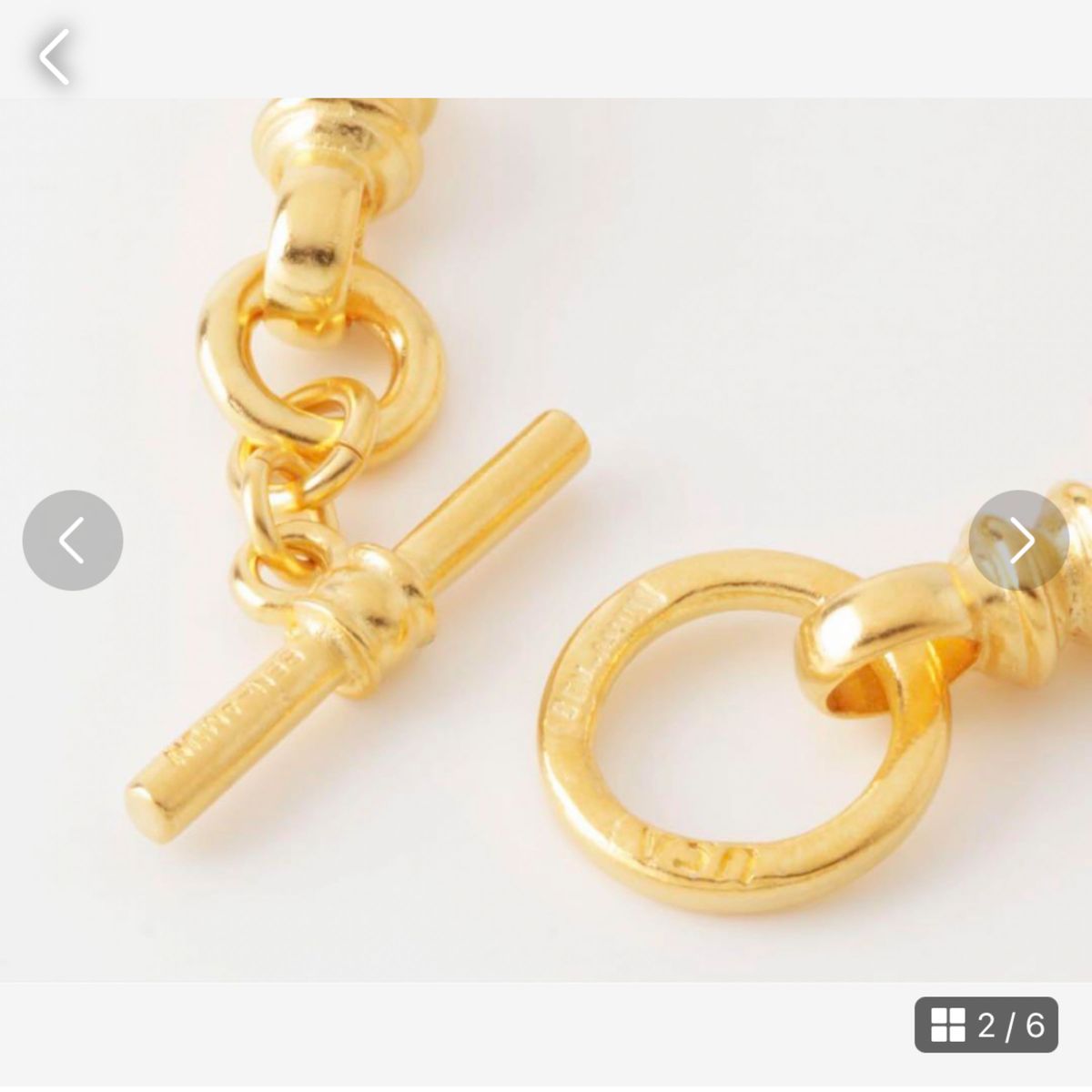

新品タグ付ben amun 定価24200円 PostchainBracelet

(税込) 送料込み

商品の説明

商品説明

benamunPostchainBracelet

新品タグ付き

ブランド保存袋

定価24200円

ゴールド

全長19センチ

幅1.1

benamun(ベンアムン)

エジプト生まれのデザイナーsaacManevits氏によるニューヨーク生まれのアクセサリーブランド。「wearableart」として特徴づけられた、大胆で面白い商品は全てニューヨークにある彼のスタジオでデザインし、ハンドメイドで生産しています。

ほかデザインも多数出品です(*^^*)

#0602ヴィンテージアクセ

⚠️フォロワー様限定⚠️

現在週末カテゴリ別全品10〜30%OFF行っております。

半額ゲリラSALEも開催中!

