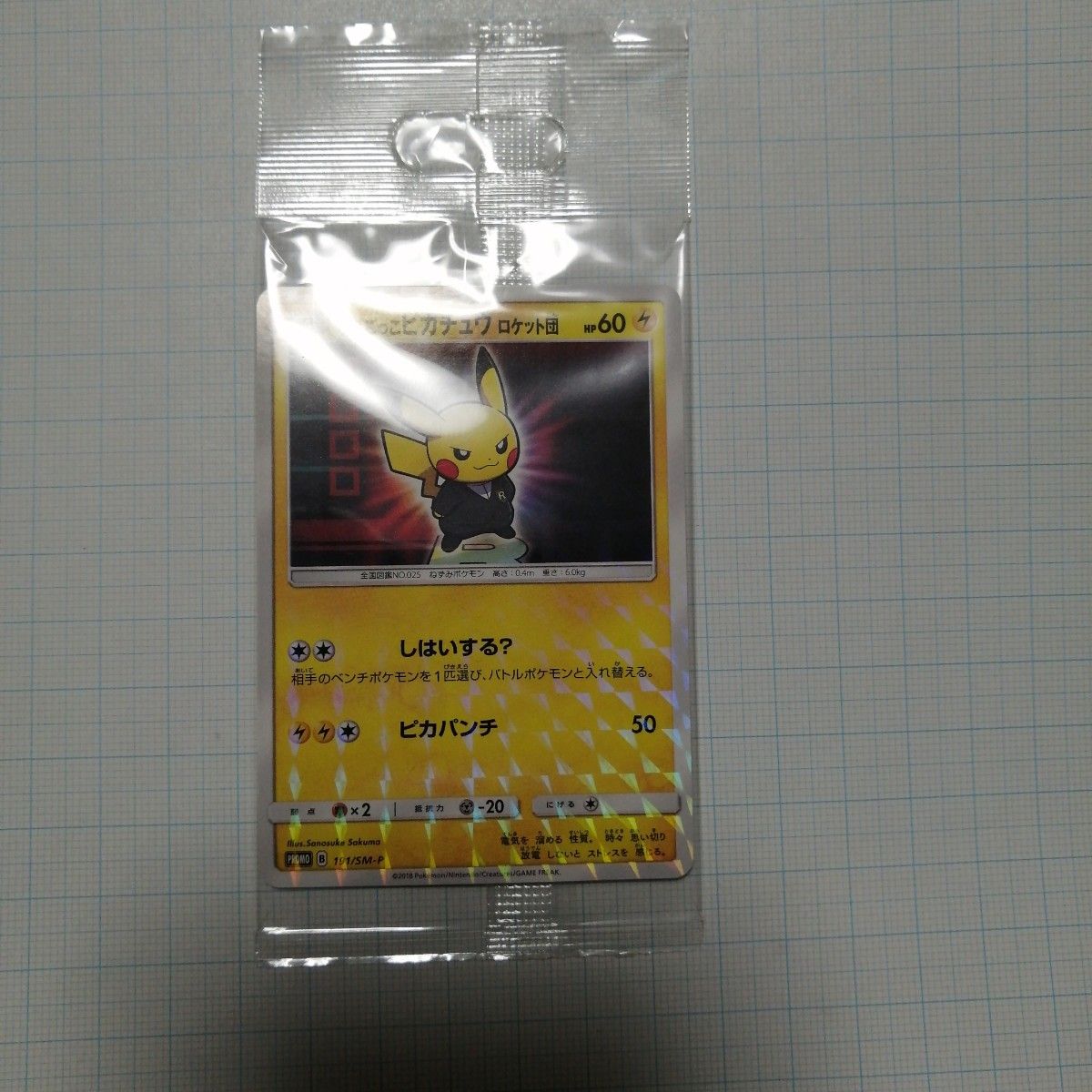

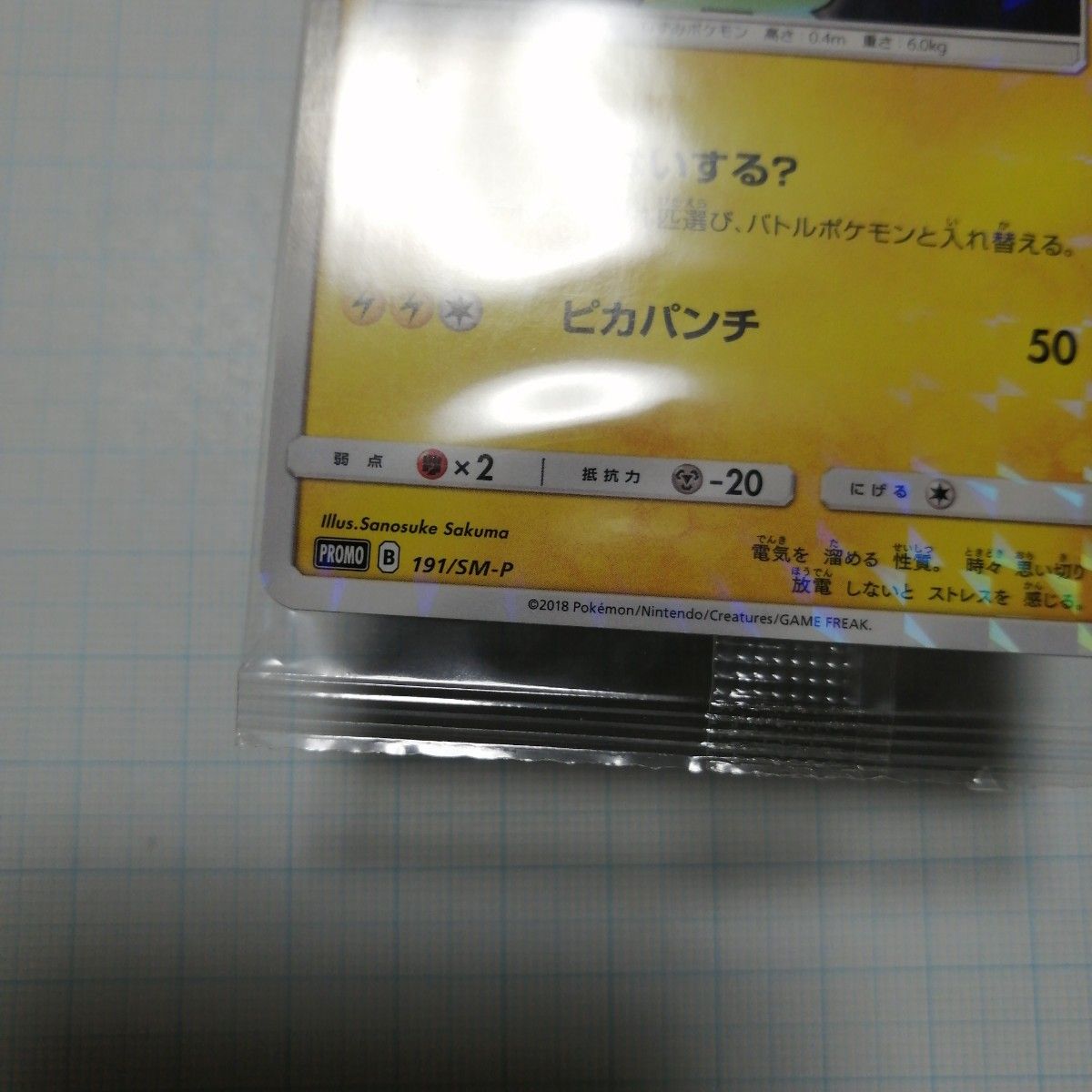

ボスごっこピカチュウ ロケット団 PROMO 191/SM-P 未開封 プロモ

(税込) 送料込み

商品の説明

商品説明

●状態

未開封品です。

●配送について

※万一、紛失・破損などの配送事故が起きた場合、当方から返金は行いません。

上記事故が発生した場合の補償金額は、配送会社の補償限度額までとなります。

●注意事項

商品によっては他サイトで併売している場合があります。

プレイ用と割り切れる方推奨です。

念の為神経質な方のご購入はお控えください

水濡れ防止・匿名配送で発送いたします

すり替え防止の為、返品また交換は受け付けませんのでご理解頂ける方のみご購入をお願い致します。

ノークレーム/ノーリターンでお願いします。

スリーブに入れ折れ対策をしプチプチに梱包して発送致します。

すり替え防止などの観点から購入後はいかなる理由であれ返品返金は致しませんのでご理解頂ける方のみ購入をお願いします。

22800円ボスごっこピカチュウ ロケット団 PROMO 191/SM-P 未開封 プロモエンタメ/ホビートレーディングカードトレーディングカード【未開封】ボスごっこピカチュウ ロケット団 191トレーディングカード【未開封】ボスごっこピカチュウ ロケット団 191

トレーディングカード【未開封】ボスごっこピカチュウ ロケット団 191

