【WHITE】TOTAL LUXURY SPA / SEA THE SOUND LONG SLEEVE

(税込) 送料込み

商品の説明

商品説明

メーカー希望小売価格:18,700円(税込)【商品詳細】

・商品名:TOTALLUXURYSPA/SEATHESOUNDLONGSLEEVE

・性別タイプ:メンズ

・原産国:アメリカ製

・素材:コットン100%

・サイズ:M、L、XL

・クリーニング:

・品番:75-10-0146-984(JA2091)

【サイズ詳細】

サイズ|着丈|肩幅|身幅|そで丈

M|70.9cm|49.1cm|52.7cm|64.5cm

L|77.4cm|50.8cm|57.3cm|69.5cm

XL|79.0cm|55.3cm|61.0cm|69.5cm

【商品説明】

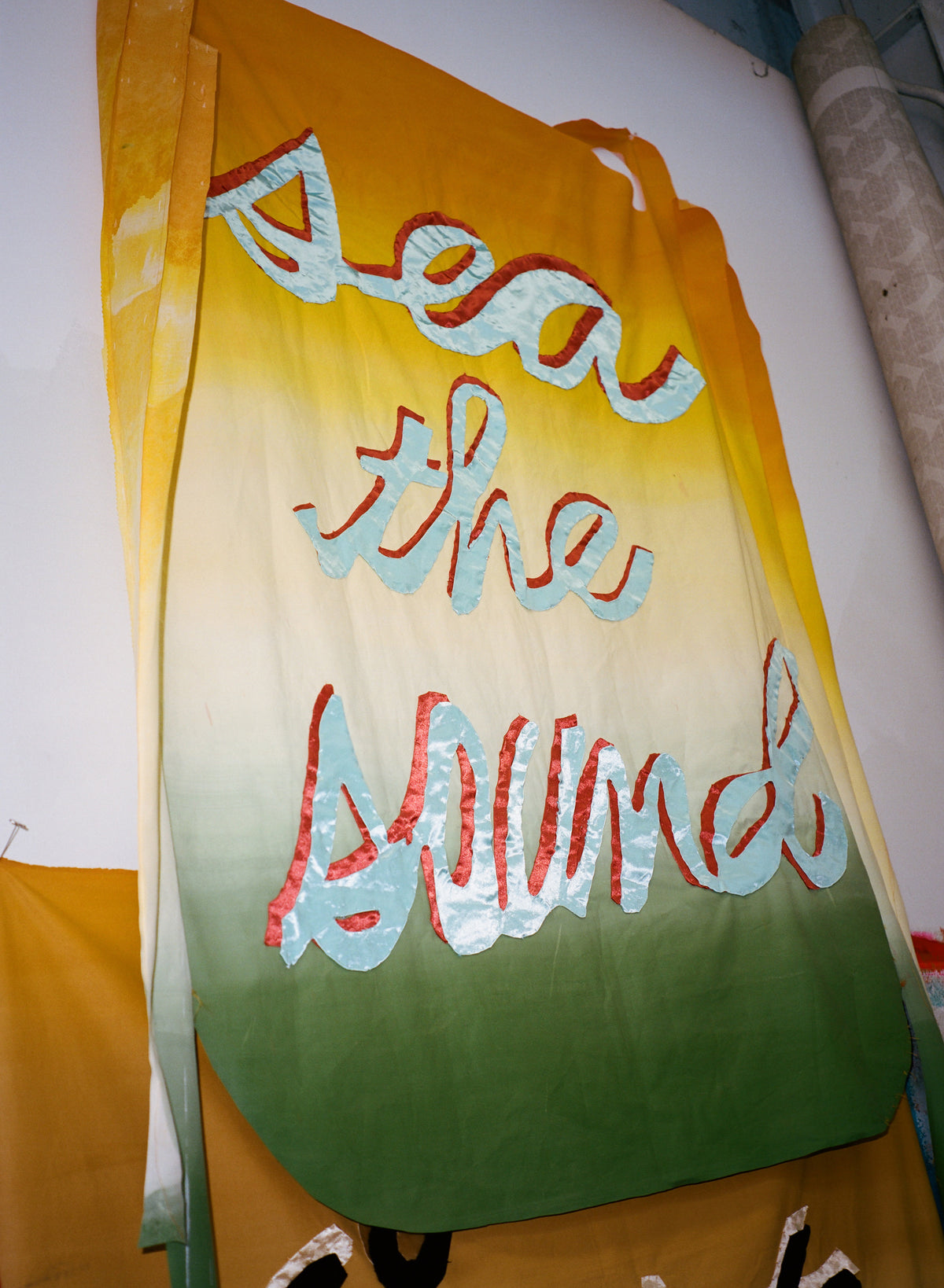

アーティストシリーズ

■デザイン/ディテール

左胸のプリントと袖のプリント、背中の中央に大きなアートワークを配置したロングスリーブTシャツ。

■素材

着心地が良いコットン100%

■メーカー品番

SPA_A5001

TotalLuxurySpa/トータルラグジュアリースパ

ロサンゼルスに拠点を置くクリエイティブスタジオ<CommonwealthProjects>から生まれたブランドであり、実験的プラットフォーム。過去の事実よりインスピレーションを受け、そこから新たな物語を作りだし、ウェア・出版物・オブジェクトに落とし込む事で、ロスのリアルを体現したブランド。<CommonwealthProjects>では、ヘディスリマンやSonosとのプロジェクト等も行っている。

