ジョニーウォーカー イヤー オブ ザ タイガー リミテッドエディション

(税込) 送料込み

商品の説明

商品説明

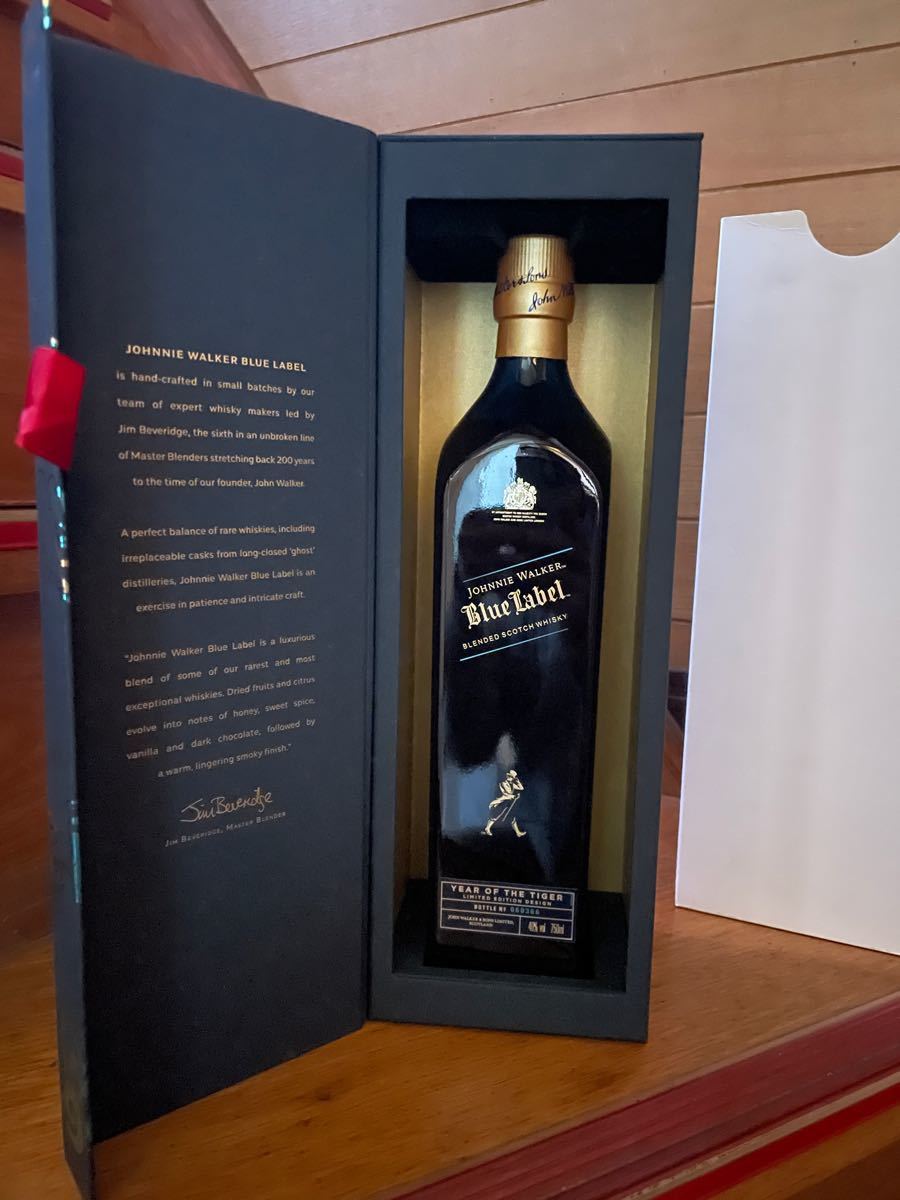

【管理番号】T22J110005【商品名】JOHNNIEWALKER(ジョニーウォーカー)ブルーラベルイヤーオブザタイガーリミテッドエディション

【容量】750ml

【度数】40%

【ヴィンテージ】-

【生産地】スコットランド

【製造年月】-

【商品状態】-

※注意事項※

出品商品は一部を除き、一般のお客様から購入した二次流通品となります。

弊社では空調管理された倉庫・ワインセラーにて保管しておりますが、お買取りする前の保管状況は分かりかねます。

酒類は開封出来ない為品質保証ができません。古酒の特性をご理解の上ご購入下さい。

ボトルのキズ・汚れ・ラベルの傷み・澱(オリ)・液面低下等がある場合がございます。

状態等は商品画像をご参照下さい。

一部商品には当店が販売したボトルであるという証明のため、当店独自のシリアルナンバーが入ったシールを瓶底に貼付しております。

剥がすと文字が浮き上がる特殊なシールですので、ご利用までは剥がさないようお願い申し上げます。

シールがない、または貼り直した形跡がある場合、返品・返金には応じかねますのでご注意下さい。

14100円ジョニーウォーカー イヤー オブ ザ タイガー リミテッドエディション食品/飲料/酒酒オンライン販売店 限定☆ジョニーウォーカーブルーラベル✨イヤー珍しい ジョニーウォーカー イヤー オブ ザ タイガー リミテッド

ジョニーウォーカー イヤーオブザタイガー - ウイスキー

食品/飲料/酒ジョニーウォーカー イヤー オブ ザ タイガー リミテッド

オンライン販売店 限定☆ジョニーウォーカーブルーラベル✨イヤー

ジョニーウォーカー イヤーオブザタイガー - ウイスキー

2022年の干支「寅」をあしらったデザインボトル『ジョニーウォーカー

【限定品】 ジョニーウォーカー ブルーラベル イヤー オブ タイガー

2022年ジョニーウォーカー🚶の干支ボトル🐯【ジョニーウォーカー

酒ジョニーウォーカー ブルーラベル イヤーオブザラビット - ウイスキー

ジョニーウォーカー ジョニーウォーカー ブルーラベル イヤーオブザ

ジョニーウォーカー ブルーラベルから2023年の干支「卯」をあしらった

ジョニーウォーカー イヤーオブザタイガー - ウイスキー

