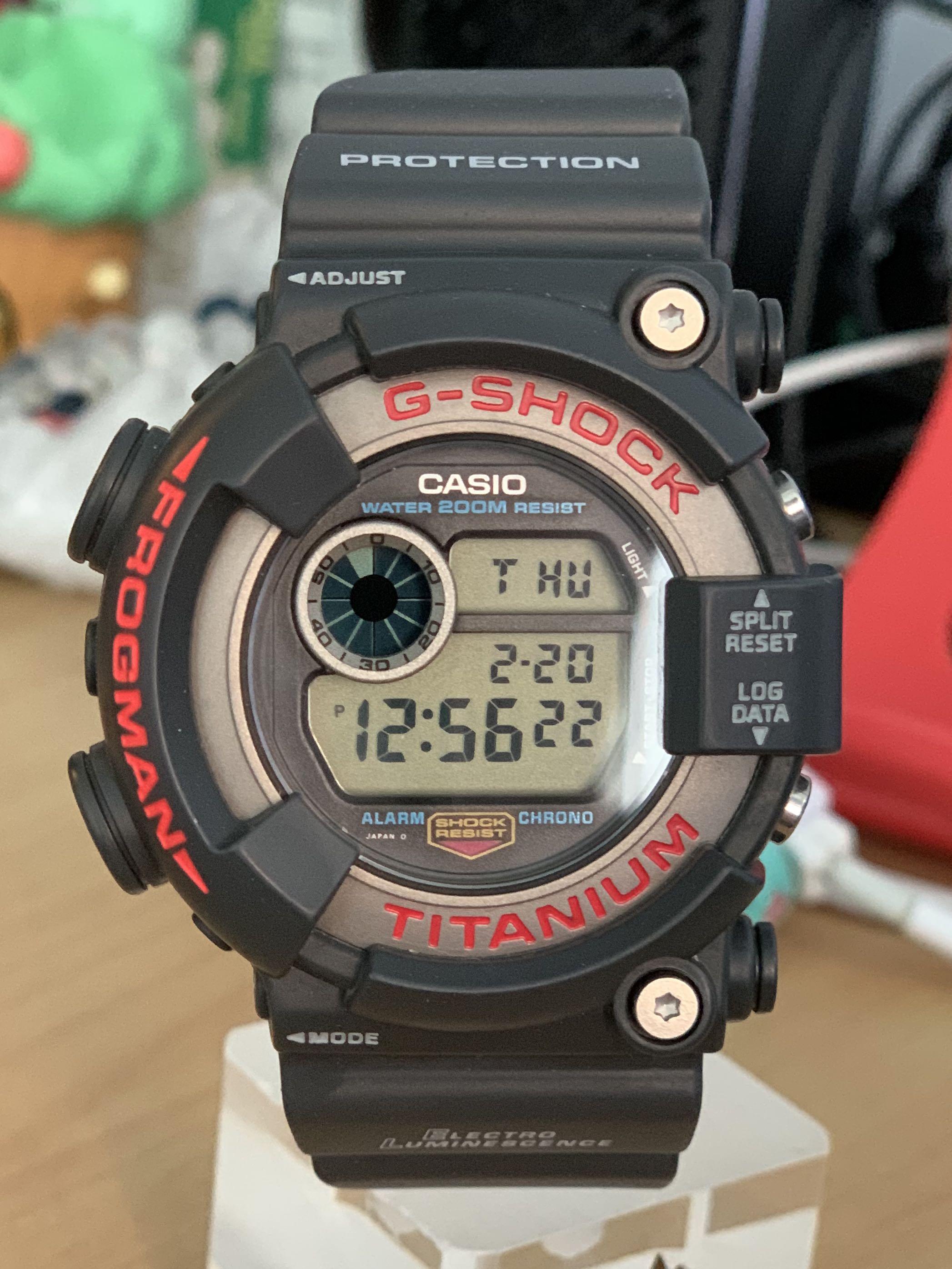

■美品■ CASIO G-SHOCK DW-8200-1A FROGMAN

(税込) 送料込み

商品の説明

商品説明

ご覧いただきありがとうございます♪♦︎美品♦︎CASIOG-SHOCKDW-8200-1AFROGMAN

2代目FROGMAN

数年前にベゼル、ベルト、電池交換済み

以降着用なく保管庫で保管

スレ、キズなく

年代物ですが状態は良いです

コレクションに如何でしょう^_^

※細かい質問、極端な値引き交渉にはお答え出来かねますのでご了承ください^_^

※中古品、自宅保管にご理解いただき、ご購入を宜しくお願い致します^_^

8775円■美品■ CASIO G-SHOCK DW-8200-1A FROGMANメンズ時計全新现货卡西欧G-SHOCK FROGMAN DW-8200-1A原年初版二代蛙人限量-TaobaoCasio G-shock Frogman DW-8200-1A 2nd Generation Model Quartz 47.5

