共五代“太子党”如何敛财?

朝鲜战争- 维基百科,自由的百科全书

百年真相】江泽民亲信黄菊涉上海六大案| 上海帮| 闷声发大财| 大纪元

中国文化大革命大事记和图片集

第二次世界大战- 维基百科,自由的百科全书

余英时逝于普林斯顿享年91岁:立场坚定的华人史学泰斗- BBC News 中文

中国不许谈六四世界就会忘记吗? — 普通话主页

伊丽莎白女王登基70年:照片中的历史时刻- 纽约时报中文网

习近平为什么看中了丁薛祥?

任贤齐- 维基百科,自由的百科全书

2023年6月30日外交部发言人毛宁主持例行记者会_中华人民共和国驻美利坚

解密时刻:中国禁书(完整版)

邓小平- 维基百科,自由的百科全书

科比·布莱恩特- 维基百科,自由的百科全书

世界日报| 北京悠世分贝文化传媒有限公司

廖天琪:纪念「六四」也具有现实意义- 公民论坛

中华人民共和国70年历史大事记

両世界評論 2006年6月号 - 文芸

译者: 彭博社:习近平家族财富过亿,权贵精英身家几何

2023年6月30日外交部发言人毛宁主持例行记者会_中华人民共和国驻美利坚

商品の情報

メルカリ安心への取り組み

お金は事務局に支払われ、評価後に振り込まれます

出品者

スピード発送

この出品者は平均24時間以内に発送しています

.jpeg)

.jpg/250px-Deng_Xiaoping_at_the_arrival_ceremony_for_the_Vice_Premier_of_China_(cropped).jpg)