世界的に有名なビジュアルアーティスト ジェームズ・ジーン氏が

ジョニーウォーカー ブルーラベル イヤー オブ ザ タイガー 2022 干支

オンライン販売店 限定☆ジョニーウォーカーブルーラベル✨イヤー

ジョニーウォーカー イヤーオブザタイガー - ウイスキー

2022年の干支「寅」をあしらったデザインボトル『ジョニーウォーカー

ジョニーウォーカー イヤーオブザタイガー-

ジョニーウォーカー ブルーラベル イヤー オブ ザ ドラゴン - 酒

ジョニーウォーカー イヤーオブザタイガー - ウイスキー

ジョニーウォーカー イヤーオブザタイガー - ウイスキー

ジョニーウォーカー・ブルーラベル 2022年 イヤー オブ ザ タイガー

使い勝手の良い ジョニーウォーカー イヤーラベル ブルーラベル ブルー

☆ジョニーウォーカー ブルーラベル イヤーオブ タイガー☆送料込み 酒

ジョニーウォーカー・ブルーラベル 2022年 イヤー オブ ザ タイガー

画家・奥田瑛二が描く世界「ジョニーウォーカー ブルーラベル ジャパン

ジョニーウォーカー ブルーラベル イヤー オブ ザ タイガー 2022 干支

ジョニーウォーカー ジョニーウォーカー ブルーラベル イヤーオブザ

ジョニーウォーカー ブルーラベル イヤー オブ ザ タイガー

ジョニーウォーカー ブルーラベル イヤー オブ ザ ラビット - 酒

オンライン販売店 限定☆ジョニーウォーカーブルーラベル✨イヤー

ジョニー・ウォーカー ブルーラベル イヤー・オブ・ザ・ドラゴン - 酒

新品未開栓】ジョニーウォーカー ブルーラベル イヤーオブ ザ ラビット

ジョニーウォーカー ブルーラベル イヤー オブ ザ ラビット - 酒

ジョニーウォーカー ブルーラベル イヤー オブ ザ タイガー40%700ml | 酒のスーパー足軽 楽天市場店

ジョニーウォーカー ジョニーウォーカー ブルーラベル イヤーオブザ

ジョニーウォーカー ブルーラベル イヤーオブドラゴン - ウイスキー

ジョニーウォーカー イヤーオブザタイガー - ウイスキー

ジョニーウォーカーブルーラベル 限定ニューイヤーオフタイガー2022

日本人気超絶の ジョニーウォーカー 楽天市場】ウイスキー ジョニー

商品の情報

メルカリ安心への取り組み

お金は事務局に支払われ、評価後に振り込まれます

出品者

スピード発送

この出品者は平均24時間以内に発送しています