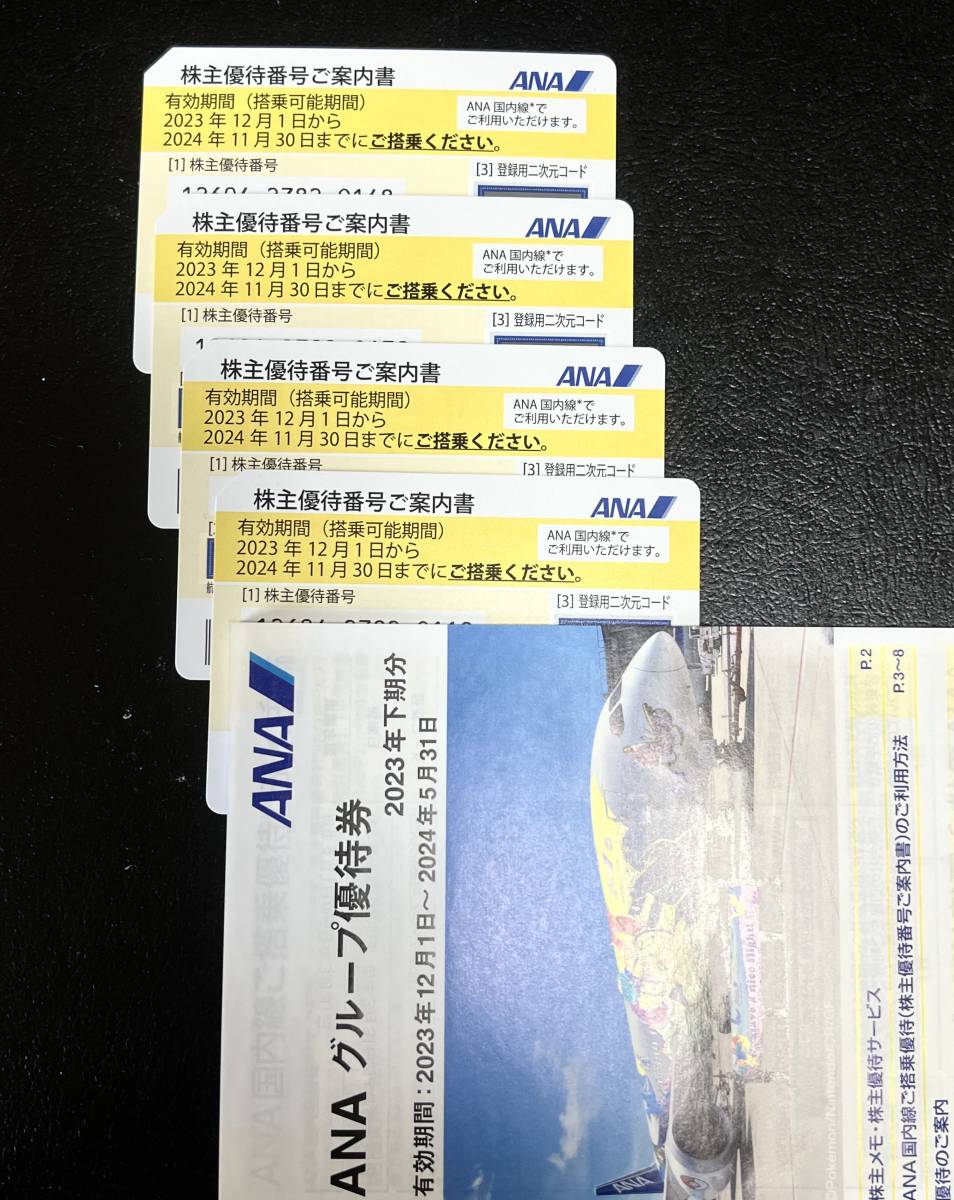

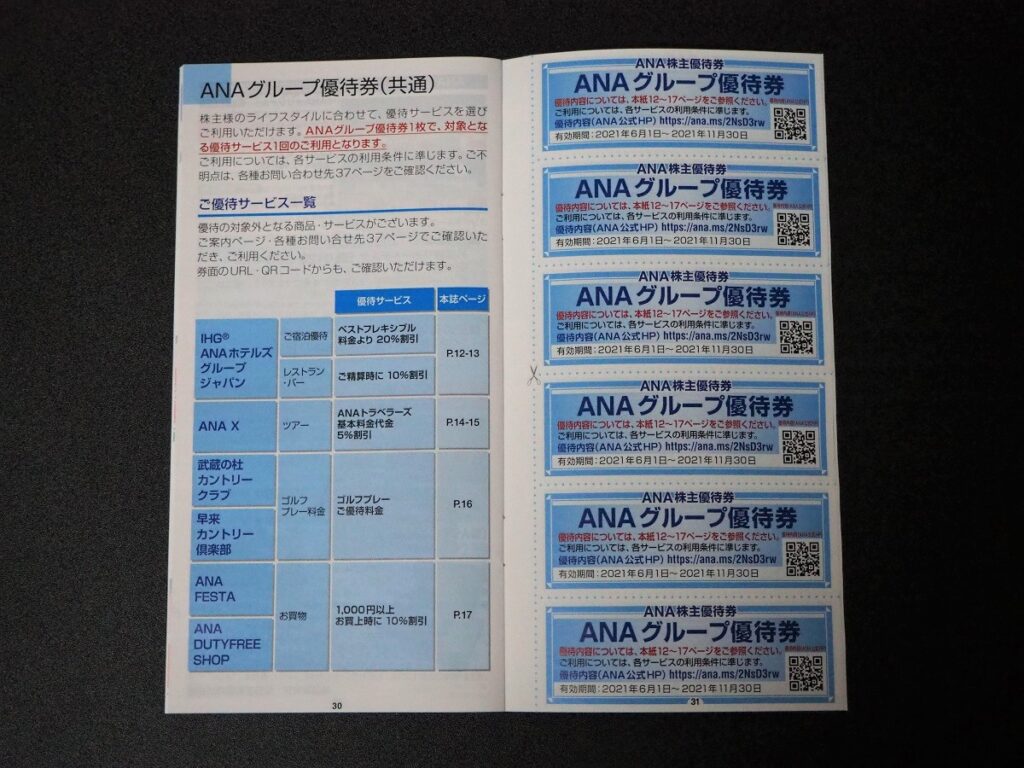

ANA株主優待券4枚+グループ優待券冊子

(税込) 送料込み

商品の説明

商品説明

写真の物が全てです。有効期間2023.12.1〜2024.11.30になります。

NCNRでお願いいたします。

6650円ANA株主優待券4枚+グループ優待券冊子チケット優待券/割引券スクエアリーフ」 ANA株主優待 4枚 + グループ優待券1冊 匿名配送ANA株主優待 4枚+グループ優待冊子-

日本公式品 ANA 株主優待ご優待 4枚+グループ優待券冊子 | rachmian.com

室外機 ANA株主優待券4枚、グループ優待券冊子 | medicalzonemangohill

スクエアリーフ」 ANA株主優待 4枚 + グループ優待券1冊 匿名配送

最新】ANA株主優待4枚+ANAグループ優待1冊その他 - その他

お取扱店 ANA株主優待(ピンク色)4枚セット+グループ優待冊子1冊

新作情報 ANA株主優待券4枚+グループ優待券冊子 | yourmaximum.com

送料無料価格 ANA 株主優待券 搭乗券4枚+小冊子(グループ優待券

公認ストア ANA株主優待券4枚 と グループ優待券冊子 | president.gov.mt

オンラインストア売り ANA株主優待券4枚+冊子1冊

ANAグループ株主優待チケット - その他

話題の行列 ANA株主優待券4枚+グループ優待券 4枚➕グループ優待券1冊

即納即納 ANA株主優待券4枚とグループ優待券冊子

値下げ値打ち ANA株主優待券4枚+冊子付き | skien-bilskade.no

人気商品を安く販売 ANA株主優待券4枚➕ANAグループ優待券 | www

ANA株主優待券4枚+グループ優待券 航空券 購入半額 | planetrail.us

全日空 ANA 株主優待券 4枚 グループ優待券 7枚-

現品販売 ANAの株主優待番号案内書4枚とANAグループ優待券冊子1冊です

