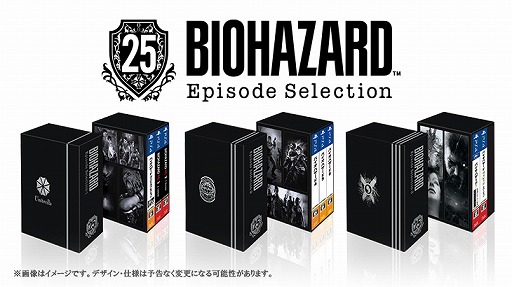

バイオBOX (付属SSカードなし) 25バッグ

(税込) 送料込み

商品の説明

商品説明

箱に破れと汚れがあり、送料無料で発送は24時間以内で行います。商品によっては全てのダメージを抜粋して掲載する事が難しく、掲載された情報以外に細部の破損や汚れ、欠品、劣化の進行などの見落としがある場合がございます。

※完璧なお品をお求めの方、恐れ入りますがご購入をお控え頂けますようお願い申し上げます。返品不可、ノークレームノーリターンでお願いします。

16500円バイオBOX (付属SSカードなし) 25バッグ その他その他バイオBOX (付属SSカードなし) 25バッグ - www.sorbillomenu.comバイオBOX (付属SSカードなし) 25バッグ - www.sorbillomenu.com

