ハイエース専用 アミド Sサイズ2枚セット

(税込) 送料込み

商品の説明

商品説明

UIVEHICLEユーアイビークル製です。3型ハイエース、SーGLに使ってました。

状態は良いと思います。

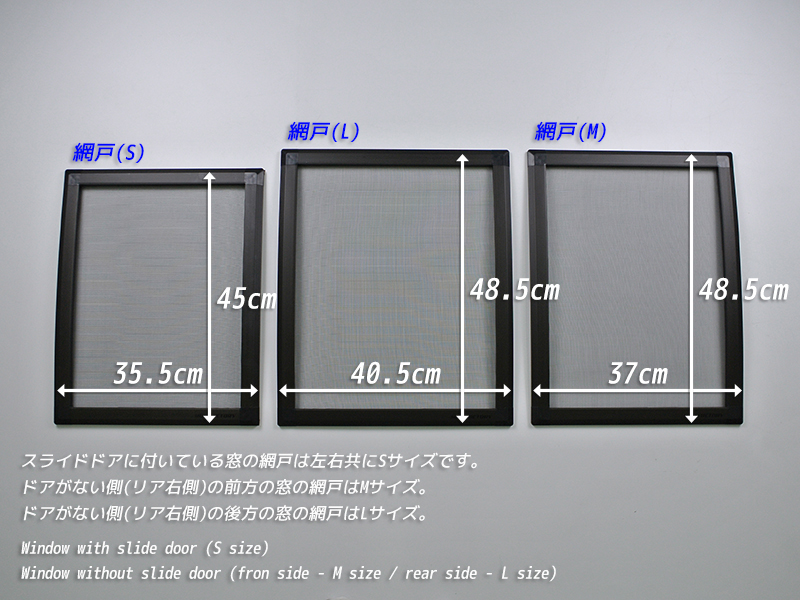

寸法35cm×45cm

荷物100サイズとなります。

適応の可否は解りかねますので、ご了承ください。

よろしくお願いします。

検索用:オグショー、UI-VEHICLE200系

6580円ハイエース専用 アミド Sサイズ2枚セット自動車/バイク自動車3月下旬入荷 ハイエース200系 網戸と専用バイザーのセット (1型-3型対応)ハイエース 200系 網戸 2枚車種別パーツ - 車種別パーツ

200系 ハイエース スーパーGLワイド [H16.8-H25.10] 車種専用網戸 アミDOエース 2枚 Sサイズ

楽天市場】\ スーパーSALE!10%OFF&P5倍/【即納】Cartist

3月下旬入荷 ハイエース200系 網戸と専用バイザーのセット (1型-3型対応)

品番M12/M20/M21 200系 ハイエース スーパーGL 標準ボディ [H16.8

楽天市場】ハイエース200系 網戸と専用バイザーのセット (1型-3型対応

ハイエース200系 標準用 HIACE メッシュカーテン サンシェード フロント用2枚 第一列目 車用網戸 日よけ 風通し 遮光 断熱【フルサイズ/ハーフサイズ】 : hy467 : FIELD-AG - 通販 - Yahoo!ショッピング

