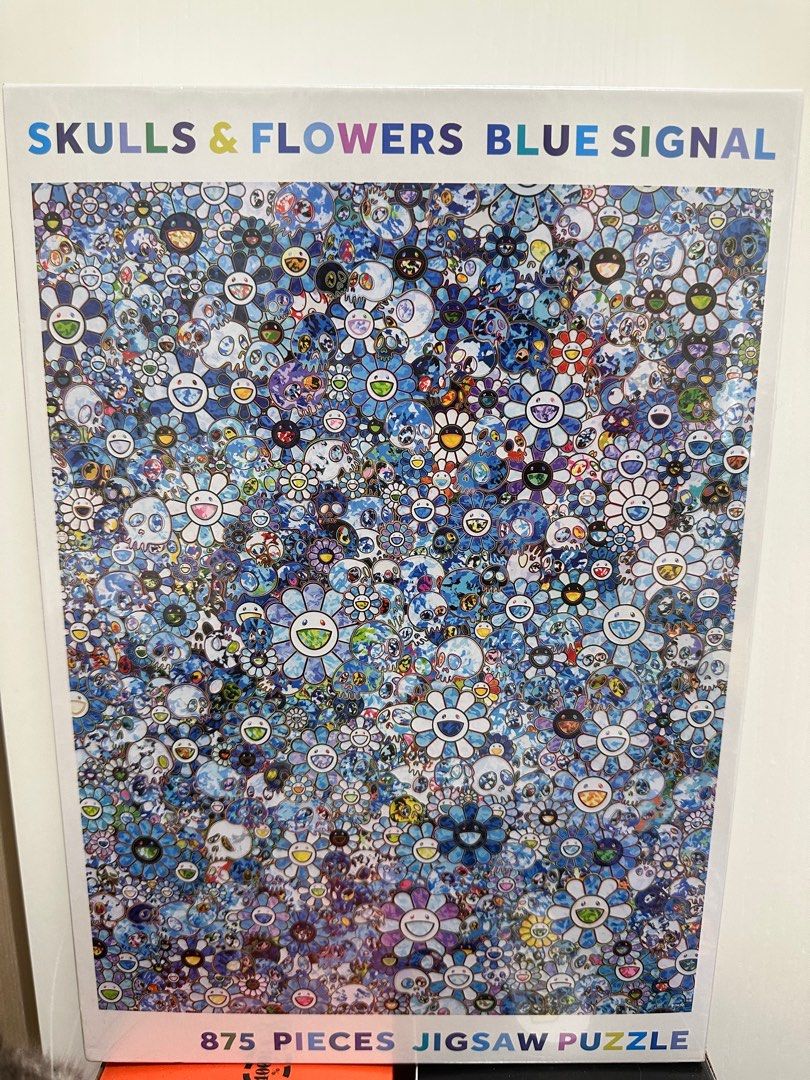

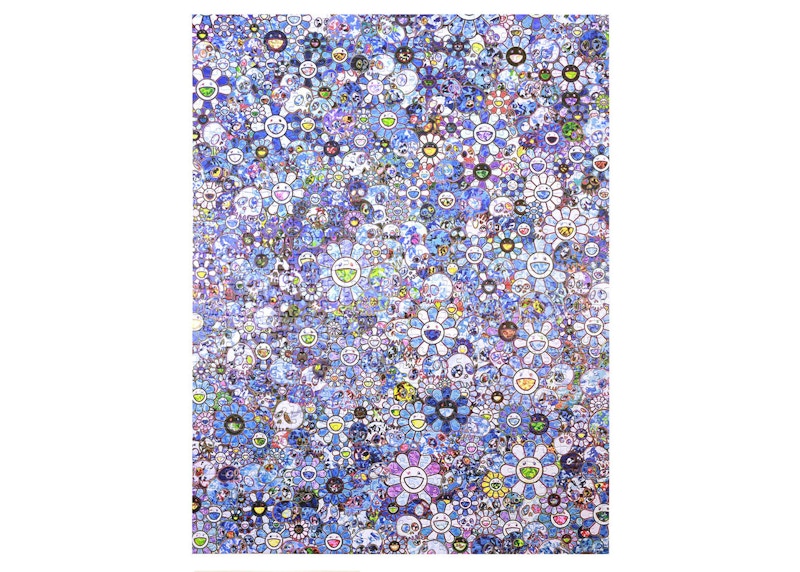

Kaikai u0026 Kiki u0026 FLOWERS カイカイキキ パズル 4個セット

(税込) 送料込み

商品の説明

商品説明

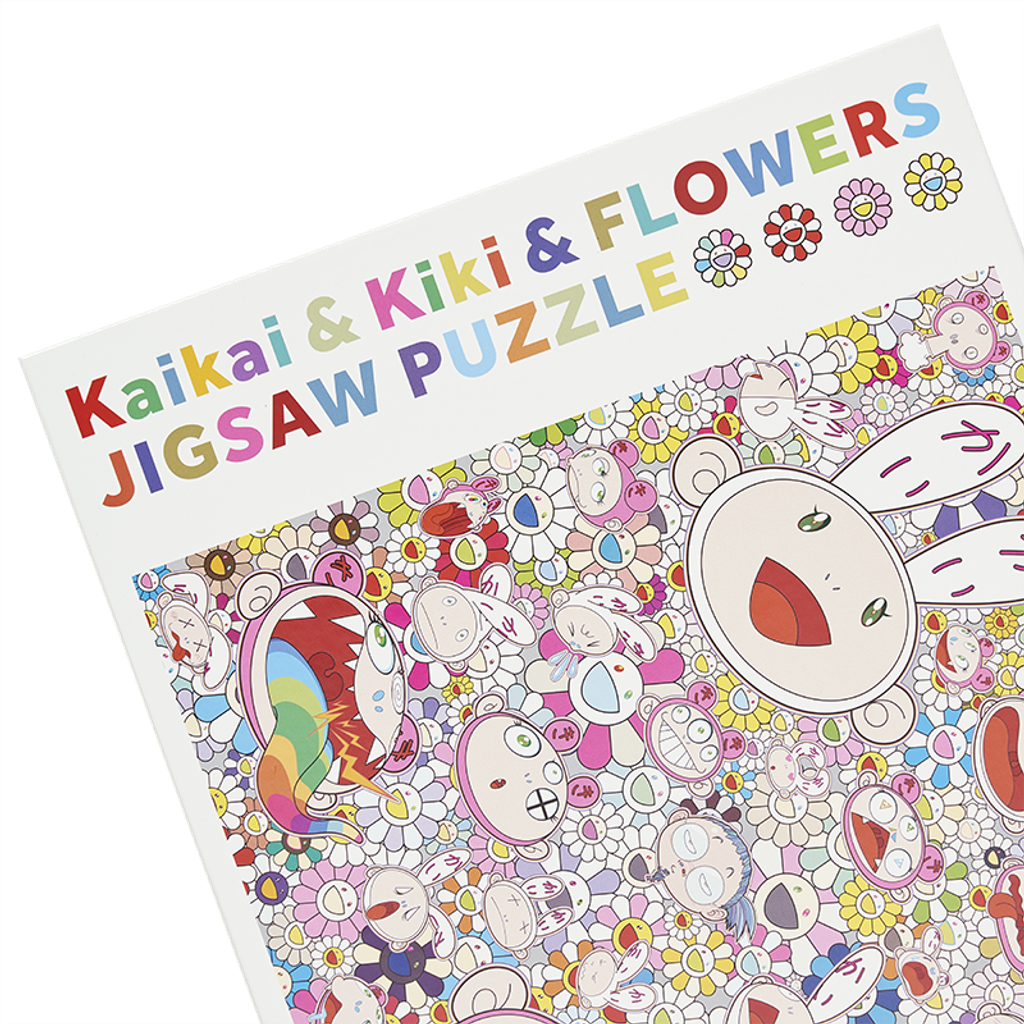