日本正規品 ANA 株主優待券 4枚 + グループ優待券 1冊 | artfive.co.jp

その他ANA 株主優待 4枚+冊子 - その他

見つけた人ラッキー! ANA 株主優待 4枚+グループ優待券 | president

比較 ANA 株主優待券4枚と優待冊子【最新】 | yigitaluminyumprofil.com

ショッピング半額 ANA株主優待券4枚 冊子一冊 | artfive.co.jp

値下・値下げ ANA株主優待券4枚、優待冊子1冊

全日空 ANA 株主優待 4枚、グループ優待優待券 - その他

ANA株主優待 4枚+グループ優待冊子-

anaANA株主優待 4枚 冊子 - dsgroupco.com

比較 ANA 株主優待券4枚と優待冊子【最新】 | yigitaluminyumprofil.com

期限切れ ANA 株主優待券2枚,グループ優待券4枚 | www.butiuae.com

売れ筋ランキングも掲載中! ANA 株主優待券4枚+グループ優待券

☆超目玉】 ANA 株主優待券 4枚 グループ優待券 1冊 | www.artfive.co.jp

若者の大愛商品 ANA株主優待 4枚 ANAグループ優待券 2024.11.30 航空券

ANA株主優待 4枚+グループ優待冊子-

ANA株主優待 & 優待冊子その他 - その他

直販 ANA株主優待券4枚+グループ優待券1冊 | artfive.co.jp

日本製送料無料 ANA 株主優待券 4枚+冊子 | www.ancientvalley.ge

ANA 株主優待券4枚+グループ優待券1冊の通販 by くれっち's shop|ラクマ

送料無料・半額 【送料込】ANA/全日空株主優待券4枚+グループ優待券

半額クーポン配布中 ANA 株主優待券6枚 グループ優待券の冊子1冊 | www

チケットANA 株主優待搭乗2枚、グループ優待冊子2部 - その他

商品の情報

メルカリ安心への取り組み

お金は事務局に支払われ、評価後に振り込まれます

出品者

スピード発送

この出品者は平均24時間以内に発送しています