200系 ハイエース スーパーGLワイド [H16.8-H25.10] 車種専用網戸 アミDOエース 2枚 Sサイズ

楽天市場】ハイエース200系 1型-3型対応 網戸(アミテクト) 1P カスタム

200系 ハイエース 4型 5型 6型 7型 [H25.12-] 車種専用網戸 アミDO

楽天市場】\ スーパーSALE!10%OFF/Cartist 200系 ハイエース 網戸

200系 ハイエース スーパーGLワイド [H16.8-H25.10] 車種専用網戸 アミDOエース 2枚 Sサイズ

ハイエース 200系 網戸 2枚車種別パーツ - 車種別パーツ

ハイエース200系 網戸専用 サイドバイザー オグショー UIビークル 対応

2024年最新】Yahoo!オークション -200系 ハイエース 網戸の中古品

Amazon | 200系 ハイエースワゴン GLワイド [H16.8-H25.10] 車種専用

ハイエース200系 網戸 アミエース? 1〜3型 左右スライドドア用 S

200系ハイエースワゴン ドア網戸2枚 - その他

【全面セット】200系ハイエース S-GL標準ボディ ESフロアパネル

楽天市場】ハイエース200系 網戸 対応 小窓 バイザー 4型以降 片側

全面セット】200系ハイエース スーパーロングバンDX ESフロアパネルF&R

200系 ハイエース 4型 5型 6型 7型 [H25.12-] 車種専用網戸 アミDO

Amazon | 200系 ハイエース スーパーGL標準 [H16.8-H25.10] 車種専用

ハイエース200系、前席左右網戸2枚組 - 車内アクセサリー

特価買取 ハイエース 200系 網戸 2枚 | umma.hu

Amazon | ウィンドーバグネット フロント2枚セットグランドハイエース

ハイエース200系 網戸 アミエース? 1〜3型 左右スライドドア用 S

200系 ハイエースワゴン GLワイド [H16.8-H25.10] 車種専用網戸 アミDO

200系 ハイエース DX標準 [H16.8-H25.10] 車種専用網戸 アミDOエース 2

200系ハイエース 虫除けの人気商品・通販・価格比較 - 価格.com

値下】ハイエース 網戸 200系 1〜3型 アミエース | www.innoveering.net

楽天市場】車用網戸 銀黒 カーアミド 車網戸 1枚 単品 ハイエース 200

200系ハイエース 虫除けの人気商品・通販・価格比較 - 価格.com

トヨタ ハイエースバン テッツRV オリジナル FFヒーター ソーラー

Amazon.co.jp: セイワ(SEIWA) 車用 カーテン 楽らくマグネット 防虫

ハイエース200系 網戸 対応 小窓 バイザー 4型以降 片側 オグショー UI

ハイエース 防虫ネット(虫除けネット) 一台フルセット

楽天市場】【送料無料】Cartist アームレスト ハイエース 200系 ドア

CGP 車種専用 メッシュサンシェード メッシュ サンシェード 運転席

むうさんパパ専用】ハイエース 網戸 200系 3型 2枚セットの通販 by

商品の情報

メルカリ安心への取り組み

お金は事務局に支払われ、評価後に振り込まれます

出品者

スピード発送

この出品者は平均24時間以内に発送しています

![200系 ハイエース スーパーGLワイド [H16.8-H25.10] 車種専用網戸 アミDOエース 2枚 Sサイズ](https://m.media-amazon.com/images/I/51T24fh6B-L._AC_UF894,1000_QL80_.jpg)

![200系 ハイエース スーパーGLワイド [H16.8-H25.10] 車種専用網戸 アミDOエース 2枚 Sサイズ](https://m.media-amazon.com/images/I/61f6i7HGxxL._AC_UF894,1000_QL80_.jpg)

![200系 ハイエース スーパーGLワイド [H16.8-H25.10] 車種専用網戸 アミDOエース 2枚 Sサイズ](https://m.media-amazon.com/images/I/51UkOrbk24L._AC_UF350,350_QL80_.jpg)

![Amazon | 200系 ハイエースワゴン GLワイド [H16.8-H25.10] 車種専用](https://images-fe.ssl-images-amazon.com/images/I/51ULcWpbCsL._AC_UL600_SR600,600_.jpg)

![Amazon | 200系 ハイエース スーパーGL標準 [H16.8-H25.10] 車種専用](https://m.media-amazon.com/images/I/61Kkk1k-5tL._AC_UF894,1000_QL80_.jpg)

![200系 ハイエース DX標準 [H16.8-H25.10] 車種専用網戸 アミDOエース 2](https://ic4-a.wowma.net/mis/gr/135/image.wowma.jp/13953335/int/int07_2.jpg)