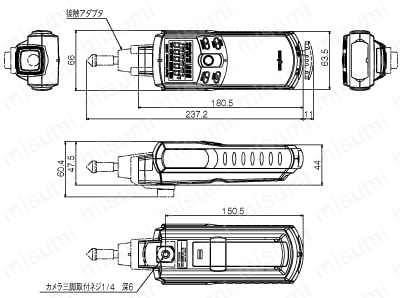

デジタルハンディタコメータ 小野測器 HT-5500

(税込) 送料込み

商品の説明

商品説明

本体に大きな目立つ傷はありません。(小傷少しあります)備品はすべて揃っています。

以下メーカーWebサイトより

回転速度測定範囲6.0~99999r/min-低速回転から高速回転までをカバーするワイドレンジ

■Loレンジ6.0~600.0r/min(小数点1桁表示)

■Hiレンジ6~99999r/min

接触・非接触どちらでも測定できる両用タイプ

メモリー機能によりMax20データを保存

非接触式でも回転体の直径を設定するだけで、周速度測定が可能

(接触式は周速リングを装着<KS-100/200>で可)

積算回転数のカウントが可能(接触式では1回転1カウント・非接触式では1反射マーク1カウントで99999までカウント)

アナログ出力・パルス出力を標準装備

■アナログ出力0~1V/0~F.S(F.S.は任意設定可)、10bitD/A変換

■パルス出力Hi:+4.5V以上、Lo:+0.5V以下

■AC電源にて使用可能(ACアダプタPB-7090使用時)

※ACアダプタは付属しません。

■回転速度・周期・周速度の最大値・最小値のホールド機能

16500円デジタルハンディタコメータ 小野測器 HT-5500その他その他Amazon.co.jp: 小野測器 ディジタルハンディタコメータ HT-5500 〈接触ハンディタコメータ HT-5500

小野測器 HT-5500 接触・非接触式両用ハンディタコメータ | 回転計タコ

計測器ワールド(日本電計株式会社) / HT-5500型 デジタルハンディ

Amazon.co.jp: 小野測器 ディジタルハンディタコメータ HT-5500 〈接触

小野測器 HT-5500 接触・非接触式両用ハンディタコメータ | 回転計タコ

ONO SOKKI - HT-5500 Handheld Digital Tachometer

小野測器 ディジタルハンディタコメータ(接触/非接触両用・多機能型・アナログ/パルス出力付) HT-5500 1台(直送品)

ハンディタコメータ HT-5500 | 小野測器 | MISUMI(ミスミ)

HT-5500 接触・非接触両用式ディジタルハンディタコメータ 小野測器

Amazon.co.jp: 小野測器 アドバンストハンディタコメータ FT-7200

小野測器 - HR-6800デジタルハンディタコメータ(高速タイプ)

ハンディタコメータ HT-5500 | 小野測器 | MISUMI(ミスミ)

小野測器 HT-6200 外部センサ入力型ハンディタコメータ(エンジン/モータ回転計)

レンタル期間10日】 小野測器 デジタルハンドタコメータ HT5500 10日

デジタルハンドタコメータ HT-5500のレンタルなら|測定器のレックス

接触・非接触両用ハンドタコメーター HT-5500のレンタル - 回転計なら

小野測器:ディジタルハンディタコメータ (接触式) HT-3200 自動車

小野測器 ディジタルハンディタコメータ(非接触式・汎用液晶表示) HT

小野測器 ディジタルハンディタコメータ HT-4200 〈非接触タイプ〉-

接触・非接触両用ハンドタコメーター HT-5500|非破壊検査器|測量機

デジタルハンドタコメーター HT-5500 - 測定器レンタルのアスコム

小野測器 HT-3200 接触式ハンディタコメータ | 回転計タコメーター

小野測器 ディジタルハンディタコメータ HT-4200 〈非接触タイプ〉-

小野測器 HT-5500 接触・非接触式両用ハンディタコメータ | 回転計タコ

株式会社小野測器 デジタルハンディタコメータ HT-3200/HT-4200/HT-5500

デジタルハンドタコメーター HT-5500 - 測定器レンタルのアスコム

正規品 HT-5500 デジタルハンディタコメータ 1台(直送品) ディジタル

HT-5500 ディジタルハンドタコメータ|レンタル|計測器|SMFLレンタル

小野測器 非接触式 回転計 ハンドタコメータ HT-4100 - その他

セール価格で販売 [1] ☆ ONOSOKKI/小野測器 デジタルハンドタコメータ

ディジタルハンドタコメーターHT-5500(信号ケーブル付)-

デジタルハンドタコメータ HT-5100のレンタルなら|測定器のレックス

ディジタルハンドタコメーターHT-5500(信号ケーブル付)-

デジタルハンディタコメータ 小野測器 HT-5500 - www.sorbillomenu.com

販売注文 デジタルハンディタコメータ 小野測器 HT-5500 - その他

小野測器 ディジタルハンディタコメータ HT-3200 〈接触タイプ

接触・非接触両用ハンドタコメーター HT-5500のレンタル - 回転計なら

小野測器:ディジタルハンディタコメータ (接触式) HT-3200 自動車

接触・非接触両用ハンドタコメーター HT-5500のレンタル - 回転計なら

販売注文 デジタルハンディタコメータ 小野測器 HT-5500 - その他

商品の情報

メルカリ安心への取り組み

お金は事務局に支払われ、評価後に振り込まれます

出品者

スピード発送

この出品者は平均24時間以内に発送しています

![セール価格で販売 [1] ☆ ONOSOKKI/小野測器 デジタルハンドタコメータ](https://auctions.c.yimg.jp/images.auctions.yahoo.co.jp/image/dr000/auc0412/users/812351b90ac19dc6c9877774324b4460905c3a27/i-img1200x900-1702628113pxsm3i48881.jpg)