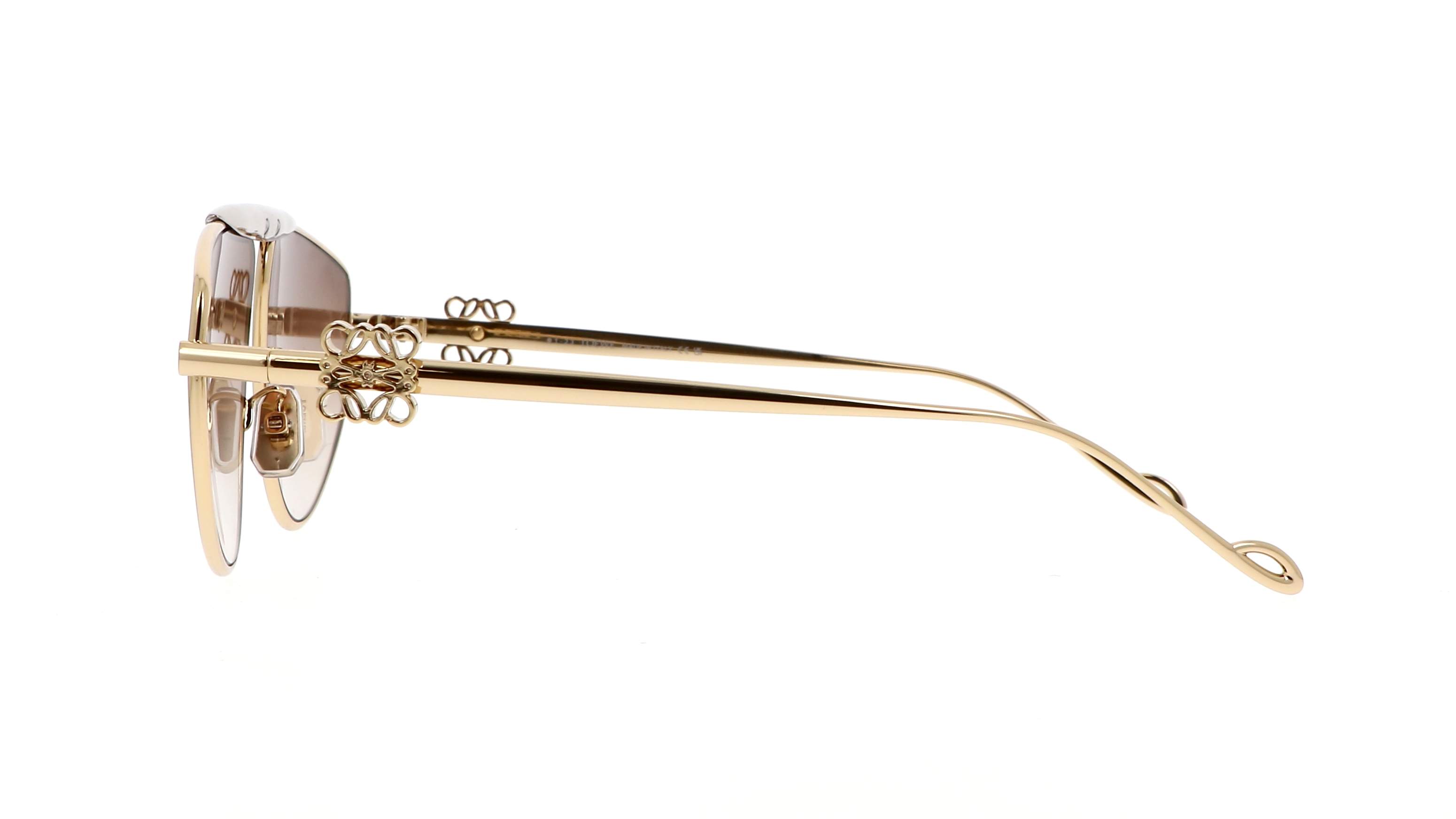

LOEWE ロエベ Puzzle Irregular-Frame Sunglasses LW40011U サングラス アイウェア ゴールド

(税込) 送料込み

商品の説明

商品説明

【ブランド】LOEWE(ロエベ)【品名】PuzzleIrregular-FrameSunglassesLW40011Uサングラスアイウェアゴールド

【対象】メンズ

【表記サイズ】89□3

【実寸】フロントフレーム幅:14.0センチレンズ高さ:5センチレンズ幅:6.8センチ

【素材表記】表記無し

【原産国】イタリア製

【カラー】ゴールド

【商品状態】

数回程度の使用感有り

【商品番号】2023L120022

【ランク】SA

【付属品】写真に写っているものがすべてです。

【備考】ー

※ランク説明

N…新品同様~未使用品

S…未使用品

A…使用感の少ない比較的状態の良い中古品

B…使用感がありダメージや汚れが見受けられる中古品

C…汚れやダメージが多数見受けられる中古品(難あり品)

