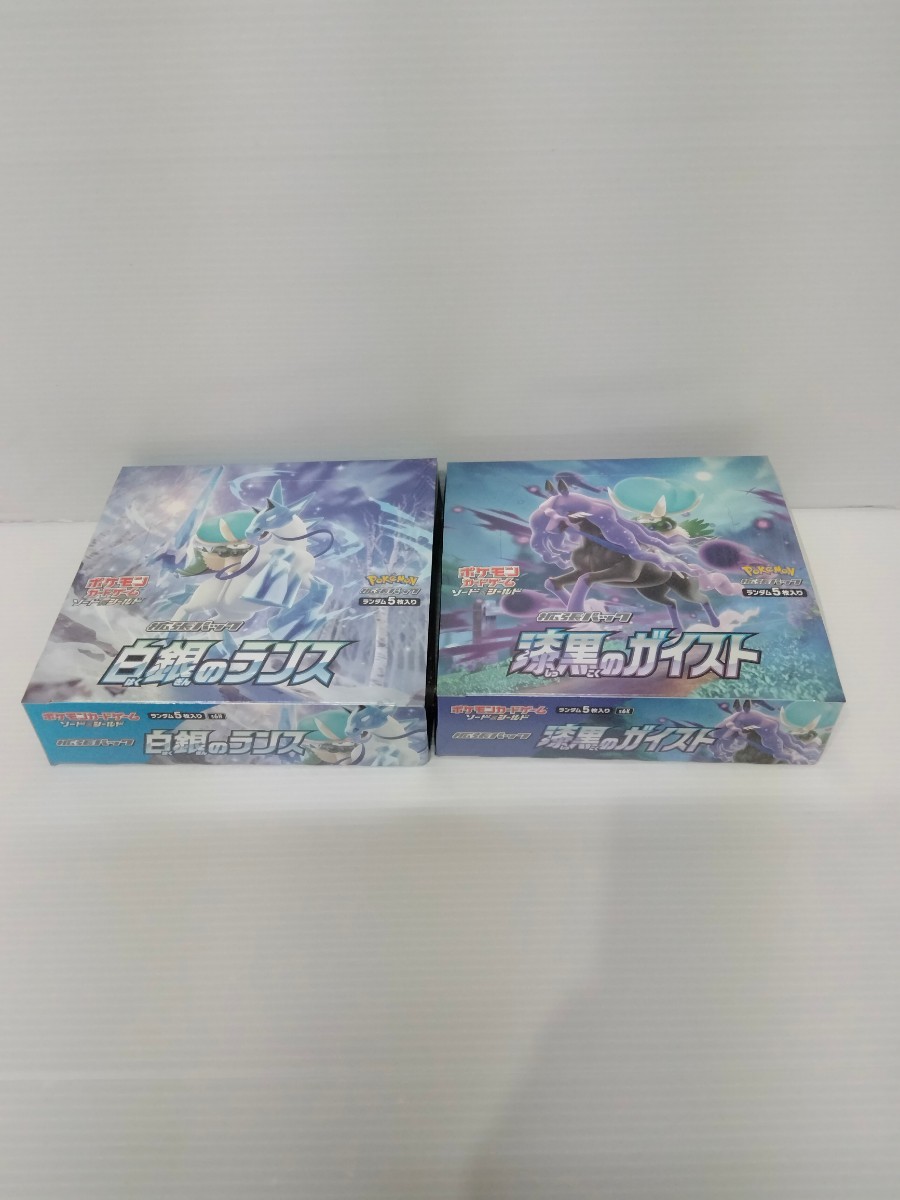

ポケモン 漆黒のガイスト 白銀のランス ボックス シュリンク付き ポケモンカード

(税込) 送料込み

商品の説明

商品説明

ポケモンボックス「BOX」新品未開封

シュリンク付き

ポケカ

漆黒のガイスト

白銀のランス

即日発送します。

バイオレット

スカーレット

#ポケモン

#バイオレットex

#1BOX

#ポケカ

#ポケモン

#スカーレット

#バイオレット

#ミライドン

#コライドン

#ミモザ

#sr

#sar

#シュリンク付き

#シュリンク

#未開封

#即日発送

#ボックス

#ポケモンカード

#イーブイヒーローズ

#蒼空ストリーム

#まとめ売り

#レア

#カード

#未使用

#トリプレッドビート

#禁断の光

#ミラクルツイン

#タッグボルト

#漆黒のガイスト

#白銀のランス

#リミックスバウト

#151

ポケモンセンター

ポケセン

151

トリプレッドビート

22800円ポケモン 漆黒のガイスト 白銀のランス ボックス シュリンク付き ポケモンカードエンタメ/ホビートレーディングカード人気絶頂 ポケモンカードゲーム 漆黒のガイストBOXシュリンク付き 白銀漆黒のガイスト 白銀のランス box 完全 シュリンク付き-

