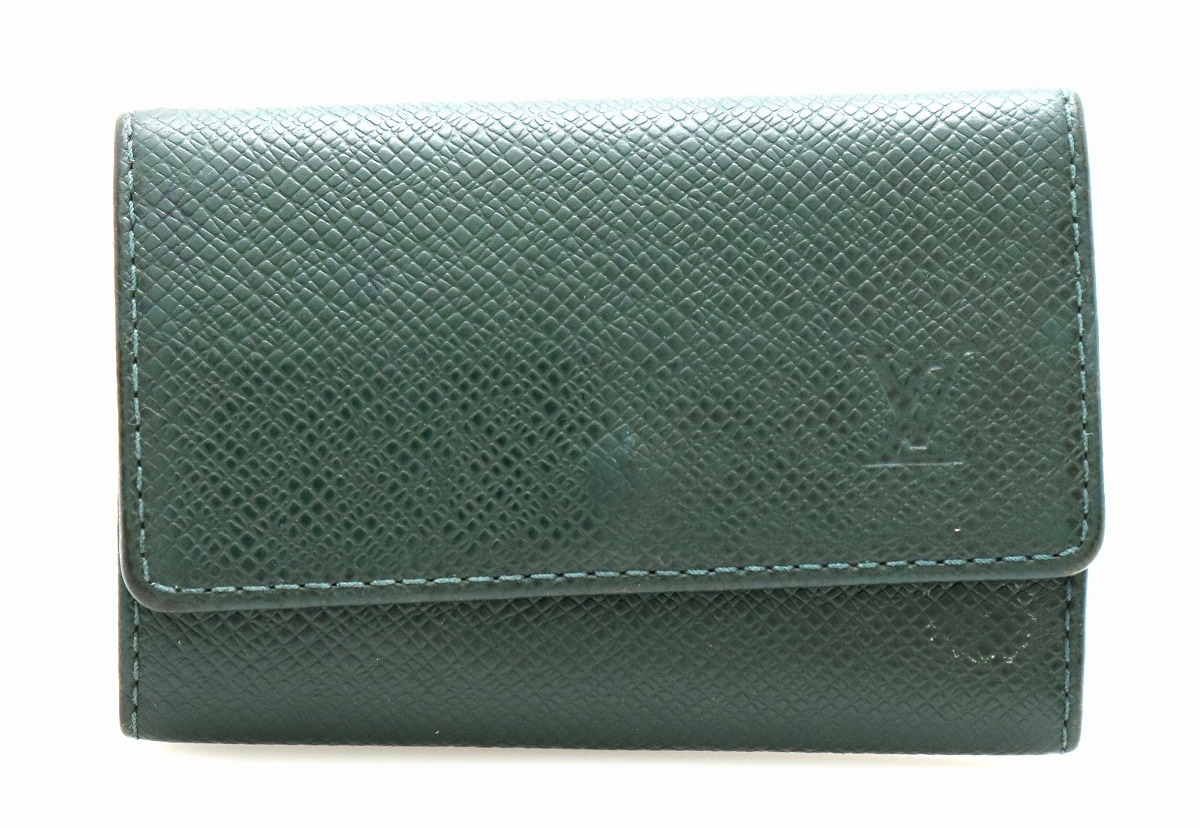

ルイヴィトン キーケース 6連キーケース ミュルティクレ6 タイガ レザー

(税込) 送料込み

商品の説明

商品説明

男性でも女性でもご愛用頂ける、鍵等を6本収納できるキーリングがついた機能性と高級感あるルイヴィトンのスマートでシンプルなおしゃれキーケースはモノグラムやエピ等でも展開されていて、誕生日プレゼントやクリスマスのギフト・父の日や母の日のお祝いの贈り物・ホワイトデーやバレンタインデーのサプライズとしても喜ばれています。※ICチップが確認出来兼ねる商品となりますのでご理解ある方のみ宜しくお願いします。

ブランドLOUISVUITTONルイヴィトン

商品名ミュルティクレ6

ラインタイガ

素材[外側]タイガレザー

[内側]カーフレザー

型番M30500

製造番号***1*1(2011年製)

英字2桁数字4桁

製造国フランス・スペイン・イタリアのいずれか

(※まれにUSAもございます)

カラー[全体]ノワール(ブラック)