≪注意事項はプロフィール欄をご覧くださいませ。≫

こちらの商品はラクマ公式パートナーのBRINGによって出品されています。

13200円LOEWE ロエベ Puzzle Irregular-Frame Sunglasses LW40011U サングラス アイウェア ゴールドメンズファッション小物楽天市場】LOEWE(ロエベ) サイズ:89□3 Puzzle Irregular-FrameLOEWE - LOEWE ロエベ Puzzle Irregular-Frame Sunglasses LW40011U

楽天市場】LOEWE(ロエベ) サイズ:89□3 Puzzle Irregular-Frame

LOEWE - LOEWE ロエベ Puzzle Irregular-Frame Sunglasses LW40011U

楽天市場】LOEWE(ロエベ) サイズ:89□3 Puzzle Irregular-Frame

LOEWE - LOEWE ロエベ Puzzle Irregular-Frame Sunglasses LW40011U

LOEWE - LOEWE ロエベ Puzzle Irregular-Frame Sunglasses LW40011U

Lw40011u Puzzle Irregular-frame Sunglasses In Gold

Lw40011u Puzzle Irregular-frame Sunglasses In Gold

2024年最新】ロエベアイウェアの人気アイテム - メルカリ

Loewe LW40116U 30G - US

LW40084U ROUND SUNGLASSES - YELLOW

2024年最新】Yahoo!オークション -ロエベサングラスの中古品・新品・未

2024年最新】ロエベアイウェアの人気アイテム - メルカリ

ロエベ サングラス・メガネ(メンズ)の通販 26点 | LOEWEのメンズを買う

Loewe Spoiler new aviator LW40116U 30F 61-13 Gold

Loewe LW40116U 30G

Loewe Spoiler new aviator LW40116U 30F 61-13 Gold

2024年最新】Yahoo!オークション -「サングラス メンズ ブランド

2024年最新】ロエベアイウェアの人気アイテム - メルカリ

ロエベ サングラス・メガネ(メンズ)の通販 26点 | LOEWEのメンズを買う

LOEWE LW40116U LW 40116U 30G Gold/Mirror Sunglasses 61-13-140 | eBay

LOEWE LW40084U Round Sunglasses | Designer Eyewear Collection

Loewe Double Frame LW40119I 67 Grey & Black Sunglasses | Sunglass

Loewe Spoiler new aviator LW40116U 30F 61-13 Gold

2024年最新】Yahoo!オークション -「サングラス メンズ ブランド

2024年最新】ロエベ サングラスの人気アイテム - メルカリ

ロエベ サングラス・メガネ(メンズ)の通販 26点 | LOEWEのメンズを買う

LOEWE LW40116U LW 40116U 30G Gold/Mirror Sunglasses 61-13-140

LOEWE LW40084U Round Sunglasses | Designer Eyewear Collection

2024年最新】Yahoo!オークション -「サングラス メンズ ブランド

ロエベ サングラス・メガネ(メンズ)の通販 26点 | LOEWEのメンズを買う

2024年最新】ロエベ サングラスの人気アイテム - メルカリ

☆【計5点まとめ】サングラス レイバン DKNY ロエベ 等 セット メンズ

Buy Loewe Sunglasses 'Gold' - LW40067U 6430G | GOAT

LOEWE(ロエベ) アイウェア(メンズ) - 海外通販のBUYMA

Loewe Spoiler new aviator LW40116U 30F 61-13 Gold

楽天市場】ロエベ 中古(眼鏡・サングラス|バッグ・小物・ブランド

LOEWE LW40116U LW 40116U 30G Gold/Mirror Sunglasses 61-13-140 | eBay

ロエベ サングラス・メガネ(メンズ)の通販 26点 | LOEWEのメンズを買う

LOEWE(ロエベ) アイウェア(メンズ) - 海外通販のBUYMA

商品の情報

メルカリ安心への取り組み

お金は事務局に支払われ、評価後に振り込まれます

出品者

スピード発送

この出品者は平均24時間以内に発送しています