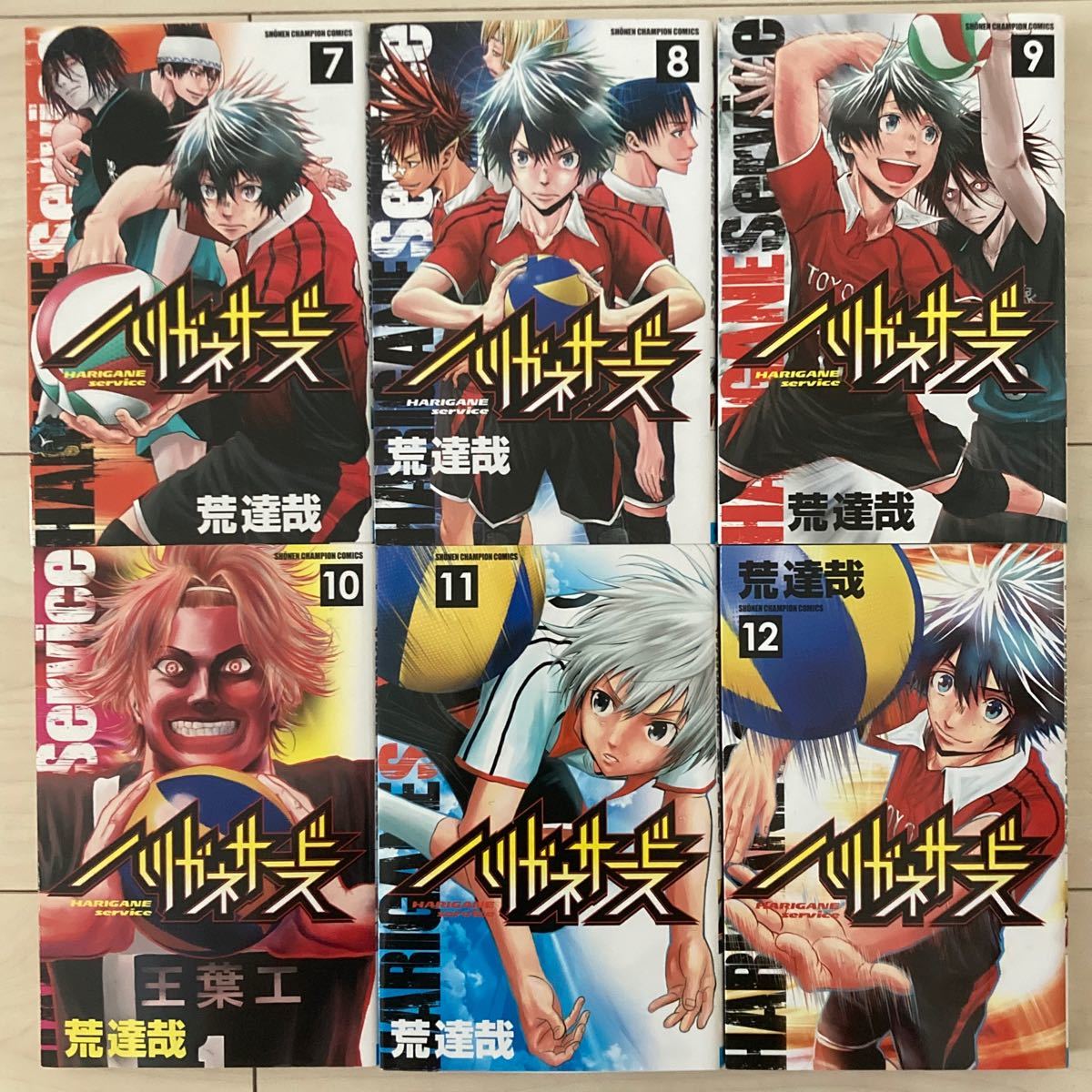

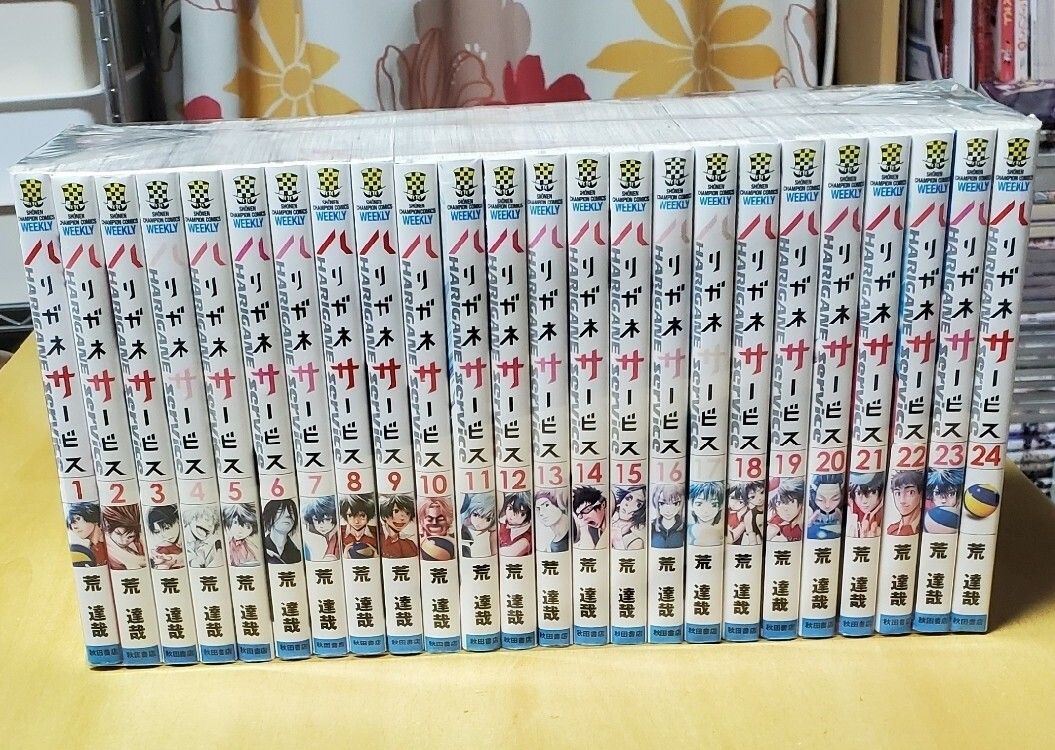

新品未読品 ハリガネサービス 全24巻 荒達哉 秋田書店

(税込) 送料込み

商品の説明

商品説明

ハリガネサービス全24巻セット全巻新品未読品です。

6955円新品未読品 ハリガネサービス 全24巻 荒達哉 秋田書店エンタメ/ホビー漫画セール銀座 新品未読品 ハリガネサービス 全24巻 荒達哉 秋田書店 - 漫画新品未読品 ハリガネサービス 全24巻 荒達哉 秋田書店の通販 by らくま

新品未読品 ハリガネサービス 全24巻 荒達哉 秋田書店の通販 by らくま

新品未読品 ハリガネサービス 全24巻 荒達哉 秋田書店の通販 by らくま

セール銀座 新品未読品 ハリガネサービス 全24巻 荒達哉 秋田書店 - 漫画

新品未読品 ハリガネサービス 全24巻 荒達哉 秋田書店の通販 by らくま

新品未読品 ハリガネサービス 全24巻 荒達哉 秋田書店の通販 by らくま

ハリガネサービス』荒達哉先生描き下ろし収納BOX付きセット予約受付中

2022春夏 新品未読品 ハリガネサービス 全24巻 荒達哉 秋田書店 - 漫画

2022春夏 新品未読品 ハリガネサービス 全24巻 荒達哉 秋田書店 - 漫画

新品未読品 ハリガネサービス 全24巻 荒達哉 秋田書店の通販 by ら

ハリガネサ-ビス (1) (少年チャンピオン・コミックス)

荒達哉「ハリガネサービス」新章「ACE」が週チャンで開幕、舞台は全国

Amazon.co.jp: 荒達哉: books, biography, latest update

2022春夏 新品未読品 ハリガネサービス 全24巻 荒達哉 秋田書店 - 漫画

セール銀座 新品未読品 ハリガネサービス 全24巻 荒達哉 秋田書店 - 漫画

ハリガネサービスACE 第24巻 | 秋田書店

2022春夏 新品未読品 ハリガネサービス 全24巻 荒達哉 秋田書店 - 漫画

