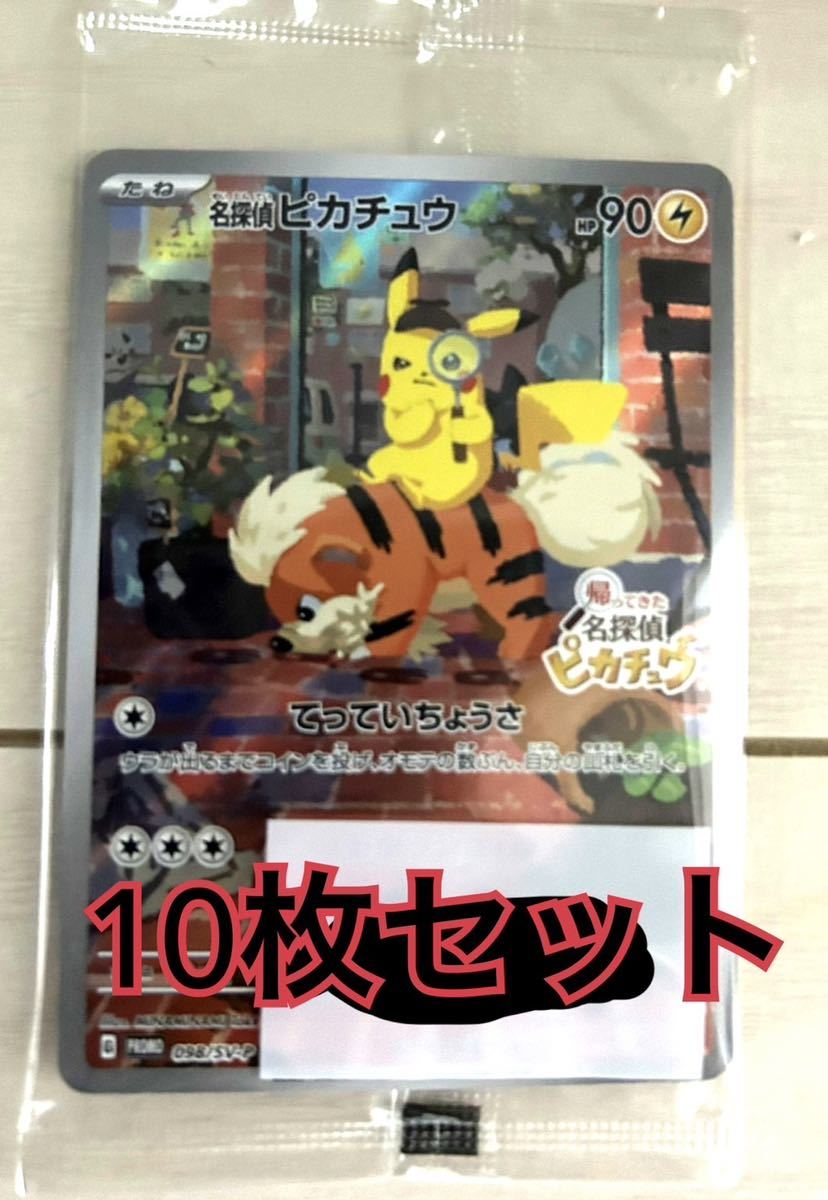

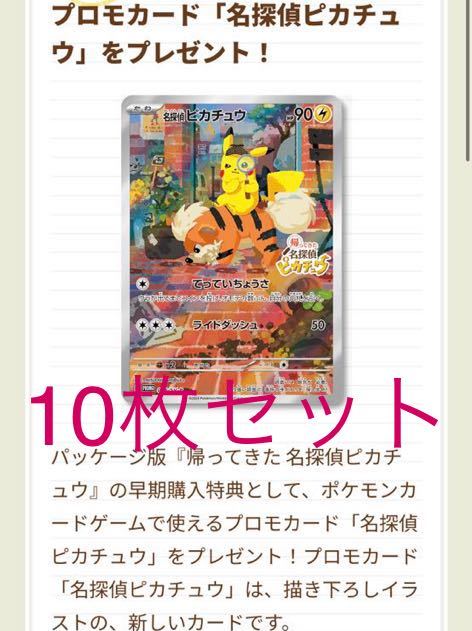

名探偵ピカチュウ プロモ 10枚

(税込) 送料込み

商品の説明

商品説明

名探偵ピカチュウプロモ10枚未開封品になります

冷暗所にて保管しておりましたが

個体差に関してはご了承下さい

濡れ折れ対策をして発送します

ポケモンカード

ポケカ

プロモカード

pokemoncard

Pikachu

22800円名探偵ピカチュウ プロモ 10枚エンタメ/ホビートレーディングカード2023新作モデル 帰ってきた名探偵ピカチュウ プロモカード 10枚 セット名探偵ピカチュウ プロモ 10枚トレーディングカード - シングルカード

