超美品 極上シルク 最初期ポロラルフローレン 60s ヴィンテージ ネクタイ

(税込) 送料込み

商品の説明

商品説明

上質なヴィンテージ紳士衣料を多く出品いたします!サイズに関してはカテゴリを参考にせず、実寸をご覧ください。[概要]

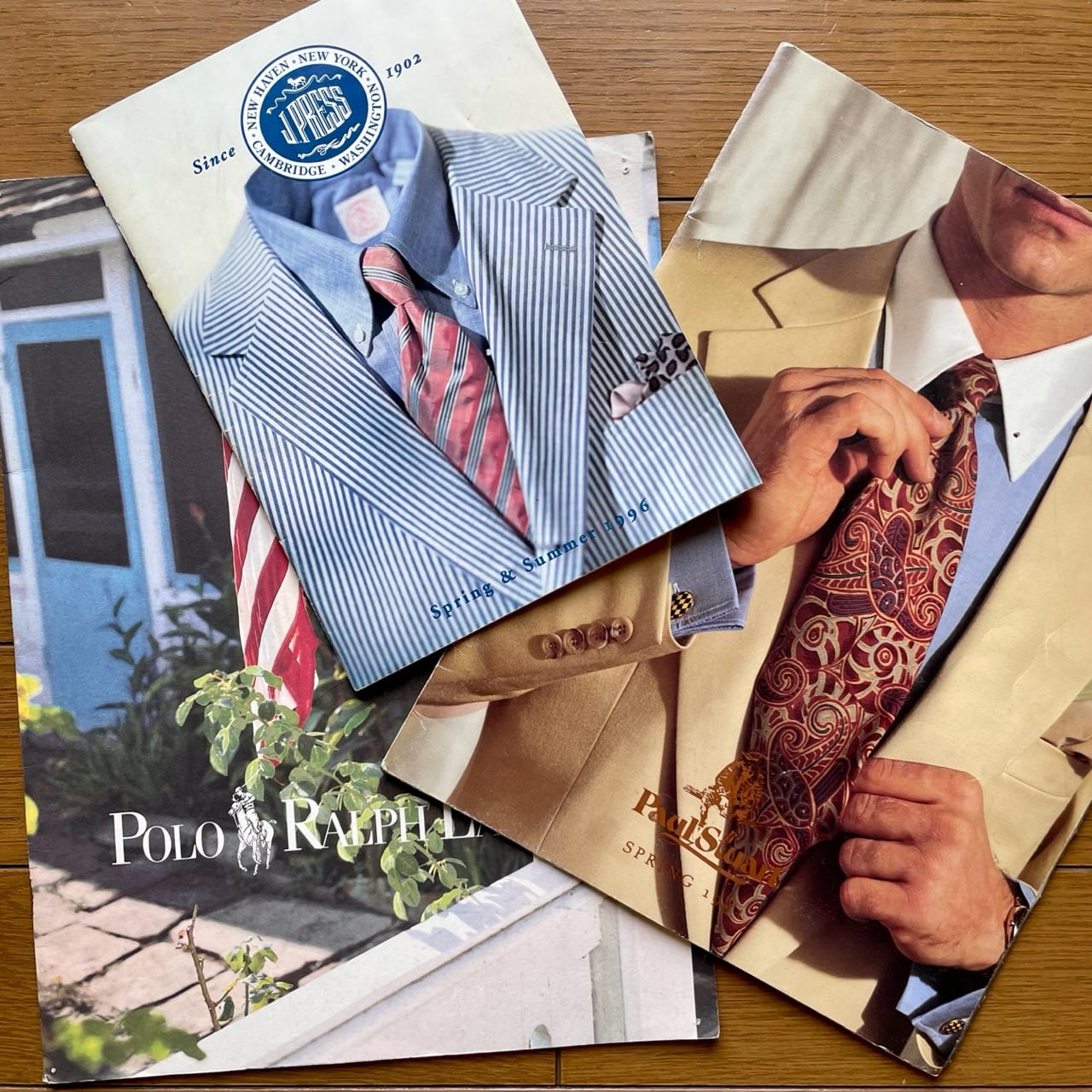

-とんでもない逸品です。大変希少な最初期(1967-70s初頭)のポロラルフローレンで、こちらは逸品揃いの最初期のなかでも極上のものになります。ハンドメイド。

-着物の生地並みにハリコシの強い素晴らしいシルクです。テイストのある大変華やかなデザイン、全体がクリームがかっていてとても上品な色使いです。

[状態]