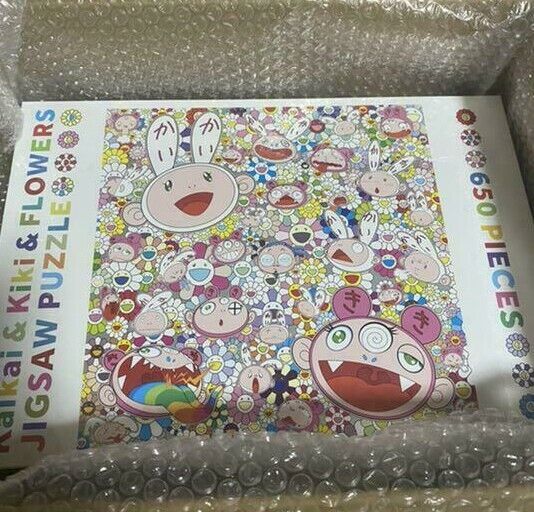

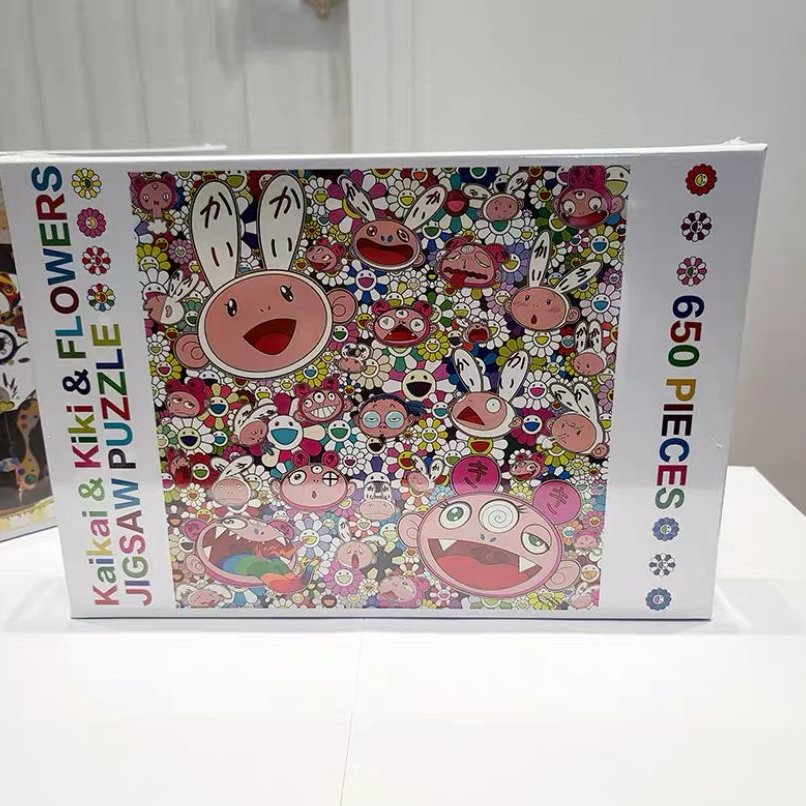

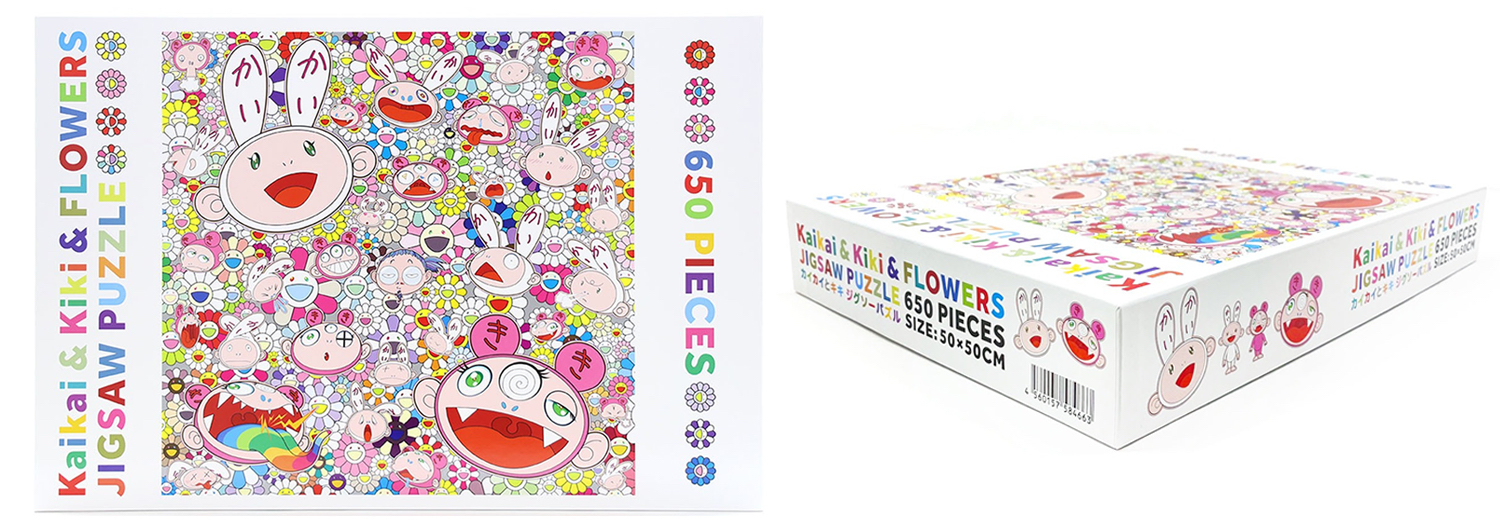

Kaikai&Kiki&FLOWERSカイカイキキパズル

W500×H500mm

650Peaces

4個セット

ZINGAROオンライン購入

国内正規品

22200円Kaikai u0026 Kiki u0026 FLOWERS カイカイキキ パズル 4個セットエンタメ/ホビー美術品/アンティーク村上隆村上隆 Zingaro Kaikai & Kiki & FLOWERS パズル - wwwアウトレットストア 4個セット Kaikai u0026 Kiki u0026 FLOWERS

