【新品】ピーティートリノ デニム PT TORINO DENIM SWING コットン コーデュロイ 5ポケット パンツ ダークピーコック【サイズ31】【メンズ】

(税込) 送料込み

商品の説明

商品説明

■ブランドPTTORINODENIM(ピーティートリノデニム)

■アイテム

コーデュロイパンツ/メンズ

■カラー

ダークピーコック

■素材

コットン98%ポリウレタン2%

■付属品

なし

■仕様/モデル

・秋冬向け・SWING・ルーマニア製・ストレッチ素材・ジッパーフライ・裾ステッチ仕上げ

■コンディション

-

■サイズ

サイズ表記31

ウエスト83cm(平置きにして両端を直線計測した2倍)

股上24cm(股下中央縫い目から前身最上部まで)

股下82.5cm(股下中央縫い目から、裾まで縫い目に沿って計測)

ワタリ28.5cm(股下0cm部分の腿幅を直線計測)

裾幅16cm(裾の両端を直線計測)

※採寸方法における若干の誤差は、ご了承頂きますようお願い致します。

■補足コメント

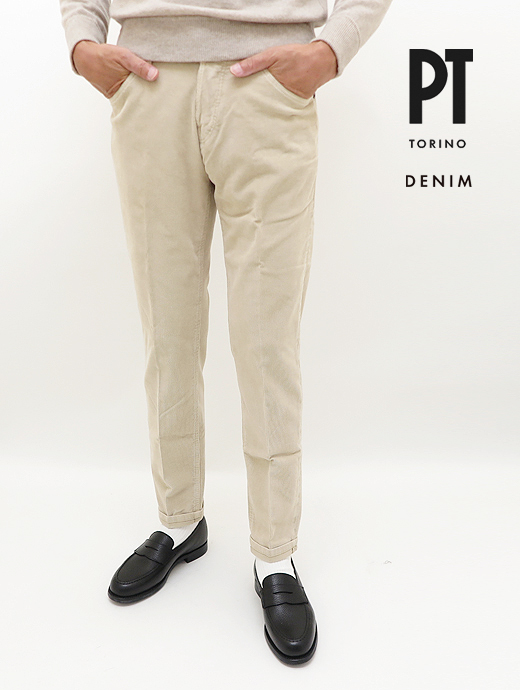

ドライタッチでしなやかな細畝コットンコーデュロイ生地を使用した、SWINGモデルの5ポケットパンツをご紹介。“SWING”モデルはスーパースリムフィットをベースに開発されたNEWSUPERSLIMFITモデルで、細身の美しいシルエットに仕上がっています。ストレッチ性のあるしなやかな生地感で、軽快な穿き心地をお楽しみいただけます。シンプル且つベーシックなデザインで、様々なアイテムとコーディネートできる汎用性の高い1本です。

[商品番号]20011834

こちらの商品はラクマ公式パートナーのRitagliolibro(リタリオリブロ)によって出品されています。

10653円【新品】ピーティートリノ デニム PT TORINO DENIM SWING コットン コーデュロイ 5ポケット パンツ ダークピーコック【サイズ31】【メンズ】メンズパンツ 【769594】 APD楽天市場】【SALE/返品不可】【新品】ピーティートリノ デニム PT