新品未読品 ハリガネサービス 全24巻 荒達哉 秋田書店の通販 by らくま

ハリガネサービス 24(最新刊) - 荒達哉 - 漫画・ラノベ(小説

ハリガネサービス 1-24 全巻 セット - 全巻セット

セール銀座 新品未読品 ハリガネサービス 全24巻 荒達哉 秋田書店 - 漫画

ハリガネサービス 1-24 全巻 セット - 全巻セット

ハリガネサービスACE|秋田書店

ハリガネサービス | 荒達哉 | レンタルで読めます!Renta!

ハリガネサービス コミック 全24巻セット |本 | 通販 | Amazon

漫画コミック【ハリガネサービス1-24巻・ACE1-19巻 全巻セット】荒達哉

2024年最新】ハリガネサービス 20 の人気アイテム - メルカリ

ハリガネサービス 1-24 全巻 セット - 全巻セット

ハリガネサービスACE 24 秋田書店|AKITA PUBLISHING 通販

ハリガネサービス 1-24 全巻 セット - 全巻セット

Amazon.co.jp: 荒達哉: books, biography, latest update

セール銀座 新品未読品 ハリガネサービス 全24巻 荒達哉 秋田書店 - 漫画

ハリガネサービスACE|秋田書店

楽天ブックス: ハリガネサービス(24) - 荒達哉 - 9784253224642 : 本

ハリガネサービスACE 24(最新刊) - 荒達哉 - 漫画・ラノベ(小説

ハリガネサービスACE 7巻 (SHONEN CHAMPION

ハリガネサービス 24(最新刊) - 荒達哉 - 漫画・ラノベ(小説

ハリガネサービス」荒達哉が池袋で講演会、新刊は本日発売 - コミック

ハリガネサービス 全巻|Yahoo!フリマ(旧PayPayフリマ)

漫画新品未読品 ハリガネサービス 全24巻 荒達哉 秋田書店 - 全巻セット

商品の情報

メルカリ安心への取り組み

お金は事務局に支払われ、評価後に振り込まれます

出品者

スピード発送

この出品者は平均24時間以内に発送しています