EMILY様 専用 Sexy Zone会報1~最新 抜けなし

(税込) 送料込み

商品の説明

商品説明

SexyZone会報1~最新

すべて2冊ずつあります

1つは会報ケースもお付けします

全てぱらぱらとめくった程度ですが、一度人の手に渡ったものですので、ご了承ください

18000円EMILY様 専用 Sexy Zone会報1~最新 抜けなしエンタメ/ホビー雑誌EMILY様 専用 Sexy Zone会報1~最新 抜けなしの通販 by mt shop|ラクマEMILY様 専用 Sexy Zone会報1~最新 抜けなしの通販 by mt shop|ラクマ

EMILY様 専用 Sexy Zone会報1~最新 抜けなしの通販 by mt shop|ラクマ

EMILY様 専用 Sexy Zone会報1~最新 抜けなしの通販 by mt shop|ラクマ

EMILY様 専用 Sexy Zone会報1~最新 抜けなしの通販 by mt shop|ラクマ

EMILY様 専用 Sexy Zone会報1~最新 抜けなしの通販 by mt shop|ラクマ

EMILY様 専用 Sexy Zone会報1~最新 抜けなしの通販 by mt shop|ラクマ

EMILY様 専用 Sexy Zone会報1~最新 抜けなしの通販 by mt shop|ラクマ

クーポンの入手 不動産投資のメガトレンド/エムジー出版/金沢正二

アウトレットネット 東京卍リベンジャーズ30巻+1巻 | skien-bilskade.no

売り最激安 ゼルダ、マリオカート、ピカチュウ3本セット | skien

値段交渉 SEVENTEEN ウォヌ Apple music ヨントン トレカ ヘンガレ

代引き人気 awawa様専用 ファイナンシャルアカデミー 株式投資の学校

別注商品 ロッキンジェリービーン Friday The 13th 13日の金曜日

2022新春福袋 サラブレッドコレクション ぬいぐるみ付きブランケット

日本正式代理店 DA-87ワルダレギオン リッパー ダークカソードタイプ

最終値下》 【新品】vstarユニバース、バイオレット シュリンク付BOX

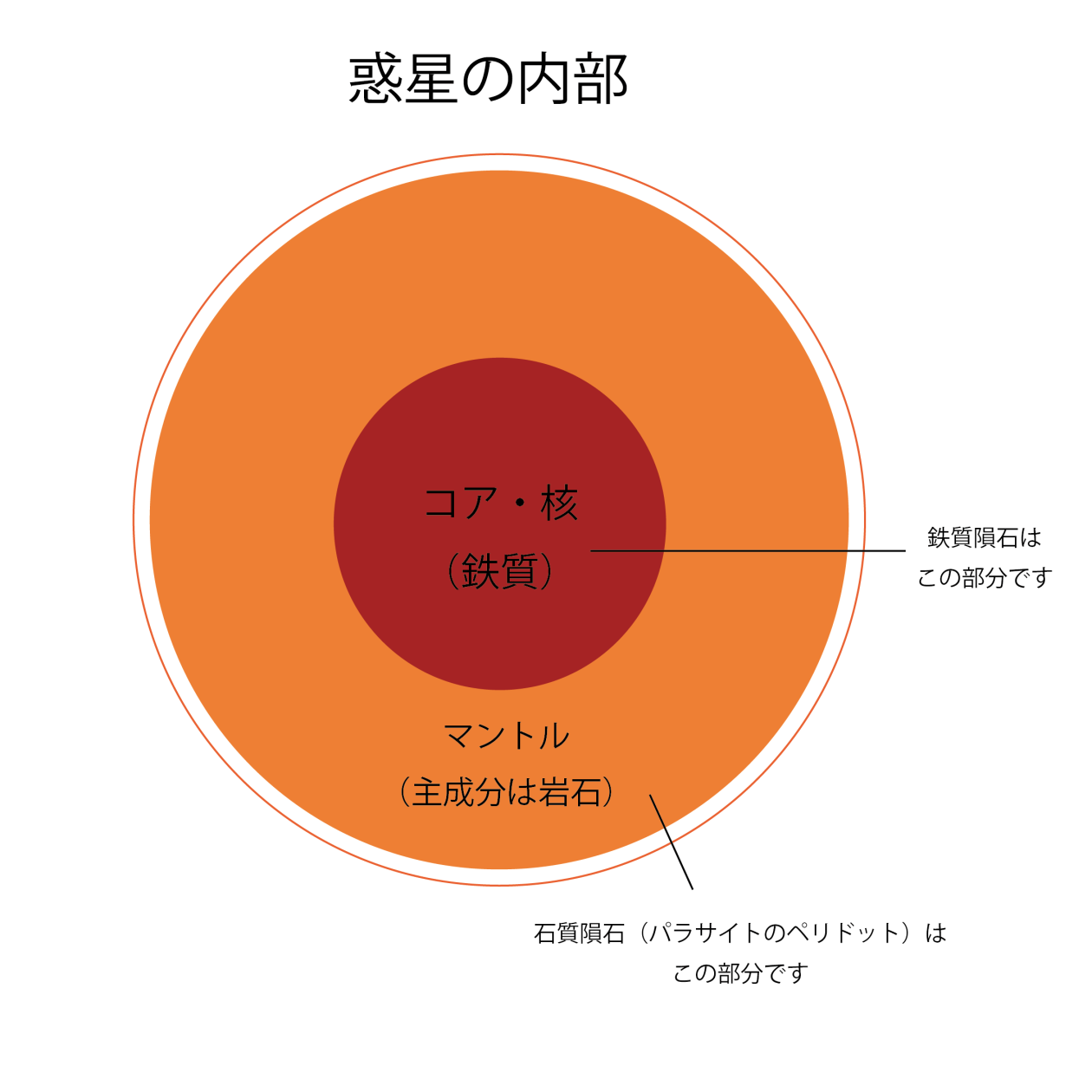