トレーディングカード【未開封】ボスごっこピカチュウ ロケット団 191

トレーディングカード【未開封】ボスごっこピカチュウ ロケット団 191

女性が喜ぶ♪ ピカチュウ ボスごっこ ロケット団 プロモ SM-P 191

トレーディングカード【未開封】ボスごっこピカチュウ ロケット団 191

ポケモン - ボスごっこピカチュウ ロケット団 PROMO 191/SM-P 未開封

ポケモンカードゲームボスごっこピカチュウ ロケット団 191/SM-P

楽天3年連続年間1位 ボスごっこピカチュウ ロケット団 PROMO 191/SM-P

197/SM-P ボスごっこピカチュウ スカル団: レインボーロケット団の

194/SM-P ボスごっこピカチュウ ギンガ団: レインボーロケット団の

ボスごっこピカチュウプラズマ団未開封-

トレーディングカード【未開封】ボスごっこピカチュウ ロケット団 191

超格安一点 ポケモンカード ボスごっこピカチュウ ボスごっこ

ボスごっこ ピカチュウ ロケット団 プロモ 開封済み - メルカリ

ボスごっこピカチュウ ロケット団 値下げあり-

ポケモンカード ボスごっこピカチュウ ロケット団 未開封 プロモ

ポケカ】【未開封】プロモ◇ボスごっこピカチュウ ロケット団 191-SM-P

本店は 未開封 ポケカ 未開封 ボスごっこピカチュウ ロケット団 未開封

楽天カード分割 ボスごっこピカチュウ ロケット団 未開封品 | www

2024年最新】ボスごっこピカチュウ ロケット団の人気アイテム - メルカリ