【新品】バグッタ Bagutta カジュアルシャツ, ブラウン【サイズ40】【BRW】【S/S/A/W】【状態ランクN】【メンズ】, 【769594】 APD

新品】ピーティートリノ デニム PT TORINO DENIM SWING コットン

【新品】バグッタ Bagutta カジュアルシャツ, ブラウン【サイズ40】【BRW】【S/S/A/W】【状態ランクN】【メンズ】, 【769594】 APD

新品】ピーティートリノ デニム PT TORINO DENIM SWING コットン

楽天市場】【SALE/返品不可】【新品】ピーティートリノ デニム PT

新品】ピーティートリノ デニム PT TORINO DENIM SWING コットン

B.R.ONLINE - Style Web Magazine & Online Shop | ビー・アール

楽天市場】【新品アウトレット】ピーティートリノ デニム PT TORINO

新品】ピーティートリノ デニム PT TORINO DENIM SWING コットン

PT TORINO DENIM ピーティートリノ デニム SWING デニム ジーンズ

PT TORINO DENIM/ピーティートリノデニム 5ポケットパンツ

【PT TORINO】「DENIM」SWING コーデュロイ5Pパンツ - SUGURU SHOP

PT TORINO DENIM/ピーティートリノデニム 5ポケットパンツ

PT TORINO DENIM ピーティートリノ デニム [秋冬] コーデュロイ

PT TORINO DENIM ピーティートリノ デニム SWING デニム ジーンズ

PT TORINO DENIM/ピーティートリノデニム 5ポケットパンツ

PT TORINO DENIM ピーティートリノ デニム [秋冬] コーデュロイ

B.R.ONLINE - Style Web Magazine & Online Shop | ビー・アール

PT TORINO DENIM ピーティートリノ デニム SWING デニム ジーンズ

PT TORINO DENIM / ピーティートリノデニム / PT05 / SWING / スーパー

Amazon | [ピーティートリノデニム] PT TORINO DENIM 2023年 春夏

B.R.ONLINE - Style Web Magazine & Online Shop | ビー・アール

楽天市場】PT TORINO DENIM【ピーティートリノデニム】デニムパンツ

PT TORINO DENIM ピーティートリノ デニム SWING デニム ジーンズ

Amazon | [ピーティートリノデニム] PT TORINO DENIM 2023年 春夏

PT TORINO DENIM(ピーティートリノデニム)|メンズセレクトショップ

PT TORINO DENIM(ピーティートリノデニム)|メンズセレクトショップ

PT TORINO DENIM ピーティートリノ デニム SWING デニム ジーンズ

PT TORINO DENIM / "SWING" ストレッチコーデュロイパンツ

PT TORINO DENIM(ピーティー トリノ デニム)の公式通販|メンズ

23AW/PT TORINO DENIM / ピーティートリノ デニム/TT31/コーデュロイ

Amazon | [ピーティートリノデニム] PT TORINO DENIM 2023年 春夏

ピーティートリノデニム PT TORINO DENIM JAZZ STRAIGHT FIT

PT TORINO DENIM/ピーティートリノデニム 5ポケットパンツ

PT TORINO(ピーティートリノ)の「<PT TORINO>PT TORINO DENIM

楽天市場】【新品アウトレット】ピーティートリノ デニム PT TORINO

PT TORINO DENIM(ピーティートリノデニム)|PT TORINO DENIM

PT TORINO DENIM ピーティートリノ デニム SWING デニム ジーンズ

INDIE マーブルストレッチコーデュロイパンツ C5ZT01Z00BAS TT31|PT

商品の情報

メルカリ安心への取り組み

お金は事務局に支払われ、評価後に振り込まれます

出品者

スピード発送

この出品者は平均24時間以内に発送しています

![PT TORINO DENIM ピーティートリノ デニム [秋冬] コーデュロイ](https://www.nakagawa1948.co.jp/img/item/tt21-soul/1.png)

![PT TORINO DENIM ピーティートリノ デニム [秋冬] コーデュロイ](https://www.nakagawa1948.co.jp/img/item/tt21-soul/_MG_3466.JPG)

![Amazon | [ピーティートリノデニム] PT TORINO DENIM 2023年 春夏](https://m.media-amazon.com/images/I/51xV5i8T4QL._AC_SX342_.jpg)

![Amazon | [ピーティートリノデニム] PT TORINO DENIM 2023年 春夏](https://m.media-amazon.com/images/I/71lulYKtQfL._AC_UY580_.jpg)

![Amazon | [ピーティートリノデニム] PT TORINO DENIM 2023年 春夏](https://m.media-amazon.com/images/I/61bUd0y3JVL._AC_SL1004_.jpg)