Casio G-shock Frogman DW-8200-1A 2nd Generation Model Quartz 47.5

カシオ腕時計グレーDW-8200-1A FROGMAN G-SHOCK-日本代購代Bid第一

全新现货卡西欧G-SHOCK FROGMAN DW-8200-1A原年初版二代蛙人限量-Taobao

カシオ腕時計グレーDW-8200-1A FROGMAN G-SHOCK-日本代購代Bid第一

Casio G-Shock DW-8200-1A FROGMAN Black Quartz Fast Shipping Fedex From Japan

□美品□ CASIO G-SHOCK DW-8200-1A FROGMAN - 時計

Casio G-shock Frogman DW-8200-1A 2nd Generation Model Quartz 47.5

楽天市場】G-SHOCK ジーショック CASIO カシオ 腕時計 DW-8200-1A

カシオ腕時計グレーDW-8200-1A FROGMAN G-SHOCK-日本代購代Bid第一

Casio G-shock Frogman DW-8200-1A 2nd Generation Model Quartz 47.5

casio g shock Frogman DW-8200-1A, 名牌, 手錶- Carousell

CASIO卡西歐】GW-8230NT-4 30周年慶限量紅蛙人太陽運動潮流能腕錶50.3

Casio G SHOCK 1995 THE FIRST TITANIUM FROGMAN ISO200m DW-8200-1A

カシオ腕時計グレーDW-8200-1A FROGMAN G-SHOCK-日本代購代Bid第一

期間限定 ☆Gショック DW-8200 美品!カシオG-SHOCK 腕時計 カシオ

□美品□ CASIO G-SHOCK DW-8200-1A FROGMAN - 時計

カシオ G-SHOCK DW-8200 フロッグマン

G-SHOCK 2代目 フロッグマン DW-8200-1A【電池交換済】 - 腕時計(デジタル)

CASIO G-SHOCK カシオ G-ショック DW-8200-1A FROGMAN フロッグマン

Pin on Watches

極美品 希少G-SHOCK DW-8200-1A FROGMANフロッグマン 2代目モデル

極美品 希少G-SHOCK DW-8200-1A FROGMANフロッグマン 2代目モデル

☆CASIO G-SHOCK DW-8200 フロッグマン☆イエロー文字-

Casio G shock Frogman DW-8200-1A, 名牌, 手錶- Carousell

カシオ腕時計グレーDW-8200-1A FROGMAN G-SHOCK-日本代購代Bid第一

カシオ G-SHOCK DW-8200 フロッグマン

Casio G SHOCK 1995 THE FIRST TITANIUM FROGMAN ISO200m DW-8200-1A

CASIO G-SHOCK カシオ G-ショック DW-8200-1A FROGMAN フロッグマン

☆CASIO G-SHOCK DW-8200 フロッグマン☆イエロー文字-

G-SHOCK - CASIO G-SHOCK フロッグマン DW-8200の+inforsante.fr

Casio G-Shock DW-8200-1A FROGMAN | eBay

G-SHOCK FROGMAN DW-8200 |商品番号:2100205252469 - 買取王国

極美品 希少G-SHOCK DW-8200-1A FROGMANフロッグマン 2代目モデル

カシオ G-SHOCK DW-8200 フロッグマン

世界的に有名な rw-1770) G-SHOCK DW-8200 FROGMAN イルクジモデル

未使用 極美品 CASIO G-SHOCK DW-8200 フロッグマン グレー

初売り 未使用 極美品 CASIO G-SHOCK G-SHOCK DW-8200 DW-8200Z動作

CASIO G-SHOCK フロッグマン DW-8200状態について - 腕時計(デジタル)

限定販売 CASIO G-SHOCK DW-8200 FROGMAN(t) | skien-bilskade.no

商品の情報

メルカリ安心への取り組み

お金は事務局に支払われ、評価後に振り込まれます

出品者

スピード発送

この出品者は平均24時間以内に発送しています