[金具]シルバー

形状6連キーケース

性別メンズ/レディース

サイズ約:横10.3cm×高さ7cm×マチ1.5cm

機能ホック開閉

6連キーリング

フリーポケット×1

付属品純正箱/保存袋

素人保管・中古品の為、目立つ箇所の記載は致しておりますが、その他気になる個所ございましたらお申し付けください。

お値下げ希望・ご質問ございましたらご気軽にコメントください。

※今後もお品物追加予定ですので、フォローしていただけると嬉しいです(^ω^)

27390円ルイヴィトン キーケース 6連キーケース ミュルティクレ6 タイガ レザーメンズファッション小物楽天市場】ルイヴィトン キーケース 6連キーケース ミュルティクレ6エピセア素材ラインLOUIS VUITTON ミュルティクレ6 6連キーケース

ルイヴィトン ミュルティクレ6 キーケース タイガ ブラック

ルイヴィトン louis vuitton タイガ ミュルティクレ6 キーケース

楽天市場】ルイヴィトン キーケース 6連キーケース ミュルティクレ6

ルイヴィトン M30500 タイガ ミュルティクレ6 キーケース メンズ

ルイヴィトン louis vuitton タイガ ミュルティクレ6 キーケース

ルイヴィトン ミュルティクレ6 キーケース タイガ ブラック

ルイヴィトン ミュルティクレ6 キーケース タイガ ブラック

ルイ ヴィトン ミュルティクレ6 6連キーケース タイガ グリズリ M30538

お買得 ルイ・ヴィトン タイガ ミュルティクレ6 キーケース | www.ouni.org

ルイ ヴィトン キーケース 6連キーケース ミュルティクレ6 タイガ

良品】ルイヴィトン ミュルティクレ 6連キーケース タイガ M30532

ルイヴィトンM30500☆タイガ☆ミュルティクレ6☆キーケース-

LOUIS VUITTON ルイヴィトン 6連 キーケース ミュルティクレ6 ルイ

ルイヴィトン LOUIS VUITTON タイガ ミュルティクレ6 6連 キーケース

ルイ ヴィトン キーケース 6連キーケース ミュルティクレ6 タイガ

未使用品】ルイヴィトン◇ミュルティクレ◇タイガ◇4連キーケース◇黒-

Amazon | (ルイヴィトン) ルイ・ヴィトン キーケース M30500 LOUIS

美品】ルイヴィトン タイガ ミュルティクレ6 6連キーケース エピセア-

人気の雑貨がズラリ! ルイヴィトン 6連キーケース タイガ

ルイヴィトン タイガ ミュルティクレ 6 6連キーケース レザー

ルイヴィトン タイガ ミュルティクレ6 6連キーケース M30500 商品の

楽天市場】【5%OFF】 ルイヴィトン キーケース 6連キーケース

LOUIS VUITTON - 新品同様美品 LOUIS VUITTON ルイヴィトン

LOUIS VUITTON - ルイヴィトン タイガ ミュルティクレ キーケース6連の

Amazon | (ルイヴィトン) ルイ・ヴィトン キーケース M30500 LOUIS

LOUIS VUITTON - ルイヴィトン ミュルティクレ6 タイガ キーケース

プレゼント対象商品 ルイ Louis ヴィトン ルイ・ヴィトン 贅沢

ルイヴィトン キーケース タイガ ミュルティクレ6 - キーケース

美品】ルイヴィトン☆ タイガ ノワール ミュルティクレ6 キーケース

ヴィトン(LOUIS VUITTON) タイガ キーケース(レディース)の通販 92点

バッグと財布 ルイヴィトン タイガ レザー6連キーケース タイガ レザー

美品 ルイ ヴィトン タイガ ミュルティクレ6 キーケース メンズ M305

ルイヴィトン 6連キーケース ミュルティクレ6タイガ アルドワーズ

ルイヴィトン louis vuitton タイガ ミュルティクレ6 キーケース

LOUIS VUITTON(ルイヴィトン) / ミュルティクレ6_タイガ_BLK/レザー

ルイヴィトン LOUIS VUITTON キーケース ミュルティクレ 6 エピ タイガ

未使用 ルイヴィトン タイガ ミュルティクレ6 6連キーケース エピセア-

楽天市場】LOUIS VUITTON ルイ ヴィトン タイガ ミュルティクレ6 6連

ルイヴィトン 6連キーケース エピ ミュルティクレ6 レザー 18年製 黒

商品の情報

メルカリ安心への取り組み

お金は事務局に支払われ、評価後に振り込まれます

出品者

スピード発送

この出品者は平均24時間以内に発送しています