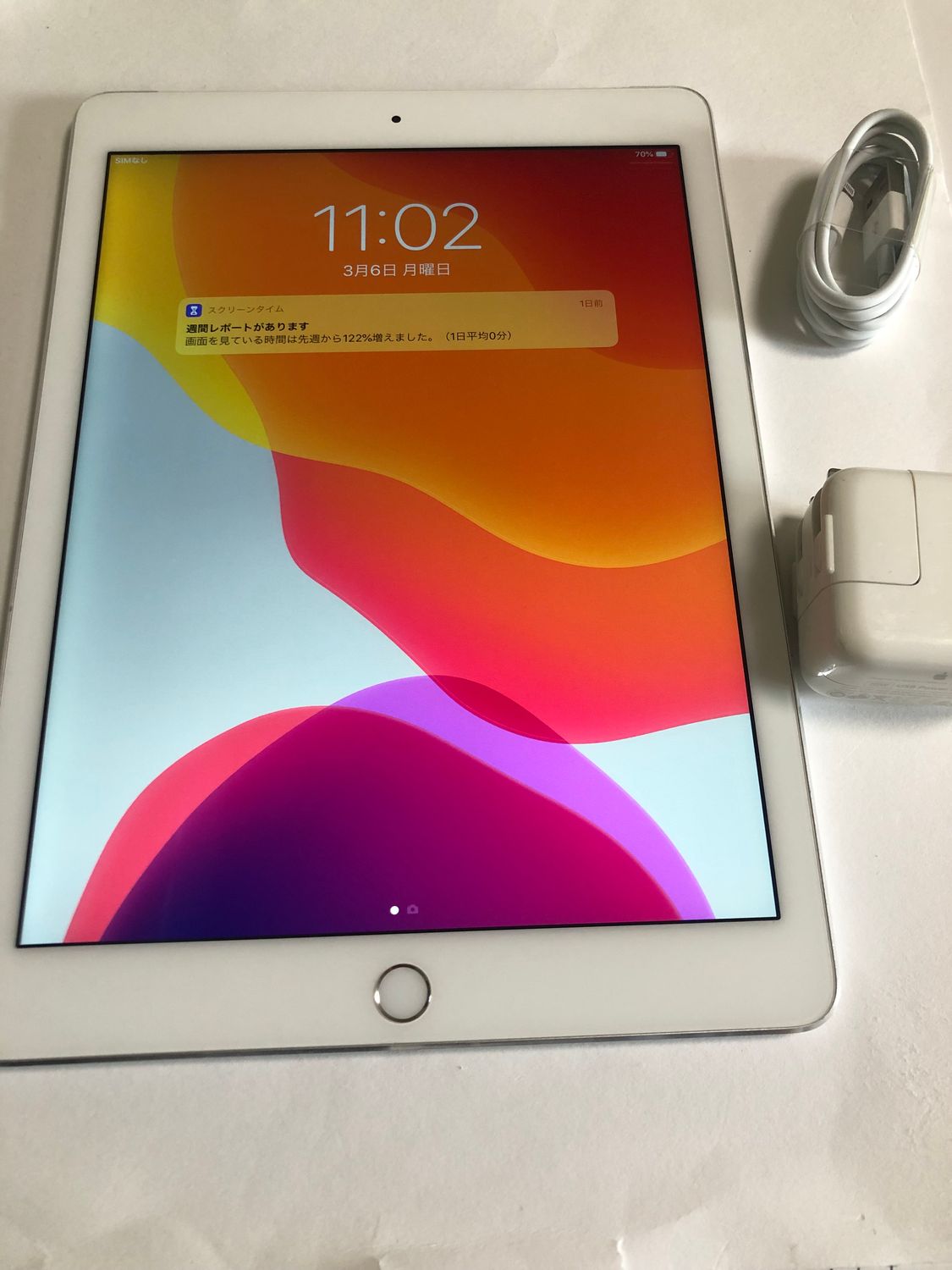

iPadair2 16GB専用Lightningケーブルなし

(税込) 送料込み

商品の説明

商品説明

汚れや傷なでありません。wifiモデルです。

付属品なし

液晶保護フィルム貼ってあります。

おまけにケースも付けときます。

14520円iPadair2 16GB専用Lightningケーブルなしスマホ/家電/カメラPC/タブレットELDEN iPadair2 16GB専用Lightningケーブルなし | www.ancientvalley.geApple - iPadair2 16GB専用Lightningケーブルなしの通販 by