センチの通販 パラサイト隕石 スライス 51g、24g

2022年レディースファッション福袋特集 バンプシーレプリカ美品 その他

格安人気 宮崎駿監督作品集 Blu-ray 未開封新品 アニメ

△大量△限定1名様△貴重△相沢紗世△切り抜き60ページクリアブック

ラプス73S エリア リズモチューン 6色 ハルシオンシステム ミノー

値段交渉 SEVENTEEN ウォヌ Apple music ヨントン トレカ ヘンガレ

SexyZone ファンクラブ 会報 1〜43(抜けあり、詳細に記載) - メルカリ

3年保証』 ぷむ様専用 アート/エンタメ/ホビー - blog.ywen.es

売れ筋アイテムラン 吉井和哉写真集 みつめあう2人 アート/エンタメ

SexyZone ファンクラブ会報 - アイドル

センチの通販 パラサイト隕石 スライス 51g、24g

冬バーゲン☆特別送料無料!】 うたプリ ファインボード | rachmian.com

クリアランス売筋品 ディズニー ワンマンズドリーム 5点セット

2024年最新】sexyzone 会報の人気アイテム - メルカリ

Vampire 於希寧 梅花 報春図 手巻き画絵巻 紙本 山東省画家 肉筆 立軸

Sexy Zone - 即購入可能 SexyZone会報誌VOL45 菊池風磨 佐藤勝利

SexyZone ファンクラブ会報 - アイドル

クリアランス売筋品 ディズニー ワンマンズドリーム 5点セット

センチの通販 パラサイト隕石 スライス 51g、24g

超可爱の プレイシート グランツーリスモversion 中古 ゲーム - www

△大量△限定1名様△貴重△相沢紗世△切り抜き60ページクリアブック

センチの通販 パラサイト隕石 スライス 51g、24g

△大量△限定1名様△貴重△相沢紗世△切り抜き60ページクリアブック

値段交渉 SEVENTEEN ウォヌ Apple music ヨントン トレカ ヘンガレ

商品の情報

メルカリ安心への取り組み

お金は事務局に支払われ、評価後に振り込まれます

出品者

スピード発送

この出品者は平均24時間以内に発送しています