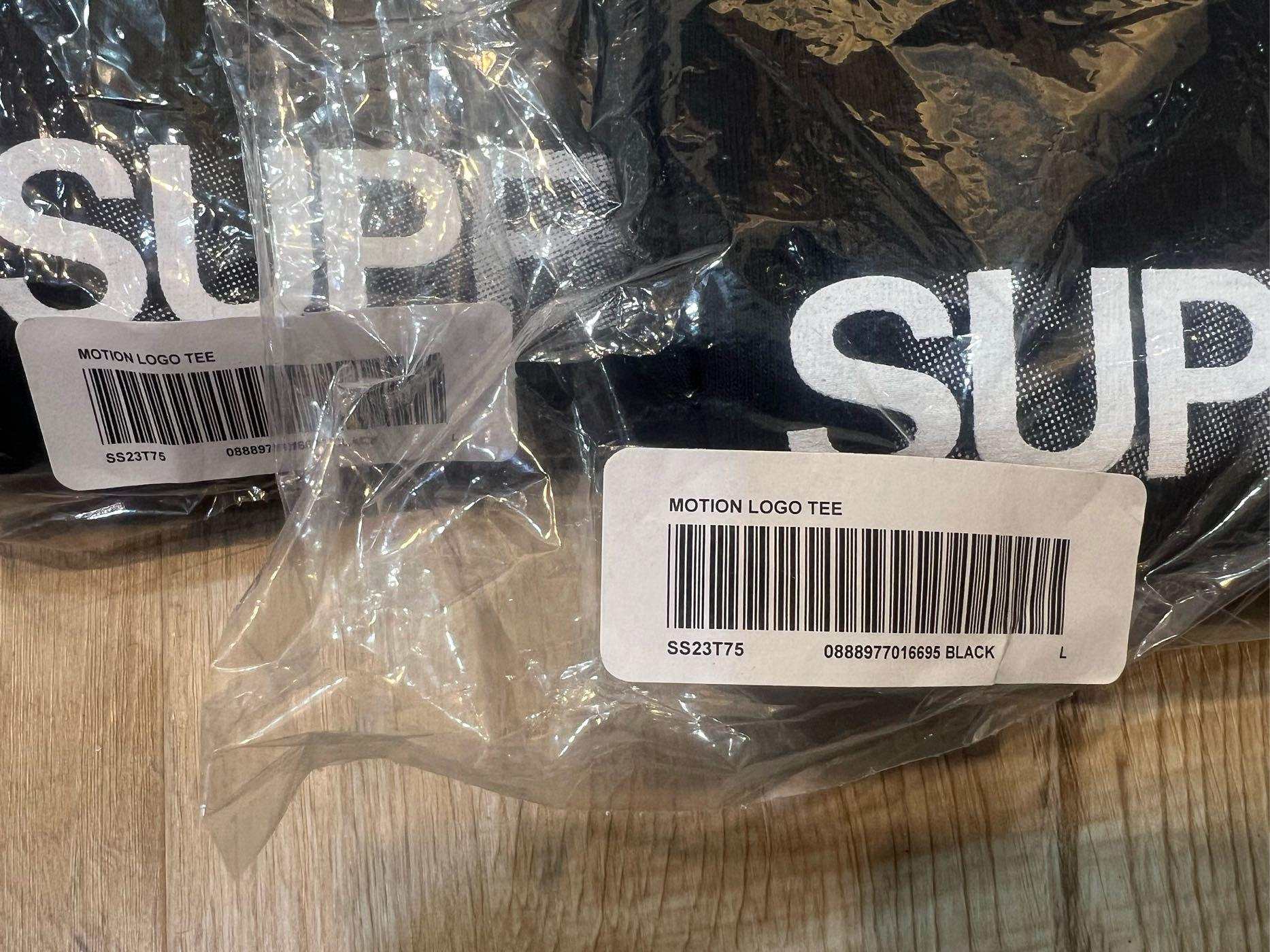

supreme Motion Logo Tee(黒)L

(税込) 送料込み

商品の説明

商品説明

店舗購入品になります。サイズ:L

カラー:黒

レシート、ショッパー、ステッカーもお付け致します。

かんたんラクマパック(日本郵便)での発送を予定しています。

8580円supreme Motion Logo Tee(黒)LメンズトップスSupremeshop状態supreme motion logo tee ash grey - TシャツメンズSUPREME MOTION LOGO TEE BLACK L - Tシャツ/カットソー(半袖/袖

Supreme Motion Logo Tee Black Men's - SS16 - US

SUPREME Motion Logo Tee SS20 Black Size Small | eBay

Supremeshop状態supreme motion logo tee ash grey - Tシャツ

Motion Logo Tee - spring summer 2023 - Supreme

買い取り supreme Motion Logo Tee(黒)L | www.ouni.org

Supreme 20ss Motion Logo Tee 幻影logo短袖T恤黑色- Supreme台灣

SUPREME SWAROVSKI BOX LOGO TEE – UNIQUE HYPE HK

Motion Logo Tee - spring summer 2023 - Supreme

全新真品現貨在台supreme motion logo tee ss23 black 黑色白logo 幻影

Supreme Motion Logo Tee - Black – Grails SF

SUPREME SF BOX LOGO TEE – UNIQUE HYPE HK

SUPREME Motion Logo Tee SS20 Black Size Small | eBay

Supreme Motion Logo Tee (6Colors)

Supreme Motion Logo Tee Black 黒 XL モーション - www.sorbillomenu.com

M Supreme Motion Logo Tee Black 黒 モーション-

製造 Lサイズ supreme Motion Logo Tee black 黒 | www.artfive.co.jp

日貨代購CITY】2023SS Supreme Motion Logo Tee 黑色幻影陰影短T 短袖

Supreme Motion Logo Tee

Supreme motion logo tee - Gem

Supreme motion logo tee Lサイズ シュプリーム 定価販売 Tシャツ

XL) Supreme Motion Logo TeeモーションロゴTシャツ黒 最短・翌日出荷

Lサイズ supreme Motion Logo Tee black 黒 | www.innoveering.net

公式通販| Supreme Motion Logo Tee モーションロゴ Tシャツ 黒L

supreme motion logo tee 黒 L - www.sorbillomenu.com

タッチパネル Supreme Motion Logo Tee White L | writethisproject.com

Supreme Motion Logo Tee (SS20) Dark Green Men's - SS20 - US

日本の人気ファッション Supreme Motion Logo Tee シュプリーム 黒 L

メンズsupreme motion logo tee 黒 L - northwoodsbookkeeping.com

supreme motion Logo tee 黒 L シュプリーム - Tシャツ/カットソー

全新真品現貨在台supreme motion logo tee ss23 black 黑色白logo 幻影

メンズsupreme motion logo TEE Tシャツ 黒 black - Tシャツ

Supreme - L 黒 シュプリーム モーションロゴ Tシャツ Motion Logo Tee

Supreme Motion Logo Tee 黒 サイズL | hartwellspremium.com

店内全品送料無料 Supreme motion logo tee S 黒 | www.takalamtech.com

L Motion Logo Tee black モーションロゴ 黒-

Lサイズ supreme Motion Logo Tee black 黒 | www.innoveering.net

1回着用・送料400円】Supreme Motion Logo Tee S/S White L

激レア】シュプリーム モーションロゴ ワンポイント Tシャツ 黒 白 L-

Supreme Motion Logo Tee Black Lトップス - www.comicsxf.com

商品の情報

メルカリ安心への取り組み

お金は事務局に支払われ、評価後に振り込まれます

出品者

スピード発送

この出品者は平均24時間以内に発送しています