Apple - iPadair2 16GB専用Lightningケーブルなしの通販 by タドコロ

専用/Apple iPad Air 2 ゴールド Wi-Fi+Cellular - www.sorbillomenu.com

ELDEN iPadair2 16GB専用Lightningケーブルなし | www.ancientvalley.ge

iPad Air 2 - 技術仕様 (日本)

楽天市場】【楽天週間ランキング1位】 iphone 全機種対応

PC/タブレットiPad Air 2 (16GB) ※docomoのみcellularでの使用可

美品 iPad Air2 16GB wifi+セルラー 管理番号:0884-

楽天市場】Apple iPad Air 2 Wi-Fi+Cellular 9.7 インチ 16GB スペース

好評につき延長! iPad Air2 Wi-Fi 16GB スペースグレイ | artfive.co.jp

楽天市場】【楽天週間ランキング1位】 iphone 全機種対応

楽天市場】【楽天週間ランキング1位】 iphone 全機種対応

Amazon.co.jp: Apple iPad Air 2 Wi-Fi 16GB シルバー (整備済み品

楽天市場】【楽天週間ランキング1位】 iphone 全機種対応

美品】iPad Air 2 16GB A1566 (037) - www.sorbillomenu.com

美品」iPad Air 2 16GB Gold 国内SIMフリー-

iPad Air 16GB wifiモデル 管理番号:0699 アップル 店舗 神戸

iPadair2 64GB cellular - sorbillomenu.com

良品 iPad Air2 16GB wifiモデルu3000管理番号:0658 商品の状態 在庫

iPad Air 2 (16GB) ※docomoのみcellularでの使用可 - www.sorbillomenu.com

楽天市場】[ギガビット対応] iPhone / iPad 用 有線LANアダプター

プチプラ iPad Air2 16GB wifi+セルラーモデル 管理番号:0695

未使用品 iPadAir2 16GB シルバー cellularモデル (ソフトバンク

iPad Air2 16GB wifi+セルラーモデル 管理番号:0972-

スペースグレー色 iPad air 16GB キーボード付き です-

工場店 iPad Air2 16GB Wi-Fi | president.gov.mt

iPad Air2 セルラー 64GB Office導入&オマケ付き-

別注 iPad Air2 16GB wifi+セルラーモデル 管理番号:0888 | skien

iPad Air2 16GB wifi+セルラーモデル 管理番号:0981 - www

良品】iPad Air 2 16GB A1566(052) シルバー - タブレット

毎回完売 【美品】iPad Apple iPad Air 2 2 iPad 16GB (Renewed) Air

ライトニングケーブル iPhone充電器 アイフォン 送料無料

iPadair2 64GB cellular - sorbillomenu.com

Amazon.co.jp: 【整備済み品】Apple iPad Air 2 Wi-Fi 16GB スペース

値下げ iPadAir2 Wi-Fi+Cellular docomo 16GB-

美品 iPad Air2 16GB wifi+セルラー 管理番号:0884-

絶品】 Apple iPad Air2 16GB (Docomo) glow.ch

Amazon.co.jp: Apple iPad Air 2 Wi-Fi 16GB シルバー (整備済み品

楽天市場】iPhone / iPad 用 SDカードリーダーLightning(オス) - SD

iPad Air 2 Wi-Fi +Cellular 32GB スペースグレイ の+inforsante.fr

商品の情報

メルカリ安心への取り組み

お金は事務局に支払われ、評価後に振り込まれます

出品者

スピード発送

この出品者は平均24時間以内に発送しています