◎ご購入前にコメント

フォロワー様300円引き

2点購入〜500円引き〜点数に応じてお値引きさせて頂きます(2800円以上併用不可)

#Americana

#CANALJEAN

#BEAUTY&YOUTH

#UNITEDARROWS

#nanouniverse

#SLOBEIENA

#Spickandspan

#URBANRESEARCH

#beams

#SHIPS

#TODAYFUL

#ronherman

#APSTUDIO

#IENA

#plage

#JOURNALSTANDARD

#ELIN

#BEAMS

#DeuxiemeClasse

#L'AppartementDEUXIEMECLASSE

#AmeriVINTAGE

#searoomlynn

#LAPUIS

#ten.

#SYKIA

#soierie

#pluie

#NothingAndOthers

#PHILIPPEAUDIBERT

#annikainez

#BENAMUN

#HARPO

#シルバー925

#14kgf

#ヴィンテージアクセサリー

12349円新品タグ付ben amun 定価24200円 PostchainBraceletレディースアクセサリー新品タグ付 ben amun 定価24200円 PostchainBracelet ブレスレットBen-Amun - 新品タグ付ben amun 定価24200円 PostchainBraceletの通販

Ben-Amun - 新品タグ付ben amun 定価24200円 PostchainBraceletの通販

新品タグ付 ben amun 定価24200円 PostchainBracelet ブレスレット

新品タグ付 ben amun 定価24200円 PostchainBracelet ブレスレット

新品最安値 新品タグ付ben amun 定価24200円 PostchainBracelet | www

Ben-Amun - 新品タグ付ben amun 定価24200円 PostchainBraceletの通販

新品最安値 新品タグ付ben amun 定価24200円 PostchainBracelet | www

Ben-Amun - 新品タグ付ben amun 定価24200円 PostchainBraceletの通販

新品タグ付ben amun 定価24200円 PostchainBracelet ブレスレット

Ben-Amun - 新品タグ付ben amun 定価24200円 PostchainBraceletの通販

価格順 新品タグ付ben amun PostchainBracelet - アクセサリー

新品タグ付ben amun 定価24200円 PostchainBracelet ブレスレット

特注品 新品タグ付ben amun PostchainBracelet | franciscovilla.mx

Supreme Kurt Cobain Sweater - ニット/セーター

価格順 新品タグ付ben amun PostchainBracelet - アクセサリー

2024年最新】ben amunの人気アイテム - メルカリ

購入を検討しておりますズンバ パンツ 正規品 - カジュアルパンツ

良質 BEN AMUN パール&スワロフスキーブレスレット | temporada.studio

特注品 新品タグ付ben amun PostchainBracelet | franciscovilla.mx

正規品取扱店舗】 新品タグ付ben amun 定価24200円 PostchainBracelet

寿ママ☆*:様専用【11月12日】✨限定品/ ブレスレット - souvlakifast.com

良質 BEN AMUN パール&スワロフスキーブレスレット | temporada.studio

正規品取扱店舗】 新品タグ付ben amun 定価24200円 PostchainBracelet

寿ママ☆*:様専用【11月12日】✨限定品/ ブレスレット - souvlakifast.com

新品タグ付ben amun 定価24200円 PostchainBracelet ブレスレット

2024年最新】ben amunの人気アイテム - メルカリ

ついに再販開始!】 よう様♡プラチナダイヤモンドブレスレット

新品未使用) クロエ 財布 美品 レア シルバー | www.cc-eventos.com.mx

Supreme Kurt Cobain Sweater - ニット/セーター

特価SALE】 【中古】TIFFANY ティファニー SV925 ワイドカフ バングル

購入を検討しておりますズンバ パンツ 正規品 - カジュアルパンツ

出産祝い アンドレルチアーノの浴衣 | www.chelecare.co.uk

【BEN AMUN/ベンアムン】イヤリング(両耳) IENA イエナ | フリマアプリ ラクマ

売れ筋最安値 SIENA ROSE オニキスハート | yigitaluminyumprofil.com

寿ママ☆*:様専用【11月12日】✨限定品/ ブレスレット - souvlakifast.com

出産祝い アンドレルチアーノの浴衣 | www.chelecare.co.uk

62.0%OFF セリーヌ♡ブレスレット 2022セール bit-consul.com-メルカリ

☆新春福袋2022☆ fifth general store ブレスレット メキシカン

産地直送品 モードエジャコモ メダ | ancientvalley.ge

良質 BEN AMUN パール&スワロフスキーブレスレット | temporada.studio

商品の情報

メルカリ安心への取り組み

お金は事務局に支払われ、評価後に振り込まれます

出品者

スピード発送

この出品者は平均24時間以内に発送しています