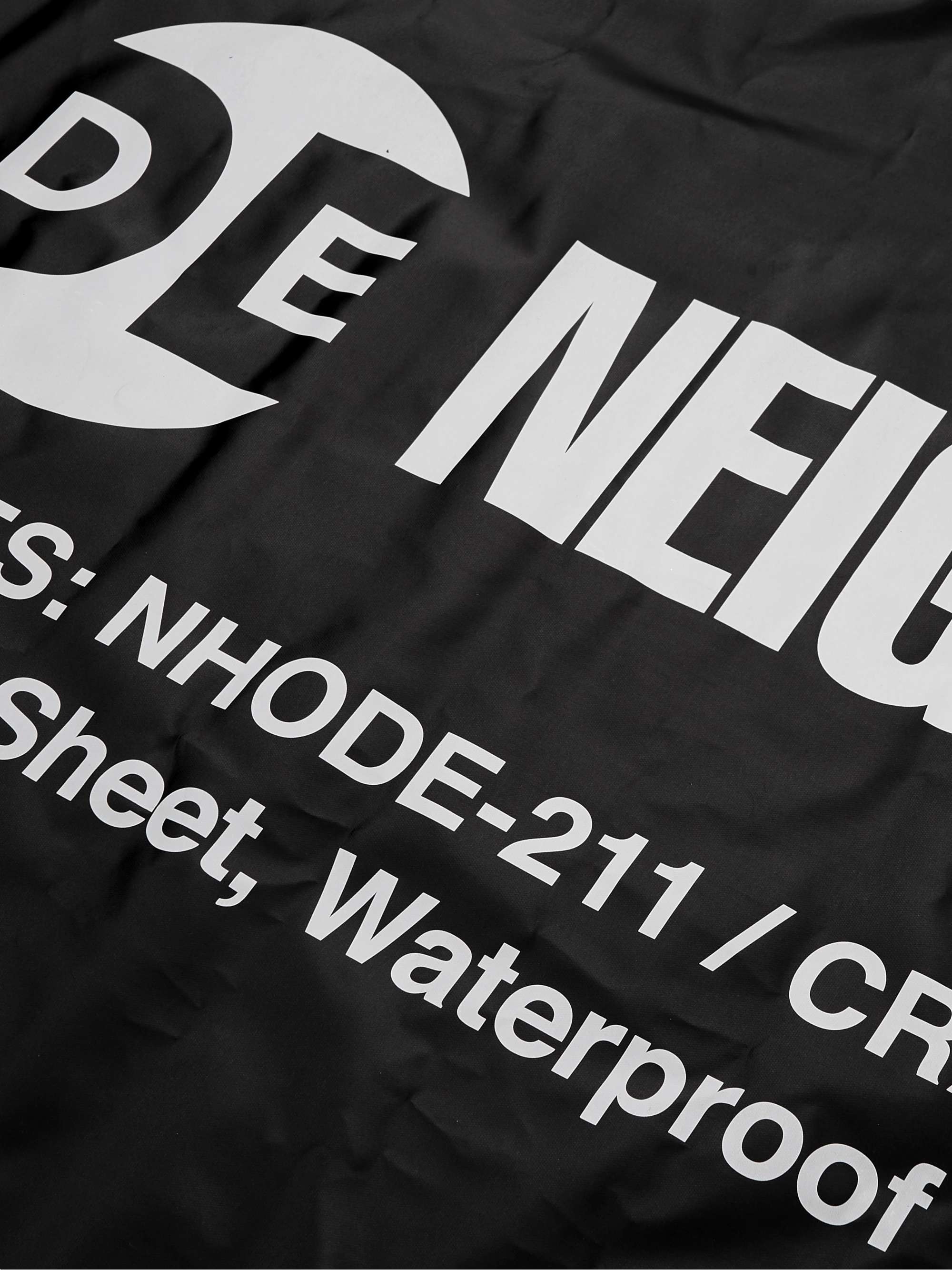

ネイバーフッド グランドシート CI / P-GROUND SHEET

(税込) 送料込み

商品の説明

商品説明

サイズF(1200mm×1860mm)カラーブラック

Neighborhoodネイバーフッド

CI/P-GROUNDSHEETグラウンドシート

受注生産の完全限定品。

防水性に優れたPVC素材のグランドシート。

フロアサイドに付属のスナップボタンとベルクロを使う事で縁が立ち上がり、水や泥などの侵入を防ぐ。

テントの下や前室に敷くだけでなく、リビングシートとしても使用可能。

10920円ネイバーフッド グランドシート CI / P-GROUND SHEETスポーツ/アウトドアアウトドアNEIGHBORHOOD「CI / P-GROUND SHEET」シート-NEIGHBORHOOD「CI / P-GROUND SHEET」シート-

NEIGHBORHOOD「CI / P-GROUND SHEET」シート-

NEIGHBORHOOD CI / P-GROUND SHEET横18602000㎜縦 - その他

NEIGHBORHOOD「CI / P-GROUND SHEET」シート-

NEIGHBORHOOD CI P-GROUND SHEET BLACK - その他

送料無料 NEIGHBORHOOD CI P-GROUND SHEET ネイバーフッド グラウンド

NEIGHBORHOOD CI / P-GROUND SHEET横18602000㎜縦 - その他

OUTDOOR EQUIPMENT CI / P-GROUND SHEET - pakalanainn.com

NEIGHBORHOOD CI / P-GROUND SHEET横18602000㎜縦 - その他

18602000HEIGHTNEIGHBORHOOD「CI / P-GROUND SHEET」シート - テント

アウトドアNEIGHBORHOOD CI / P-GROUND SHEET グランドシート

ネイバーフッド グランドシート-

18602000HEIGHTNEIGHBORHOOD「CI / P-GROUND SHEET」シート - テント

通販卸値 NEIGHBORHOOD CI / P-GROUND SHEET BLACK - アウトドア

NEIGHBORHOOD CI / P-GROUND SHEET ネイバーフッド - アウトドア