【よくあるお問い合わせ】

※配送方法について

日本郵便(宅配便またはポスト投函便)、佐川急便(宅配便)でのお届けとなります。

※納期・発送予定について

取り寄せ商品等、発送までお時間を頂く商品もございます。「発送日の目安」をご確認のうえご購入ください。

※在庫確保について

同時刻に同商品の注文が集中した場合等、在庫が確保できない場合がございます。

※キャンセルについて

ご購入後のお客様のご都合によるキャンセルは、システム上承れませんのでよくご確認のうえご購入ください。

※商品仕様について

現物の写真を追加でアップする等、記載以上の商品情報のご質問を頂きましても対応できかねます。

メーカー希望小売価格は、楽天市場「商品価格ナビ」に登録されている価格に準じています。

こちらの商品はラクマ公式パートナーの楽天グループ株式会社のRakutenFashionによって出品されています。

7293円【WHITE】TOTAL LUXURY SPA / SEA THE SOUND LONG SLEEVEその他その他CAULEEN SMITH x TOTAL LUXURY SPA - SEA THE SOUND - L/S TEE - WHITECAULEEN SMITH x TOTAL LUXURY SPA - SEA THE SOUND - L/S TEE - WHITE

Cauleen Smith Sea The Sound Longsleeve T-Shirt White

CAULEEN SMITH x TOTAL LUXURY SPA - SEA THE SOUND - L/S TEE - WHITE

CAULEEN SMITH x TOTAL LUXURY SPA - SEA THE SOUND - L/S TEE - WHITE

CAULEEN SMITH x TOTAL LUXURY SPA - SEA THE SOUND - L/S TEE - WHITE

BEAMS T(ビームスT)【アウトレット】TOTAL LUXURY SPA / SEA THE

CAULEEN SMITH x TOTAL LUXURY SPA - SEA THE SOUND - L/S TEE - WHITE

Total Luxury Spa Long-sleeve t-shirts for Men | Online Sale up to

CAULEEN SMITH x TOTAL LUXURY SPA - OPEN WIDE - L/S TEE - WHITE

TOTAL LUXURY SPA x SLAM JAM – WHITE L/S TEE

CAULEEN SMITH x TOTAL LUXURY SPA - SEA THE SOUND - L/S TEE - WHITE

BEAMS OUTLET|TOTAL LUXURY SPA / SEA THE SOUND LONG SLEEVE

Total Luxury Spa | Los Angeles CA

CAULEEN SMITH x TOTAL LUXURY SPA - SEA THE SOUND - L/S TEE - WHITE

BEAMS OUTLET|TOTAL LUXURY SPA / SEA THE SOUND LONG SLEEVE

Total Luxury Spa | Los Angeles CA

KAOS / QUEST - L/S TEE - WHITE – Total Luxury Spa

Total Luxury Spa | Los Angeles CA

ID MAGAZINE X TOTAL LUXURY SPA - ULTRA! - S/S TEE - WHITE – Total

BEAMS OUTLET|TOTAL LUXURY SPA / SEA THE SOUND LONG SLEEVE

T-shirt

CAULEEN SMITH x TOTAL LUXURY SPA - OPEN WIDE - L/S TEE - WHITE

BEAMS OUTLET|TOTAL LUXURY SPA / SEA THE SOUND LONG SLEEVE

WHITE】TOTAL LUXURY SPA / I WHO HAVE NOTHING LONG SLEEVE-

PARADISE SPA - S/S - WHITE – Total Luxury Spa

Kelsey Lu stars in LA streetwear label Total Luxury Spa's new

Best Luxury Hotel Spas | goop

ID MAGAZINE X TOTAL LUXURY SPA - ULTRA! - S/S TEE - WHITE – Total

TOTAL LUXURY SPA | White Men's T-shirt | YOOX

PARADISE SPA - S/S - WHITE – Total Luxury Spa

Total Luxury Spa | Los Angeles CA

DO YOU SEE? - S/S TEE - WHITE

DO YOU SEE? - S/S TEE - WHITE

TOTAL LUXURY SPA | White Men's T-shirt | YOOX

TOTAL LUXURY SPA x SLAM JAM – DISCHARGE DYE L/S TEE

Total Luxury Spa Long-sleeve t-shirts for Men | Online Sale up to

DENISE REIN - TOTAL LUXURY SPA L/S TEE - BLACK – Total Luxury Spa

ID MAGAZINE X TOTAL LUXURY SPA - ULTRA! - S/S TEE - WHITE – Total

Total Luxury Spa — Open Dialogue

CAULEEN SMITH x TOTAL LUXURY SPA - SEA THE SOUND - L/S TEE - WHITE

商品の情報

メルカリ安心への取り組み

お金は事務局に支払われ、評価後に振り込まれます

出品者

スピード発送

この出品者は平均24時間以内に発送しています