数量各1BOXポケモンカードゲーム 漆黒のガイスト 白銀のランス

ポケモンカード 漆黒のガイスト 白銀のランス BOX シュリンク付 販売最

人気絶頂 ポケモンカードゲーム 漆黒のガイストBOXシュリンク付き 白銀

返品?交換対象商品】 ポケモンカード 漆黒のガイスト 白銀のランス 未

漆黒のガイスト 白銀のランス 2BOXセット シュリンク付き ポケモン-

通販安心 ポケモンカード 白銀のランス 漆黒のガイスト 各2BOX

シュリンク付】ポケモンカード 漆黒のガイスト 白銀のランス 各5box

ポケモンカード 漆黒のガイスト 白銀のランス BOX シュリンク付き

ポケモンシュリンク付き BOX漆黒のガイスト 白銀のランス-

漆黒のガイストポケモンカード 漆黒のガイスト シュリンク付 2箱

ポケモンカード 漆黒のガイスト 白銀のランス 各2BOX シュリンク付き-

漆黒のガイスト boxシュリンク付き-

ポケモンカード 漆黒のガイスト シュリンク付き BOX 未開封 ポケカ-

通販人気商品 ポケモンカード 漆黒のガイスト 白銀のランス 合計2BOX

ポケモンカードBOX 漆黒のガイスト・白銀のランス シュリンク付き 宅配

ポケモンシュリンク付き BOX漆黒のガイスト 白銀のランス-

シュリンク付】ポケモンカード 漆黒のガイスト 白銀のランス 各5box

ポケモンカード 漆黒のガイスト 白銀のランス box シュリンク付き 未

漆黒のガイスト BOX シュリンク付き ポケモンカード-

シュリンクつき 漆黒のガイスト 白銀のランス ミステリーボックス 仰天

ポケモンカードBOX 漆黒のガイスト・白銀のランス シュリンク付き 宅配

ポケモン - ポケモン 漆黒のガイスト 白銀のランス ボックス

シュリンクなし1ボックスポケモンカード 白銀のランス - ポケモン

シュリンク付きBOX 白熱のアルカナ 漆黒のガイスト 白銀のランス-

漆黒のガイスト 白銀のランス スペースジャグラー 未開封BOX

2023年春の シュリンク付き 漆黒のガイスト 白銀のランス Vスター

漆黒のガイスト 白銀のランス box 新品未開封 シュリンク付き 格安買取

ポケモンカード 漆黒のガイスト BOX シュリンク付きBox/デッキ/パック

漆黒のガイスト 白銀のランス box 完全 シュリンク付き-

ポケモンカード 漆黒のガイスト 白銀のランス BOX シュリンク付き 各

漆黒のガイスト boxシュリンク付き-

ポケモンカードゲーム 漆黒のガイスト 白銀のランス 新品未開封BOX

ワンオーナー 漆黒のガイスト 白銀のランス BOX シュリンク付 ポケモン

ポケカ 漆黒のガイスト 白銀のランス シュリンク付き 未開封 box

ポケモンカード 漆黒のガイスト 白銀のランス BOX シュリンク付き 各

新品・未開封・シュリンク付 漆黒のガイスト 2BOX、白銀のランス 2BOX

ポケモン - ポケモン 漆黒のガイスト 白銀のランス ボックス

漆黒のガイスト BOX シュリンク付き-

新品BOX】ポケモンカード 漆黒のガイスト 白銀のランス シュリンク付き

商品の情報

メルカリ安心への取り組み

お金は事務局に支払われ、評価後に振り込まれます

出品者

スピード発送

この出品者は平均24時間以内に発送しています