NEIGHBORHOOD CI / P-GROUND SHEET横18602000㎜縦

売れ筋ランキングも掲載中! NEIGHBORHOOD CI style Groundsheet

NEIGHBORHOOD CI / P-GROUND SHEET ネイバーフッド - アウトドア

ネイバーフッド グランドシート CI / P-GROUND SHEETスポーツ

NEIGHBORHOOD CI / P-GROUND SHEET - zapmed.com.br

ネイバーフッド グランドシート-

NEIGHBORHOOD CI / P-GROUND SHEET ネイバーフッド - アウトドア

NEIGHBORHOOD CI / P-GROUND SHEET BLACKその他

ネイバーフッド グランドシート-

NEIGHBORHOOD「CI / P-GROUND SHEET」シート-

NEIGHBORHOOD - NEIGHBORHOOD 「CI / P-GROUND SHEET」の通販 by yes

ネイバーフッド グランドシート CI / P-GROUND SHEET - その他

正規取扱サイト ネイバーフッド CI / P-GROUND SHEET グランドシート

ネイバーフッド グランドシート-

お買得な商品 ネイバーフッド グランドシート CI / P-GROUND SHEET

通販大特価 NEIGHBORHOOD CI / P-GROUND SHEET | barstoolvillage.com

NEIGHBORHOOD - NEIGHBORHOOD CI / P-GROUND SHEET グランドシートの

Yahoo!オークション - 【新品正規】21ss NEIGHBORHOOD CI /

NEIGHBORHOOD CI / P-GROUND SHEET ネイバーフッド - アウトドア

NEIGHBORHOOD - NEIGHBORHOOD CI / P-GROUND SHEET グランドシートの

正規取扱サイト ネイバーフッド CI / P-GROUND SHEET グランドシート

ネイバーフッド グランドシート-

日本公式通販サイト NEIGHBORHOOD P-GROUND SHEET ネイバーフッド

ネイバーフッド グランドシート-

NEIGHBORHOOD CI P-GROUND SHEET BLACK - その他

商品の情報

メルカリ安心への取り組み

お金は事務局に支払われ、評価後に振り込まれます

出品者

スピード発送

この出品者は平均24時間以内に発送しています