ジグソーパズル村上隆 Zingaro Kaikai & Kiki & FLOWERS パズル - その他

で迅速にお届け 村上隆「Kaikai u0026 Kiki u0026 FLOWERS

村上隆村上隆 Zingaro Kaikai & Kiki & FLOWERS パズル - www

村上隆 パズル 4個セット Kaikai & Kiki & FLOWERSその他 - www

製品 村上隆 Zingaro Kaikai u0026 Kiki u0026 FLOWERS パズル | www

中古美品】 カイカイとキキジグソーパズル | artfive.co.jp

ジグソーパズル村上隆 Zingaro Kaikai & Kiki & FLOWERS パズル - その他

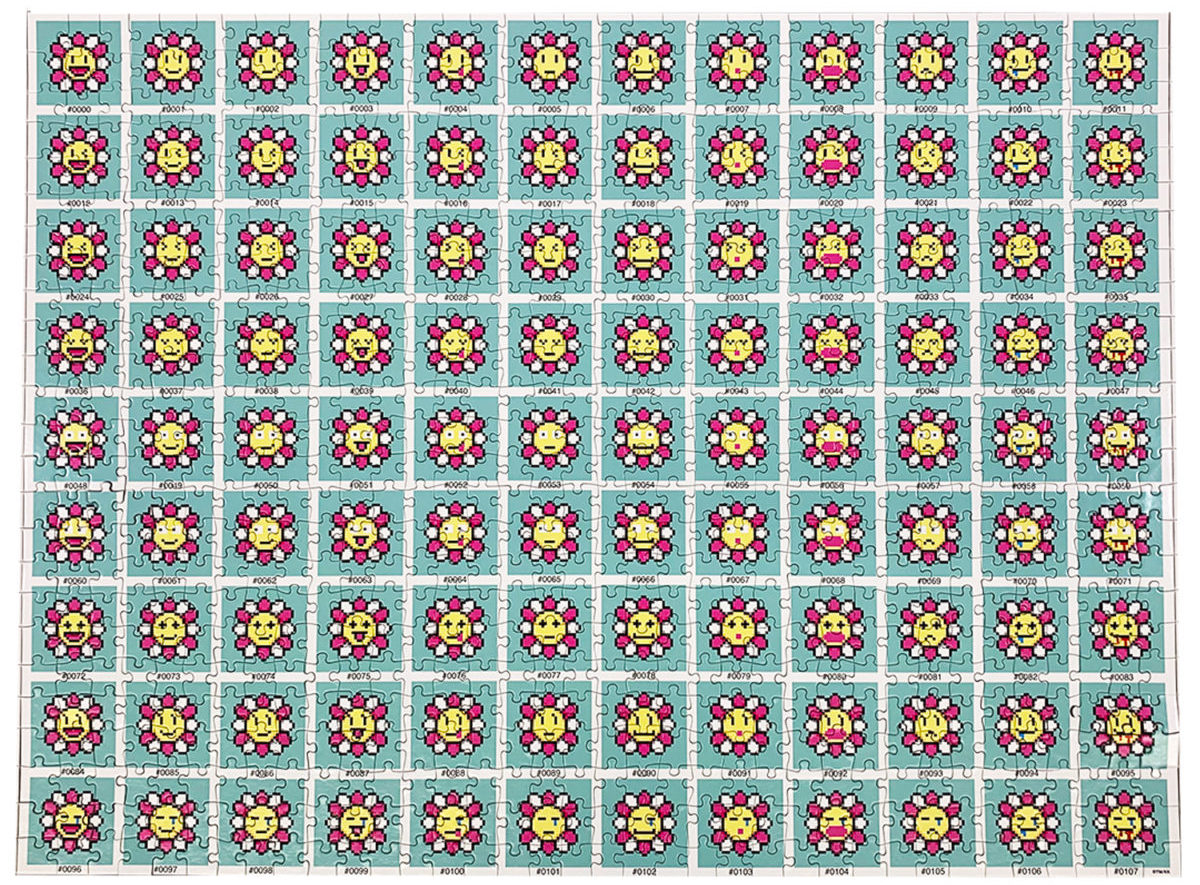

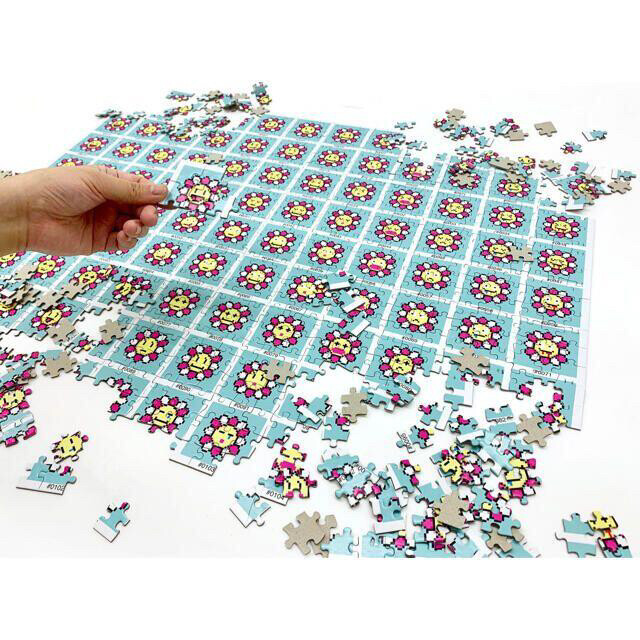

Takashi Murakami Jigsaw Puzzle 108 Bonno #0000 Murakami.Flowers

kaikaikikiカイカイキキ パズル 桜とカイカイとキキ ジグソーパズル

Kaikai u0026 Kiki u0026 FLOWERS パズル 3個-

美術品/アンティークJigsaw Puzzle Cherry Blossom Kaikai Kiki - その他

村上隆 パズル Kaikai & Kiki & FLOWERS 4箱の+inforsante.fr

ジグソーパズル村上隆 Kaikai & Kiki & FLOWERS パズル 2個 - www

TAKASHI MURAKAMI Kaikai Kiki Flowers Jigsaw Puzzle 650 Pieces New

アウトレットストア 4個セット Kaikai u0026 Kiki u0026 FLOWERS

12月24日(木)20時よりWEBショップにて新作パズル「桜とカイカイとキキ

美術品/アンティークJigsaw Puzzle Cherry Blossom Kaikai Kiki - その他

純正買付 Kaikai & Kiki & FLOWERS 村上隆 お花 パズル | www.artfive

2024年最新】村上隆 パズル カイカイキキの人気アイテム - メルカリ

