マックスマーラ Pコート サイズJ(40) - 黒

(税込) 送料込み

商品の説明

商品説明

[カテゴリ]コート

[ブランド]

MaxMara(マックスマーラ)

[商品名]

-

[型番]

-

[男女別]

レディース

[表記サイズ]

J(40)

[実寸サイズ]

肩幅:約40cm

袖丈(ゆき丈):約58cm

身幅:約46cm

着丈:約70cm

[カラー]

黒

[デザイン]

長袖/ステッチ/肩パッド/冬

[コンディションの備考]

【外側】

・全体的⇒ヨレ目立つ/シワ目立つ/毛羽立ち若干

【内側】

・特筆すべきダメージなし

【特記事項】

・保存時のニオイあり

[製造番号・刻印]

-

[シリアル]

***

[付属品]

なし

こちらの商品はラクマ公式パートナーのBrandear(ブランディア)によって出品されています。

以下の内容のお問い合わせについてはお返事ができませんのであらかじめご了承ください。

・商品状態の確認(汚れ具合、形状の確認等々)

・お値下げの交渉

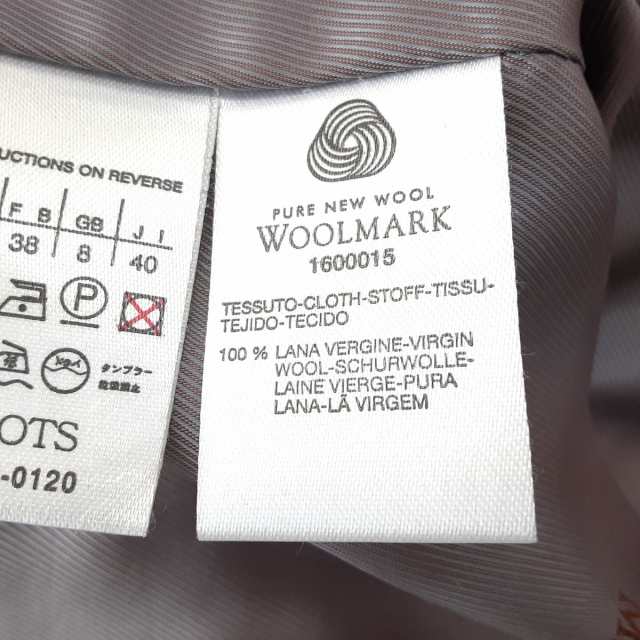

6370円マックスマーラ Pコート サイズJ(40) - 黒レディースジャケット/アウターマックスマーラ Max Mara コート Pコート ダブルブレスト 無地 ウール アウター レディース JI38 USA4 FB36(S相当) ブラックマックスマーラ Max Mara Pコート サイズJ(40) レディース - 黒 長袖

マックスマーラ Max Mara コート Pコート ダブルブレスト 無地 ウール アウター レディース JI38 USA4 FB36(S相当) ブラック | フリマアプリ ラクマ

Max Mara - マックスマーラ Pコート サイズJ(40) - 黒の通販|ラクマ

マックスマーラ Max Mara コート Pコート ダブルブレスト 無地 ウール アウター レディース JI38 USA4 FB36(S相当) ブラック

マックスマーラ Max Mara Pコート サイズJ(40) レディース - 黒 長袖

マックスマーラ Max Mara コート Pコート ダブルブレスト 無地 ウール アウター レディース JI38 USA4 FB36(S相当) ブラック

マックスマーラ Pコート レディース美品 -ジャケット/アウター

マックスマーラ コート サイズJI40 レディース - 黒 長袖/冬(16781572

Max Mara - マックスマーラ Pコート サイズJ(40) - 黒の通販|ラクマ

Max Mara Pコート ブラック-

マックスマーラ Pコート レディース美品 -ジャケット/アウター

マックスマーラ Max Mara Pコート サイズJ(40) レディース - 黒 長袖

Max Mara Pコート ブラック-

Max Mara - マックスマーラ Pコート サイズJ(40) - 黒の通販|ラクマ

Max Mara(マックスマーラ) Pコート サイズ(JI)42 レディース - 黒 長袖

2024年最新】マックスマーラ ピーコート・ウールコートの人気アイテム

ピュア ヴァージンウール ダブルフェイス コート, キャメル |

マックスマーラ Max Mara Pコート サイズJ(40) レディース - 黒 長袖

Max Mara マックスマーラ ロングコート/アイコンコート/101801 MADAME

Max Mara Pコート ブラック-

MaxMara コート ハーフコート

マックスマーラ ピーコート Pコート IJ38 M相当 ダブル テーラード

三越伊勢丹 | Max Mara/マックスマーラ通販 | マニュエラ アイコン

マックスマーラ WEEKEND Max Mara ラグランコート PAROLE 大きいサイズ

マックスマーラ コート サイズ40 M - 黒その他 - その他

三越伊勢丹 | Max Mara/マックスマーラ通販 | 101801 アイコンコート

キャメル100% 高級白タグ マックスマーラ ショートコート Mサイズ

タイムセール TOPS】Max Mara マックスマーラ カシミアコート/JERRY

Max Mara STUDIO マックスマーラ コート ブラック 黒 レディース 商品

楽天市場】【MAX15,000円OFFクーポン配布中!】S Max Mara エス

ウールリバー Pコート(505725346) | アイシービー(iCB) - MAGASEEK

マックスマーラ コート サイズJI40 レディース - 黒 長袖/冬(16781572

Pコート Max Mara(マックスマーラ) アウター(レディース) - 海外通販の

店舗良い Max Mara Pコート ブラック | everestfin.com

マックスマーラ Max Mara Pコート サイズJ(40) レディース - 黒 長袖

Max Mara Pコート ブラック-

2024年最新】マックスマーラ ピーコート・ウールコートの人気アイテム

キャメル100% 高級白タグ マックスマーラ ショートコート Mサイズ

Pコート Max Mara(マックスマーラ) アウター(レディース) - 海外通販の

リクエスト・アウター別コーデ・黒ロングコート編。 | 仕事と育児

商品の情報

メルカリ安心への取り組み

お金は事務局に支払われ、評価後に振り込まれます

出品者

スピード発送

この出品者は平均24時間以内に発送しています