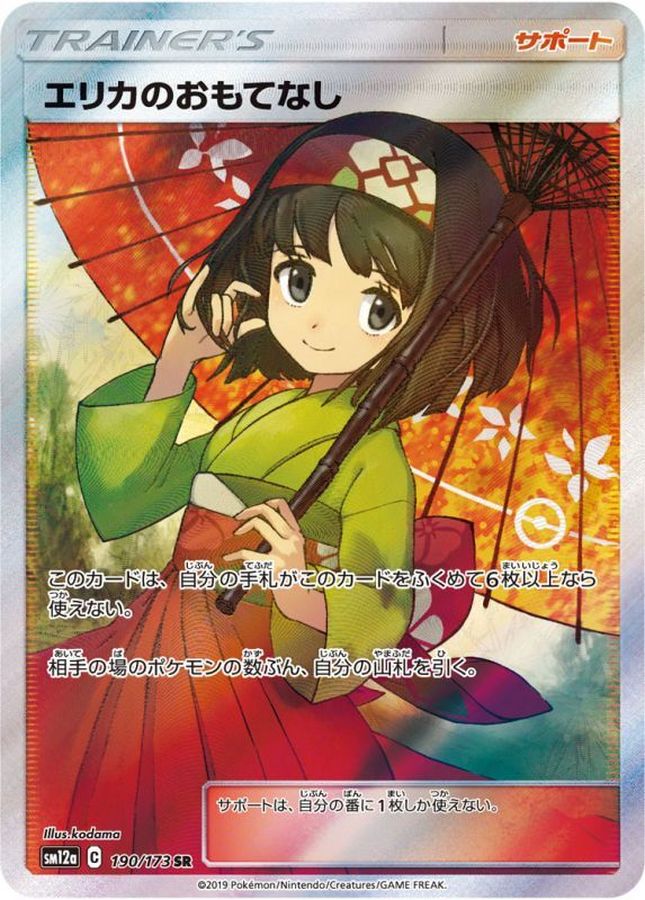

ポケカ エリカのおもてなし SR

(税込) 送料込み

商品の説明

商品説明

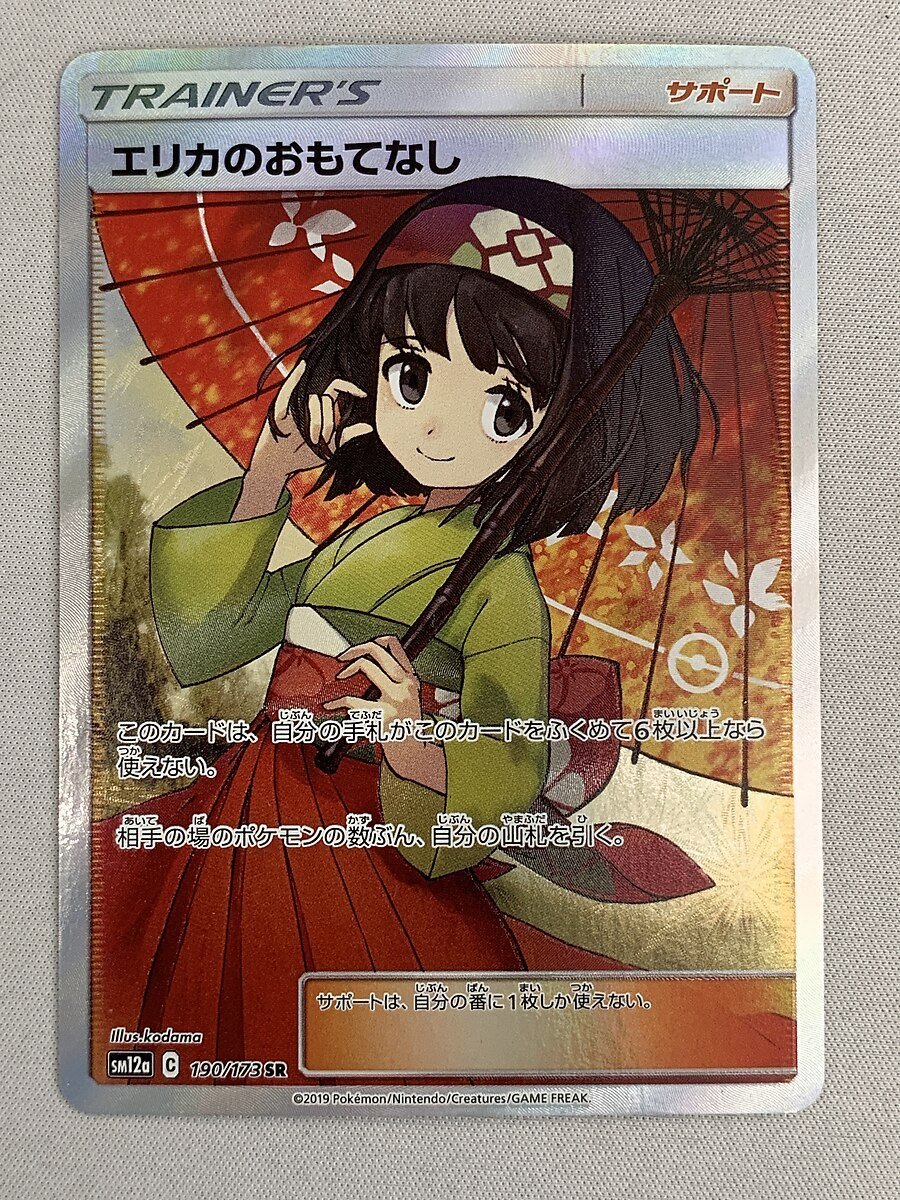

裏によく見ると白欠けがあります。画像の方を良く確認してから購入お願いします。

二重スリーブに入れ、水濡れ、折れ対策して発送させて頂きます

22800円ポケカ エリカのおもてなし SRエンタメ/ホビートレーディングカードポケモンカード エリカのおもてなし sr-エリカのおもてなし【SR】{107/095}