デッドストックかもしれない超美品となります。

[サイズ]

全長:142cm大剣幅:98mm

##phot02131

12096円超美品 極上シルク 最初期ポロラルフローレン 60s ヴィンテージ ネクタイメンズファッション小物超美品 極上シルク 最初期ポロラルフローレン 60s ヴィンテージ美品 最初期ポロラルフローレン 60sヴィンテージ 極上シルクネクタイ

超美品 極上シルク 最初期ポロラルフローレン 60s ヴィンテージ

超美品 極上シルク 最初期ポロラルフローレン 60s ヴィンテージ

超美品 極上シルク 最初期ポロラルフローレン 60s ヴィンテージ

売上超特価 超美品 極上シルク 最初期ポロラルフローレン 60s

超美品 極上シルク 最初期ポロラルフローレン 60s ヴィンテージ

美品 最初期ポロラルフローレン 60sヴィンテージ 極上シルクネクタイの

超美品 極上シルク 最初期ポロラルフローレン 60s ヴィンテージ

phot02644希少 最初期ポロラルフローレン 60sヴィンテージ シルク

美品 最初期ポロラルフローレン 60sヴィンテージ 極上シルクネクタイの

超希少 最初期ポロラルフローレン 60sヴィンテージ グレープ ネクタイ

超美品 60sヴィンテージ ポロラルフローレン 極上シルクネクタイ

60s USAポロラルフローレン 肉厚極上シルク ネクタイ ブルーphot02209

超美品 60sヴィンテージ ポロラルフローレン 極上シルクネクタイ

美品 最初期ポロラルフローレン 60sヴィンテージ 極上シルクネクタイ

超希少 最初期ポロラルフローレン 60sヴィンテージ グレープ ネクタイ

超希少 最初期ポロラルフローレン 60sヴィンテージ グレープ ネクタイ

希少 最初期ポロラルフローレン 60sヴィンテージ シルクネクタイ

超希少 最初期ポロラルフローレン 60sヴィンテージ グレープ ネクタイ

60sヴィンテージ 創業期ポロラルフローレン 極上リネン ネクタイ レッド-

美品 最初期ポロラルフローレン 60sヴィンテージ 極上シルクネクタイの

最新の激安 超美品 超美品 最初期ポロラルフローレン 英国シルク 8109

初期ポロラルフローレン シルクネクタイ ブルー ブレザー 70s

phot03298美品 初期ポロラルフローレン 70s USAヴィンテージ シルク

最新の激安 超美品 超美品 最初期ポロラルフローレン 英国シルク 8109

60s USAポロラルフローレン 肉厚極上シルク ネクタイ ブルーphot02209

とんでもなく重厚で華やか 最初期ポロラルフローレン 60sヴィンテージ-

美品 最初期ポロラルフローレン 60sヴィンテージ 極上シルクネクタイの

ポロラルフローレン POLO シルク カラフル ネクタイ | Vintage.City

最初期ポロラルフローレン レジメンタルストライプ シルクネクタイ-

美品 スペシャル 最初期ポロラルフローレン 特上シルク ネクタイ-

美品 最初期ポロラルフローレン 60sヴィンテージ 極上シルクネクタイの

美品 最初期ポロラルフローレン 60sヴィンテージ 極上シルクネクタイ

最初期ポロラルフローレン レジメンタルストライプ シルクネクタイ-

超希少 最初期ポロラルフローレン 60sヴィンテージ グレープ ネクタイ

美品 最初期ポロラルフローレン 60sヴィンテージ 極上シルクネクタイの

ドット シルク レップ ナロータイ-

とんでもなく重厚で華やか 最初期ポロラルフローレン 60sヴィンテージ-

最初期ポロラルフローレン レジメンタルストライプ シルクネクタイ-

初期ポロラルフローレン シルクネクタイ ブルー ブレザー 70s

商品の情報

メルカリ安心への取り組み

お金は事務局に支払われ、評価後に振り込まれます

出品者

スピード発送

この出品者は平均24時間以内に発送しています