春新作の ポケモンカード 098 プロモ 帰ってきた ポケモンカード 名

安い日本製 名探偵ピカチュウ プロモカード 10枚セット【1375

2023新作モデル 帰ってきた名探偵ピカチュウ プロモカード 10枚 セット

オフクーポン付 帰ってきた 名探偵ピカチュウ プロモカード 10枚

人気No.1/本体 帰ってきた名探偵ピカチュウ プロモ PSA10】名探偵

包装・送料無料 ポケモンカード 名探偵ピカチュウ プロモ ピカチュウ

楽天限定公式 名探偵ピカチュウ プロモ 10枚 | cityleaguecoffee.com

通販できます 名探偵ピカチュウ プロモカード 10枚 購入特典 | www

帰ってきた 名探偵ピカチュウ : ポケモンセンターオンライン

有名な高級ブランド 10枚 帰ってきた名探偵ピカチュウプロモカード

新品非売品】 帰ってきた名探偵ピカチュウ プロモ 10枚

帰ってきた名探偵ピカチュウ プロモ 10枚明日の発送は可能でしょうか

ポケモンカード 名探偵ピカチュウ プロモカード 10枚|Yahoo!フリマ

送料無料/新品未開封】ポケモンカード ポケカ 名探偵ピカチュウ プロモ

のアイテムを Nintendo switch 帰ってきた名探偵ピカチュウ プロモ未

49.0%割引 帰ってきた名探偵ピカチュウ プロモ 10枚セット 2022年秋冬

再入荷♪ プロモ 名探偵ピカチュウswitch 10枚◾️新品未開封 特典

帰ってきた 名探偵 ピカチュウ プロモ プロモカード 10枚アニメグッズ

新規値下げ ポケモンカード 帰ってきた 名探偵ピカチュウ プロモ 098

ポケモンカード 名探偵ピカチュウ プロモカード 10枚 Yahoo!フリマ(旧)-

名探偵ピカチュウプロモ10枚|Yahoo!フリマ(旧PayPayフリマ)

帰ってきた名探偵ピカチュウ プロモ 10枚トレーディングカード

名探偵ピカチュウ(339/SM-P) | プロモ | ドラゴンスター | ポケモンカード

割50% 帰ってきた名探偵ピカチュウ プロモ 10枚 | www.artfive.co.jp

キャンプ用品に参入 ポケモンカード 帰ってきた 名探偵ピカチュウ

Amazon.co.jp: 帰ってきた 名探偵ピカチュウ -Switch (【メーカー特典

新品未開封 ☆10枚セット 名探偵ピカチュウ プロモカード 即日発送

ポケモン - 【新品未開封】 ☆10枚セット☆ 名探偵ピカチュウ プロモ

商品を編集 名探偵ピカチュウ プロモ10枚セット - トレーディングカード

セール 登場から人気沸騰 名探偵ピカチュウ プロモ 名探偵ピカチュウ

Yahoo!オークション - 10枚セット プロモカード 名探偵ピカチュウ

新品未開封 ☆10枚セット 名探偵ピカチュウ プロモカード 即日発送

第1位獲得! 【ポケモンカード】名探偵ピカチュウ プロモカード 10枚

ポケモン - 【新品未開封】 ☆10枚セット☆ 名探偵ピカチュウ プロモ

名探偵ピカチュウ プロモ psa10 10枚 pikachu detective preorder

PSA10】ポケモンカード 名探偵ピカチュウ プロモ 098/SV-P 1円スタート

名探偵ピカチュウ プロモ psa10 10枚 pikachu detective preorder

帰ってきた名探偵ピカチュウ プロモカード 10枚|Yahoo!フリマ(旧

人気メーカー・ブランド 名探偵ピカチュウ 名探偵ピカチュウ プロモ10

商品の情報

メルカリ安心への取り組み

お金は事務局に支払われ、評価後に振り込まれます

出品者

スピード発送

この出品者は平均24時間以内に発送しています