ボスごっこピカチュウ 新品未開封-

Amazon.co.jp: ポケモンカードゲーム PK-SM-P-191 ボスごっこ

2024年最新】ボスごっこピカチュウ ロケット団の人気アイテム - メルカリ

最終値下】ボスごっこピカチュウ ロケット団-

10%クーポン ポケモンカード ボスごっこピカチュウ ロケット団 プロモ

ボスごっこピカチュウ 未開封 ロケット団-

ポケモンカード ボスごっこピカチュウ ロケット団 未開封 プロモ

ボスごっこピカチュウ ロケット団-

公式クリアランス ポケモンカード ボスごっこピカチュウ ロケット団 未

ボスごっこピカチュウ ロケット団-

割引中 ポケモンカード ボスごっこピカチュウ ロケット団 | www

ボスごっこピカチュウ ロケット団 psa10-

未開封品 ポケモンカード ボスごっこピカチュウ ロケット団 191/SM-P

人気メーカー・ブランド ボスごっこピカチュウ ロケット団 未開封 ボス

ポケモンカード ボスごっこピカチュウ マグマ団 プロモ - ポケモン

2024年最新】ボスごっこピカチュウ ロケット団の人気アイテム - メルカリ

プロモピカチュウ ボスごっこ(ロケット団) キミにきめた(ホウエン) 海

ボスごっこピカチュウ ロケット団 psa10-

ボスごっこピカチュウ マグマ団 未開封-

商品の情報

メルカリ安心への取り組み

お金は事務局に支払われ、評価後に振り込まれます

出品者

スピード発送

この出品者は平均24時間以内に発送しています