ポケモンカード エリカのおもてなし srトレーディングカード

ポケモンカード エリカのおもてなし srトレーディングカード

ポケモンカード エリカのおもてなし sr-

エリカのおもてなし SR ポケモンカード-

エリカのおもてなし SR-

PSA10】【GEM-MINT】エリカのおもてなしSR-

2024年最新】エリカのおもてなしsrの人気アイテム - メルカリ

2024年最新】ポケモンカード エリカのおもてなしsrの人気アイテム

ポケモンカード エリカのおもてなし srトレーディングカード

オンラインストア販売 ポケカ エリカのおもてなし SR | skien-bilskade.no

エリカのおもてなし(107/095 SR) | SR | ドラゴンスター | ポケモンカード

ポケモンカード エリカのおもてなし SR-

2024年最新】エリカのおもてなしsrの人気アイテム - メルカリ

ポケモン - ⑥ポケカ エリカのおもてなし SR 107/095 高騰の+inforsante.fr

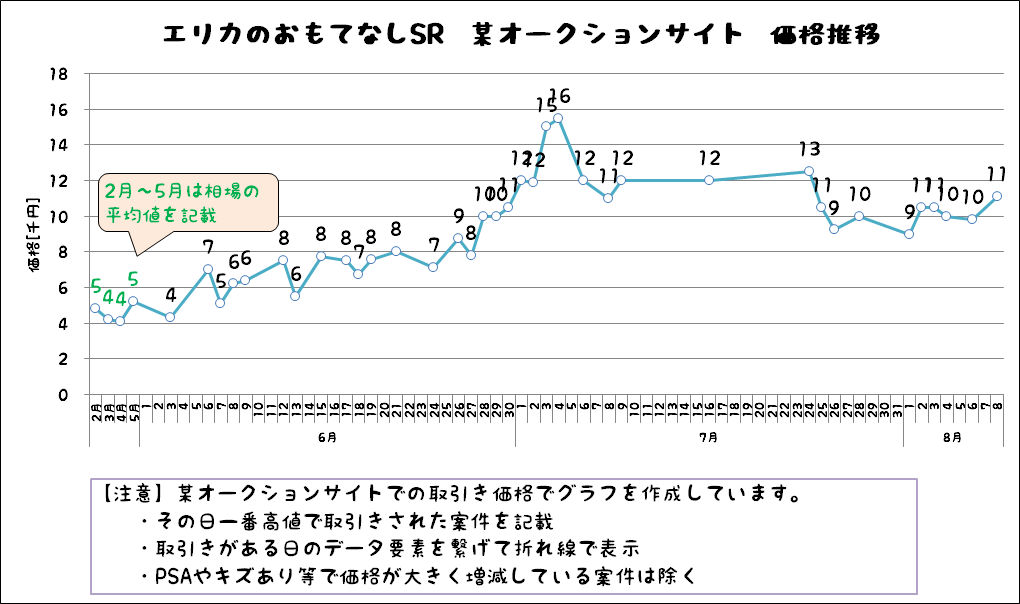

Yahoo!オークション -「エリカのおもてなし sr」の落札相場・落札価格

③ポケカ エリカのおもてなし SR 107/095 高騰-

エリカの招待【SR】{196/165}

大阪のショップ ポケカ エリカのおもてなし SR | artfive.co.jp

2024年最新】エリカのおもてなし sr 美品の人気アイテム - メルカリ

2024年最新】Yahoo!オークション -エリカのおもてなし srの中古品

ポケモンカード エリカのおもてなし abitur.gnesin-academy.ru

エリカのおもてなし SR ポケモンカード サポート 女の子 ポケカ

ポケカ エリカのおもてなし sr-

エリカのおもてなし sr ポケモンカード-

ポケモンカード エリカのおもてなし SRの通販 by プログラマー|ラクマ

参考価格 ポケカ エリカのおもてなし SR | irackeg.com

ポケモンカード エリカのおもてなし SR 買取査定満額 - トレーディング

⑤ポケカ エリカのおもてなし SR 107/095 高騰-

⑤ポケカ エリカのおもてなし SR 107/095 高騰-

エリカ のおもてなし SRのYahoo!オークション(旧ヤフオク!)の相場

2024年最新】エリカのおもてなしsrの人気アイテム - メルカリ

ポケカ エリカ おもてなし SR 2枚セット 【専用】 - トレーディングカード

買取情報『ポケモンカードゲームの【107/095】エリカのおもてなし「SR

ポケカ エリカのおもてなし SR-

ポケモンカード エリカのおもてなし【SR】-

ポケモンカード エリカのおもてなし SRの通販 by プログラマー|ラクマ

ポケモンカード エリカのおもてなし sr 美品-

ポケカ】エリカのおもてなし SR-

ポケモンカード エリカのおもてなし sr-

商品の情報

メルカリ安心への取り組み

お金は事務局に支払われ、評価後に振り込まれます

出品者

スピード発送

この出品者は平均24時間以内に発送しています