村上隆 Kaikai & Kiki & FLOWERS パズル-

日本新作 Kaikai u0026 Kiki u0026 FLOWERS パズル 村上隆

ネット店舗 【新品】Kaikai u0026 Kiki u0026 FLOWERS パズル 4個

TAKASHI MURAKAMI Kaikai Kiki Flowers Jigsaw Puzzle 650 Pieces New

Kaikai Kiki(カイカイキキ) MOMAストア限定 村上隆 お花 ぬいぐるみ

アウトレットストア 4個セット Kaikai u0026 Kiki u0026 FLOWERS

村上隆村上隆 Zingaro Kaikai & Kiki & FLOWERS パズル - www

で迅速にお届け 村上隆「Kaikai u0026 Kiki u0026 FLOWERS

純正公式 Kaikai u0026 Kiki u0026 FLOWERS パズル 村上隆

○新品未使用○ Kaikai & Kiki & FLOWERS パズルその他 - www.comicsxf.com

Takashi Murakami Jigsaw Puzzle / Murakami.Flowers 900 Pieces

村上隆 Kaikai & Kiki & FLOWERS パズル-

村上隆 パズル Cherry Blossom with Kaikai Kiki - www.sorbillomenu.com

品質割引 新品未開封 Kaikai u0026 Kiki u0026 FLOWERS」村上隆 お花

新品未開封 Kaikai Kiki FLOWERS」村上隆 お花 パズル

Kaikai u0026 Kiki u0026 FLOWERS パズル 3個-

Takashi Murakami Jigsaw Puzzle 108 Bonno Murakami.Flowers

超話題新作 未開封】「Kaikai 通販 カイカイキキ 村上隆 カイカイキキ

Kaikai & Kiki & FLOWERS 4個セットその他 - mirabellor.com

村上隆 Jigsaw Puzzle ジグソーパズル カイカイとキキ 650pcsその他

商品の情報

メルカリ安心への取り組み

お金は事務局に支払われ、評価後に振り込まれます

出品者

スピード発送

この出品者は平均24時間以内に発送しています