バイオBOX (付属SSカードなし) 25バッグ - www.sorbillomenu.com

バイオBOX (付属SSカードなし) 25バッグ - www.sorbillomenu.com

バイオBOX (付属SSカードなし) 25バッグ - www.sorbillomenu.com

バイオBOX (付属SSカードなし) 25バッグ - www.sorbillomenu.com

バイオBOX (付属SSカードなし) 25バッグ - www.sorbillomenu.com

その他バイオBOX (付属SSカードなし) 25バッグ - その他

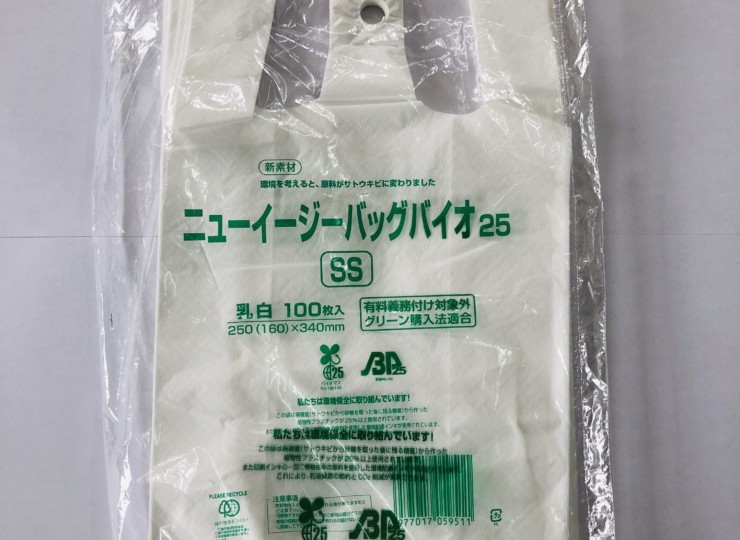

楽天市場】ニューイージーバッグ バイオ25 SSサイズ 乳白(100枚)福助

バイオBOX (付属SSカードなし) 25バッグ | annagrant.de

楽天市場】ニューイージーバッグ バイオ25 SSサイズ 乳白(100枚)福助

バイオ25ニューイージーバッグS | 高崎包装

シリーズ25周年を記念する豪華7枚組CD-BOX「BIOHAZARD SOUND CHRONICLE

バイオ」25周年記念タイトル「バイオハザード RE:バース」OBT開催決定

個数限定販売 バイオBOX (付属SSカードなし) 25バッグ

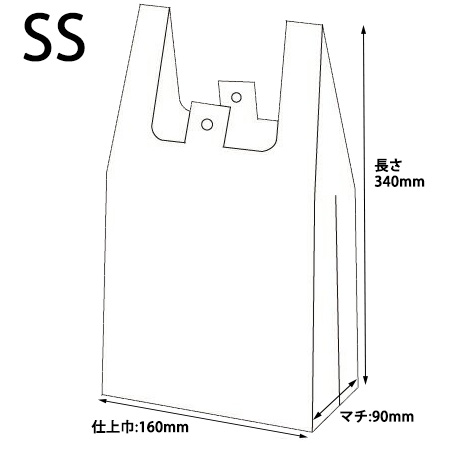

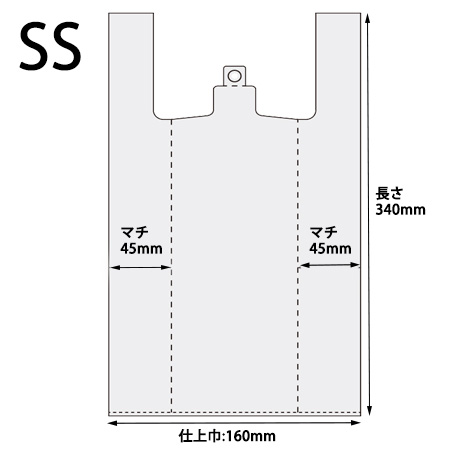

バイオマスレジ袋 ニューイージーバッグバイオ25 SS 半透明 福助工業

バイオマスレジ袋 ニューイージーバッグバイオ25 SS 半透明 福助工業

バイオ25ニューイージーバッグSS

イージーバッグランチバイオ25ベージュ(弁当袋) EGランチバイオ25ベージュ SS 1色刷 15600

バイオハザード」シリーズ25周年記念,ナンバリング作品のパッケージ

福助工業 ニューイージーバッグバイオ25 レジ袋(乳白)バイオマス25

福助工業 ニューイージーバッグバイオ25 レジ袋(乳白)バイオマス25

Holle(ホレ)Bio やぎの粉ミルクSTEP1 (生後0日) 2箱

福助工業 ニューイージーバッグバイオ25 レジ袋(乳白)バイオマス25

楽天市場】ニューイージーバッグ バイオ25 SSサイズ 乳白(100枚)福助

バイオハザード」,アンブレラの新たな入浴剤「ブルーハーブ

イージーバッグランチバイオ25ベージュ(弁当袋)|オリジナルネーム

福助工業 ニューイージーバッグバイオ25 レジ袋(乳白)バイオマス25

楽天市場】ニューイージーバッグ バイオ25 SSサイズ 乳白(100枚)福助

バイオハザード RE:4」がセール初登場で25%オフ! 各オンラインストア

レジ袋(バイオマス25%配合)|オリジナルネーム入れは名入れスタイル

Amazon.co.jp: Mop Mob 漏れない、医療用グレード バイオハザード廃棄

楽天市場】ニューイージーバッグ バイオ25 SSサイズ 乳白(100枚)福助

BOX)ポケモンカードゲーム スカーレット&バイオレット 拡張パック

福助工業 ニューイージーバッグバイオ25 レジ袋(乳白)バイオマス25

Amazon.co.jp: ポケモンカードゲーム スカーレット&バイオレット 拡張

6000枚・3箱】レジ袋 SSサイズ (白) ハッピーバッグ (ブロック付き

BOX未開封)ポケモンカードゲーム スカーレット&バイオレット 拡張

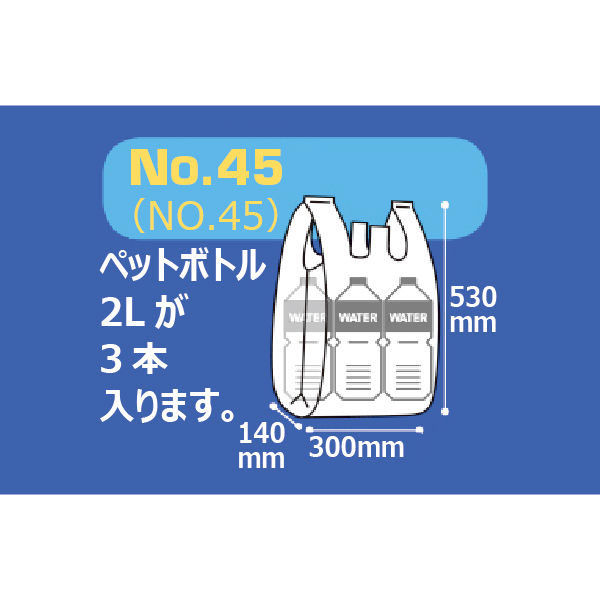

100枚】レジ袋 バイオ25 ランチ 乳白 【無料配布可】 SS 20x32(22)x横

BOX未開封)ポケモンカードゲームBW 拡張パック リューズブラスト(20

福助工業 ニューイージーバッグバイオ25 レジ袋(乳白)バイオマス25

商品の情報

メルカリ安心への取り組み

お金は事務局に支払われ、評価後に振り込まれます

出品者

スピード発送

この出品者は平均24時間以内に発送しています